In today’s digital age, cybersecurity is more crucial than ever, making companies like Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc. pivotal players in the software infrastructure sector. Both firms operate within the same industry and share a commitment to innovation in cybersecurity solutions, yet they employ distinct strategies in addressing market needs. As an investor, understanding these differences can be key to making informed decisions. Let’s delve into which of these two companies may offer the most promising opportunities for your portfolio.

Table of contents

Company Overview

Palo Alto Networks, Inc. Overview

Palo Alto Networks (PANW) is a leading cybersecurity provider focused on delivering comprehensive security solutions for organizations globally. Since its incorporation in 2005, the company has positioned itself at the forefront of the cybersecurity industry, offering a wide array of products and services, including firewall appliances, threat prevention, and cloud security. Their mission is to protect digital transformation by providing cutting-edge technology that addresses evolving cyber threats. With a market capitalization of approximately $122.3B, they cater to various sectors, including healthcare, finance, and government, making them a pivotal player in the cybersecurity landscape.

CrowdStrike Holdings, Inc. Overview

Founded in 2011, CrowdStrike (CRWD) specializes in cloud-delivered endpoint protection and cybersecurity solutions. The company’s Falcon platform is a hallmark of its offering, providing real-time threat intelligence, identity protection, and managed security services. Serving a diverse clientele worldwide, CrowdStrike aims to empower businesses to combat sophisticated cyber threats effectively. With a market cap of around $121.6B, it has established a strong foothold in the technology sector, driven by innovation and a subscription-based model that emphasizes ongoing customer engagement and security.

Key Similarities and Differences

Both Palo Alto Networks and CrowdStrike operate within the cybersecurity sector and utilize subscription-based models to deliver their services. However, while Palo Alto focuses heavily on hardware solutions alongside software, CrowdStrike primarily emphasizes cloud-based services and endpoint protection. This distinction indicates different operational strategies and market approaches, catering to varying customer needs in the evolving cybersecurity landscape.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) for their most recent fiscal years.

| Metric | PANW | CRWD |

|---|---|---|

| Revenue | 9.22B | 3.95B |

| EBITDA | 1.94B | 294M |

| EBIT | 1.60B | 80.8M |

| Net Income | 1.13B | -19M |

| EPS | 1.71 | -0.08 |

Interpretation of Income Statement

Palo Alto Networks shows robust growth, with revenue increasing from 8.03B in 2024 to 9.22B in 2025, while net income rose significantly from 258M to 1.13B, indicating improved profitability. The EBITDA margin also reflects stability, demonstrating efficient cost management. In contrast, CrowdStrike’s revenue growth from 3.06B to 3.95B is commendable, but the company reported a net loss of 19M in 2025, reflecting challenges in expense management. Overall, PANW exhibits stronger financial health, while CRWD needs to refine its operational strategies to enhance profitability.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD).

| Metric | PANW | CRWD |

|---|---|---|

| ROE | 14.49% | -0.59% |

| ROIC | 5.67% | 0.70% |

| P/E | 101.43 | -5055.66 |

| P/B | 14.70 | 29.71 |

| Current Ratio | 0.89 | 1.67 |

| Quick Ratio | 0.89 | 1.67 |

| D/E | 0.043 | 0.241 |

| Debt-to-Assets | 0.014 | 0.090 |

| Interest Coverage | 414.3 | -4.58 |

| Asset Turnover | 0.39 | 0.45 |

| Fixed Asset Turnover | 12.56 | 4.76 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Palo Alto Networks showcases strong financial health with a solid ROE of 14.49%, indicating effective management and profitability. In contrast, CrowdStrike’s negative P/E ratio suggests significant operational challenges. PANW’s low debt levels (D/E of 0.043) and high interest coverage (414.3) reflect robust risk management, while CRWD’s higher debt ratios raise concerns about financial stability. Investors should weigh these factors carefully when considering their investment choices.

Dividend and Shareholder Returns

Neither Palo Alto Networks (PANW) nor CrowdStrike Holdings (CRWD) currently pays dividends, reflecting a focus on reinvestment for growth rather than immediate shareholder returns. Both companies are in high-growth phases, prioritizing R&D and expansion. Importantly, they engage in share buybacks, which can bolster shareholder value over time. While this strategy may align with long-term value creation, investors should assess the sustainability of such approaches amid ongoing market volatility.

Strategic Positioning

Palo Alto Networks (PANW) and CrowdStrike (CRWD) are key players in the cybersecurity market, both holding substantial market shares. PANW’s emphasis on diverse cybersecurity solutions positions it competitively against CRWD’s specialized cloud-delivered protection services. With PANW’s market cap at $122.3B and CRWD at $121.6B, both companies face competitive pressure from emerging technologies and new entrants. The ongoing technological disruption in cybersecurity requires both companies to innovate continuously to maintain their positions.

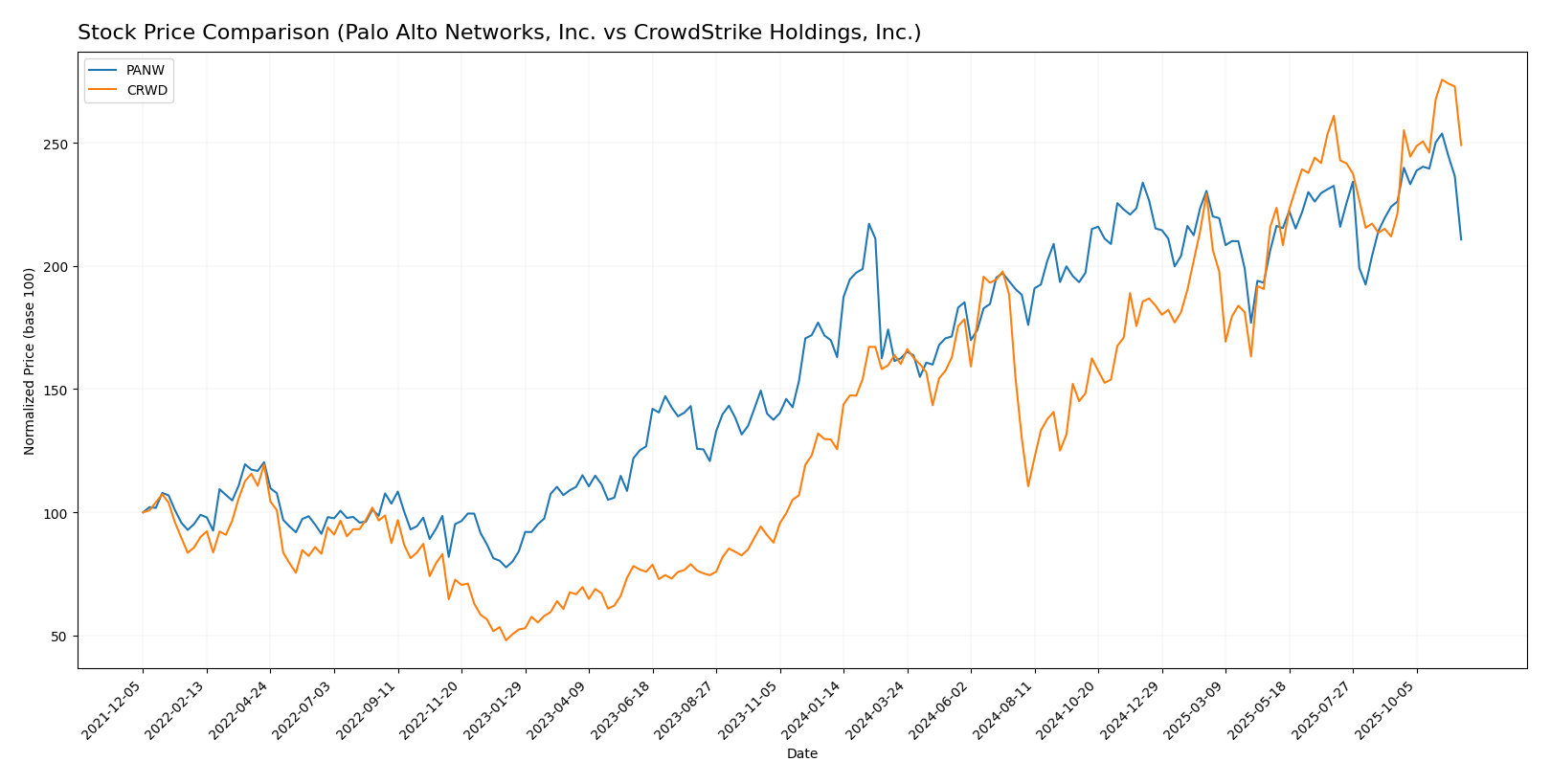

Stock Comparison

In analyzing the weekly stock price movements of Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) over the past year, we observe significant fluctuations and trading dynamics that reflect the companies’ performance in the cybersecurity sector.

Trend Analysis

Palo Alto Networks, Inc. (PANW) has demonstrated a price change of +24.05% over the past year, indicating a bullish trend. However, the recent analysis from September 7, 2025, to November 23, 2025, reveals a decline of -5.94%, suggesting a deceleration in momentum. The price range during this period oscillated between a high of 220.24 and a low of 134.51, with a notable standard deviation of 20.4, indicating volatility in the stock’s price.

CrowdStrike Holdings, Inc. (CRWD) exhibits a robust price change of +92.18% over the last year, also reflecting a bullish trend. The recent performance from September 7, 2025, to November 23, 2025, shows a positive change of +17.49%, accompanied by an acceleration in the trend. The stock recorded a price range from a low of 217.89 to a high of 543.01, with a significant standard deviation of 79.27, highlighting its volatility.

Investors should consider these dynamics and the respective trends when evaluating their positions in either company.

Analyst Opinions

Recent analyst recommendations for Palo Alto Networks, Inc. (PANW) indicate a “Buy” rating, with analysts praising its strong discounted cash flow and return on equity scores. Notably, analysts appreciate the company’s robust growth potential and solid financial metrics. On the other hand, CrowdStrike Holdings, Inc. (CRWD) has received a “Hold” rating, with analysts like those from Morgan Stanley expressing concerns about its lower overall scores, particularly in return on equity and assets. The consensus for PANW leans towards a buy, while CRWD remains a more cautious hold for 2025.

Stock Grades

In this section, I present the latest stock grades for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) based on reliable grading data from recognized companies.

Palo Alto Networks, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-20 |

| Rosenblatt | Maintain | Buy | 2025-11-20 |

| Wedbush | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-20 |

| Piper Sandler | Maintain | Overweight | 2025-11-20 |

CrowdStrike Holdings, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-11-18 |

| Rosenblatt | Maintain | Buy | 2025-11-18 |

| Stifel | Maintain | Buy | 2025-11-17 |

| Mizuho | Maintain | Neutral | 2025-11-17 |

| Barclays | Maintain | Overweight | 2025-11-14 |

| Baird | Maintain | Neutral | 2025-11-14 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| BTIG | Maintain | Buy | 2025-11-04 |

| Oppenheimer | Maintain | Outperform | 2025-10-17 |

| WestPark Capital | Maintain | Hold | 2025-10-15 |

Overall, we see a mixed trend for PANW, with a recent downgrade from HSBC to Reduce, while other firms maintain a Buy or higher rating. CRWD maintains a strong Buy rating from multiple analysts, indicating consistent investor confidence in the stock’s performance.

Target Prices

The consensus target prices for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) indicate optimistic growth potential in their respective valuations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 250 | 157 | 228.83 |

| CrowdStrike Holdings, Inc. | 706 | 430 | 541.57 |

For PANW, the consensus target price of 228.83 suggests significant upside potential compared to the current price of 182.9, while CRWD shows a strong consensus of 541.57 against its current price of 490.67, indicating confidence among analysts in both companies’ growth trajectories.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD).

| Criterion | Palo Alto Networks, Inc. (PANW) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Diversification | High, with multiple cybersecurity solutions | Moderate, focusing mainly on endpoint security |

| Profitability | Net Profit Margin: 12.3% | Net Profit Margin: -0.5% |

| Innovation | Strong focus on continuous innovation | High emphasis on advanced threat detection |

| Global presence | Established in multiple regions | Rapidly expanding internationally |

| Market Share | Strong presence in enterprise security | Growing market share in endpoint protection |

| Debt level | Low debt-to-equity ratio: 0.043 | Moderate debt-to-equity ratio: 0.241 |

In summary, Palo Alto Networks exhibits strong profitability and low debt levels, making it a financially stable choice. Conversely, CrowdStrike, while innovative, struggles with profitability, which may present a risk for investors seeking stable returns.

Risk Analysis

The following table outlines the various risks associated with Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD).

| Metric | PANW | CRWD |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

In synthesizing the risks, I observe that both companies face significant market risk, with CrowdStrike experiencing a higher level. Regulatory challenges are pronounced for Palo Alto Networks, while operational risks are elevated for both firms, primarily due to their reliance on software infrastructure in a rapidly changing technological landscape.

Which one to choose?

In comparing Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD), the fundamentals indicate that PANW is currently a more favorable option for investors. PANW exhibits a higher gross profit margin at 73.41% versus CRWD’s 74.92%, but its net income margin of 12.30% is significantly better than CRWD’s negative margin. The valuation metrics also favor PANW, which has a price-to-earnings ratio of 101.43 compared to CRWD’s staggering -5055.66. Analyst ratings are also notable; PANW holds a rating of B, while CRWD has a C-.

For investors seeking growth, PANW appears to be the better choice due to its upward price trend and solid financial performance, while conservative investors might prefer PANW for its stability and relatively lower risk profile. However, both companies face substantial competition and market dependence risks.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc. to enhance your investment decisions: