In a world increasingly shaped by digital innovation, Globant S.A. stands at the forefront of transforming how businesses operate and engage with their customers. As a prominent player in the Information Technology Services sector, Globant excels in delivering cutting-edge solutions ranging from augmented revenue management to game development. With a commitment to quality and a reputation for pioneering new technologies, the company invites us to consider whether its current market valuation is aligned with its robust growth potential and strong fundamentals.

Table of contents

Company Description

Globant S.A. is a leading technology services company founded in 2003 and headquartered in Luxembourg City. With a market cap of approximately $2.75B, it specializes in a diverse array of services, including e-commerce solutions, cloud transformation, and advanced data analytics. Globant operates on a global scale, serving key markets in North America, Europe, and Latin America. The company integrates innovation across hardware, software, and services, positioning itself as a challenger in the Information Technology Services industry. Through its commitment to digital reinvention and sustainable business practices, Globant plays a pivotal role in shaping the future of technology, driving efficiency and creativity within various sectors.

Fundamental Analysis

In this section, I will analyze Globant S.A.’s income statement, financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

Income Statement

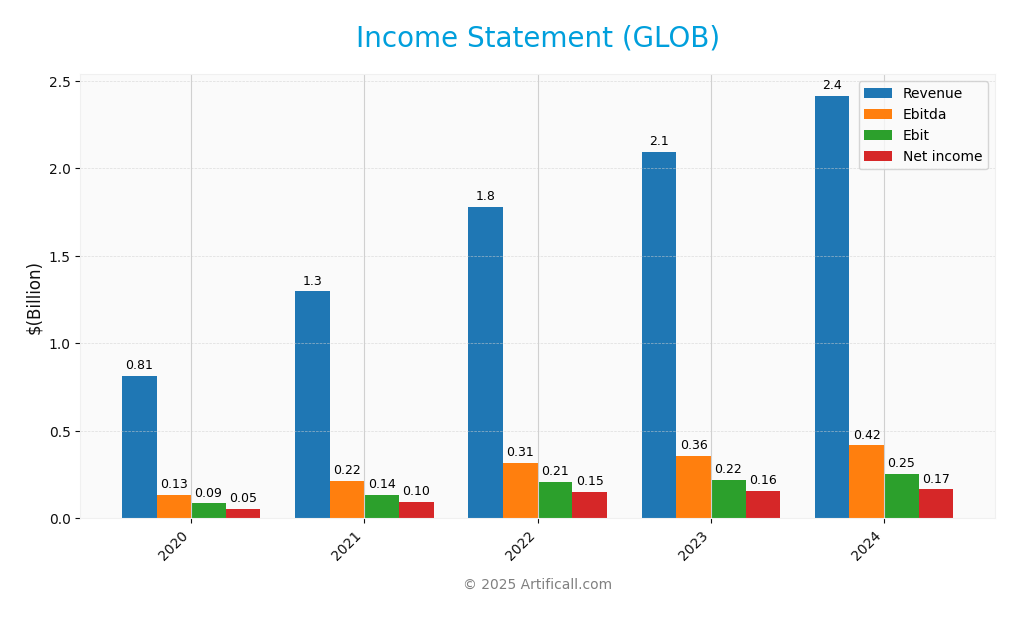

The following table summarizes the income statement for Globant S.A. over the past five fiscal years, highlighting key financial metrics such as revenue, net income, and earnings per share (EPS).

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 814M | 1.30B | 1.78B | 2.10B | 2.42B |

| Cost of Revenue | 510M | 802M | 1.11B | 1.34B | 1.55B |

| Operating Expenses | 220M | 351M | 463M | 557M | 638M |

| Gross Profit | 304M | 495M | 669M | 756M | 863M |

| EBITDA | 134M | 216M | 315M | 358M | 417M |

| EBIT | 85M | 135M | 207M | 218M | 254M |

| Interest Expense | 10M | 10M | 14M | 24M | 29M |

| Net Income | 54M | 96M | 149M | 159M | 166M |

| EPS | 1.41 | 2.35 | 3.55 | 3.72 | 3.82 |

| Filing Date | 2021-02-26 | 2022-02-28 | 2023-02-29 | 2024-02-29 | 2025-02-28 |

Interpretation of Income Statement

Globant S.A. has demonstrated a robust upward trajectory in both revenue and net income over the past five years. Revenue grew from 814M in 2020 to 2.42B in 2024, marking a significant CAGR. Net income also reflects this growth, increasing from 54M to 166M in the same period. Despite stable operating expenses, the gross margin improved slightly, indicating effective cost management. In 2024, while the growth rate of revenue may have shown signs of slowing compared to previous years, net income continued to expand, suggesting improved operational efficiency and profitability. Overall, the company appears well-positioned for sustained growth, although vigilance is required regarding potential market fluctuations.

Financial Ratios

The table below summarizes the financial ratios for Globant S.A. over the past five fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.66% | 7.41% | 8.36% | 7.56% | 6.86% |

| ROE | 6.16% | 7.36% | 9.88% | 9.17% | 8.44% |

| ROIC | 2.68% | 3.25% | 4.61% | 7.04% | 6.82% |

| P/E | 154.59 | 133.86 | 47.36 | 63.95 | 57.64 |

| P/B | 9.52 | 9.85 | 4.68 | 5.86 | 4.86 |

| Current Ratio | 2.60 | 2.12 | 2.04 | 1.36 | 1.54 |

| Quick Ratio | 2.60 | 2.12 | 2.15 | 1.36 | 1.54 |

| D/E | 0.13 | 0.11 | 0.09 | 0.16 | 0.13 |

| Debt-to-Assets | 8.81% | 7.76% | 6.33% | 10.16% | 12.95% |

| Interest Coverage | 3.98 | 5.10 | 6.52 | 8.38 | 7.87 |

| Asset Turnover | 0.63 | 0.69 | 0.81 | 0.77 | 0.76 |

| Fixed Asset Turnover | 4.26 | 4.66 | 5.76 | 7.43 | 8.70 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Globant S.A.’s financial ratios for 2024 reveals mixed signals regarding its financial health. The liquidity ratios are reassuring, with a current ratio of 1.54 and a quick ratio of 1.54, indicating adequate short-term financial stability. However, the solvency ratio stands at a relatively low 0.29, suggesting potential concerns regarding long-term financial sustainability. Profitability ratios show a net profit margin of 6.86%, which is modest, while the EBITDA margin is more favorable at 17.02%. The higher debt-to-equity ratio of 0.21 indicates a reliance on debt financing, which could increase financial risk, especially in a volatile market. Overall, while certain ratios display strength, the low solvency ratio and moderate profitability suggest a cautious investment approach is warranted.

Evolution of Financial Ratios

Over the past five years, Globant S.A.’s financial ratios exhibit a general decline in profitability margins while maintaining relatively stable liquidity ratios. The net profit margin has decreased from 8.36% in 2022 to 6.86% in 2024, highlighting a downward trend in profitability, despite consistent liquidity.

Distribution Policy

Globant S.A. (GLOB) does not pay dividends, which aligns with its strategy of reinvesting in growth and innovation. The company is in a high-growth phase, focusing on research and development and acquisitions to enhance its competitive edge. While it does not distribute cash to shareholders, it engages in share buybacks, signaling confidence in its own stock. This approach, while potentially limiting immediate returns, supports sustainable long-term value creation for shareholders by fostering growth.

Sector Analysis

Globant S.A. is positioned in the Information Technology Services industry, offering a wide range of innovative solutions. Its key competitive advantages include robust technological expertise and a diverse service portfolio.

Strategic Positioning

Globant S.A. (GLOB) operates within the highly competitive Information Technology Services sector, where it has developed a strong market presence. The company boasts a market capitalization of approximately 2.75B and offers a range of innovative services, including cloud transformation and AI-driven solutions. Although it faces competitive pressure from other tech service providers, its focus on cutting-edge technologies and digital transformation positions it favorably. However, the rapid pace of technological disruption necessitates continuous adaptation to maintain its market share and stay ahead of competitors. With a beta of 1.245, GLOB’s stock has higher volatility, indicating potential risks that investors should consider.

Key Products

Globant S.A. offers a diverse range of technology services aimed at enhancing digital experiences and operational efficiency for its clients. Below is a table summarizing some of their key products.

| Product | Description |

|---|---|

| E-commerce Solutions | Comprehensive platforms enabling businesses to enhance their online sales and customer interactions. |

| Digital Lending Services | Tools and services that facilitate digital loan processing and management for financial institutions. |

| Game as a Service (GaaS) | A platform providing game developers with the necessary tools and infrastructure for game deployment. |

| Smart Farming Solutions | Innovative technologies aimed at optimizing agricultural practices through data analytics and IoT. |

| Cloud Transformation | Services that assist companies in migrating to the cloud, including support and operational management. |

| Conversational Interfaces | Development of AI-driven interfaces to enhance user engagement through natural language processing. |

| Cybersecurity Services | Solutions designed to protect digital assets and ensure compliance with industry regulations. |

| UI and UX Design | Services focused on creating user-friendly interfaces and experiences for applications and websites. |

| Augmented Coding | Tools that enhance the software development process through automation and intelligent coding assistance. |

| Telemedicine Platforms | Solutions that enable remote healthcare services, including virtual consultations and patient management. |

This table provides a snapshot of Globant’s offerings, reflecting their commitment to innovation and comprehensive service delivery in the technology sector.

Main Competitors

No verified competitors were identified from available data. Globant S.A. holds a market share in the Information Technology Services sector, with an estimated market cap of approximately 2.75B USD. The company is positioned as a leader in various technology service offerings, catering to diverse industries including healthcare, media, and cloud transformation, establishing itself as a significant player in its niche.

Competitive Advantages

Globant S.A. (GLOB) holds a strong competitive edge in the technology services sector due to its diverse service offerings, including augmented revenue management, digital lending, and cloud transformation solutions. The company’s innovative approach, such as its reinvention studios and focus on sectors like healthcare and entertainment, positions it well for future growth. With a robust market cap of $2.75B and a commitment to expanding into new markets and developing advanced technologies like AI and blockchain, I foresee ample opportunities for GLOB to enhance its market presence and drive sustained profitability.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing Globant S.A. to inform strategic decision-making.

Strengths

- Strong market position

- Diverse service offerings

- Experienced leadership

Weaknesses

- High dependency on technology trends

- Limited brand recognition outside tech

Opportunities

- Growing demand for digital transformation

- Expansion into emerging markets

- Partnerships with tech giants

Threats

- Intense competition

- Rapid technological changes

- Economic fluctuations

Overall, the SWOT assessment indicates that while Globant S.A. has significant strengths and opportunities for growth, it must navigate inherent weaknesses and external threats to sustain its competitive edge. Strategic focus on expanding brand recognition and adapting to tech trends will be crucial for future success.

Stock Analysis

In analyzing Globant S.A. (GLOB), we observe significant price movements and trading dynamics over the past year, characterized by a steep decline and recent recovery efforts.

Trend Analysis

Over the past two years, Globant’s stock has experienced a price change of -71.79%, indicating a bearish trend. The trend shows acceleration, with notable highs reaching 249.69 and lows at 56.11. The standard deviation of 61.52 suggests considerable volatility, reflecting a turbulent trading environment.

In the recent trend from September 14, 2025, to November 30, 2025, the stock has increased by 11.26%, suggesting a potential shift in sentiment. With a trend slope of 0.56, this indicates a gradual upward movement, although the overall long-term outlook remains bearish.

Volume Analysis

In the last three months, total trading volume for GLOB reached approximately 441.85M, with buyer volume at 197.30M and seller volume at 241.36M. This distribution shows that seller activity has been predominant, as sellers constituted about 55.35% of the total volume. However, the current volume trend is increasing.

In the recent period from September 14, 2025, to November 30, 2025, buyer volume surged to 63.07M against seller volume of 20.72M, indicating a strongly buyer-dominant market with a buyer dominance percentage of 75.27%. This suggests a shift in investor sentiment, potentially reflecting growing confidence in the stock despite its overall bearish trend.

Analyst Opinions

Recent analyst recommendations for Globant S.A. (GLOB) indicate a consensus rating of “Buy.” Analysts highlight the company’s strong discounted cash flow score of 5 and solid overall score of 4, suggesting robust growth potential. Notably, the A- rating reflects a positive outlook despite moderate concerns regarding debt-to-equity and price-to-earnings ratios. Analysts emphasize that GLOB’s strong return on equity and return on assets position it well for future profitability. Overall, I find the current consensus supports a favorable investment stance for 2025.

Stock Grades

In recent evaluations of Globant S.A. (GLOB), several reputable grading companies have provided their ratings, reflecting a cautious sentiment surrounding the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-18 |

| Canaccord Genuity | Maintain | Hold | 2025-11-14 |

| Needham | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-14 |

| Goldman Sachs | Maintain | Neutral | 2025-10-09 |

| UBS | Maintain | Neutral | 2025-08-20 |

| Goldman Sachs | Maintain | Neutral | 2025-08-18 |

| JP Morgan | Downgrade | Neutral | 2025-08-15 |

| Needham | Maintain | Buy | 2025-08-15 |

The overall trend indicates a shift towards caution, with Jefferies downgrading GLOB to a “Hold” rating. While some firms maintain their “Buy” recommendations, the prevalence of “Neutral” ratings suggests a more tempered outlook among analysts.

Target Prices

The consensus target price for Globant S.A. (GLOB) reflects analyst optimism.

| Target High | Target Low | Consensus |

|---|---|---|

| 80 | 61 | 70.5 |

Overall, analysts expect GLOB to reach a consensus price of 70.5, indicating a balanced outlook within the established range.

Consumer Opinions

Consumer sentiment surrounding Globant S.A. (GLOB) reveals a mix of praise and criticism, reflecting the diverse experiences of its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative solutions that drive business growth.” | “Customer service response times can be slow.” |

| “Highly skilled and professional team.” | “Pricing can be on the higher side for startups.” |

| “Projects delivered on time and within budget.” | “Some projects lacked clear communication.” |

Overall, consumer feedback for Globant S.A. highlights strengths in innovation and professionalism, while weaknesses often revolve around customer service and pricing concerns.

Risk Analysis

In evaluating Globant S.A. (GLOB), I have identified several key risks that could influence the company’s performance and investor sentiment.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for IT services | High | High |

| Competition | Intense competition from other tech firms | Medium | High |

| Regulatory | Changes in data protection regulations | Medium | Medium |

| Economic | Global economic downturn affecting budgets | Medium | High |

| Operational | Challenges in scaling operations efficiently | Low | Medium |

The most likely and impactful risks for GLOB include market fluctuations and intense competition, particularly as the tech sector faces rapid changes and evolving client needs.

Should You Buy Globant S.A.?

Globant S.A. has demonstrated a positive net margin of 6.86% and a return on invested capital (ROIC) of 6.82%, which indicates profitability, although it falls below the weighted average cost of capital (WACC) of 8.97%, suggesting value destruction. The company’s total debt stands at 410.16M, with a debt-to-equity ratio of 0.15, reflecting a manageable level of debt. Over the past few years, the company has shown consistent revenue growth, with a revenue increase of 32.39% year-over-year, and holds an overall rating of A-.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company’s ROIC of 6.82% is below the WACC of 8.97%, indicating value destruction. The price-to-earnings ratio (PER) is high at 57.64, suggesting that the stock may be overvalued. The overall price trend is bearish with a significant price change of -71.79%, which raises concerns about the stock’s future performance.

Conclusion Given the unfavorable signals, it might be prudent to wait for more positive developments before considering an investment in Globant S.A.

However, the high PER indicates that the stock is overvalued, and the lack of growth in net income raises a risk of correction.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Ensign Peak Advisors Inc Boosts Stake in Globant S.A. $GLOB – MarketBeat (Nov 24, 2025)

- Are Options Traders Betting on a Big Move in Globant Stock? – TradingView (Nov 24, 2025)

- Globant S.A.: Bottom-Feeding In AI/Software At Less Than 10x P/E (NYSE:GLOB) – Seeking Alpha (Nov 20, 2025)

- How Globant S.a. (GLOB) Affects Rotational Strategy Timing – news.stocktradersdaily.com (Nov 23, 2025)

- Globant SA (GLOB) Q3 2025 Earnings Call Highlights: Navigating Growth Amidst Economic Challenges – Yahoo Finance (Nov 13, 2025)

For more information about Globant S.A., please visit the official website: globant.com