In the fast-evolving landscape of technology, Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC) stand out as key players in the software application industry. Both companies are dedicated to innovation, yet they approach their markets differently, with a focus on distinct product offerings and customer solutions. Cadence thrives in the realm of integrated circuit design, while PTC leads in digital transformation through its advanced IoT and AR platforms. This article will help you determine which company presents the more compelling investment opportunity.

Table of contents

Company Overview

Cadence Design Systems, Inc. Overview

Cadence Design Systems, Inc. (CDNS) is a leader in electronic design automation, providing software, hardware, and services tailored for the design of integrated circuits (ICs). Founded in 1987 and headquartered in San Jose, California, Cadence focuses on functional verification, digital IC design, and system analysis. Its robust portfolio includes tools for logic simulation, emulation, and physical design, serving various markets such as 5G communications, automotive, and aerospace. With a market capitalization of approximately $83.5B, Cadence is well-positioned in the technology sector, continuously innovating to meet the evolving needs of its clients.

PTC Inc. Overview

PTC Inc. (PTC) is a prominent software and services company that specializes in product lifecycle management (PLM) and augmented reality solutions. Established in 1985 and based in Boston, Massachusetts, PTC operates globally, offering platforms like ThingWorx and Vuforia, which empower businesses to digitally transform their operations. Comprising two segments—Software Products and Professional Services—PTC has a market cap of around $20.6B, focusing on enhancing product development and collaboration through innovative software solutions.

Key Similarities and Differences

Both Cadence and PTC operate within the software application industry, emphasizing technological solutions to enhance design and development processes. However, Cadence primarily concentrates on electronic design automation for ICs, while PTC focuses on broader product lifecycle management and augmented reality applications. This distinction defines their target markets and service offerings, indicating differing specialized expertise within the technology sector.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Cadence Design Systems, Inc. (CDNS) and PTC Inc. for their most recent fiscal years.

| Metric | CDNS | PTC |

|---|---|---|

| Revenue | 4.64B | 2.74B |

| EBITDA | 1.67B | 1.06B |

| EBIT | 1.47B | 0.93B |

| Net Income | 1.06B | 741M |

| EPS | 3.89 | 6.18 |

Interpretation of Income Statement

In the most recent fiscal year, CDNS reported a revenue increase to 4.64B, reflecting strong market demand, while PTC experienced significant growth as well, reaching 2.74B. Both companies maintained healthy EBITDA margins, with CDNS at 36% and PTC at 39%. Notably, CDNS’s net income of 1.06B shows a consistent upward trend, indicating effective cost management and operational efficiency. PTC’s net income also improved to 741M, highlighting its recovery trajectory. Overall, both companies demonstrate resilience, although CDNS is showcasing more robust growth metrics compared to PTC.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Cadence Design Systems (CDNS) and PTC Inc. (PTC). This table summarizes key metrics that can guide your investment decisions.

| Metric | Cadence Design Systems (CDNS) | PTC Inc. (PTC) |

|---|---|---|

| ROE | 22.58% | 19.33% |

| ROIC | 13.43% | 11.82% |

| P/E | 77.20 | 32.88 |

| P/B | 17.44 | 6.36 |

| Current Ratio | 2.93 | 0.78 |

| Quick Ratio | 2.74 | 0.78 |

| D/E | 0.55 | 0.60 |

| Debt-to-Assets | 28.80% | 30.24% |

| Interest Coverage | 17.77 | 4.91 |

| Asset Turnover | 0.52 | 0.41 |

| Fixed Asset Turnover | 7.68 | 15.58 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Cadence Design Systems exhibits strong financial health with a robust current ratio and interest coverage, indicating good liquidity and ability to meet debt obligations. Conversely, while PTC has lower P/E and P/B ratios, suggesting it may be undervalued, its current ratio and interest coverage ratios are concerning. Both companies have no dividend payouts, which could be a point of interest for income-focused investors.

Dividend and Shareholder Returns

Neither Cadence Design Systems (CDNS) nor PTC Inc. pays dividends, which aligns with their growth-focused strategies. CDNS has consistently reinvested in innovation, while PTC is in a similar phase, prioritizing R&D and acquisitions. Both companies engage in share buybacks, signaling management’s confidence in their long-term growth potential. This approach, while lacking immediate cash returns, appears to support sustained value creation for shareholders through capital appreciation.

Strategic Positioning

Cadence Design Systems, Inc. (CDNS) holds a significant market share in the semiconductor design software sector, especially with its advanced verification tools like JasperGold and Xcelium. Meanwhile, PTC Inc. (PTC) competes robustly through its ThingWorx platform and 3D CAD solutions. Both companies face competitive pressure from emerging technologies and startups that prioritize innovation, which compels them to adapt quickly. Technological disruption continues to reshape their landscape, making agility and strategic investment in R&D crucial for maintaining their market positions.

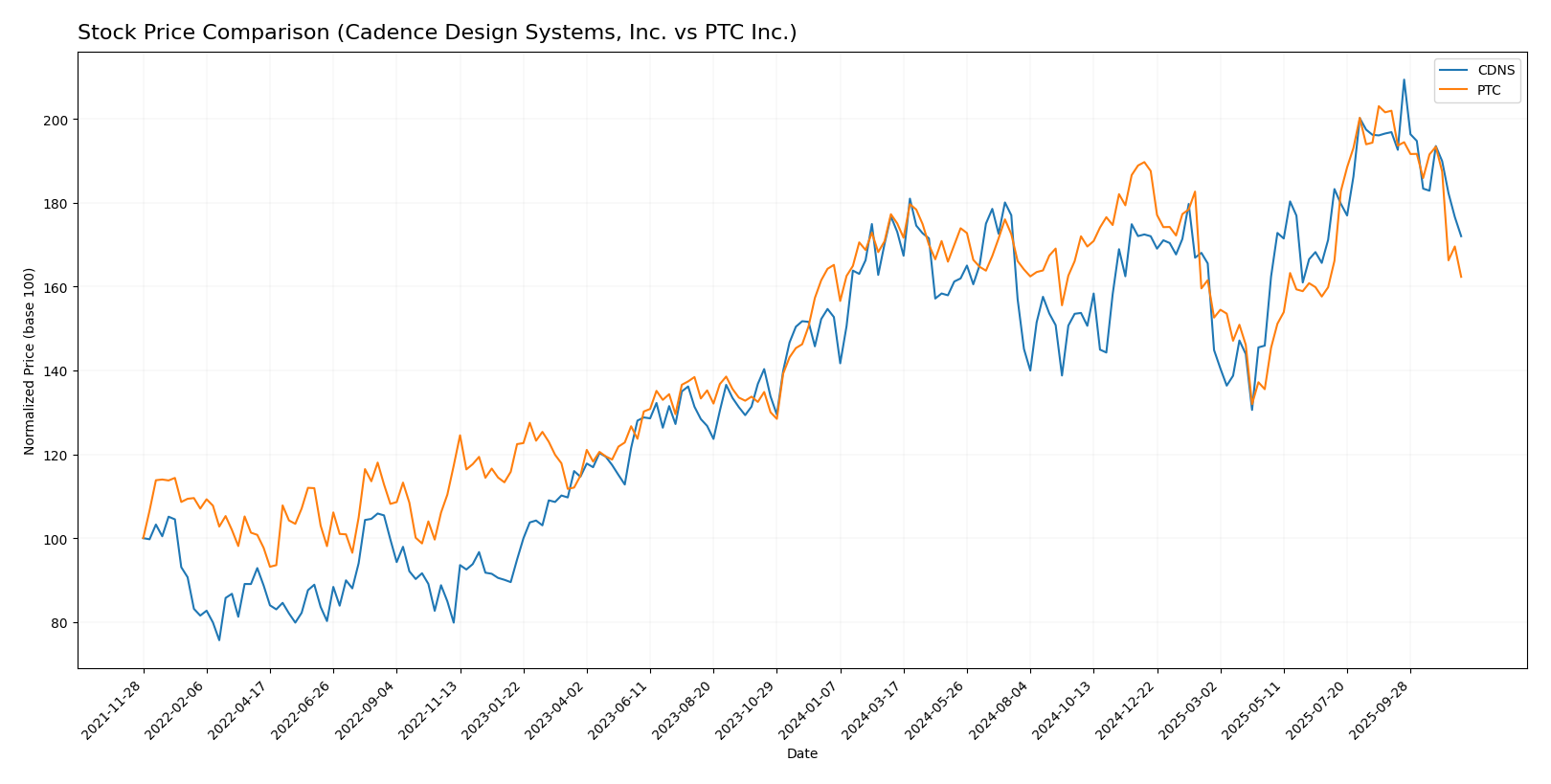

Stock Comparison

In this section, I will analyze the weekly stock price dynamics of Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC) over the past year, highlighting key price movements and trends.

Trend Analysis

Cadence Design Systems, Inc. (CDNS) Over the past year, CDNS has experienced a price change of +12.63%. This indicates a bullish trend, although the recent trend shows a decline of -12.61%, suggesting a deceleration in momentum. The stock has fluctuated between a high of 373.35 and a low of 232.88, with a standard deviation of 29.23, reflecting considerable volatility.

PTC Inc. (PTC) PTC’s stock has seen a price change of -1.73% over the past year, indicating a bearish trend. The recent period has shown a more significant decline of -19.62%, which further confirms the bearish sentiment. The stock has varied between a high of 215.05 and a low of 139.77, with a standard deviation of 15.42, also indicating notable volatility.

Analyst Opinions

Recent analyst recommendations for both Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC) indicate a consensus of “buy” for the current year. Analysts have given CDNS a rating of “B,” highlighting strong return on assets and equity, though noting lower scores in price-to-earnings and price-to-book ratios. PTC received a slightly higher “B+” rating, praised for its solid discounted cash flow score and strong asset returns. Notable analysts have expressed confidence in the growth potential of both companies, making them attractive options for investors.

Stock Grades

In the current market, stock ratings offer valuable insights for investors. Here are the latest grades for Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC):

Cadence Design Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-07-29 |

| JP Morgan | Maintain | Overweight | 2025-07-29 |

| Stifel | Maintain | Buy | 2025-07-29 |

PTC Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-07-31 |

| Piper Sandler | Maintain | Neutral | 2025-07-31 |

| Oppenheimer | Maintain | Outperform | 2025-07-31 |

| Rosenblatt | Maintain | Buy | 2025-07-31 |

| Keybanc | Maintain | Overweight | 2025-07-31 |

| RBC Capital | Maintain | Outperform | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-31 |

Overall, both companies show a mix of grades, with several maintaining strong positions such as “Overweight” and “Buy.” Notably, while CDNS has a diversity of ratings, PTC has a consistent buy sentiment from multiple analysts. As always, it’s essential to consider these grades in conjunction with your risk management strategy.

Target Prices

Currently, I have reliable target price data for Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC), showcasing the consensus expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cadence Design Systems | 418 | 355 | 396.14 |

| PTC Inc. | 255 | 120 | 213.25 |

Analysts expect Cadence Design Systems to rise to a consensus target of 396.14, while PTC’s target consensus is set at 213.25. Compared to their current prices of 306.76 for CDNS and 171.94 for PTC, both stocks show promising upside potential based on analyst expectations.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC) based on recent financial data.

| Criterion | Cadence Design Systems (CDNS) | PTC Inc. (PTC) |

|---|---|---|

| Diversification | Strong in semiconductor design and verification | Focused on IoT and product lifecycle management |

| Profitability | Net margin: 22.7% | Net margin: 27.1% |

| Innovation | High R&D investment | Strong AR and digital transformation solutions |

| Global presence | Operates in various tech sectors worldwide | Strong presence in Americas, Europe, and Asia Pacific |

| Market Share | Significant in EDA software | Increasing in IoT and PLM markets |

| Debt level | Moderate (debt-to-equity: 0.55) | Moderate (debt-to-equity: 0.36) |

In summary, while both companies exhibit strong profitability and innovation, Cadence stands out in semiconductor design, whereas PTC excels in IoT solutions. Both maintain manageable debt levels, highlighting potential for growth.

Risk Analysis

In this section, I will outline the primary risks associated with two companies, Cadence Design Systems, Inc. (CDNS) and PTC Inc. (PTC), to guide your investment decisions.

| Metric | Cadence Design Systems, Inc. | PTC Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face notable risks. PTC is particularly vulnerable to market and operational risks due to economic fluctuations and competition in the tech sector. Cadence, while also exposed to market risks, benefits from a strong regulatory stance and operational stability.

Which one to choose?

In comparing Cadence Design Systems (CDNS) and PTC Inc. (PTC), both companies exhibit solid fundamentals. CDNS shows a strong gross profit margin of 86% and a net profit margin of 23%, although it has a high P/E ratio of approximately 77, indicating a premium valuation. Conversely, PTC presents a lower gross profit margin of 84% and a net profit margin of 27%, with a more favorable P/E ratio of around 33.

Analyst ratings give CDNS a grade of B, while PTC stands slightly higher with a B+. Stock trends reveal CDNS in a bullish phase despite recent corrections, while PTC is currently bearish, experiencing a decline in price. For growth-oriented investors, CDNS may be appealing, whereas those seeking stability might prefer PTC due to its more favorable valuation and consistent margins.

Risks include competition in the tech sector and potential valuation concerns for CDNS.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cadence Design Systems, Inc. and PTC Inc. to enhance your investment decisions: