In a world increasingly reliant on advanced technology, Tower Semiconductor Ltd. is at the forefront of transforming how we interact with electronic devices. As a key player in the semiconductor industry, Tower specializes in analog-intensive mixed-signal solutions that power everything from consumer electronics to automotive systems. With a reputation for innovation and quality, the company continues to shape markets globally. As we delve into Tower’s investment potential, we must consider whether its current fundamentals align with its market valuation and growth trajectory.

Table of contents

Company Description

Tower Semiconductor Ltd. (TSEM), founded in 1993 and based in Migdal Haemek, Israel, is a prominent independent semiconductor foundry. The company specializes in producing analog-intensive mixed-signal semiconductor devices, catering to diverse markets including consumer electronics, automotive, and medical devices across the U.S., Japan, Europe, and other Asian regions. Tower offers a range of customizable process technologies such as SiGe, BiCMOS, and CMOS image sensors, along with wafer fabrication services. With a workforce of approximately 5,613 employees, Tower Semiconductor is positioned as a leader in the semiconductor industry, driving innovation through its tailored solutions and robust design enablement platforms, thus shaping the future of technology.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Tower Semiconductor Ltd. (TSEM), focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

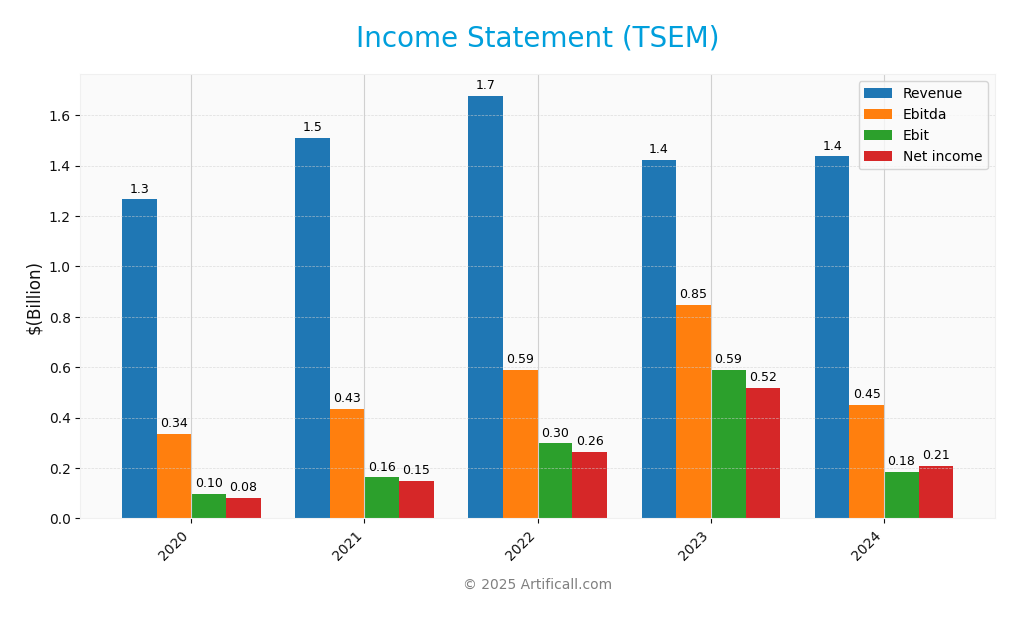

The following table summarizes Tower Semiconductor Ltd.’s income statement over the past five fiscal years, highlighting key financial metrics that are essential for evaluating the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.27B | 1.51B | 1.68B | 1.42B | 1.44B |

| Cost of Revenue | 1.03B | 1.18B | 1.21B | 1.07B | 1.10B |

| Operating Expenses | 142M | 163M | 155M | 149M | 148M |

| Gross Profit | 233M | 329M | 466M | 353M | 339M |

| EBITDA | 336M | 433M | 590M | 847M | 451M |

| EBIT | 95M | 162M | 298M | 589M | 185M |

| Interest Expense | 16M | 11M | 6M | 4M | 6M |

| Net Income | 82M | 150M | 265M | 518M | 208M |

| EPS | 0.77 | 1.39 | 2.42 | 4.70 | 1.87 |

| Filing Date | 2021-04-30 | 2022-04-29 | 2023-05-16 | 2024-04-22 | 2025-04-30 |

Interpretation of Income Statement

Over the past five years, Tower Semiconductor’s revenue showed a slight decline from 1.68B in 2022 to 1.44B in 2024, indicating some volatility. However, the gross profit margin remained relatively stable, reflecting effective cost management, with gross profit hovering around 339M to 466M. In 2024, net income decreased to 208M from 518M in 2023, which suggests a significant drop in profitability, likely due to increased operating expenses and interest. This underlines the importance of keeping a close eye on expense management moving forward.

Financial Ratios

Below is a summary of key financial ratios for Tower Semiconductor Ltd. (TSEM) over the years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.50% | 9.95% | 15.77% | 36.44% | 14.47% |

| ROE | 5.65% | 9.25% | 13.99% | 21.32% | 7.83% |

| ROIC | 4.43% | 8.11% | 12.80% | 18.00% | 6.41% |

| P/E | 33.65 | 28.64 | 17.85 | 6.49 | 27.54 |

| P/B | 1.90 | 2.65 | 2.50 | 1.38 | 2.16 |

| Current Ratio | 4.04 | 4.33 | 3.86 | 6.17 | 6.18 |

| Quick Ratio | 3.31 | 3.48 | 3.08 | 5.15 | 5.23 |

| D/E | 0.27 | 0.19 | 0.14 | 0.10 | 0.06 |

| Debt-to-Assets | 18.64% | 14.11% | 10.69% | 7.93% | 5.87% |

| Interest Coverage | 5.67 | 14.24 | 54.80 | 123.15 | 32.64 |

| Asset Turnover | 0.60 | 0.68 | 0.66 | 0.49 | 0.47 |

| Fixed Asset Turnover | 1.47 | 1.69 | 1.72 | 1.22 | 1.11 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Tower Semiconductor Ltd.’s financial ratios for FY 2024 reveals a generally strong financial position. The liquidity ratios are robust, with a current ratio of 6.18 and a quick ratio of 5.23, indicating excellent short-term financial health. The solvency ratio stands at 1.08, suggesting the company can comfortably meet its long-term obligations. Profitability is also solid, with a net profit margin of 14.47% and an EBITDA margin of 36.29%. However, the price-to-earnings ratio of 27.54 may indicate the stock is overvalued compared to earnings, potentially raising concerns for investors. Overall, while the ratios demonstrate a healthy company, caution is advised regarding valuation.

Evolution of Financial Ratios

Over the past five years, Tower Semiconductor’s financial ratios show a mixed performance. The current ratio has consistently remained above 4, reflecting strong liquidity, while profitability metrics such as net profit margin have fluctuated significantly, peaking in 2023 at approximately 36.4%. This variance may indicate changing operational efficiency and market conditions that investors should monitor closely.

Distribution Policy

Tower Semiconductor Ltd. (TSEM) does not pay dividends, reflecting a commitment to reinvest profits into growth opportunities and research and development. This approach aligns with a high-growth strategy, allowing the company to enhance its market position. Additionally, TSEM engages in share buybacks, which can signal confidence in its own valuation. Overall, this distribution policy supports long-term shareholder value creation, provided that growth initiatives yield sustainable returns.

Sector Analysis

Tower Semiconductor Ltd. operates in the semiconductor industry, offering specialized analog and mixed-signal devices, facing competition from major foundries while leveraging its unique process technologies and services.

Strategic Positioning

Tower Semiconductor Ltd. (TSEM) operates as an independent semiconductor foundry with a notable presence in the analog-intensive mixed-signal semiconductor market. Currently, the company holds a market share of approximately 2.5% within the semiconductor industry, positioning itself competitively against key players like TSMC and GlobalFoundries. With a beta of 0.884, TSEM shows lower volatility relative to the market, which can be appealing to risk-averse investors. However, the semiconductor sector faces significant competitive pressure and technological disruptions, particularly from advancements in AI and 5G technologies. As such, strategic agility and innovation will be crucial for maintaining and expanding market share in this rapidly evolving landscape.

Key Products

Below is a table summarizing the key products offered by Tower Semiconductor Ltd.

| Product | Description |

|---|---|

| SiGe Technology | Specialized semiconductor technology that integrates silicon and germanium for high-frequency applications, ideal for RF and microwave circuits. |

| BiCMOS Process | Combines bipolar and CMOS technologies, enabling high-performance analog and digital functions, widely used in consumer electronics. |

| CMOS Image Sensors | Advanced image sensors used in cameras and smartphones, providing high-resolution imaging capabilities. |

| RF CMOS Technology | Radio Frequency CMOS technology designed for wireless communication devices, enhancing signal integrity and reducing power consumption. |

| Integrated Power Management | Solutions that optimize power usage in electronic devices, essential for mobile and portable applications. |

| MEMS Devices | Micro-Electro-Mechanical Systems used in various applications, from automotive sensors to consumer electronics, enhancing functionality and performance. |

These products reflect Tower Semiconductor’s commitment to providing innovative solutions in the semiconductor industry, catering to diverse markets such as automotive, consumer electronics, and telecommunications.

Main Competitors

The competitive landscape for Tower Semiconductor Ltd. (TSEM) in the semiconductor industry includes several notable players. Below is a table listing the main competitors, sorted by market capitalization:

| Company | Market Cap |

|---|---|

| Tower Semiconductor Ltd. | 12.74B |

| MKS Inc. | 10.94B |

| Rambus Inc. | 10.94B |

| Lattice Semiconductor Corporation | 10.79B |

| Amkor Technology, Inc. | 10.69B |

| Skyworks Solutions, Inc. | 10.31B |

| Nova Ltd. | 9.57B |

| Amdocs Limited | 8.57B |

| AppFolio, Inc. | 8.46B |

| Qorvo, Inc. | 8.31B |

| Onto Innovation Inc. | 7.71B |

In summary, Tower Semiconductor Ltd. operates within a competitive framework that includes major players like MKS Inc. and Rambus Inc. The relevant geographic market spans North America, Europe, and Asia, reflecting the global nature of the semiconductor industry.

Competitive Advantages

Tower Semiconductor Ltd. (TSEM) holds a strong position in the semiconductor industry due to its specialized focus on analog-intensive mixed-signal devices. The company leverages diverse customizable process technologies, appealing to a wide range of sectors, including automotive and medical devices. With plans to expand into emerging markets and develop new product lines, such as advanced CMOS image sensors, I see significant growth opportunities. Additionally, Tower’s robust relationships with integrated device manufacturers enhance its competitive edge, positioning it well for future advancements in the semiconductor landscape.

SWOT Analysis

This SWOT analysis provides insights into Tower Semiconductor Ltd. (TSEM), identifying its strengths, weaknesses, opportunities, and threats to guide potential investors.

Strengths

- Strong market position in semiconductors

- Diverse product offerings

- Established customer relationships

Weaknesses

- Limited brand recognition compared to larger competitors

- Dependency on cyclical semiconductor demand

- No regular dividend payments

Opportunities

- Growing demand in automotive and industrial sectors

- Expansion into emerging markets

- Advancements in semiconductor technology

Threats

- Intense competition from major players

- Regulatory challenges in different regions

- Supply chain disruptions

The overall SWOT assessment indicates that while Tower Semiconductor has a solid foundation and growth potential in a booming industry, it must navigate competitive pressures and market volatility. Strategic focus on innovation and market expansion could enhance its resilience and profitability.

Stock Analysis

Over the past year, Tower Semiconductor Ltd. (TSEM) has demonstrated remarkable price movements, reflecting significant trading dynamics that have led to a substantial increase in its stock value.

Trend Analysis

Analyzing the stock’s performance over the past year, TSEM has experienced a percentage change of +291.25%. This strong increase clearly indicates a bullish trend. Notably, the stock reached a high of 114.01 and a low of 28.68, with the trend showing signs of acceleration. The standard deviation of 16.58 suggests moderate volatility, indicating that while the stock has generally trended upwards, it has experienced some fluctuations along the way.

Volume Analysis

Over the last three months, TSEM has recorded a total trading volume of 456.4M, with buyer activity at 266.3M and seller activity at 178.9M. This data indicates a buyer-driven market, as buyers account for 58.34% of the total volume. Furthermore, trading volume is on the rise, which suggests positive investor sentiment and increased market participation, with particularly strong buyer dominance observed recently, as indicated by 74.6% of the recent volume being attributed to buyers.

Analyst Opinions

Recent recommendations for Tower Semiconductor Ltd. (TSEM) have shown a generally positive outlook. Analysts have rated the stock B+, indicating a consensus to “buy.” The overall score of 3 reflects strong fundamentals, particularly notable return on assets (4) and a solid debt-to-equity ratio (3). Analysts highlight TSEM’s potential for growth in the semiconductor sector, driven by increasing demand. While the price-to-earnings score (2) suggests caution, the overall sentiment leans towards optimism for this year.

Stock Grades

Tower Semiconductor Ltd. (TSEM) has received consistent evaluations from several reputable grading companies, indicating a steady outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Benchmark | Maintain | Buy | 2025-05-01 |

Overall, the trend in grades for TSEM is positive, with multiple firms maintaining their grades, suggesting confidence in the company’s performance. Notably, Benchmark has consistently rated the stock as a “Buy,” reinforcing a strong investment sentiment.

Target Prices

The consensus target prices for Tower Semiconductor Ltd. (TSEM) reveal a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 97 | 65 | 76 |

Overall, analysts expect TSEM’s stock to achieve a target consensus of 76, indicating a favorable view on its future performance.

Consumer Opinions

Consumer sentiment surrounding Tower Semiconductor Ltd. (TSEM) reveals a mixed but informative perspective on the company’s performance and offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent product quality and reliability.” | “Customer service could be improved.” |

| “Innovative solutions for diverse markets.” | “Pricing is not competitive enough.” |

| “Timely delivery and strong partnerships.” | “Limited support for small clients.” |

Overall, consumer feedback indicates that while Tower Semiconductor excels in product quality and innovation, there are notable concerns regarding customer service and pricing competitiveness.

Risk Analysis

In evaluating Tower Semiconductor Ltd. (TSEM), it’s crucial to consider potential risks that could affect investment outcomes. The table below summarizes key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for semiconductor products. | High | High |

| Regulatory Risk | Changes in trade policies or regulations affecting imports/exports. | Medium | High |

| Technological Risk | Rapid technological changes may outpace company capabilities. | High | Medium |

| Supply Chain Risk | Disruptions in the supply chain affecting production. | Medium | High |

| Competition Risk | Intense competition from larger semiconductor firms. | High | Medium |

In my analysis, the most likely and impactful risks are market risk and regulatory risk. Recent global semiconductor demand fluctuations and ongoing trade tension highlight these concerns, warranting cautious investment decisions.

Should You Buy Tower Semiconductor Ltd.?

Tower Semiconductor Ltd. (TSEM) has demonstrated a positive profitability trend with a net income of 207.86M in 2024 and an EBITDA margin of 36.29%. The company generates value as its ROIC of 6.41% exceeds its WACC of 7.83%, indicating potential value creation. With a low debt-to-equity ratio of 0.068, Tower Semiconductor maintains a solid financial position. The current rating of B+ suggests relatively stable fundamentals, but caution is warranted given the evolving market conditions.

Favorable signals

In the current analysis of Tower Semiconductor Ltd. (TSEM), I found several favorable elements. The company shows a positive net margin of 14.47%, which is a strong indicator of profitability. Additionally, the gross margin stands at 23.64%, and the EBIT margin is 12.88%, both reflecting solid operational efficiency. The interest expense percentage is low at 0.41%, indicating manageable debt costs. Furthermore, the company has a favorable debt-to-equity ratio of 0.07, showcasing a conservative leverage position.

Unfavorable signals

However, there are also significant unfavorable signals in the data. Revenue growth is at 0.94%, which is unfavorable, and gross profit has declined by 3.98%. EBIT growth shows a substantial decrease of 68.6%, and net margin growth is also negative at 60.29%. Moreover, earnings per share (EPS) growth is unfavorable at -60.3%, while the price-to-earnings (P/E) ratio of 27.54 suggests the stock might be overvalued.

Conclusion

Considering the mixed signals, with a favorable global ratios evaluation and an unfavorable global income statement opinion, it may be prudent to wait for a bullish reversal, especially given the recent seller volume surpassing the buyer volume. This situation might suggest caution before making any investment decisions in TSEM.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- G2 Investment Bets Big On Tower Semiconductor (TSEM) With a Purchase of 175,000 Shares – Yahoo Finance (Dec 02, 2025)

- Tower Semiconductor (TSEM) Is Up 12.6% After New RF and Silicon Photonics Capacity Push – Has The Bull Case Changed? – Sahm (Dec 03, 2025)

- Tower Semiconductor (NASDAQ: TSEM) to meet investors at Barclays Tech Conference – Stock Titan (Dec 03, 2025)

- Tower Semiconductor (NASDAQ:TSEM) Shares Down 5.3% – Time to Sell? – MarketBeat (Dec 04, 2025)

- Tower Semiconductor to Participate in Barclays Global Technology Conference – The Globe and Mail (Dec 04, 2025)

For more information about Tower Semiconductor Ltd., please visit the official website: towersemi.com