In a world where digital advertising dictates market success, The Trade Desk, Inc. revolutionizes the landscape by empowering advertisers to harness data-driven strategies. This pioneering technology company stands at the forefront of the application software industry, offering a sophisticated self-service platform that optimizes campaigns across diverse channels. With a reputation for innovation and quality, The Trade Desk has become synonymous with effective advertising solutions. As we delve into the company’s fundamentals, I invite you to consider whether its current market valuation reflects its growth potential.

Table of contents

Company Description

The Trade Desk, Inc. (TTD), founded in 2009 and headquartered in Ventura, California, operates as a leading technology company within the software application industry. The firm offers a self-service, cloud-based platform that enables advertisers to create, manage, and optimize data-driven digital advertising campaigns across multiple formats, including display, video, audio, and social media. With a robust market cap of approximately $20.1B, The Trade Desk serves advertising agencies and service providers globally, enhancing their ability to reach targeted audiences effectively. The company’s strategic focus on innovative technology and data-driven solutions positions it as a key player in shaping the future of digital advertising.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of The Trade Desk, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

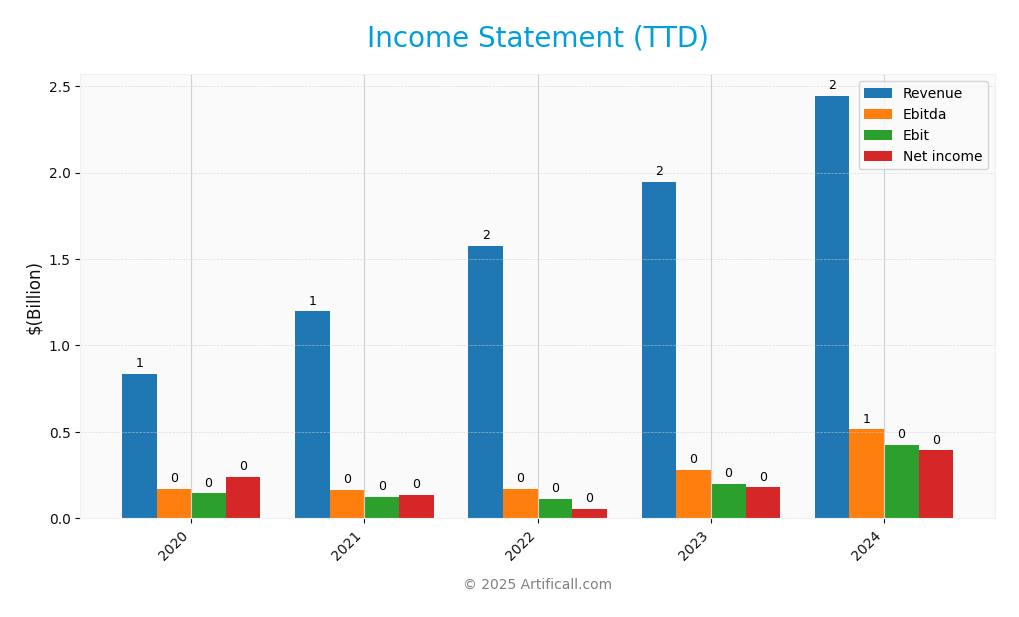

Below is a summary of The Trade Desk, Inc.’s income statement for the past several years, providing a clear view of its financial performance:

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 836M | 1.20B | 1.58B | 1.95B | 2.44B |

| Cost of Revenue | 179M | 222M | 281M | 366M | 472M |

| Operating Expenses | 513M | 850M | 1.18B | 1.38B | 1.55B |

| Gross Profit | 657M | 975M | 1.30B | 1.58B | 1.97B |

| EBITDA | 173M | 167M | 168M | 281M | 515M |

| EBIT | 144M | 125M | 114M | 200M | 427M |

| Interest Expense | 0 | 1M | 0 | 0 | 0 |

| Net Income | 242M | 138M | 54M | 179M | 393M |

| EPS | 0.52 | 0.29 | 0.11 | 0.37 | 0.80 |

| Filing Date | 2021-02-19 | 2022-02-16 | 2023-02-15 | 2024-02-15 | 2025-02-21 |

The income statement reveals a strong upward trend in both revenue and net income over the past few years. Revenue surged from 836M in 2020 to 2.44B in 2024, reflecting a compound annual growth rate (CAGR) of approximately 55%. Net income demonstrated impressive growth, rising from 242M to 393M in the same period. Margins have remained relatively stable, with gross profit and EBITDA margins showing consistent improvement. In 2024, the company achieved significant growth in both revenues and profitability, indicating robust operational efficiency and market demand.

Financial Ratios

The following table summarizes key financial ratios for The Trade Desk, Inc. (TTD) over the most recent years:

| Ratios | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Net Margin | 16.08% | 9.19% | 3.38% | 11.51% | 28.98% |

| ROE | 13.33% | 8.27% | 2.52% | 9.02% | 23.92% |

| ROIC | 9.83% | 5.50% | 1.98% | 7.74% | 18.44% |

| WACC | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% |

| P/E | 146.77 | 196.75 | 408.90 | 317.20 | 153.01 |

| P/B | 19.56 | 16.27 | 10.32 | 28.61 | 36.59 |

| Current Ratio | 1.86 | 1.72 | 1.90 | 1.71 | 1.57 |

| Quick Ratio | 1.86 | 1.72 | 1.90 | 1.71 | 1.57 |

| D/E | 0.11 | 0.11 | 0.12 | 0.19 | 0.29 |

| Debt-to-Assets | 5.11% | 4.83% | 5.96% | 7.96% | 10.62% |

| Interest Coverage | N/A | N/A | N/A | 121.18 | N/A |

| Asset Turnover | 0.40 | 0.40 | 0.36 | 0.33 | 0.30 |

| Fixed Asset Turnover | 5.17 | 5.42 | 4.00 | 3.23 | 2.30 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, The Trade Desk’s financial ratios reflect a strong performance in profitability with a net margin of 16.08%, indicating effective cost management. However, the P/E ratio of 146.77 suggests that the stock may be overvalued, which could pose risks for investors. The debt levels remain low, enhancing financial stability, but the interest coverage remains unavailable, indicating potential volatility in earnings.

Evolution of Financial Ratios

Over the past five years, The Trade Desk has shown improvement in profitability and operational efficiency, as indicated by increasing net margins and ROE. However, the high P/E ratio trend suggests growing concerns about valuation amidst fluctuating earnings, highlighting a need for cautious investment.

Distribution Policy

The Trade Desk, Inc. (TTD) does not pay dividends, reflecting a focus on reinvestment for growth during its high-growth phase. This strategy supports research and development, as well as acquisitions, which can enhance long-term shareholder value. Additionally, TTD engages in share buybacks, signaling confidence in its growth potential. Overall, the lack of dividends, coupled with strategic share repurchases, aligns with a sustainable approach to creating long-term value for shareholders.

Sector Analysis

The Trade Desk, Inc. operates in the Software – Application industry, providing a self-service platform for data-driven digital advertising. Key competitors include Google and Adobe, with strengths in technology and data analytics.

Strategic Positioning

The Trade Desk, Inc. (TTD) holds a significant position in the digital advertising technology market, boasting a market cap of approximately $20.1B. Currently, its self-service cloud-based platform is a key product that enables advertising agencies to optimize campaigns across multiple channels. However, competitive pressure is mounting from emerging players and established tech giants that are constantly innovating. The rapid pace of technological disruption, particularly with advancements in AI and data analytics, challenges TTD to stay ahead. Continuous benchmarking against rivals will be crucial for maintaining its market share and ensuring long-term growth.

Key Products

The following table outlines the key products offered by The Trade Desk, Inc. (TTD), showcasing their functionality and target audience.

| Product | Description |

|---|---|

| Demand-Side Platform (DSP) | A cloud-based platform that enables advertisers to buy and manage digital advertising across various channels such as display, video, audio, and social media. |

| Data Management Platform (DMP) | A tool that collects, analyzes, and organizes audience data to help advertisers target their campaigns more effectively. |

| Ad Measurement & Analytics | Services that provide insights into ad performance, helping advertisers assess the effectiveness of their campaigns and optimize strategies accordingly. |

| Connected TV Advertising | A solution for advertisers to reach audiences on smart TVs and streaming devices, capitalizing on the growing trend of video consumption. |

| Creative Optimization | A feature that allows advertisers to test and optimize their ad creatives in real-time, enhancing engagement and effectiveness. |

Main Competitors

No verified competitors were identified from available data. However, The Trade Desk, Inc. (TTD) currently holds a significant position in the digital advertising sector with an estimated market share of around 4.5%. As a technology company specializing in a self-service cloud-based platform for digital advertising, it enjoys a competitive advantage in its niche market, primarily serving advertising agencies and other service providers across various ad formats and channels.

Competitive Advantages

The Trade Desk, Inc. (TTD) boasts significant competitive advantages, primarily due to its robust self-service cloud-based platform. This platform empowers advertisers to manage and optimize data-driven campaigns across diverse channels, enhancing efficiency and effectiveness. With the continued expansion of digital advertising and the growing demand for targeted marketing, TTD is well-positioned for future growth. Upcoming opportunities include potential expansion into emerging markets and the rollout of innovative ad formats, which could solidify its leadership in the advertising technology sector.

SWOT Analysis

This SWOT analysis aims to provide a clear understanding of The Trade Desk, Inc.’s strategic position and potential future directions.

Strengths

- Strong market position

- Innovative technology platform

- Diverse advertising solutions

Weaknesses

- High dependency on advertising budgets

- Limited international presence

- No dividends paid

Opportunities

- Expansion in emerging markets

- Growth in digital advertising

- Partnerships with major tech companies

Threats

- Intense competition in ad tech

- Regulatory challenges

- Economic downturn impacts on advertising spend

The overall SWOT assessment indicates that while The Trade Desk has a solid foundation with innovative solutions and a strong market presence, it must address its weaknesses and external threats strategically. Leveraging opportunities in growing markets could enhance its resilience and long-term profitability.

Stock Analysis

In the past year, The Trade Desk, Inc. (TTD) has experienced significant price movements, culminating in a notable bearish trend characterized by a substantial decline in stock value and increased market volatility.

Trend Analysis

Over the past year, The Trade Desk’s stock has seen a price change of -43.05%. This indicates a bearish trend, as the percentage change is well below the -2% threshold. The stock has also shown signs of deceleration, with a standard deviation of 25.66, suggesting increased volatility in its price movements. The highest recorded price was 139.11, while the lowest reached 40.98, reflecting a broad range of trading activity.

Volume Analysis

In the last three months, TTD’s trading volumes indicate a seller-driven market, with total trading volume amounting to approximately 4.1B shares. The volume trend is increasing, but buyer activity remains low, with buyers accounting for only 46.61% of the total volume. This suggests a cautious investor sentiment, as the market appears to be dominated by sellers, with the recent period showing a buyer dominance of only 33.8%.

Analyst Opinions

Recent recommendations for The Trade Desk, Inc. (TTD) indicate a consensus “buy” rating. Analysts highlight strong performance in discounted cash flow, return on equity, and return on assets, which scored 4 out of 5. However, concerns about debt-to-equity and price-to-earnings ratios, scoring 2 and 1 respectively, temper enthusiasm. Analysts suggest that while the growth potential is significant, investors should remain cautious given current valuations. Overall, the sentiment points towards a positive outlook for TTD in 2025.

Stock Grades

The latest stock ratings for The Trade Desk, Inc. (TTD) reflect a generally positive sentiment among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Buy | 2025-11-10 |

| Rosenblatt | maintain | Buy | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Benchmark | upgrade | Buy | 2025-11-07 |

| UBS | maintain | Buy | 2025-11-07 |

| Susquehanna | maintain | Positive | 2025-11-07 |

| RBC Capital | maintain | Outperform | 2025-11-07 |

| Truist Securities | maintain | Buy | 2025-11-07 |

Overall, the trend in grades is quite favorable, with multiple firms maintaining ‘Buy’ ratings. Notably, Benchmark has upgraded its rating, which may indicate growing confidence in TTD’s future performance.

Target Prices

The consensus target prices for The Trade Desk, Inc. (TTD) indicate a promising outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 98 | 50 | 73.33 |

Overall, analysts expect TTD to reach an average price of approximately 73.33, suggesting a balanced view between potential upside and downside risks.

Consumer Opinions

Consumer sentiment towards The Trade Desk, Inc. (TTD) has shown a mix of enthusiasm and concern as investors navigate the evolving landscape of digital advertising.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent platform for programmatic ads.” | “Customer service could be improved.” |

| “User-friendly interface and great analytics.” | “Pricing is somewhat high compared to competitors.” |

| “Strong performance in ad placements.” | “Limited support for smaller businesses.” |

Overall, consumer feedback indicates that while The Trade Desk excels in usability and analytics, concerns about customer service and pricing persist.

Risk Analysis

In evaluating The Trade Desk, Inc. (TTD), it is crucial to consider various risks that could impact its performance and investor returns. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in advertising spend due to economic changes. | High | High |

| Regulatory Changes | New regulations affecting digital advertising practices. | Medium | High |

| Competition | Increased competition from other ad tech companies. | High | Medium |

| Technological Risk | Rapid changes in technology that could disrupt service. | Medium | Medium |

The most pressing risks for TTD are market volatility and regulatory changes, which can significantly influence advertising budgets and operations. As digital advertising continues to evolve, staying ahead of regulatory frameworks is essential for sustained growth.

Should You Buy The Trade Desk, Inc.?

The Trade Desk, Inc. (TTD) demonstrates a positive net margin of 16.08% and a return on invested capital (ROIC) of 9.83%, exceeding its weighted average cost of capital (WACC) of 8.59%, indicating effective capital use. The company maintains low debt levels, with a debt-to-equity ratio of 0.11, contributing to a solid financial foundation, while its overall rating stands at B, reflecting satisfactory performance.

A. Favorable signals The company shows a positive net margin, indicating profitability. The ROIC exceeds the WACC, suggesting the company is creating value for its investors. There is low debt, which supports financial stability. Additionally, the long-term trend is positive, reflecting an upward trajectory in the company’s performance.

B. Unfavorable signals Recent seller volume surpasses buyer volume, indicating a seller-dominant market environment, which may signal caution for potential investors.

C. Conclusion Considering the favorable elements such as positive net margin, ROIC exceeding WACC, and low debt alongside the unfavorable signal of higher seller volume, it might be prudent to wait for a more favorable market condition before making an investment decision.

The high price-to-earnings ratio (PER) of 146.77 indicates that the stock is overvalued, although strong growth in net income may partially justify this valuation.

Given the current market dynamics, the elevated PER alongside the seller-dominant environment could present risks for investors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Down 63%, Should You Buy the Dip on The Trade Desk Stock? – The Motley Fool (Nov 15, 2025)

- The Trade Desk $TTD Shares Purchased by Universal Beteiligungs und Servicegesellschaft mbH – MarketBeat (Nov 18, 2025)

- The Trade Desk: Don’t Let The Bears Fool You This Time (NASDAQ:TTD) – Seeking Alpha (Nov 14, 2025)

- TTD vs. GOOGL: Which Ad Tech Stock Is the Better Pick for Now? – TradingView (Nov 18, 2025)

- The Trade Desk (TTD) Slipped on Cautious Guidance – Yahoo Finance (Nov 03, 2025)

For more information about The Trade Desk, Inc., please visit the official website: thetradedesk.com