In a world where efficient material handling is crucial for productivity, Columbus McKinnon Corporation revolutionizes how industries move and secure their goods. With a robust portfolio of innovative solutions, including electric hoists and advanced automation systems, CMCO stands out as a trusted partner in sectors ranging from construction to e-commerce. As we delve into an investment analysis, I invite you to consider whether CMCO’s solid fundamentals and growth trajectory still justify its current market valuation.

Table of contents

Company Description

Columbus McKinnon Corporation (CMCO), founded in 1875 and headquartered in Buffalo, NY, is a prominent player in the agricultural machinery industry, specializing in intelligent motion solutions. The company designs, manufactures, and markets a wide range of products, including hoists, crane systems, rigging equipment, and power technology solutions. With a market capitalization of approximately $443M, CMCO serves diverse sectors, such as transportation, energy, and industrial automation, through both direct sales and partnerships with distributors and manufacturers. Its strategic focus on innovation and comprehensive material handling solutions positions it as a leader in shaping industry standards and advancing operational efficiencies.

Fundamental Analysis

In this section, I will analyze Columbus McKinnon Corporation’s income statement, financial ratios, and dividend payout policy to evaluate its investment potential.

Income Statement

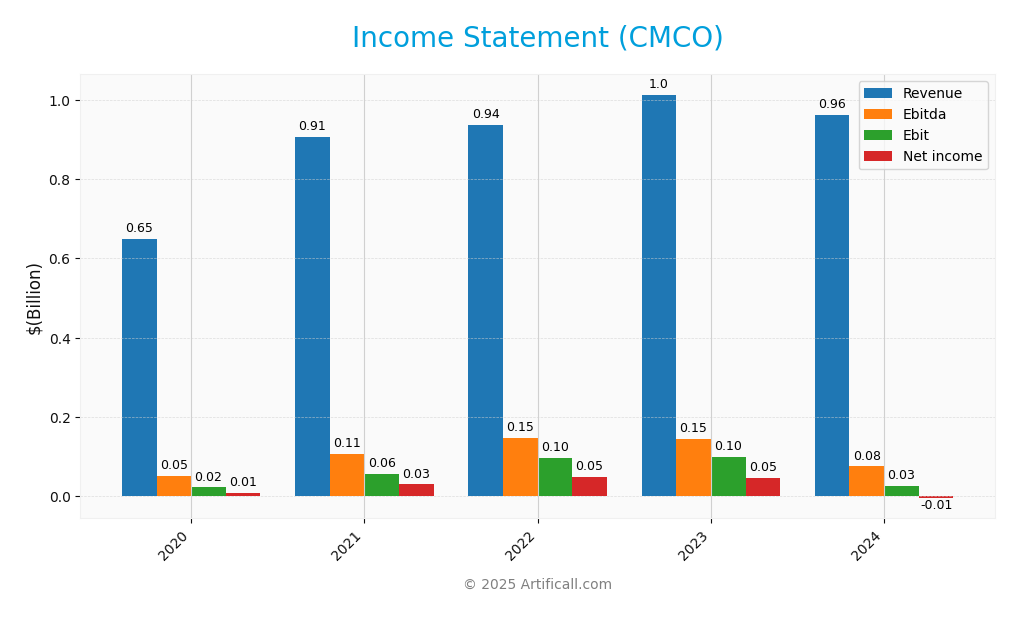

The following table provides a comprehensive overview of Columbus McKinnon Corporation’s income statement for the fiscal years 2021 to 2025, highlighting key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 650M | 907M | 936M | 1014M | 963M |

| Cost of Revenue | 429M | 591M | 594M | 639M | 637M |

| Operating Expenses | 178M | 242M | 244M | 268M | 271M |

| Gross Profit | 220M | 316M | 342M | 375M | 326M |

| EBITDA | 50M | 106M | 147M | 145M | 75M |

| EBIT | 22M | 57M | 97M | 99M | 27M |

| Interest Expense | 12M | 20M | 28M | 38M | 32M |

| Net Income | 9M | 30M | 48M | 47M | -5M |

| EPS | 0.38 | 1.06 | 1.69 | 1.62 | -0.18 |

| Filing Date | 2021-05-26 | 2022-05-25 | 2023-05-25 | 2024-05-29 | 2025-05-28 |

Interpretation of Income Statement

Over the observed period, Columbus McKinnon Corporation experienced fluctuations in revenue, peaking in 2024 at 1B but falling to 963M in 2025. Notably, net income shifted dramatically from a profit of 48M in 2023 to a loss of 5M in 2025, indicating a significant decline in profitability. Gross profit margins remained relatively stable, yet the recent year’s EBITDA reflects a notable drop, suggesting potential operational challenges. The increased operating expenses, particularly in research and development, may have impacted overall profitability, warranting caution for investors considering the company’s current trajectory.

Financial Ratios

Here is a summary of the financial ratios for Columbus McKinnon Corporation (CMCO) over the last few fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 3.27% | 5.17% | 4.60% | -0.53% |

| ROE | 1.72% | 5.81% | 5.21% | -0.58% |

| ROIC | 1.92% | 3.83% | 4.23% | 3.30% |

| P/E | 40.08 | 21.95 | 26.56 | -94.69 |

| P/B | 1.54 | 1.27 | 1.40 | 0.55 |

| Current Ratio | 1.87 | 2.05 | 1.96 | 1.81 |

| Quick Ratio | 1.18 | 1.31 | 1.25 | 1.04 |

| D/E | 0.66 | 0.63 | 0.68 | 0.61 |

| Debt-to-Assets | 30.33% | 30.97% | 32.84% | 31.09% |

| Interest Coverage | 3.67 | 3.50 | 2.82 | 1.68 |

| Asset Turnover | 0.54 | 0.55 | 0.56 | 0.55 |

| Fixed Asset Turnover | 9.26 | 9.92 | 5.89 | 9.07 |

| Dividend Yield | 0.55% | 0.75% | 0.65% | 1.65% |

Interpretation of Financial Ratios

Analyzing Columbus McKinnon Corporation’s (CMCO) financial ratios reveals several insights into its financial health. The current ratio stands at 1.81, indicating solid short-term liquidity, while the quick ratio of 1.04 suggests adequate ability to cover immediate liabilities without relying on inventory sales. However, the solvency ratio is quite low at 0.05, raising concerns about long-term financial stability. Profitability ratios show weakness, with a net profit margin of -0.0053, indicating losses. The debt-to-equity ratio of 0.61 suggests moderate leverage, but the interest coverage ratio of 1.68 implies potential difficulties in meeting interest obligations. Overall, while liquidity is acceptable, profitability and solvency present significant challenges.

Evolution of Financial Ratios

Over the past five years, CMCO’s financial ratios have shown a concerning downward trend in profitability, with net profit margins transitioning from positive to negative. Liquidity ratios have remained relatively stable, indicating consistent short-term financial health, but solvency ratios have deteriorated, raising red flags for long-term sustainability.

Distribution Policy

Columbus McKinnon Corporation (CMCO) currently does pay dividends, with a recent annual dividend yield of approximately 1.65%. However, the dividend payout ratio stands at a concerning -156%, indicating that distributions are not sustainable at current income levels. The company also engages in share buybacks, which may offer some shareholder value, but the risks of unsustainable distributions and excessive repurchases cannot be overlooked. Overall, while dividend payments are made, they do not appear to support long-term value creation given the financial metrics.

Sector Analysis

Columbus McKinnon Corporation operates within the agricultural machinery industry, providing innovative motion solutions and competing with major players through its extensive product offerings and specialized equipment.

Strategic Positioning

Columbus McKinnon Corporation (CMCO) currently holds a competitive position in the agricultural machinery sector, with a market cap of approximately $443M. The company faces moderate competitive pressure from both established players and new entrants, as technological disruption continues to reshape the industry landscape. CMCO’s key products, such as electric hoists and crane systems, maintain a solid market share, but ongoing innovations in automation and material handling solutions necessitate continuous adaptation. As a result, effective risk management strategies will be crucial for sustaining its market presence.

Revenue by Segment

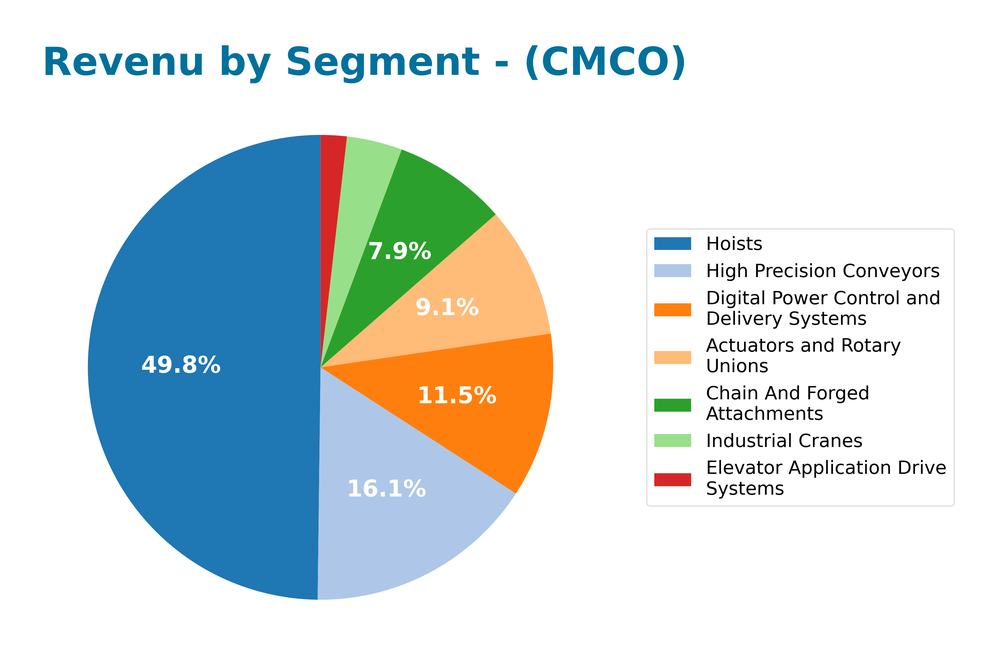

The following chart illustrates Columbus McKinnon Corporation’s revenue by segment for the fiscal year ending March 31, 2024, highlighting key performance areas and their contributions.

In FY 2024, Columbus McKinnon saw significant contributions from its various product segments. Hoists led the way with a remarkable $480M, followed by High Precision Conveyors at $155M and Digital Power Control Systems at $110M. Notably, revenue from Actuators and Rotary Unions and Chain and Forged Attachments remained stable but showed signs of slight decline compared to the previous year. The overall trend indicates a strong performance in core segments, although a slowdown in growth might pose risks related to market concentration and margin pressures going forward.

Key Products

Below is a table showcasing some of the key products offered by Columbus McKinnon Corporation, highlighting their primary functions and applications.

| Product | Description |

|---|---|

| Electric Hoists | Designed for efficient lifting and positioning of materials, these hoists are ideal for various industrial applications. |

| Crane Systems | Comprehensive crane solutions, including components and kits for mobile and jib cranes, enhancing material handling capabilities. |

| Rigging Equipment | A range of lifting devices such as chains, shackles, and slings that ensure safe and effective load handling. |

| Power and Motion Technology | Products that include motor controls and automation systems, facilitating advanced motion solutions for diverse industries. |

| Explosion-Protected Hoists | Custom-engineered hoists designed for use in hazardous environments, ensuring safety and reliability in challenging conditions. |

| Conveyor Systems | Flexible and scalable conveyor solutions for material handling in various sectors, from manufacturing to warehousing. |

| Mechanical Actuators | Devices that convert electrical energy into motion, used in various applications from automation to industrial machinery. |

These products reflect Columbus McKinnon’s commitment to providing innovative and intelligent motion solutions across multiple industries.

Main Competitors

No verified competitors were identified from available data. Columbus McKinnon Corporation (CMCO) operates in the agricultural machinery sector and has an estimated market share that positions it effectively within its niche. The company focuses on intelligent motion solutions for various industries, showcasing its competitive strength in the market.

Competitive Advantages

Columbus McKinnon Corporation (CMCO) holds a strong competitive edge through its extensive portfolio of intelligent motion solutions, which cater to diverse industries such as energy, construction, and e-commerce. The company’s focus on innovation enables it to launch new products like advanced automation systems and energy-efficient hoists, capturing emerging market opportunities. As the demand for sophisticated material handling continues to rise, CMCO stands poised for growth, enhancing its market position while ensuring long-term value for investors. I remain cautious, however, as market fluctuations could impact performance.

SWOT Analysis

This SWOT analysis aims to identify the key strengths, weaknesses, opportunities, and threats relevant to Columbus McKinnon Corporation (CMCO) to aid in strategic decision-making.

Strengths

- Strong market presence

- Diverse product range

- Experienced management

Weaknesses

- Dependence on industrial sectors

- Limited global reach

- Supply chain vulnerabilities

Opportunities

- Growth in e-commerce logistics

- Expansion into emerging markets

- Technological advancements in automation

Threats

- Intense competition

- Economic downturns

- Regulatory changes in manufacturing

The overall SWOT assessment suggests that while CMCO has a solid foundation and growth opportunities, it must address its weaknesses and potential threats to enhance its strategic position. Focusing on diversifying its market reach and investing in technology could be pivotal for long-term sustainability and growth.

Stock Analysis

Over the past year, Columbus McKinnon Corporation (CMCO) has experienced significant price movements, characterized by notable volatility and a pronounced bearish trend. The stock has faced a steep decline, reflecting the broader trading dynamics in the market.

Trend Analysis

Analyzing the stock price over the past year reveals a percentage change of -58.22%. This indicates a bearish trend, suggesting that the stock has been under substantial selling pressure. Notably, the highest price during this period reached 44.9, while the lowest dipped to 12.96. Furthermore, the trend has shown signs of acceleration, with a standard deviation of 11.27 indicating high volatility.

In the recent two and a half months, from September 14, 2025, to November 30, 2025, the stock has shown a positive price change of 6.86%. This shift indicates a potential neutral trend as it falls within the -2% to +2% range, although the upward slope of the trend suggests some recovery momentum.

Volume Analysis

Over the last three months, total trading volume for CMCO has reached 157.88M shares, with buyer volume at 72.72M and seller volume at 84.83M. The volume trend is increasing, indicating heightened market activity, albeit predominantly seller-driven as sellers have outpaced buyers overall, accounting for 53.94% of the total volume.

In the recent period from September 14, 2025, to November 30, 2025, buyer volume was 10.23M against seller volume of 6.95M, reflecting a slight buyer dominance at 59.55%. This suggests a shift in investor sentiment toward a more positive outlook, albeit with caution as the overall market remains bearish.

Analyst Opinions

Recent analyst recommendations for Columbus McKinnon Corporation (CMCO) have shown a consensus rating of “Buy” with a B+ grade. Analysts highlight strong discounted cash flow projections and a solid price-to-book ratio as key factors supporting this rating. However, the company’s lower scores in return on equity and debt-to-equity raise some caution. Notable analysts backing this recommendation include those from major investment firms who emphasize CMCO’s growth potential in the industrial sector. Overall, the sentiment remains positive as investors seek to leverage CMCO’s strengths while being mindful of its financial metrics.

Stock Grades

Columbus McKinnon Corporation (CMCO) has recently seen notable changes in its stock ratings. Below is a summary of the most recent grades from reliable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2025-02-11 |

| DA Davidson | Maintain | Buy | 2024-02-05 |

| DA Davidson | Maintain | Buy | 2022-10-04 |

| DA Davidson | Maintain | Buy | 2022-10-03 |

| Barrington Research | Maintain | Outperform | 2022-07-29 |

| Barrington Research | Maintain | Outperform | 2022-07-28 |

| JP Morgan | Downgrade | Neutral | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-25 |

| JP Morgan | Downgrade | Neutral | 2022-05-25 |

The overall trend indicates a recent downgrade from DA Davidson, changing from “Buy” to “Neutral,” suggesting a more cautious outlook. Meanwhile, Barrington Research continues to show confidence with a consistent “Outperform” rating. This mixed sentiment highlights an evolving perspective on CMCO’s market position.

Target Prices

The target consensus for Columbus McKinnon Corporation (CMCO) indicates a stable outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 50 | 48 | 49 |

Analysts expect CMCO to trade around the consensus price of 49, reflecting a positive sentiment within the market.

Consumer Opinions

Consumer sentiment regarding Columbus McKinnon Corporation (CMCO) reveals a mix of appreciation and criticism, providing valuable insights for potential investors.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent quality and reliability of products.” | “Customer service could be more responsive.” |

| “Innovative solutions that enhance productivity.” | “Prices are on the higher side.” |

| “Strong reputation in the industry.” | “Limited product range compared to competitors.” |

Overall, consumer feedback highlights Columbus McKinnon’s strong product quality and innovation as key strengths, while concerns about customer service and pricing are common weaknesses that could impact future growth.

Risk Analysis

In evaluating Columbus McKinnon Corporation (CMCO), I have compiled a table outlining the key risks that could affect the company’s performance and shareholder value.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in market demand affecting sales. | High | High |

| Supply Chain | Disruptions in raw material supply affecting production. | Medium | High |

| Regulatory | Changes in regulations impacting operational costs. | Medium | Medium |

| Competition | Increased competition reducing market share. | High | Medium |

| Economic Downturn | Broader economic issues leading to reduced capital spending. | Medium | High |

The most pressing risks for CMCO include market volatility and supply chain disruptions, which are highly probable and can significantly impact operational efficiency and revenue generation. Recent trends in inflation and geopolitical tensions could exacerbate these issues, necessitating careful monitoring.

Should You Buy Columbus McKinnon Corporation?

Columbus McKinnon Corporation (CMCO) is currently facing challenges with a negative net margin of -0.0053, and it has a high level of debt with a total debt of 540671000. The fundamentals have shown a recent decline in profitability, and the company is rated B+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a negative net margin, which indicates unprofitability. Additionally, the long-term trend of the stock is bearish, with a significant price change of -58.22%. Furthermore, the recent seller volume exceeds the recent buyer volume, suggesting a lack of buyer interest in the stock.

Conclusion Given the negative net margin, the bearish long-term trend, and the recent seller dominance, it might be preferable to wait for more favorable conditions before considering an investment in CMCO.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Segall Bryant & Hamill LLC Boosts Holdings in Columbus McKinnon Corporation $CMCO – MarketBeat (Nov 24, 2025)

- We Wouldn’t Be Too Quick To Buy Columbus McKinnon Corporation (NASDAQ:CMCO) Before It Goes Ex-Dividend – Yahoo Finance (Nov 02, 2025)

- Columbus McKinnon to Present at the 2025 Baird Global Industrial Conference – Sahm (Nov 06, 2025)

- Columbus McKinnon Reports 8% Sales Growth in Q2 FY26 and Reaffirms Guidance – PR Newswire (Oct 30, 2025)

- Columbus McKinnon’s (NASDAQ:CMCO) Soft Earnings Don’t Show The Whole Picture – simplywall.st (Nov 06, 2025)

For more information about Columbus McKinnon Corporation, please visit the official website: columbusmckinnon.com