Imagine a world where your favorite foods are not only delicious but produced with cutting-edge technology that ensures quality and safety. JBT Marel Corporation is at the forefront of the industrial machinery sector, revolutionizing the food and beverage industry with its innovative processing solutions. Known for its exceptional engineering and commitment to excellence, JBT Marel is shaping how food is prepared and packaged globally. As we delve into the investment analysis, I invite you to consider whether the company’s fundamentals still align with its current market valuation and future growth trajectory.

Table of contents

Company Description

JBT Marel Corporation, incorporated in 1994 and headquartered in Chicago, IL, specializes in delivering advanced technology solutions to the global food and beverage industry. Operating across North America, Europe, the Middle East, Africa, Asia Pacific, and Latin America, the company provides a comprehensive suite of value-added processing services, including chilling, cooking, and packaging, tailored for a diverse range of markets, from baby food to pharmaceuticals. JBT Marel, formerly known as John Bean Technologies Corporation, is positioned as a leader within the industrial machinery sector, with a robust emphasis on automation and innovation. By continually enhancing operational efficiencies, the company plays a pivotal role in shaping the future of food processing and packaging solutions.

Fundamental Analysis

In this section, I will analyze JBT Marel Corporation’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

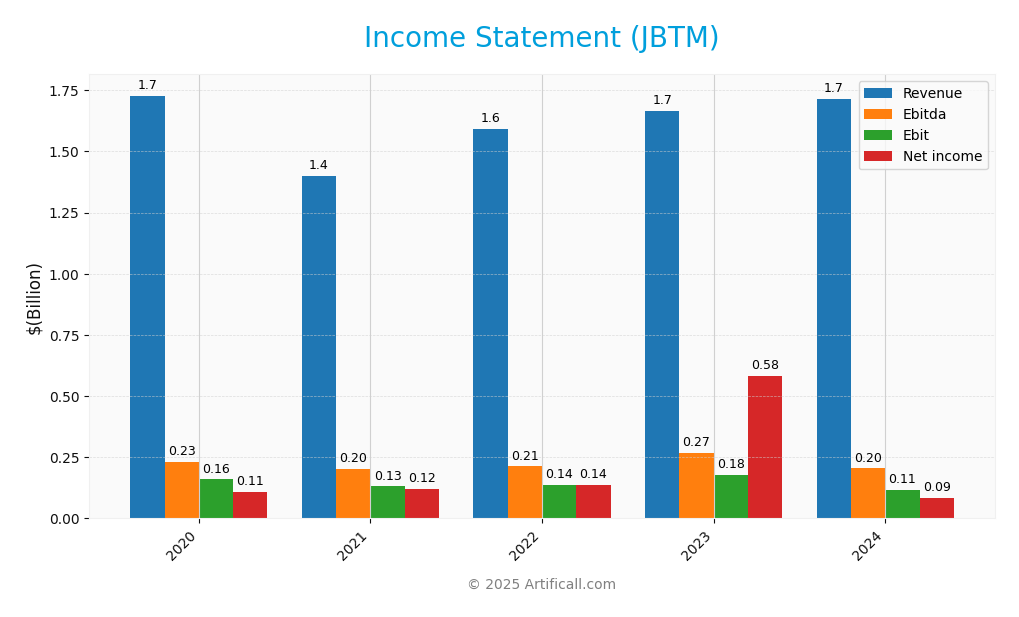

Income Statement

The following table summarizes the income statement for JBT Marel Corporation over the past five fiscal years, highlighting key financial metrics that are essential for evaluating the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.73B | 1.40B | 1.59B | 1.66B | 1.72B |

| Cost of Revenue | 1.19B | 918M | 1.06B | 1.08B | 1.09B |

| Operating Expenses | 371M | 357M | 397M | 421M | 508M |

| Gross Profit | 534M | 482M | 529M | 586M | 627M |

| EBITDA | 231M | 203M | 212M | 269M | 204M |

| EBIT | 159M | 131M | 136M | 177M | 115M |

| Interest Expense | 14M | 11M | 16M | 24M | 19M |

| Net Income | 109M | 119M | 137M | 583M | 85M |

| EPS | 3.40 | 3.70 | 4.08 | 18.21 | 2.67 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2024-12-31 |

Interpretation of Income Statement

Over the observed period, JBT Marel Corporation exhibited a strong upward trend in revenue, increasing from 1.73B in 2020 to 1.72B in 2024. However, net income saw significant volatility, peaking at 583M in 2023 before dropping to 85M in 2024. The gross profit margin remained relatively stable, but the dip in EBITDA and EBIT in the latest year indicates increased operating expenses, which may have impacted profitability. Overall, while revenue growth persisted, the decline in net income and operating performance in 2024 warrants a closer examination of the company’s cost management strategies moving forward.

Financial Ratios

Here are the financial ratios for JBT Marel Corporation over the last few fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.30% | 8.50% | 8.64% | 35.00% | 4.98% |

| ROE | 17.08% | 15.88% | 15.18% | 39.13% | 5.53% |

| ROIC | 9.03% | 6.11% | 5.68% | 6.26% | 3.65% |

| P/E | 33.49 | 41.26 | 21.27 | 5.46 | 47.63 |

| P/B | 5.72 | 6.55 | 3.23 | 2.14 | 2.63 |

| Current Ratio | 1.35 | 1.31 | 1.48 | 2.27 | 3.48 |

| Quick Ratio | 0.92 | 0.89 | 1.06 | 1.78 | 3.04 |

| D/E | 0.82 | 0.90 | 1.08 | 0.43 | – |

| Debt-to-Assets | 29.07% | 31.49% | 37.03% | 23.85% | 36.68% |

| Interest Coverage | 11.73 | 15.70 | 11.62 | 6.78 | 6.10 |

| Asset Turnover | 0.96 | 0.65 | 0.60 | 0.61 | – |

| Fixed Asset Turnover | 6.45 | 5.23 | 6.48 | 6.71 | 7.34 |

| Dividend Yield | 0.35% | 0.26% | 0.45% | 0.40% | 0.32% |

Interpretation of Financial Ratios

Analyzing the financial ratios of JBT Marel Corporation for the fiscal year 2024 reveals a mixed picture of financial health. The current ratio is strong at 3.48, indicating robust liquidity, while the quick ratio of 3.04 also supports this claim. Conversely, the solvency ratio at 0.093 indicates a potential concern regarding long-term obligations. Profitability appears weak with a net profit margin of 4.98% and a price-to-earnings ratio of 47.63, suggesting that the stock may be overvalued. The debt-to-equity ratio stands at 0.81, indicating moderate leverage, which could raise red flags for risk-averse investors. Overall, while liquidity is solid, profitability and solvency require careful attention.

Evolution of Financial Ratios

Over the past five years, JBT Marel Corporation’s financial ratios show fluctuating trends. Notably, liquidity ratios have improved significantly, with the current ratio rising from 1.31 in 2021 to 3.48 in 2024. However, profitability ratios have not kept pace, with net profit margins remaining relatively low, reflecting ongoing concerns about operational efficiency.

Distribution Policy

JBT Marel Corporation (ticker: JBTM) has a modest dividend payout ratio of approximately 15.3%, indicating a conservative approach to capital return. The annual dividend yield stands at 0.32%, with a consistent trend in dividend payments over recent years, reflecting a commitment to shareholder returns. The company also engages in share buyback programs, which can enhance shareholder value. However, potential risks include the sustainability of these distributions, particularly in the face of fluctuating profits. Overall, JBTM’s distribution policy appears aligned with long-term value creation.

Sector Analysis

JBT Marel Corporation operates in the industrial machinery sector, providing advanced technology solutions for the food and beverage industry globally. Its key competitive advantages include a diverse product range and strong market presence, facing competition from other machinery manufacturers.

Strategic Positioning

JBT Marel Corporation (ticker: JBTM) holds a competitive position in the industrial machinery sector, with a market cap of approximately $7.28B. The company specializes in technology solutions for the food and beverage industry, reflecting a robust market share in its niche. However, competitive pressures from emerging technologies and established players necessitate continuous innovation and adaptation. As the industry faces technological disruption, JBTM must remain vigilant in enhancing its product offerings and operational efficiencies to sustain its market position and capitalize on growth opportunities.

Key Products

Below is a table summarizing the key products offered by JBT Marel Corporation, which provide technology solutions primarily for the food and beverage industry.

| Product | Description |

|---|---|

| Chilling Systems | Advanced chilling technology to enhance food preservation and quality throughout the supply chain. |

| Automated Guided Vehicles (AGVs) | Systems designed for efficient material movement in manufacturing and warehouse settings, improving operational efficiency. |

| High Pressure Processing (HPP) | Innovative processing technology that extends shelf life while maintaining nutritional values and taste. |

| Mixing and Grinding Equipment | Machinery that ensures consistent blending and texture for various food products, enhancing production quality. |

| Portioning and Coating Solutions | Automated systems for precise portion control and uniform coating of food items, improving presentation and reducing waste. |

| Packaging Solutions | Comprehensive packaging systems that ensure product safety and extend shelf life through innovative designs. |

| Sterilization Equipment | Technology for effective sterilization of food products, ensuring safety and compliance with health regulations. |

| Weighing and Inspection Systems | Solutions that guarantee accurate measurements and quality checks, essential for maintaining product standards. |

| Marinating and Tumbling Machines | Equipment designed to enhance flavor infusion through advanced marinating processes, improving product appeal. |

| Freezing and Cooking Systems | Integrated solutions for freezing and cooking, optimizing production timelines and product quality. |

These products reflect JBT Marel Corporation’s commitment to providing innovative solutions that cater to a wide range of industries, from food processing to pharmaceuticals, contributing to operational excellence and safety.

Main Competitors

No verified competitors were identified from available data. JBT Marel Corporation holds a significant position in the industrial machinery sector, particularly within the food and beverage technology solutions market. The company is estimated to have a competitive market share, primarily operating in North America and Europe, where it caters to a diverse range of industries including food processing, pharmaceutical, and packaging.

Competitive Advantages

JBT Marel Corporation (JBTM) holds a robust competitive edge in the food and beverage technology solutions industry. Its extensive portfolio spans various sectors, including baby food, poultry, and pharmaceuticals, allowing it to cater to diverse market needs. The company’s commitment to innovation is evident in its recent advancements in automated guided vehicle systems and high-pressure processing technologies. Looking ahead, JBTM has promising opportunities in expanding its global footprint and enhancing its product offerings, particularly in plant-based and health-focused sectors, positioning it well for sustained growth and profitability.

SWOT Analysis

This SWOT analysis evaluates JBT Marel Corporation’s strategic position in the industrial machinery sector.

Strengths

- Strong market presence

- Diverse product offerings

- Experienced management team

Weaknesses

- Dependency on food sector

- High operational costs

- Limited brand recognition in emerging markets

Opportunities

- Expansion in emerging markets

- Increasing demand for automation

- Growth in health and wellness sectors

Threats

- Intense competition

- Economic downturns

- Regulatory changes affecting the food industry

In summary, JBT Marel Corporation possesses significant strengths and opportunities that can be leveraged for growth, but it must also address its weaknesses and be wary of external threats. A focus on innovation and market expansion will be crucial for enhancing its competitive edge.

Stock Analysis

In the past year, JBT Marel Corporation (ticker: JBTM) has demonstrated significant price movements, with a notable upward trend that highlights its resilience and growth potential in the market.

Trend Analysis

Over the past year, JBTM has experienced an impressive price change of +52.15%. This substantial increase indicates a bullish trend for the stock. However, it is essential to note that the trend is currently showing signs of deceleration, which may impact future performance. The stock reached a high of 147.7 and a low of 87.85 during this period, with a standard deviation of 17.42 suggesting moderate volatility in its price movements.

Volume Analysis

In the last three months, JBTM’s trading volume has totaled approximately 219.34M shares, with buyer-driven activity accounting for 53.01% (around 116.27M shares) compared to seller activity at 102.31M shares. The volume trend is increasing, but in the recent period, the buyer dominance has decreased to 34.34% (approximately 11.21M shares) against seller activity of 21.44M shares. This shift indicates a seller-dominant sentiment in the short term, reflecting potential caution among investors despite the overall bullish trend.

Analyst Opinions

Recent recommendations for JBT Marel Corporation (JBTM) have been cautious, with a consensus rating of “C” indicating a hold. Analysts point to a mixed financial outlook, with a discounted cash flow score of 3 suggesting potential value, but low scores in return on equity and return on assets (both at 1) raise concerns about profitability. Notable analysts suggest that while the current pricing may offer some upside, risks remain significant due to the company’s debt-to-equity ratio (2) and low price-to-earnings score (1). Overall, the consensus leans towards holding rather than buying or selling.

Stock Grades

JBT Marel Corporation (JBTM) has recently received an updated rating that could indicate a positive shift in investor sentiment.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | Upgrade | Outperform | 2025-08-06 |

The overall trend shows a favorable upgrade from “Market Perform” to “Outperform,” suggesting that analysts are becoming more optimistic about JBTM’s performance in the market. This shift could reflect improved fundamentals or market conditions favorable to the company.

Target Prices

The consensus target price for JBT Marel Corporation (JBTM) is firmly established.

| Target High | Target Low | Consensus |

|---|---|---|

| 169 | 169 | 169 |

Analysts uniformly expect the stock to reach a target price of 169, indicating a strong consensus on its future performance.

Consumer Opinions

Consumer sentiment about JBT Marel Corporation (JBTM) reflects a mix of satisfaction and concerns, showcasing the company’s strengths while revealing areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent product quality and reliability!” | “Customer service response times are too slow.” |

| “Innovative solutions that meet our needs!” | “Pricing seems higher compared to competitors.” |

| “Great user-friendly technology!” | “Occasional technical issues that disrupt use.” |

Overall, consumer feedback highlights JBTM’s high product quality and innovative solutions as key strengths, while slow customer service and pricing concerns are common weaknesses that the company needs to address.

Risk Analysis

In assessing the investment potential of JBT Marel Corporation (JBTM), it’s crucial to understand the various risks that could impact its performance. Below is a synthesis of key risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand and pricing pressures | High | High |

| Regulatory Risk | Changes in food safety regulations | Medium | High |

| Operational Risk | Disruptions in supply chain or production processes | Medium | Medium |

| Competitive Risk | Increased competition from other food processing firms | High | Medium |

| Currency Risk | Exposure to foreign exchange fluctuations | Medium | Medium |

I find that the most likely and impactful risks for JBTM are Market Risk and Regulatory Risk, given the current volatility in the food industry and ongoing regulatory changes that could affect operations.

Should You Buy JBT Marel Corporation?

JBT Marel Corporation shows a positive net margin of 0.04977, indicating profitability. The company has a total debt of 1.25B, which is substantial in relation to its equity of 4.51B. Over the past years, the fundamentals show fluctuations in profitability, with varying net incomes, and the current rating is C.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a significant total debt of 1.25B, which could pose a risk to financial stability. Additionally, the recent seller volume exceeds recent buyer volume, indicating a seller-dominant market sentiment.

Conclusion Considering the unfavorable signals, it might be prudent to wait for a more favorable market environment or signs of improved financial stability before making any investment considerations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- JBT Marel (JBTM): Evaluating Valuation Following Recent Investor Interest and Stock Momentum – Yahoo Finance UK (Nov 24, 2025)

- JBT Marel Corporation Reports Third Quarter 2025 Results and Raises Full Year 2025 Guidance – Business Wire (Nov 03, 2025)

- JBT Marel Stock Surges: What’s Driving the Growth? – StocksToTrade (Nov 04, 2025)

- JBT Marel (JBTM): Evaluating Valuation Gap After Recent Share Price Pullback – simplywall.st (Nov 20, 2025)

- JBT Marel’s Surge Doesn’t Justify Renewed Optimism – Seeking Alpha (Nov 05, 2025)

For more information about JBT Marel Corporation, please visit the official website: jbtc.com