In a world where efficiency and innovation drive productivity, Hyster-Yale Materials Handling, Inc. is transforming how industries operate, from manufacturing to logistics. Renowned for its robust lift trucks and commitment to quality, Hyster-Yale not only leads the agricultural machinery sector but also pioneers advancements like hydrogen fuel-cell technology. As we delve into the investment potential of this dynamic player, the pivotal question arises: do the company’s fundamentals still align with its current market valuation and growth trajectory?

Table of contents

Company Description

Hyster-Yale Materials Handling, Inc. (NYSE: HY), founded in 1991 and headquartered in Cleveland, Ohio, is a key player in the agricultural machinery sector, specializing in the design, manufacture, and service of lift trucks and related components. With a market capitalization of approximately $498M, the company markets its products mainly under the Hyster and Yale brands to a network of independent dealerships. In addition to lift trucks, Hyster-Yale produces hydrogen fuel-cell technology and various attachments, serving diverse markets including manufacturing, transportation, and government agencies. The company is strategically positioned to lead in innovation and sustainability within the materials handling industry, shaping the future of logistics and equipment efficiency.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Hyster-Yale Materials Handling, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

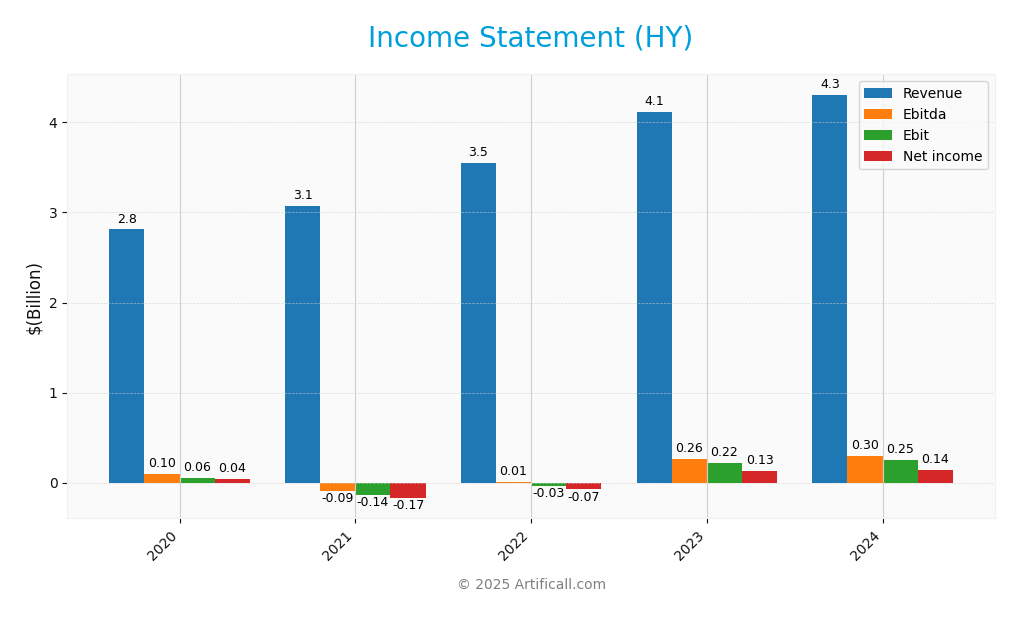

The following table summarizes the income statement for Hyster-Yale Materials Handling, Inc. over the past five fiscal years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.81B | 3.08B | 3.55B | 4.12B | 4.31B |

| Cost of Revenue | 2.35B | 2.71B | 3.11B | 3.33B | 3.41B |

| Operating Expenses | 0.42B | 0.52B | 0.47B | 0.58B | 0.65B |

| Gross Profit | 0.47B | 0.36B | 0.43B | 0.79B | 0.90B |

| EBITDA | 0.10B | -0.09B | 0.09B | 0.26B | 0.30B |

| EBIT | 0.06B | -0.14B | -0.03B | 0.22B | 0.25B |

| Interest Expense | 0.014B | 0.015B | 0.028B | 0.037B | 0.034B |

| Net Income | 0.037B | -0.173B | -0.074B | 0.126B | 0.142B |

| EPS | 2.21 | -10.29 | -4.38 | 7.35 | 8.16 |

| Filing Date | 2021-02-24 | 2022-02-28 | 2023-02-27 | 2024-02-27 | 2025-02-25 |

Interpretation of Income Statement

Over the past five years, Hyster-Yale’s revenue has shown a steady upward trend, increasing from $2.81B in 2020 to $4.31B in 2024. This consistent growth in revenue is a positive indicator of the company’s market position. Net income has also rebounded significantly from a loss of $173M in 2021 to a profit of $142M in 2024, reflecting improved operational efficiency and cost management. The gross profit margin has strengthened, indicating better control over production costs. In the most recent year, while revenue growth remained strong, the increase in operating expenses suggests a need for continued focus on cost management to maintain profitability.

Financial Ratios

Below is a summary of key financial ratios for Hyster-Yale Materials Handling, Inc. over the last few years.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | -5.62% | -2.09% | 3.06% | 3.30% |

| ROE | -48.45% | -36.25% | 32.29% | 29.95% |

| ROIC | -16.05% | -4.63% | 13.27% | 13.59% |

| P/E | -3.99 | -5.77 | 8.47 | 6.24 |

| P/B | 1.94 | 2.09 | 2.73 | 1.87 |

| Current Ratio | 1.22 | 1.09 | 1.22 | 1.35 |

| Quick Ratio | 0.52 | 0.49 | 0.55 | 0.64 |

| D/E | 1.45 | 2.70 | 1.27 | – |

| Debt-to-Assets | 26.32% | 27.29% | 23.76% | 26.70% |

| Interest Coverage | -9.83 | -1.38 | 5.60 | 7.24 |

| Asset Turnover | 1.56 | 1.75 | 1.98 | 2.12 |

| Fixed Asset Turnover | 9.31 | 11.45 | 13.12 | 14.05 |

| Dividend Yield | 3.12% | 5.10% | 2.09% | 2.70% |

Interpretation of Financial Ratios

Hyster-Yale Materials Handling, Inc. shows mixed financial health based on its ratios for 2024. The liquidity ratios, such as the current ratio of 1.35, indicate sufficient short-term assets to cover liabilities, although the quick ratio of 0.64 raises concerns about immediate liquidity. The solvency ratio at 0.12 suggests moderate reliance on debt, while a debt-to-equity ratio of 1.14 indicates a significant leverage level, which could pose risks in a downturn. Profitability metrics are weak, with a net profit margin of 3.30% and an EBIT margin of 5.87%, reflecting challenges in cost management. Overall, while some ratios are acceptable, the combination of high leverage and low profitability warrants caution.

Evolution of Financial Ratios

Over the past five years, Hyster-Yale’s financial ratios have displayed volatility. The liquidity ratios showed improvement, with the current ratio increasing from 1.09 in 2022 to 1.35 in 2024. However, profitability ratios have struggled, with the net profit margin recovering slightly from -2.09% in 2022 to 3.30% in 2024, indicating ongoing challenges in achieving sustainable profitability.

Distribution Policy

Hyster-Yale Materials Handling, Inc. (HY) has implemented a dividend policy with a payout ratio of approximately 17%. The annual dividend yield stands at around 2.7%, indicating a steady commitment to returning value to shareholders. Furthermore, HY engages in share buyback programs, reinforcing its confidence in long-term growth. However, potential risks include unsustainable distributions if profits decline. Overall, this distribution strategy supports sustainable long-term value creation, aligning with shareholder interests.

Sector Analysis

Hyster-Yale Materials Handling, Inc. operates in the Agricultural – Machinery industry, specializing in lift trucks and aftermarket parts, with strong brand recognition through its Hyster and Yale names. Key competitors include Toyota and Crown, while Hyster-Yale’s advantages lie in its diverse product range and innovative fuel-cell technology. A SWOT analysis reveals strengths in brand loyalty, weaknesses in market volatility, opportunities in green technology, and threats from economic downturns.

Strategic Positioning

Hyster-Yale Materials Handling, Inc. (HY) holds a sturdy position in the agricultural machinery sector, with a market capitalization of approximately $498M. The company primarily markets its products under the Hyster and Yale brands, catering to a diverse clientele ranging from manufacturers to governmental agencies. Despite facing competitive pressure from emerging players and technological disruptions, such as electric and hydrogen fuel technologies, Hyster-Yale’s established reputation and extensive product line provide a solid foundation for maintaining its market share. Continued investment in innovation will be crucial to counteract competitive threats and leverage new market opportunities.

Revenue by Segment

The chart below illustrates the revenue distribution across different segments for Hyster-Yale Materials Handling, Inc. during the fiscal years 2022 to 2024.

In reviewing the revenue data, we observe that the “Lift truck business” remains the dominant segment, generating 3.36B in 2022, although it saw a decline to 355M in 2024 under “Other revenue.” The “Bolzoni” segment also showed stability, contributing approximately 356M in 2022. Notably, the “JAPIC” segment exhibited consistent growth from 193.1M in 2020 to 250M in 2022, but its absence in the more recent years suggests strategic shifts. Overall, while the latest year’s figures reflect some slowing growth in core segments, the company must navigate potential concentration risks as market dynamics evolve.

Key Products

Hyster-Yale Materials Handling, Inc. offers a diverse range of products designed to meet the needs of various industries. Below is a summary of their key products:

| Product | Description |

|---|---|

| Hyster Lift Trucks | A line of durable lift trucks designed for heavy-duty applications, providing efficient material handling. |

| Yale Lift Trucks | Versatile lift trucks that focus on performance, safety, and comfort for a wide range of warehouse tasks. |

| Aftermarket Parts | Comprehensive range of replacement parts for lift trucks, enhancing service life and operational efficiency. |

| Hydrogen Fuel Cell Engines | Innovative fuel-cell technology for environmentally friendly material handling solutions. |

| Bolzoni Attachments | Specialized attachments and forks that improve the functionality of lift trucks for various applications. |

| Port Equipment | Advanced equipment designed for efficient container handling in port operations. |

| Rough Terrain Forklifts | Robust forklifts built to perform in challenging outdoor environments, ideal for construction and forestry. |

These products reflect Hyster-Yale’s commitment to quality and innovation in the materials handling industry, catering to a wide range of customers from manufacturers to government agencies.

Main Competitors

No verified competitors were identified from available data. Hyster-Yale Materials Handling, Inc. holds a significant position in the agricultural machinery sector, with an estimated market share that reflects its strong brand presence and diversified product offerings. The company operates primarily within the North American market, catering to a wide range of industries, including trucking, automotive, and governmental agencies.

Competitive Advantages

Hyster-Yale Materials Handling, Inc. (HY) boasts a robust portfolio of well-established brands, such as Hyster and Yale, which are recognized globally for quality and reliability in the materials handling industry. The company is focusing on expanding its product range, particularly in the hydrogen fuel-cell technology sector, which presents significant growth opportunities in the evolving landscape of sustainable materials handling. Additionally, entering new markets and enhancing aftermarket services will further solidify its competitive edge, positioning HY favorably for future growth and resilience against market fluctuations.

SWOT Analysis

The following SWOT analysis provides a structured overview of Hyster-Yale Materials Handling, Inc. to assist investors in understanding the company’s current position and strategic direction.

Strengths

- Strong brand recognition

- Diverse product line

- Established distribution network

Weaknesses

- High beta indicating volatility

- Dependence on market cycles

- Limited geographic presence

Opportunities

- Growth in e-commerce logistics

- Demand for eco-friendly solutions

- Expansion into emerging markets

Threats

- Intense competition

- Economic downturn impact

- Supply chain disruptions

The overall SWOT assessment indicates that Hyster-Yale has significant strengths and promising opportunities that can drive growth. However, it must address its weaknesses and remain vigilant against external threats to ensure sustainable success in the evolving materials handling industry.

Stock Analysis

Over the past year, Hyster-Yale Materials Handling, Inc. (ticker: HY) has experienced significant price movements, culminating in a bearish trend marked by a notable decline in stock value.

Trend Analysis

Analyzing the stock’s performance over the last two years reveals a price change of -56.02%. This substantial decline indicates a bearish trend, characterized by deceleration in price movements. The stock reached its highest price of 78.14 and fell to a low of 28.05. With a standard deviation of 13.38, the stock has exhibited considerable volatility, underscoring the uncertainty in its current market positioning.

Volume Analysis

In the last three months, Hyster-Yale’s trading volume totals approximately 46.79M shares, with buyer-driven activity accounting for 49.91% of this volume. However, the overall volume trend is decreasing. Recently, the buyer volume was 1.48M against seller volume of 3.11M, suggesting a seller-dominant market sentiment, which may reflect cautious investor behavior in the face of declining prices.

Analyst Opinions

Recent analyst recommendations for Hyster-Yale Materials Handling, Inc. (HY) indicate a cautious stance, with a consensus rating of “Hold.” Analysts, including notable voices in the sector, highlight concerns over the company’s C+ rating, primarily driven by a low discounted cash flow score and challenges in return on equity. However, a solid price-to-book ratio suggests potential value. While some analysts see long-term recovery prospects, the current sentiment leans towards maintaining positions rather than aggressive buying or selling.

Stock Grades

Hyster-Yale Materials Handling, Inc. has received consistent ratings from reputable grading companies, indicating a stable outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-11-06 |

| Roth MKM | Maintain | Buy | 2024-08-08 |

| Roth MKM | Maintain | Buy | 2024-06-07 |

| Northland Capital Markets | Upgrade | Outperform | 2024-06-05 |

| Northland Capital Markets | Downgrade | Market Perform | 2024-05-10 |

| Roth MKM | Maintain | Buy | 2024-05-09 |

| EF Hutton | Maintain | Buy | 2023-05-04 |

| EF Hutton | Maintain | Buy | 2023-05-03 |

| EF Hutton | Maintain | Buy | 2023-03-01 |

| EF Hutton | Maintain | Buy | 2022-03-02 |

Overall, the trend in grades reflects a strong confidence in Hyster-Yale’s performance, with multiple “Buy” ratings maintaining a consistent outlook amidst some fluctuations in grades from Northland Capital Markets. This suggests that while there are moments of reassessment, the general sentiment remains positive for investors.

Target Prices

The consensus target price for Hyster-Yale Materials Handling, Inc. (HY) is firmly established.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 40 | 40 |

Analysts expect Hyster-Yale’s stock to reach a target price of 40, indicating a stable outlook for the company.

Consumer Opinions

Consumer sentiment towards Hyster-Yale Materials Handling, Inc. (ticker: HY) reveals a mix of appreciation for its product quality and concerns regarding customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Durable equipment that performs well.” | “Customer service response times are slow.” |

| “Great value for the price offered.” | “Parts availability can be an issue.” |

| “Innovative technology enhances productivity.” | “Some models have high maintenance costs.” |

Overall, consumer feedback highlights strengths in product durability and value, while recurring weaknesses include slow customer service and parts availability challenges.

Risk Analysis

In evaluating Hyster-Yale Materials Handling, Inc. (ticker: HY), it’s essential to consider various risks that could impact investment decisions. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for material handling equipment | High | High |

| Supply Chain Risk | Disruptions in supply chain affecting production | Medium | High |

| Regulatory Risk | Changes in regulations affecting operational costs | Medium | Medium |

| Competitive Risk | Increased competition from emerging technologies | High | Medium |

| Economic Risk | Economic downturn impacting customer spending | Medium | High |

Hyster-Yale faces significant market and competitive risks due to evolving industry dynamics and economic conditions. Recent trends indicate heightened competition and potential supply chain disruptions, which warrant careful consideration in investment strategies.

Should You Buy Hyster-Yale Materials Handling, Inc.?

Hyster-Yale Materials Handling, Inc. has shown a positive net margin of 3.30% in the latest fiscal year, indicating profitability. However, the company carries a significant amount of debt, with a debt-to-equity ratio of 1.14, which may present a risk for investors. The fundamentals have seen fluctuations, with a recent overall rating of C+ suggesting average performance.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a negative trend with a price change of -56.02% over the overall period and -21.57% recently, indicating a bearish sentiment. The recent seller volume exceeding buyer volume suggests that sellers are currently dominating the market, indicating potential weakness in demand. Additionally, the company’s return on invested capital (ROIC) of 13.59% is lower than the weighted average cost of capital (WACC) of 7.73%, indicating value destruction.

Conclusion Given the unfavorable signals, it might be more prudent to wait before considering an investment in Hyster-Yale Materials Handling, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- HYSTER-YALE ANNOUNCES COST REDUCTION ACTIONS AMID CHALLENGING MARKET CONDITIONS – PR Newswire (Nov 19, 2025)

- Hyster-Yale cuts 575 jobs globally amid industrial segment slowdown – Investing.com (Nov 19, 2025)

- Hyster-Yale (NYSE: HY) Unveils Restructuring, Sees $21M Charge and $40M Savings – Stock Titan (Nov 19, 2025)

- HYSTER-YALE DECLARES QUARTERLY DIVIDEND – Nasdaq (Nov 13, 2025)

- Hyster-Yale Materials Handling’s (NYSE:HY) Q3: Beats On Revenue – Markets Financial Content (Nov 04, 2025)

For more information about Hyster-Yale Materials Handling, Inc., please visit the official website: hyster-yale.com