In the fast-paced world of technology, NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA) stand out as two prominent players in the semiconductor industry. Both companies are known for their innovative approaches to connectivity and computing solutions, catering to overlapping markets such as automotive and IoT. While NVIDIA leads with its expansive GPU offerings and AI solutions, CEVA focuses on licensing cutting-edge wireless and smart sensing technologies. Join me as we delve into the strengths and strategies of these companies to uncover the more compelling investment opportunity.

Table of contents

Company Overview

NVIDIA Corporation Overview

NVIDIA Corporation, headquartered in Santa Clara, California, is a leading player in the semiconductors industry, specializing in graphics processing units (GPUs) and artificial intelligence (AI) solutions. Founded in 1993, NVIDIA has positioned itself at the forefront of gaming, professional visualization, data centers, and automotive sectors. The company’s mission revolves around enhancing computing experiences through innovative technologies, such as its GeForce GPUs for gaming and advanced computing platforms for AI and high-performance computing (HPC). With a market capitalization of $4.47T and a beta of 2.27, NVIDIA is known for its strong growth prospects and strategic collaborations, including one with Kroger Co.

CEVA, Inc. Overview

CEVA, Inc., based in Rockville, Maryland, operates as a licensor of wireless connectivity and smart sensing technologies to semiconductor companies and original equipment manufacturers (OEMs) globally. Established in 1999, CEVA focuses on providing digital signal processors (DSPs), AI processors, and integrated platforms for applications in mobile, IoT, and industrial sectors. The company’s mission is to empower innovation in smart devices through its advanced technology solutions. With a market capitalization of $448M and a beta of 1.45, CEVA is carving out a niche in the digital signal processing space, catering to a diverse array of industries, including automotive and robotics.

Key similarities between NVIDIA and CEVA include their focus on semiconductor technology and their roles as enablers for various industries through innovative solutions. However, they differ significantly in their business models: NVIDIA directly sells high-performance GPUs and computing platforms, while CEVA primarily licenses its technologies to OEMs and semiconductor companies for integration into their products.

Income Statement Comparison

In this section, I present a comparative analysis of the Income Statements for NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA) based on the most recent fiscal year data.

| Metric | NVIDIA Corporation (NVDA) | CEVA, Inc. (CEVA) |

|---|---|---|

| Revenue | 130.5B | 106.9M |

| EBITDA | 86.1B | -3.4M |

| EBIT | 84.3B | -7.5M |

| Net Income | 72.9B | -8.8M |

| EPS | 2.97 | -0.37 |

Interpretation of Income Statement

In FY 2025, NVIDIA demonstrated robust revenue growth, reaching 130.5B, a significant increase from previous years, leading to a net income of 72.9B. The company’s EBITDA and EBIT margins remained strong, indicating effective cost management. In contrast, CEVA reported a revenue drop to 106.9M and a net loss of 8.8M, marking a continuation of its struggles with profitability. The stark difference in performance between the two companies highlights NVIDIA’s strength in the market compared to CEVA’s challenges in maintaining growth and managing expenses effectively.

Financial Ratios Comparison

The following table summarizes the most recent financial ratios for NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA), allowing for a quick comparison of their financial health and performance.

| Metric | NVIDIA (NVDA) | CEVA (CEVA) |

|---|---|---|

| ROE | 91.87% | -3.30% |

| ROIC | 75.28% | -8.56% |

| P/E | 39.90 | -44.90 |

| P/B | 36.66 | 2.79 |

| Current Ratio | 4.44 | 7.09 |

| Quick Ratio | 3.88 | 7.09 |

| D/E | 0.13 | 0.02 |

| Debt-to-Assets | 0.09 | 0.02 |

| Interest Coverage | 329.77 | N/A |

| Asset Turnover | 1.17 | 0.34 |

| Fixed Asset Turnover | 16.16 | 8.43 |

| Payout Ratio | 1.14% | 0% |

| Dividend Yield | 0.03% | 0% |

Interpretation of Financial Ratios

NVIDIA demonstrates strong profitability with a high ROE and ROIC, indicating effective use of equity and capital. The P/E ratio suggests that the stock is relatively expensive, but this could be justified by its growth potential. On the other hand, CEVA’s negative profitability ratios raise concerns about its financial health, indicating potential operational challenges. The high current and quick ratios for both companies signal good liquidity, but CEVA’s negative returns could warrant caution from investors.

Dividend and Shareholder Returns

NVIDIA Corporation (NVDA) pays a minimal dividend with a payout ratio of approximately 1.1%, reflecting a strategy focused on growth and share buybacks, which enhance shareholder value. The annual dividend yield stands at just 0.03%. CEVA, Inc. does not distribute dividends, likely due to its ongoing investment in growth and R&D, alongside negative net income. Both companies engage in share buyback programs, but NVDA’s approach seems more aligned with sustainable long-term value creation for shareholders compared to CEVA’s current lack of distributions.

Strategic Positioning

NVIDIA Corporation (NVDA) commands a substantial market share in the semiconductor industry, primarily through its advanced GPUs, capturing key segments like gaming and data centers. Its innovative AI and computing solutions create high competitive pressure, especially from emerging technologies. In contrast, CEVA, Inc. (CEVA) focuses on licensing wireless connectivity and smart sensing technologies, making it a niche player. While NVDA faces technological disruptions from competitors, CEVA must navigate a crowded market with diverse applications in IoT and automotive sectors. Risk management is essential for both companies as they adapt to rapid technological changes.

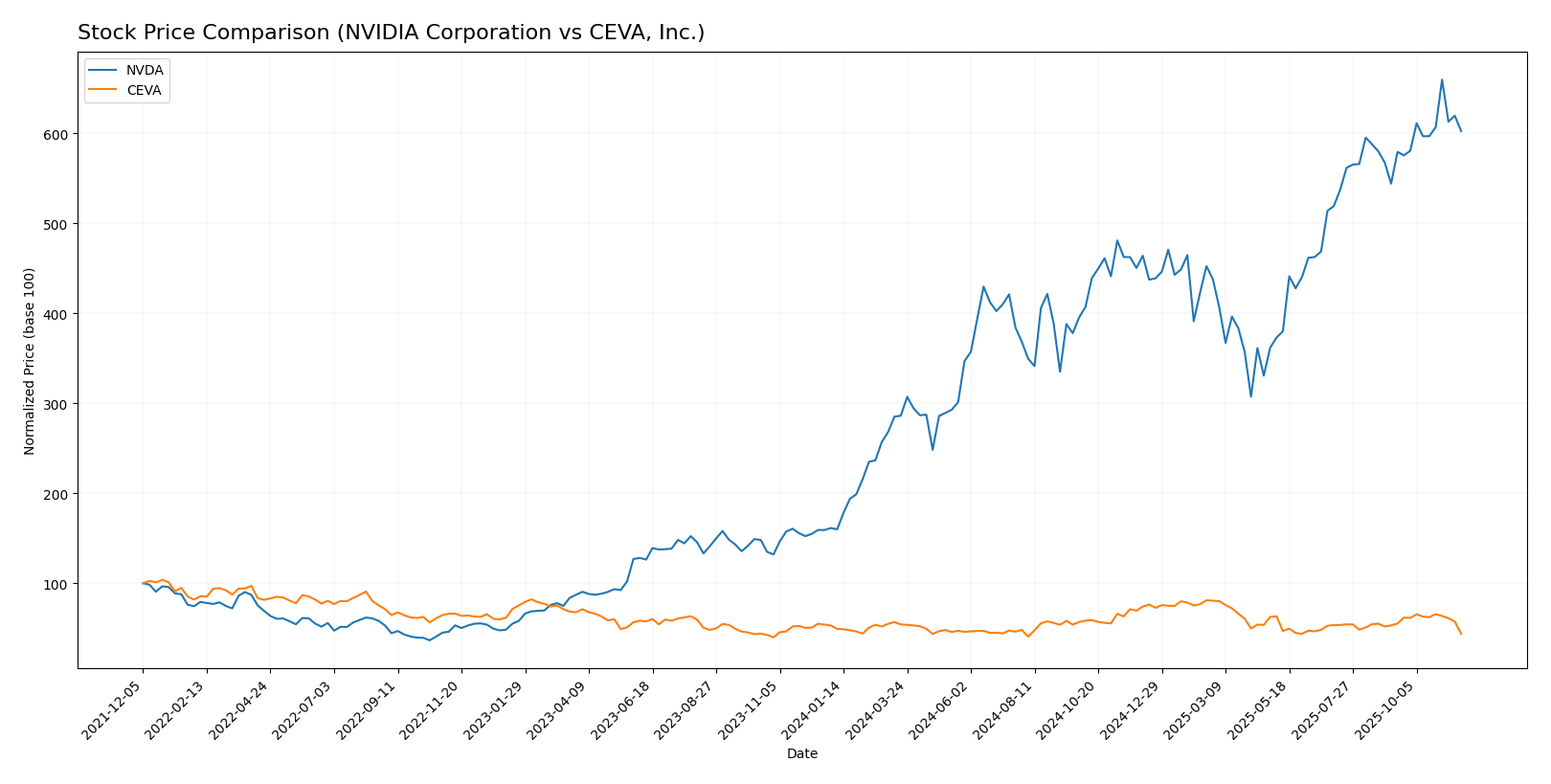

Stock Comparison

In this section, I will analyze the weekly stock price movements and trading dynamics for NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA) over the past year, highlighting key price changes and trends.

Trend Analysis

NVIDIA Corporation (NVDA) Over the past year, NVDA has experienced a remarkable price change of +273.45%. This signifies a bullish trend characterized by acceleration, as indicated by the highest price of 202.49 and the lowest price of 49.1. The recent trend, analyzed from September 7, 2025, to November 23, 2025, shows a positive change of +10.72% with a standard deviation of 8.32, reflecting moderate volatility. The trend exhibits an upward slope of 1.77, indicating continued strength in the stock.

CEVA, Inc. (CEVA) In contrast, CEVA has faced a decline of -17.38% over the last year, categorizing it in a bearish trend with deceleration. The stock recorded a high of 34.67 and a low of 17.39. The recent analysis from September 7, 2025, to November 23, 2025, reveals a further decrease of -17.46% with a standard deviation of 2.56. The trend slope of -0.11 indicates a weakening position, with the stock showing signs of persistent downward pressure.

In summary, NVDA presents a strong upward trajectory, while CEVA is on a downward trend, suggesting distinct investment considerations for each.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA). Analysts have assigned NVDA a solid B+ rating, reflecting strong return metrics and overall performance, suggesting a buy consensus. In contrast, CEVA received a C+ rating, with concerns over its lower return on equity and asset efficiency, leading to a hold recommendation. Analysts from various firms seem to favor NVDA for its growth potential while approaching CEVA with caution. Overall, the consensus favors a buy on NVDA, while CEVA remains under scrutiny.

Stock Grades

In the current market landscape, it’s crucial to stay informed about stock ratings from reputable grading companies. Here’s a look at the recent grades for NVIDIA Corporation and CEVA, Inc.

NVIDIA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | maintain | Buy | 2025-11-20 |

| Benchmark | maintain | Buy | 2025-11-20 |

| Bernstein | maintain | Outperform | 2025-11-20 |

| Mizuho | maintain | Outperform | 2025-11-20 |

| DA Davidson | maintain | Buy | 2025-11-20 |

| Morgan Stanley | maintain | Overweight | 2025-11-20 |

| Baird | maintain | Outperform | 2025-11-20 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| Keybanc | maintain | Overweight | 2025-11-20 |

| Deutsche Bank | maintain | Hold | 2025-11-20 |

CEVA, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-11-12 |

| Rosenblatt | maintain | Buy | 2025-11-11 |

| Rosenblatt | maintain | Buy | 2025-08-14 |

| Oppenheimer | maintain | Outperform | 2025-05-09 |

| Barclays | maintain | Overweight | 2025-05-08 |

| Rosenblatt | maintain | Buy | 2025-05-08 |

| Rosenblatt | maintain | Buy | 2025-04-23 |

| Barclays | maintain | Overweight | 2025-02-14 |

| Rosenblatt | maintain | Buy | 2025-02-14 |

| Rosenblatt | maintain | Buy | 2025-02-11 |

Overall, the trend for both NVIDIA and CEVA suggests a strong position, with multiple grading companies maintaining positive ratings. This could indicate investor confidence in their respective business models and market strategies.

Target Prices

The consensus target price data for NVIDIA Corporation (NVDA) indicates a robust outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation | 352 | 200 | 261.36 |

Analysts expect NVDA to reach a consensus price of 261.36, which suggests significant potential upside compared to its current price of 183.54. Unfortunately, no verified target price data is available for CEVA, Inc. (CEVA), indicating uncertainty in market sentiment regarding this stock.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA) based on the most recent financial data.

| Criterion | NVIDIA Corporation (NVDA) | CEVA, Inc. (CEVA) |

|---|---|---|

| Diversification | High (multiple markets) | Moderate (focused on wireless and AI) |

| Profitability | Strong (net margin: 55.8%) | Weak (negative margins) |

| Innovation | High (leading in AI tech) | Moderate (advancing in DSP technologies) |

| Global presence | Extensive (operates internationally) | Limited (mainly in the US) |

| Market Share | Leading (semiconductor industry) | Niche player |

| Debt level | Low (debt-to-equity: 0.13) | Very low (debt-to-equity: 0.02) |

Key takeaways indicate that NVIDIA excels in profitability and innovation, marking it as a strong investment. In contrast, CEVA, although having a low debt level, struggles with profitability and market presence, suggesting higher risks for potential investors.

Risk Analysis

The following table summarizes the various risks associated with NVIDIA Corporation and CEVA, Inc.:

| Metric | NVIDIA Corporation (NVDA) | CEVA, Inc. (CEVA) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In synthesizing these risks, I find that both companies face significant environmental and regulatory challenges. For NVIDIA, geopolitical tensions, especially related to tech supply chains, can impact operations. CEVA, on the other hand, grapples with high operational and regulatory risks due to its reliance on varied tech sectors.

Which one to choose?

When comparing NVIDIA Corporation (NVDA) and CEVA, Inc. (CEVA), it’s clear that NVDA stands out as the more robust investment opportunity. NVDA boasts a market cap of 2.91T and impressive profitability metrics, including a net profit margin of 55.8% and a gross profit margin of 74.99%. In contrast, CEVA has struggled with declines, showing a bearish trend with a price change of -17.38% recently and a net loss in the last fiscal year. Financially, NVDA’s rating is B+ compared to CEVA’s C+, reflecting strong fundamentals and favorable analyst opinions, which suggest a continued bullish trend for NVDA.

Investors seeking growth may prefer NVDA, while those focused on value might cautiously consider CEVA, acknowledging its current challenges. However, potential risks include intense competition and market dependence that could affect both companies’ performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NVIDIA Corporation and CEVA, Inc. to enhance your investment decisions: