In the rapidly evolving landscape of human capital management and enterprise solutions, Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) emerge as key players. Both companies operate within overlapping sectors—ADP in staffing and employment services, and Workday in software applications—yet they adopt distinctly different innovation strategies. This article will evaluate their market positions, growth prospects, and technological advancements to help you determine which company presents a more compelling investment opportunity.

Table of contents

Company Overview

Automatic Data Processing, Inc. Overview

Automatic Data Processing, Inc. (ADP) is a leader in cloud-based human capital management solutions, providing a wide array of services designed to optimize HR processes for businesses globally. Founded in 1949 and headquartered in Roseland, NJ, ADP operates primarily through two segments: Employer Services and Professional Employer Organization (PEO) Services. The Employer Services segment delivers comprehensive HR outsourcing solutions, including payroll, benefits administration, and talent management, while the PEO segment focuses on small to mid-sized businesses, offering co-employment models that enhance HR capabilities. With a market cap of $102.4B and a workforce of 64K employees, ADP is well-positioned in the staffing and employment services industry.

Workday, Inc. Overview

Workday, Inc. specializes in enterprise cloud applications that cater to business management and operations. Founded in 2005 and based in Pleasanton, CA, Workday provides a suite of integrated applications focusing on financial management, human capital management (HCM), and analytics. By enabling organizations to manage everything from employee recruitment to financial processes, Workday serves diverse industries, including healthcare and technology. With a market cap of $60.1B and a team of approximately 20.5K employees, Workday is recognized for its strong emphasis on innovation and user experience in the software application sector.

Key Similarities and Differences

Both ADP and Workday operate in the HR and business management space, yet they differ in their primary services. ADP emphasizes comprehensive HR outsourcing and payroll solutions, while Workday focuses on integrated cloud applications for finance and HCM. Additionally, ADP serves a broader range of business sizes, including small and mid-sized companies through its PEO services, while Workday primarily targets larger enterprises with its robust software applications.

Income Statement Comparison

The table below compares the most recent income statements of Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY), highlighting key financial metrics.

| Metric | [Company A: ADP] | [Company B: WDAY] |

|---|---|---|

| Revenue | 20.56B | 8.42B |

| EBITDA | 6.24B | 1.08B |

| EBIT | 5.76B | 0.75B |

| Net Income | 4.08B | 0.53B |

| EPS | 10.02 | 1.98 |

Interpretation of Income Statement

In the most recent fiscal year, ADP has shown robust growth with a 10.5% increase in revenue from $19.20B in 2024 to $20.56B in 2025, while WDAY’s revenue increased by 17% from $7.20B to $8.42B. ADP’s net income rose to $4.08B, reflecting strong operational efficiency with improved margins. In contrast, WDAY’s net income also improved to $0.53B, indicating a turnaround despite previous losses. Overall, ADP continues to maintain higher margins, showcasing its established market position, while WDAY demonstrates promising growth potential as it recovers from prior challenges.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent revenue and financial ratios for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY).

| Metric | ADP | WDAY |

|---|---|---|

| ROE | 65.93% | 5.82% |

| ROIC | 24.66% | 3.22% |

| P/E | 30.77 | 132.15 |

| P/B | 20.29 | 7.69 |

| Current Ratio | 1.05 | 1.85 |

| Quick Ratio | 1.05 | 1.85 |

| D/E | 1.46 | 0.37 |

| Debt-to-Assets | 16.99% | 18.70% |

| Interest Coverage | 11.87 | 4.30 |

| Asset Turnover | 0.39 | 0.47 |

| Fixed Asset Turnover | 19.97 | 5.34 |

| Payout ratio | 58.80% | 0% |

| Dividend yield | 1.91% | 0% |

Interpretation of Financial Ratios

ADP demonstrates strong financial health with robust ROE and ROIC, indicating effective management of equity and capital. In contrast, WDAY’s high P/E ratio suggests it may be overvalued, especially given its low profitability margins. While WDAY’s current and quick ratios are favorable, the lack of dividends raises concerns for income-oriented investors. Overall, ADP appears to be a more stable investment option.

Dividend and Shareholder Returns

Automatic Data Processing, Inc. (ADP) offers a solid dividend with a yield of 1.91% and a payout ratio around 58.8%, showing a commitment to returning value to shareholders. However, potential risks exist if these distributions become unsustainable amid cash flow fluctuations. In contrast, Workday, Inc. (WDAY) does not pay dividends, focusing instead on reinvestment for growth. This strategy may align with long-term value creation if it successfully enhances profitability. Ultimately, ADP’s dividends may better support sustainable shareholder value compared to WDAY’s growth-focused approach.

Strategic Positioning

In the competitive landscape of human capital management solutions, Automatic Data Processing, Inc. (ADP) holds a significant market share, leveraging its extensive offerings in payroll and HR outsourcing. ADP faces competitive pressure from Workday, Inc., which specializes in enterprise cloud applications, particularly in financial and human capital management. Both companies are navigating technological disruptions, focusing on AI-driven solutions to enhance operational efficiency and customer experience. As they innovate, risk management remains critical to sustaining their market positions.

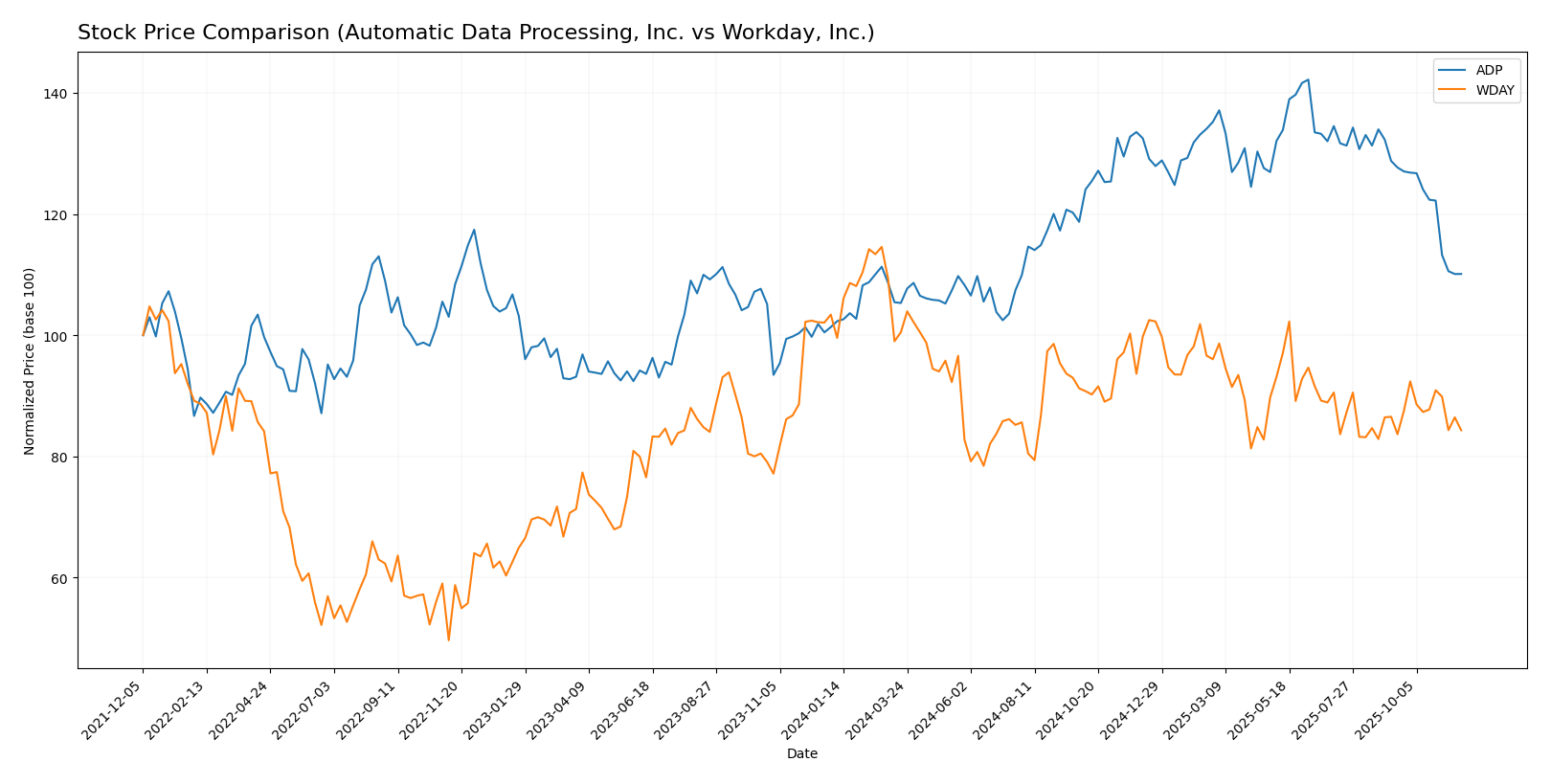

Stock Comparison

In this section, I will analyze the stock price movements of Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) over the past year, highlighting key trends and trading dynamics that could impact investor decisions.

Trend Analysis

Automatic Data Processing, Inc. (ADP) Over the past year, ADP’s stock has experienced a percentage change of +8.65%, indicating a bullish trend. The stock reached a notable high of 326.81 and a low of 232.97. Despite this overall growth, recent data from September 7, 2025, to November 23, 2025, shows a decline of -14.48%, with a standard deviation of 16.61, suggesting increased volatility. The trend has also shown signs of deceleration, with a trend slope of -4.51.

Workday, Inc. (WDAY) In contrast, WDAY’s stock has decreased by -18.45% over the past year, reflecting a bearish trend. The stock hit a high of 305.88 and a low of 209.48. More recently, from September 7, 2025, to November 23, 2025, WDAY’s stock saw a decline of -2.57%, with a standard deviation of 6.86, indicating lower volatility in this period. The trend slope during this timeframe is -0.25, suggesting a stable decrease.

In summary, ADP presents a bullish outlook despite recent short-term declines, while WDAY’s bearish trend reflects broader challenges. Investors should weigh these dynamics carefully when considering their portfolios.

Analyst Opinions

Recent analyst recommendations for Automatic Data Processing, Inc. (ADP) indicate a “Buy” rating with a B+ score, highlighting strong return on equity and return on assets as key strengths. Analysts emphasize ADP’s solid fundamentals and low debt-to-equity ratio. Conversely, Workday, Inc. (WDAY) received a “Hold” recommendation with a B rating, as analysts note decent performance but caution against potential market volatility. The consensus for ADP leans toward a buy, while WDAY remains a hold for the current year.

Stock Grades

In this section, I present the latest stock ratings for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) as evaluated by reputable grading companies.

Automatic Data Processing, Inc. (ADP) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

| Stifel | maintain | Hold | 2025-07-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-17 |

| Mizuho | maintain | Outperform | 2025-06-13 |

| UBS | maintain | Neutral | 2025-06-13 |

| RBC Capital | maintain | Sector Perform | 2025-06-05 |

| TD Securities | maintain | Hold | 2025-05-21 |

Workday, Inc. (WDAY) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Neutral | 2025-11-03 |

| DA Davidson | maintain | Neutral | 2025-09-19 |

| Barclays | maintain | Overweight | 2025-09-18 |

| Guggenheim | upgrade | Buy | 2025-09-18 |

| RBC Capital | maintain | Outperform | 2025-09-17 |

| JMP Securities | maintain | Market Outperform | 2025-09-17 |

| Guggenheim | upgrade | Buy | 2025-09-17 |

| Needham | maintain | Buy | 2025-09-17 |

| Evercore ISI Group | maintain | Outperform | 2025-09-17 |

| TD Cowen | maintain | Buy | 2025-09-17 |

Overall, the grades for ADP indicate a consistent stance of caution with multiple firms maintaining an “Underweight” rating, suggesting limited upside potential. In contrast, WDAY has seen some upgrades to “Buy” from Guggenheim, indicating a more favorable outlook among certain analysts.

Target Prices

The consensus target prices for the following companies indicate a positive outlook among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Automatic Data Processing, Inc. (ADP) | 290 | 245 | 278.25 |

| Workday, Inc. (WDAY) | 304 | 235 | 272.45 |

For ADP, the consensus target price of 278.25 suggests an upside potential from the current price of 253.12, while WDAY has a consensus target of 272.45 compared to its current price of 225.14, indicating room for growth as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) based on the most recent data.

| Criterion | ADP | WDAY |

|---|---|---|

| Diversification | Strong in HR solutions across various sectors | Focused primarily on enterprise applications |

| Profitability | Net profit margin of 19.8% | Net profit margin of 6.3% |

| Innovation | Consistent updates and integrations in HR tech | Strong focus on financial management innovation |

| Global presence | Operates worldwide with a robust client base | Expanding internationally but less established than ADP |

| Market Share | Significant share in HR services | Growing but lower share in the enterprise software market |

| Debt level | Moderate debt-to-equity ratio of 1.46 | Higher debt-to-equity ratio of 0.37 |

In summary, ADP demonstrates strong profitability and global presence, making it a solid choice for investors seeking stability. WDAY, while innovative, carries higher risk due to its lower profitability and market share.

Risk Analysis

In the following table, I outline the key risks associated with Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY):

| Metric | ADP | WDAY |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

Both companies face significant operational risks, particularly WDAY, which has been notably affected by high competition in the software sector. Additionally, WDAY’s market risk is elevated due to its dependency on revenue growth in a volatile tech landscape.

Which one to choose?

When comparing Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY), ADP appears to present a more favorable opportunity for long-term investors. ADP boasts a higher net profit margin (20%) compared to WDAY’s lower margin (6.25%). Additionally, ADP’s price-to-earnings ratio of 30.77 suggests a more reasonable valuation than WDAY’s significantly higher 132.15. Analysts rate ADP at a B+ while WDAY receives a B, indicating stronger fundamentals for ADP.

For growth-oriented investors, WDAY may seem appealing due to its innovative cloud solutions; however, its recent bearish stock trend (-18.45%) raises concerns about short-term performance. Conversely, ADP’s bullish trend and lower volatility could benefit investors seeking stability and consistent returns.

Risks include competition and market dependence, particularly for WDAY in the rapidly evolving tech landscape.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Automatic Data Processing, Inc. and Workday, Inc. to enhance your investment decisions: