In a world increasingly driven by precision and innovation, IPG Photonics Corporation stands at the forefront of the semiconductor industry, transforming how materials are processed and communicated. Renowned for its cutting-edge fiber lasers and comprehensive laser solutions, IPG is synonymous with quality and performance. As we delve into the investment analysis, one must ponder: do the robust fundamentals of IPG still align with its current market valuation and future growth potential?

Table of contents

Company Description

IPG Photonics Corporation (NASDAQ: IPGP), founded in 1990 and headquartered in Oxford, Massachusetts, is a leader in the semiconductor industry, specializing in high-performance fiber lasers and amplifiers. With a market capitalization of approximately $3.22B, the company develops products for a wide array of applications, including materials processing, communications, and medical fields. Its offerings range from hybrid fiber-solid state lasers to integrated laser systems and optical transceivers, catering to original equipment manufacturers and system integrators worldwide. As a strategic innovator in laser technology, IPG Photonics plays a pivotal role in advancing manufacturing efficiency and precision across diverse sectors.

Fundamental Analysis

In this section, I will analyze IPG Photonics Corporation’s income statement, financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

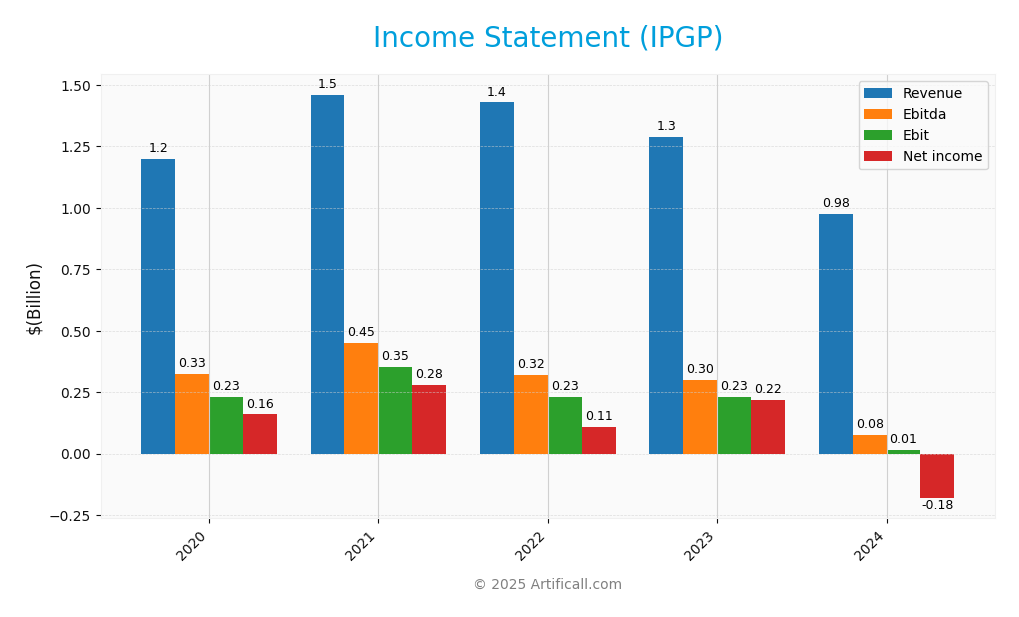

Income Statement

The following table summarizes the income statements of IPG Photonics Corporation over the last five fiscal years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.20B | 1.46B | 1.43B | 1.29B | 977M |

| Cost of Revenue | 661M | 764M | 874M | 746M | 639M |

| Operating Expenses | 340M | 329M | 386M | 310M | 546M |

| Gross Profit | 539M | 696M | 555M | 542M | 338M |

| EBITDA | 326M | 449M | 322M | 301M | 76M |

| EBIT | 232M | 353M | 231M | 232M | 15M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 160M | 278M | 110M | 219M | -182M |

| EPS | 3.00 | 5.21 | 2.17 | 4.64 | -4.09 |

| Filing Date | 2021-02-22 | 2022-02-22 | 2023-02-27 | 2024-02-21 | 2025-02-20 |

Interpretation of Income Statement

The income statement reveals a concerning trend for IPG Photonics Corporation. Revenue decreased significantly from 1.29B in 2023 to 977M in 2024, resulting in a negative net income of -182M, a stark contrast to the positive 219M reported in 2023. The gross profit margin has also decreased, indicating increasing cost pressures. The operating expenses surged in 2024, suggesting potential inefficiencies or strategic investments that have yet to yield returns. Overall, the company’s performance in 2024 shows a clear decline, warranting a cautious approach for investors considering this stock.

Financial Ratios

Below is a summary of the financial ratios for IPG Photonics Corporation over the last few years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13.29% | 19.06% | 7.69% | 17.00% | -18.58% |

| ROE | 6.15% | 10.14% | 4.61% | 9.06% | -8.97% |

| ROIC | 5.67% | 12.88% | 4.11% | 7.40% | -11.15% |

| P/E | 74.59 | 33.02 | 43.72 | 23.38 | -17.76 |

| P/B | 4.59 | 3.35 | 2.01 | 2.12 | 1.59 |

| Current Ratio | 10.01 | 7.49 | 7.23 | 8.91 | 6.98 |

| Quick Ratio | 8.31 | 6.02 | 5.38 | 6.80 | 5.59 |

| D/E | 0.024 | 0.021 | 0.016 | 0.008 | 0.009 |

| Debt-to-Assets | 2.12% | 1.83% | 1.39% | 0.68% | 0.78% |

| Interest Coverage | – | 200.05 | – | – | – |

| Asset Turnover | 0.41 | 0.46 | 0.52 | 0.48 | 0.43 |

| Fixed Asset Turnover | 2.01 | 2.30 | 2.46 | 2.09 | 1.66 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

Analyzing IPG Photonics Corporation’s financial ratios for the fiscal year 2024 reveals a mixed picture of its financial health. The liquidity ratios are strong, with a current ratio of 6.98 and a quick ratio of 5.59, indicating solid short-term financial stability. However, the company faces challenges in profitability, as it reports a net profit margin of -18.58%, signaling potential concerns over cost management and pricing strategies. The solvency ratio is negative at -0.45, which raises alarms regarding its long-term financial obligations. While the debt-to-assets ratio is low at 0.008, indicating minimal reliance on leverage, the interest coverage ratio is at 0, suggesting difficulties in covering interest expenses. These factors collectively highlight a need for caution in investment decisions regarding IPGP.

Evolution of Financial Ratios

Over the past five years, IPGP’s financial ratios have shown significant volatility. The current ratio has declined from 10.01 in 2020, while the profitability margins have turned negative in recent years, indicating a troubling trend in financial performance that investors should monitor closely.

Distribution Policy

IPG Photonics Corporation (IPGP) does not pay dividends, with a dividend payout ratio of 0%. This strategy aligns with its focus on reinvestment for growth, especially given its current negative net income. The company prioritizes capital for research and development, which is essential in the high-tech sector. Additionally, IPGP engages in share buybacks, contributing to shareholder value through stock price support. Overall, this approach appears to support long-term value creation, despite the absence of dividends.

Sector Analysis

IPG Photonics Corporation operates in the semiconductor industry, focusing on high-performance fiber lasers and amplifiers, competing with leaders like Coherent and Trumpf. Its competitive advantages include innovative technology and a strong market presence.

Strategic Positioning

IPG Photonics Corporation (IPGP) holds a significant share in the high-performance fiber laser market, driven by its innovative technologies and comprehensive product range. With a market cap of approximately $3.22B, the company faces competitive pressure from both established players and emerging technologies in the semiconductor industry. The ongoing technological disruption, particularly in materials processing and communications applications, challenges IPG to continuously enhance its offerings. Nevertheless, its strong position and commitment to R&D allow it to benchmark effectively against competitors, maintaining a competitive edge in this dynamic market.

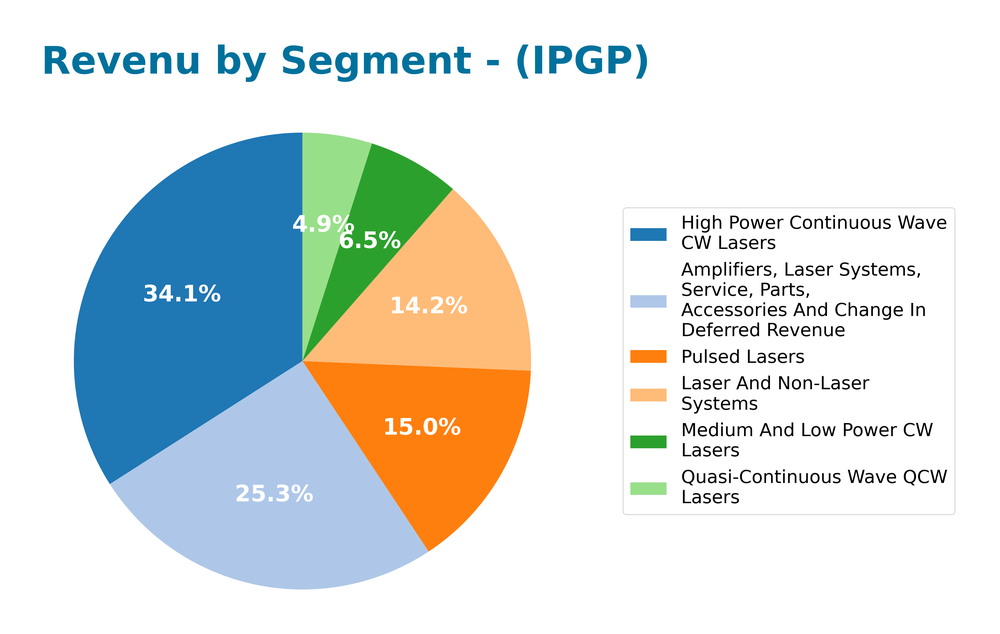

Revenue by Segment

The following chart illustrates IPG Photonics Corporation’s revenue distribution across different segments for the fiscal year 2024.

In FY 2024, IPG Photonics experienced a decline in revenue across most segments compared to the previous year. The High Power Continuous Wave Lasers segment remains the largest contributor at 333M, although it has seen a significant drop from 525M in FY 2023. Notably, the Amplifiers and Laser Systems segment also decreased to 247M from 295M. This trend indicates potential market saturation and competitive pressures. While segments like Medium and Low Power CW Lasers showed resilience, overall growth has slowed, raising concerns about margins and the concentration of revenue sources moving forward.

Key Products

Below is a table outlining the key products offered by IPG Photonics Corporation, which specialize in high-performance laser technology for various applications.

| Product | Description |

|---|---|

| Fiber Lasers | High-performance lasers used in materials processing, offering efficient cutting, welding, and marking. |

| Diode Lasers | Compact and versatile lasers for applications in telecommunications and medical fields. |

| Fiber Amplifiers | Devices that enhance the power of signals, used in broadband networks and data communication systems. |

| Specialty Fiber Amplifiers | Ytterbium and thulium amplifiers designed for specific applications in scientific and industrial use. |

| Integrated Laser Systems | Complete systems for high-precision applications, including multi-axis cutting and welding solutions. |

| Optical Transceivers | Modules that facilitate data transfer between electronic devices, crucial for networking applications. |

| Chillers and Scanners | Accessories that support laser operations, ensuring optimal performance and cooling during use. |

This overview highlights the diverse range of products that IPG Photonics Corporation offers, emphasizing its commitment to innovation in the laser technology sector.

Main Competitors

No verified competitors were identified from available data. However, I estimate that IPG Photonics Corporation holds a significant market share in the semiconductor industry, particularly in the fiber laser segment. The company is well-positioned as a leader in high-performance laser technology, serving a global market with diverse applications in materials processing and communications.

Competitive Advantages

IPG Photonics Corporation (IPGP) stands out in the semiconductor industry due to its innovative high-performance fiber lasers and amplifiers, which cater to diverse applications like materials processing and telecommunications. The company’s commitment to R&D has positioned it to capitalize on emerging trends in automation and advanced manufacturing. Looking ahead, IPG plans to expand its product portfolio with new laser technologies and tap into growth markets such as renewable energy and medical applications, enhancing its competitive edge and potential for long-term profitability.

SWOT Analysis

The SWOT analysis below provides a strategic overview of IPG Photonics Corporation, highlighting its strengths, weaknesses, opportunities, and threats.

Strengths

- Leading in fiber laser technology

- Strong market position in semiconductors

- Diverse product portfolio

Weaknesses

- High dependency on semiconductor industry

- Limited brand recognition compared to larger competitors

- No dividend payouts

Opportunities

- Growing demand for high-performance lasers

- Expansion into emerging markets

- Potential for new applications in medical technology

Threats

- Intense competition in the laser market

- Economic fluctuations affecting capital investment

- Supply chain disruptions

Overall, IPG Photonics demonstrates strong technological capabilities and market presence but faces significant risks from competition and economic conditions. The company should leverage its innovative strengths while addressing its weaknesses and exploring growth opportunities in new markets to enhance its resilience and strategic positioning.

Stock Analysis

Over the past year, IPG Photonics Corporation (IPGP) has experienced significant price movements, culminating in a notable bearish trend characterized by a substantial decline in stock value.

Trend Analysis

Analyzing the stock’s performance over the past year reveals a price change of -24.68%. This indicates a bearish trend, as the stock has lost a considerable percentage of its value. The trend is showing signs of deceleration, with the highest price recorded at 102.82 and the lowest at 52.12. The standard deviation of 10.92 suggests moderate volatility in the stock’s price movements.

Volume Analysis

Looking at trading volumes over the last three months, total trading activity amounted to 151.95M shares, with buyer-driven volume accounting for approximately 51.77% of the total. Overall, trading volume is increasing, albeit with a recent period exhibiting a slight shift in buyer dominance to 47.72%. This indicates a neutral buyer behavior, suggesting mixed investor sentiment and cautious market participation.

Analyst Opinions

Recent analyst recommendations for IPG Photonics Corporation (IPGP) indicate a cautious stance. Analysts have assigned a rating of B- to the stock, reflecting a mix of potential and risk. The overall score is 3, with a strong discounted cash flow score of 4, suggesting healthy future cash flows. However, concerns about return on equity and debt-to-equity ratios, which scored 2 and 1 respectively, may temper optimism. Currently, the consensus leans towards a hold position, indicating that while the stock has some favorable aspects, investors should remain vigilant about its risks.

Stock Grades

IPG Photonics Corporation (IPGP) has recently received several noteworthy stock ratings from reputable grading companies. Here’s a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | upgrade | Buy | 2025-11-05 |

| Bernstein | upgrade | Outperform | 2025-08-07 |

| Raymond James | maintain | Strong Buy | 2025-05-07 |

| CL King | upgrade | Buy | 2025-03-18 |

| Citigroup | maintain | Sell | 2025-02-18 |

| Stifel | maintain | Buy | 2025-02-12 |

| Needham | maintain | Hold | 2025-02-12 |

| Seaport Global | downgrade | Neutral | 2024-08-01 |

| Stifel | maintain | Buy | 2024-07-31 |

| Raymond James | maintain | Strong Buy | 2024-07-31 |

The overall trend indicates a positive shift in sentiment towards IPGP, with multiple upgrades from analysts, reflecting growing confidence in the company’s prospects. Notably, Citigroup’s recent upgrade to “Buy” signals a significant turnaround in their outlook.

Target Prices

The consensus target prices for IPG Photonics Corporation (IPGP) indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 96 | 92 | 94 |

Overall, analysts expect IPGP to stabilize around the consensus target of 94, suggesting moderate confidence in its performance.

Consumer Opinions

Consumer sentiment towards IPG Photonics Corporation (IPGP) reflects a mix of appreciation and concern, showcasing the company’s strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Outstanding product quality and performance!” | “Customer support can be slow to respond.” |

| “Innovative technology that exceeds expectations.” | “Pricing is higher than competitors.” |

| “Reliable and durable equipment.” | “Limited availability in certain regions.” |

Overall, consumer feedback highlights IPG’s exceptional product quality and innovative technology as key strengths, while slower customer support and higher pricing compared to competitors are common weaknesses.

Risk Analysis

In evaluating IPG Photonics Corporation (IPGP), it’s essential to consider various risks that could affect its performance. Here’s a summary of the key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in demand for photonics products due to economic changes. | High | High |

| Supply Chain Disruptions | Potential delays in the supply of critical components affecting production timelines. | Medium | High |

| Technological Changes | Rapid advancements in competing technologies that could render current products obsolete. | High | Medium |

| Regulatory Changes | Changes in regulations that could impose additional costs or restrictions on operations. | Medium | Medium |

| Currency Fluctuations | Exposure to foreign currency risks impacting international sales and profitability. | Medium | Medium |

In my analysis, market volatility and technological changes emerge as the most likely and impactful risks for IPGP, given the rapid pace of innovation and economic uncertainty in the photonics sector.

Should You Buy IPG Photonics Corporation?

IPG Photonics Corporation has shown a significant decline in profitability with a negative net income of -181.53M for the fiscal year 2024. The company maintains a low debt level with a debt-to-equity ratio of just 0.0089, indicating sound financial health. Over recent years, the fundamentals have deteriorated, as reflected in the recent bearish trend of the stock, which has declined by 24.68%. The current rating for the company is B-.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has experienced a negative net margin of -18.58%, which indicates an overall lack of profitability. Additionally, the long-term trend is bearish, suggesting ongoing challenges in the market. Recent seller volume has exceeded recent buyer volume, indicating a lack of demand for the stock.

Conclusion Considering the negative net margin and the bearish long-term trend, it might be preferable to wait for signs of recovery before considering an investment in IPG Photonics Corporation.

Additional Resources

- What Does IPG Photonics Corporation’s (NASDAQ:IPGP) Share Price Indicate? – Yahoo! Finance Canada (Nov 24, 2025)

- Will IPG Photonics’ (IPGP) New Defense Facility Boost Its Shift Toward High-Growth Markets? – Yahoo! Finance Canada (Nov 24, 2025)

- IPG Photonics Corporation (NASDAQ:IPGP) Receives Average Rating of “Moderate Buy” from Brokerages – MarketBeat (Nov 20, 2025)

- Valentin Gapontsev trust sells IPG Photonics (IPGP) shares for $5.09m – Investing.com (Nov 19, 2025)

- IPG Photonics (IPGP) Is Down 5.9% After Block Insider Sales and New Defense Unit Launch – What’s Changed – simplywall.st (Nov 23, 2025)

For more information about IPG Photonics Corporation, please visit the official website: ipgphotonics.com