Fortive Corporation is redefining the landscape of precision and reliability across various industries, from healthcare to manufacturing. With its innovative suite of products and services, including advanced calibration tools and software solutions, Fortive stands out as a beacon of quality and market influence. As a significant player in the hardware and equipment sector, the company’s commitment to excellence raises an important question: do its current fundamentals support a robust market valuation and growth trajectory for investors?

Table of contents

Company Description

Fortive Corporation (NYSE: FTV), established in 2015 and headquartered in Everett, Washington, is a leading player in the hardware, equipment, and parts industry. The company designs and manufactures a diverse range of professional and engineered products, software, and services tailored for various sectors, including manufacturing, healthcare, and energy. With a workforce of approximately 18,000 employees, Fortive operates primarily in North America and has a strong portfolio of brands such as Fluke, Gordian, and Tektronix. The company is strategically positioned to drive innovation in operational efficiency and safety through its Intelligent Operating Solutions and Advanced Healthcare Solutions segments, reinforcing its role as a key influencer in shaping industry standards and practices.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Fortive Corporation, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

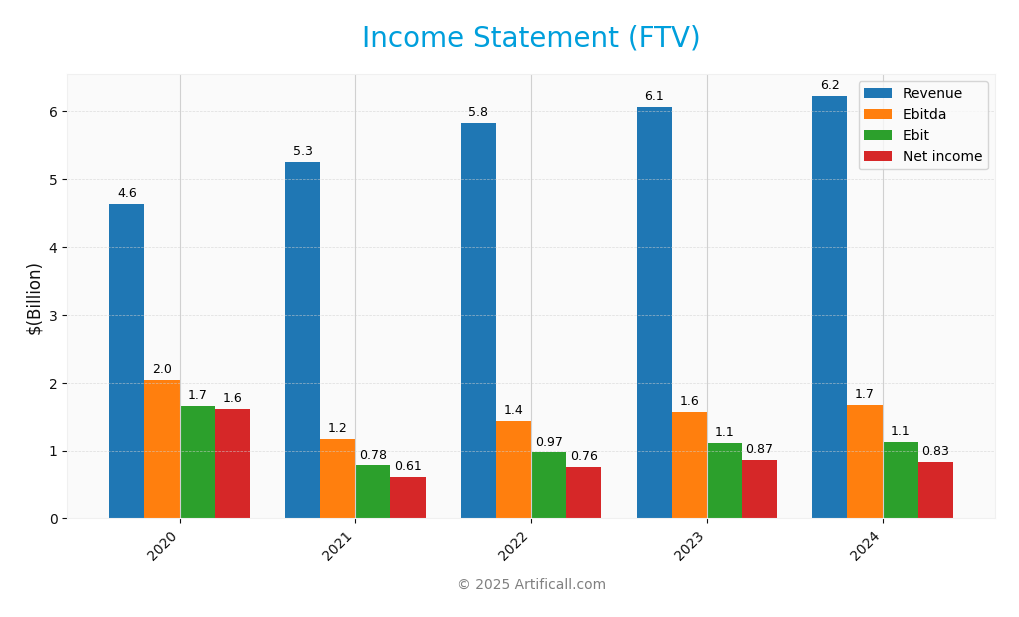

The following table presents Fortive Corporation’s income statement, detailing key financial metrics over the last five fiscal years for your analysis.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.63B | 5.25B | 5.83B | 6.07B | 6.23B |

| Cost of Revenue | 2.02B | 2.24B | 2.46B | 2.47B | 2.50B |

| Operating Expenses | 1.97B | 2.18B | 2.36B | 2.46B | 2.55B |

| Gross Profit | 2.62B | 3.00B | 3.36B | 3.59B | 3.73B |

| EBITDA | 2.04B | 1.78B | 1.44B | 1.57B | 1.67B |

| EBIT | 1.66B | 0.78B | 0.97B | 1.11B | 1.12B |

| Interest Expense | 0.15B | 0.10B | 0.10B | 0.12B | 0.15B |

| Net Income | 1.61B | 0.61B | 0.76B | 0.87B | 0.83B |

| EPS | 4.58 | 1.64 | 2.12 | 2.46 | 2.39 |

| Filing Date | 2021-02-26 | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-02-25 |

Interpretation of Income Statement

Over the past five years, Fortive Corporation’s revenue has shown a consistent upward trend, increasing from 4.63B in 2020 to 6.23B in 2024, reflecting a robust demand for its products. However, net income has fluctuated, peaking at 1.61B in 2020 before stabilizing around 0.83B in 2024. Margins indicate slight improvements, with gross profit margins hovering around 60%. In the most recent year, while revenue growth continued, net income saw a decline compared to the previous year, suggesting increased operational costs impacted profitability. This warrants a closer examination of cost management strategies moving forward.

Financial Ratios

Below are the financial ratios for Fortive Corporation (FTV) over the last few fiscal years.

| Metrics | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 11.58% | 12.96% | 14.27% | 13.37% |

| ROE | 6.40% | 7.80% | 8.39% | 8.17% |

| ROIC | 5.04% | 6.12% | 6.54% | 6.65% |

| P/E | 32.98 | 22.85 | 22.59 | 23.69 |

| P/B | 2.11 | 1.78 | 1.90 | 1.94 |

| Current Ratio | 0.68 | 0.91 | 2.05 | 1.16 |

| Quick Ratio | 0.54 | 0.71 | 1.75 | 0.91 |

| D/E | 0.44 | 0.35 | 0.37 | 0.38 |

| Debt-to-Assets | 25.16% | 21.53% | 22.53% | 22.78% |

| Interest Coverage | 8.06 | 10.23 | 9.18 | 7.70 |

| Asset Turnover | 0.32 | 0.37 | 0.36 | 0.37 |

| Fixed Asset Turnover | 13.29 | 13.81 | 13.79 | 14.39 |

| Dividend Yield | 0.66% | 0.58% | 0.52% | 0.56% |

Interpretation of Financial Ratios

Fortive Corporation (FTV) demonstrates a mixed financial health profile based on its 2024 ratios. The liquidity ratios show a current ratio of 1.16, indicating adequate short-term asset coverage, although the quick ratio of 0.91 raises concerns about immediate liquidity. Solvency remains solid with a debt-to-equity ratio of 0.38 and a solvency ratio of 0.20, suggesting manageable debt levels. Profitability appears stable with a net profit margin of 13.37% and an EBITDA margin of 28.74%. However, the decrease in the operating cash flow coverage ratio to 0.39 could signal potential cash flow issues. Overall, while certain ratios are strong, the drop in liquidity and cash flow coverage warrants caution.

Evolution of Financial Ratios

Over the past five years, Fortive’s financial ratios reflect a generally improving trend in profitability, with net profit margins increasing from 11.58% in 2021 to 13.37% in 2024. However, liquidity ratios have been inconsistent, dropping from a current ratio of 1.55 in 2020 to 1.16 in 2024, indicating increasing short-term financial pressure.

Distribution Policy

Fortive Corporation (FTV) has adopted a distribution policy that includes a dividend payout ratio of approximately 13.4%, reflecting its commitment to returning value to shareholders while maintaining a strong balance sheet. The annual dividend yield is around 0.56%, supported by positive free cash flow coverage. Additionally, the company engages in share buybacks, enhancing shareholder value. However, potential risks include reliance on debt and economic fluctuations. Overall, Fortive’s distribution strategy appears aligned with sustainable long-term value creation for shareholders.

Sector Analysis

Fortive Corporation operates in the Hardware, Equipment & Parts industry, offering a diverse range of professional and engineered products and services, positioning itself against competitors through innovative solutions and strong brand recognition.

Strategic Positioning

Fortive Corporation (FTV) operates in a highly competitive landscape characterized by rapid technological advancements and evolving market demands. With a market capitalization of approximately $17.9B, Fortive holds a significant share in the hardware, equipment, and parts industry. The company’s diverse product offerings span various sectors, including healthcare and manufacturing, providing a buffer against competitive pressures. However, the rise of smart technologies and software solutions presents both opportunities and challenges, necessitating ongoing innovation to maintain its market position. The benchmarking against peers reveals Fortive’s resilience, yet the need for strategic agility remains critical in navigating potential disruptions.

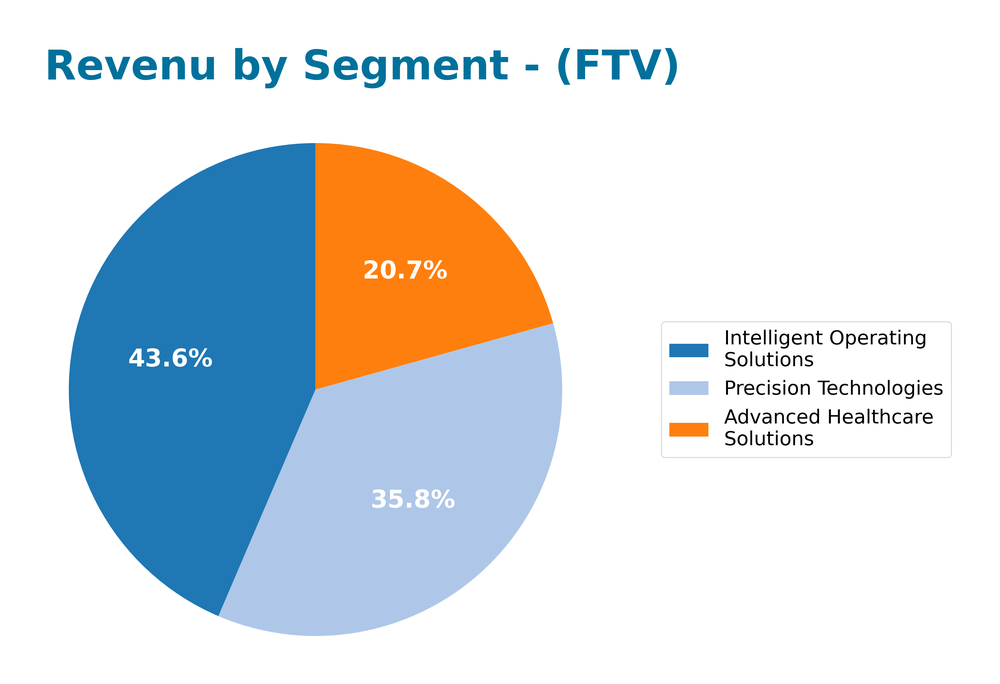

Revenue by Segment

The following chart illustrates the revenue distribution across Fortive Corporation’s segments for the fiscal year 2024.

In 2024, Fortive demonstrated solid growth across its core segments, notably with Intelligent Operating Solutions leading at 2.71B. Advanced Healthcare Solutions and Precision Technologies followed, generating 1.29B and 2.23B, respectively. Compared to 2023, Intelligent Operating Solutions saw a notable increase, while Advanced Healthcare Solutions experienced a slight decline. Overall, the company faces risks related to margins in the Advanced Healthcare segment, although it continues to be a crucial part of the revenue streams. The performance indicates a stable yet cautious outlook for 2025, emphasizing the importance of monitoring these segments closely.

Key Products

Fortive Corporation offers a diverse range of products across various industries. Below is a table summarizing some of its key products.

| Product | Description |

|---|---|

| ACCRUENT | Enterprise software solutions for facility and asset lifecycle management. |

| FLUKE | Professional test tools for electrical, pressure, and temperature calibration. |

| GORDIAN | Construction procurement and pre-construction planning software solutions. |

| INDUSTRIAL SCIENTIFIC | Portable gas detection tools for safety in various industrial applications. |

| INTELEX | Software products focused on environment, health, safety, and quality management. |

| PRUFTECHNIK | Connected reliability tools for maintenance and inspection in manufacturing settings. |

| SERVICECHANNEL | Software for managing service operations and asset management. |

| ANDERSON-NEGELE | Precision measurement instruments for food and beverage industries. |

| KEITHLEY | Advanced electrical test and measurement instruments for various applications, including semiconductors. |

| FLUKE BIOMEDICAL | Biomedical test tools and asset management services for healthcare facilities. |

This selection showcases Fortive’s commitment to delivering innovative solutions to meet the needs of its clients across multiple sectors.

Main Competitors

No verified competitors were identified from available data. However, Fortive Corporation holds a significant position in the Hardware, Equipment & Parts sector, with an estimated market share reflective of its robust product offerings and global reach. The company is well-positioned in its niche, focusing on professional and engineered products across various industries, including manufacturing, healthcare, and energy.

Competitive Advantages

Fortive Corporation (FTV) excels in providing a diversified range of high-quality professional and engineered products across various sectors, including healthcare, manufacturing, and utilities. Its strong brand portfolio features well-recognized names such as FLUKE and GORDIAN, which enhance market trust and customer loyalty. Looking ahead, Fortive is poised to capitalize on growth opportunities through the development of innovative software solutions and expansion into emerging markets. This positions the company favorably to adapt to evolving industry demands and maintain a competitive edge in the technology sector.

SWOT Analysis

This analysis aims to identify the strengths, weaknesses, opportunities, and threats for Fortive Corporation to inform strategic decision-making.

Strengths

- strong brand portfolio

- diverse product offerings

- robust market presence

Weaknesses

- dependence on key markets

- exposure to supply chain disruptions

- potential for high competition

Opportunities

- growth in healthcare technology

- expansion into emerging markets

- advancements in digital solutions

Threats

- economic downturns

- regulatory changes

- rapid technological advancements

The overall SWOT assessment indicates that Fortive Corporation is well-positioned with strong brand recognition and diverse offerings. However, it must navigate potential market dependencies and external threats to capitalize on growth opportunities effectively.

Stock Analysis

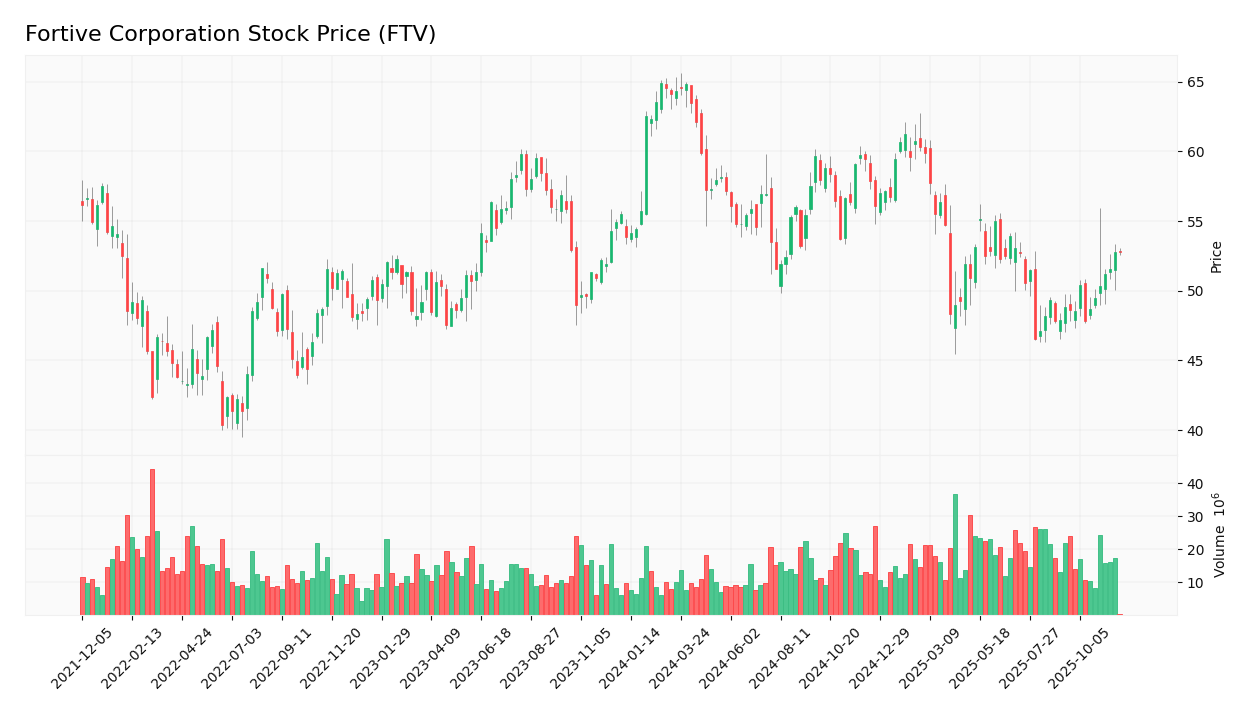

Over the past year, Fortive Corporation (FTV) has experienced notable price movements and trading dynamics, reflecting a bearish overall trend despite a recent uptick in price performance.

Trend Analysis

Analyzing the stock’s performance over the past year, Fortive’s price has changed by -1.9%. This indicates a bearish trend, characterized by acceleration in the downward movement. The stock reached a notable high of 64.89 and a low of 46.55 during this period, with a standard deviation of 4.63 suggesting moderate volatility in price movements.

Volume Analysis

In the last three months, Fortive’s trading volume has totaled approximately 1.8B shares, with 955M attributed to buyers and 819M to sellers, resulting in a buyer dominance of 53.13%. The volume trend is increasing, implying a positive sentiment among investors as recent activity has shown strong buyer dominance at 72.73%, suggesting robust market participation.

Analyst Opinions

Recent analyst recommendations for Fortive Corporation (FTV) indicate a consensus rating of “buy.” Analysts emphasize the company’s strong discounted cash flow score of 5, which suggests robust future cash generation potential. Notably, the overall score stands at 3, reflecting a balanced view on performance metrics such as return on equity and return on assets, both scoring 3 and 4, respectively. While the debt-to-equity score of 1 raises some caution, analysts like those at Zacks and Morningstar highlight Fortive’s growth prospects as a compelling reason to invest.

Stock Grades

Fortive Corporation (FTV) has received a series of recent stock grades from reputable grading companies, reflecting a cautious yet stable outlook from analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-11-05 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Truist Securities | Maintain | Hold | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-30 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| Barclays | Maintain | Equal Weight | 2025-10-30 |

| Mizuho | Maintain | Outperform | 2025-10-17 |

| JP Morgan | Downgrade | Neutral | 2025-10-15 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-09-02 |

| Barclays | Downgrade | Equal Weight | 2025-08-14 |

Overall, the trend in grades suggests stability, with several analysts maintaining their ratings despite recent downgrades. Notably, the consistent “Equal Weight” ratings from multiple firms indicate a cautious sentiment around Fortive’s performance moving forward.

Target Prices

According to the latest analysis, there is a clear consensus on the target prices for Fortive Corporation (FTV).

| Target High | Target Low | Consensus |

|---|---|---|

| 66 | 40 | 54.57 |

Analysts expect Fortive’s stock to reach a consensus target of approximately 54.57, with a range from a low of 40 to a high of 66.

Consumer Opinions

Consumer sentiment about Fortive Corporation (FTV) reveals a mixed yet insightful perspective that can guide potential investors.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative product offerings enhance efficiency. | Customer service response times are slow. |

| Strong commitment to sustainability initiatives. | Some products have durability issues. |

| Reliable brand with a solid reputation. | Pricing is higher compared to competitors. |

| Excellent user-friendly technology. | Limited availability of support resources. |

| Positive impact on operational performance. | Occasional software glitches reported. |

Overall, consumer feedback highlights Fortive’s innovation and sustainability as major strengths, while slow customer service and higher pricing are noted as common weaknesses.

Risk Analysis

In evaluating Fortive Corporation (FTV), it’s essential to understand the potential risks that could impact the company’s performance. Below is a table summarizing these risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Increasing competition from tech-focused firms. | High | High |

| Supply Chain Disruptions | Vulnerability to global supply chain issues. | Medium | High |

| Regulatory Changes | Potential changes in industry regulations. | Medium | Medium |

| Economic Downturn | Global economic conditions affecting sales. | High | Medium |

| Technological Obsolescence | Rapid tech advancement may outpace product offerings. | Medium | High |

Synthesizing these risks, market competition and economic downturns are the most likely to occur and can have significant impacts on Fortive’s operations. Recent trends show a growing emphasis on innovation, which could heighten competitive pressures.

Should You Buy Fortive Corporation?

Fortive Corporation has demonstrated a positive net margin of 13.37%, which indicates strong profitability. The company maintains a debt-to-equity ratio of 0.38, reflecting a manageable level of debt. Over recent years, the fundamentals have shown steady growth, and the company is currently rated B+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company’s long-term trend is currently negative, which suggests potential concerns for investors. Additionally, the recent seller volume exceeds the buyer volume, indicating a lack of buying pressure in the market.

Conclusion Considering the negative long-term trend and the recent seller dominance, it might be prudent to wait for more favorable conditions to emerge before considering an investment in Fortive Corporation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Vanguard Group Inc. Grows Stock Position in Fortive Corporation $FTV – MarketBeat (Nov 23, 2025)

- How Will Fortive’s (FTV) Operational Streamlining and Share Buybacks Shape Its Investment Narrative? – Yahoo Finance (Nov 08, 2025)

- Fortive Corporation (NYSE:FTV) Q3 2025 Earnings Call Transcript – MSN (Oct 29, 2025)

- Magnetar Financial LLC Grows Stock Position in Fortive Corporation $FTV – MarketBeat (Nov 23, 2025)

- Fortive Declares Regular Quarterly Dividend on its Common Stock and Announces Replenishment of its General Share Repurchase Authorization – Stock Titan (Nov 05, 2025)

For more information about Fortive Corporation, please visit the official website: fortive.com