In a world increasingly reliant on smart technology, Microchip Technology Incorporated stands as a pivotal force in the semiconductor industry, crafting innovative solutions that power everything from automotive systems to consumer electronics. Renowned for its high-quality microcontrollers and embedded control solutions, Microchip has established a formidable reputation for reliability and performance. As we delve into the investment landscape, I invite you to consider whether Microchip’s impressive fundamentals and growth trajectory continue to justify its current market valuation.

Table of contents

Company Description

Microchip Technology Incorporated (MCHP), founded in 1989 and headquartered in Chandler, Arizona, is a prominent player in the semiconductor industry. The company specializes in developing and manufacturing smart, connected, and secure embedded control solutions, offering a diverse range of products including microcontrollers, microprocessors, and analog interface products. Operating across the Americas, Europe, and Asia, Microchip serves various sectors such as automotive, industrial, and communications. With a workforce of approximately 22,300 employees, the company emphasizes innovation and strategic partnerships to enhance its market position. Microchip’s commitment to providing comprehensive embedded solutions positions it as a crucial driver of technological advancement in the semiconductor space.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Microchip Technology Incorporated, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

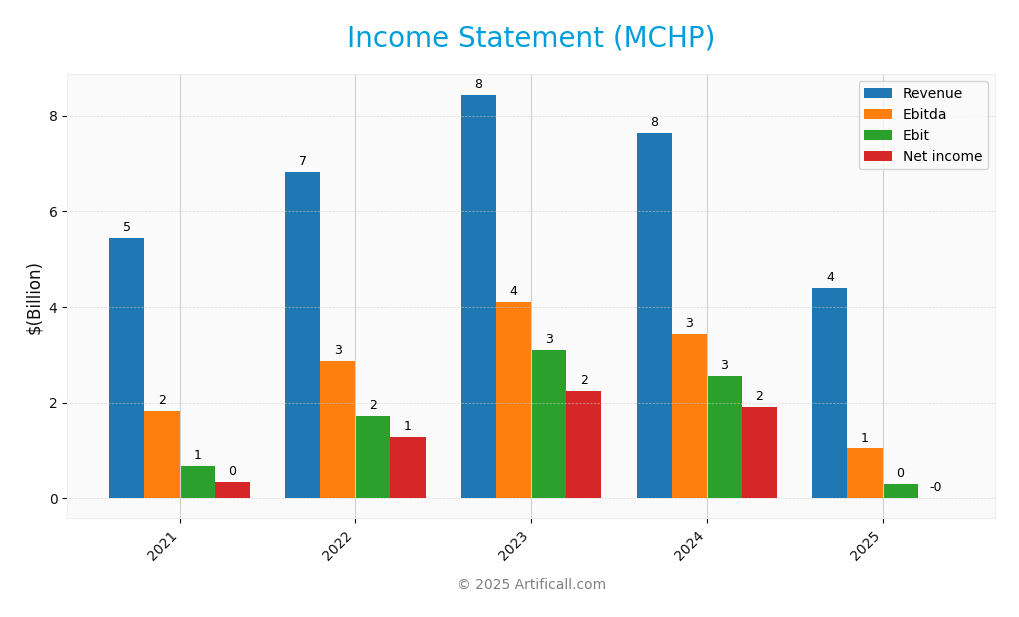

Below is the income statement for Microchip Technology Incorporated, highlighting key financial metrics over the past five fiscal years.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 5.44B | 6.82B | 8.44B | 7.63B | 4.40B |

| Cost of Revenue | 2.06B | 2.37B | 2.74B | 2.64B | 1.93B |

| Operating Expenses | 2.38B | 2.60B | 2.58B | 2.42B | 2.17B |

| Gross Profit | 3.38B | 4.45B | 5.70B | 4.99B | 2.47B |

| EBITDA | 1.83B | 2.87B | 4.10B | 3.44B | 1.04B |

| EBIT | 679M | 1.73B | 3.10B | 2.56B | 290M |

| Interest Expense | 356M | 257M | 204M | 198M | 251M |

| Net Income | 349M | 1.29B | 2.24B | 1.91B | -500K |

| EPS | 0.67 | 2.33 | 4.07 | 3.52 | -0.005 |

| Filing Date | 2021-05-18 | 2022-05-20 | 2023-05-25 | 2024-05-23 | 2025-05-23 |

In reviewing the income statement, we observe a concerning decline in revenue from 8.44B in 2023 to 4.40B in 2025, indicating significant volatility. The net income saw a drastic shift from a positive 2.24B in 2023 to a negative 500K in 2025, suggesting deteriorating profitability. The operating expenses remained relatively stable, but the sharp drop in gross profit and EBITDA indicates worsening efficiency and possibly increased competition. The latest year’s performance reflects a troubling trend of declining revenues and profitability, warranting cautious evaluation for potential investors.

Financial Ratios

Below is a summary of key financial ratios for Microchip Technology Incorporated (MCHP) over the last available years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 6.42% | 18.85% | 26.52% | 24.98% | -0.01% |

| ROE | 6.43% | 13.38% | 24.71% | 16.37% | -0.01% |

| ROIC | 6.30% | 13.01% | 23.45% | 15.67% | -0.01% |

| P/E | 115.33 | 32.28 | 20.61 | 25.51 | -52021.39 |

| P/B | 7.55 | 7.04 | 7.08 | 7.31 | 3.67 |

| Current Ratio | 0.89 | 1.75 | 0.98 | 1.20 | 2.59 |

| Quick Ratio | 0.61 | 1.14 | 0.56 | 0.67 | 1.47 |

| D/E | 1.70 | 1.33 | 1.01 | 0.91 | 0.80 |

| Debt-to-Assets | 55.04% | 48.46% | 40.32% | 38.00% | 36.85% |

| Interest Coverage | 2.80 | 7.20 | 15.28 | 12.97 | 1.18 |

| Asset Turnover | 0.33 | 0.42 | 0.52 | 0.48 | 0.29 |

| Fixed Asset Turnover | 6.36 | 7.05 | 7.16 | 6.39 | 3.72 |

| Dividend Yield | 0.96% | 1.21% | 1.51% | 1.87% | 3.75% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate significant financial challenges for MCHP, particularly with a negative net margin and a drastically high P/E ratio, suggesting that the stock may be overvalued compared to its earnings. The decline in profitability and the interest coverage ratio, which is just above 1, raises potential concerns regarding the company’s ability to meet its debt obligations.

Evolution of Financial Ratios

Over the past five years, MCHP’s financial ratios have shown a troubling trend, particularly with declining profitability and increasing debt levels. While the current and quick ratios have improved, the overall decline in margins and increasing leverage signal potential risks that investors should closely monitor.

Distribution Policy

Microchip Technology Incorporated (MCHP) does not currently pay dividends, reflecting its focus on reinvestment and growth strategies. The company has a negative net income margin, which suggests that it may prioritize R&D and acquisitions over immediate shareholder returns. However, MCHP does engage in share buybacks, which indicates a commitment to returning value to shareholders. This approach supports long-term value creation, albeit with a careful eye on risk management and financial stability.

Sector Analysis

Microchip Technology Incorporated operates in the semiconductors industry, offering a range of embedded control solutions. Its strengths lie in diverse product offerings and established market positioning against competitors.

Strategic Positioning

Microchip Technology Incorporated (MCHP) holds a significant position in the semiconductor industry, boasting a market cap of approximately $28.8B. The company specializes in smart, connected, and secure embedded control solutions, with a diverse product offering that includes microcontrollers and FPGAs. Despite competitive pressure from larger players like Intel and Texas Instruments, MCHP maintains a solid market share through continuous innovation and adaptation to technological disruptions. The company’s focus on automotive and industrial applications positions it well to capitalize on the growing demand for smart technologies, although ongoing supply chain challenges remain a risk factor.

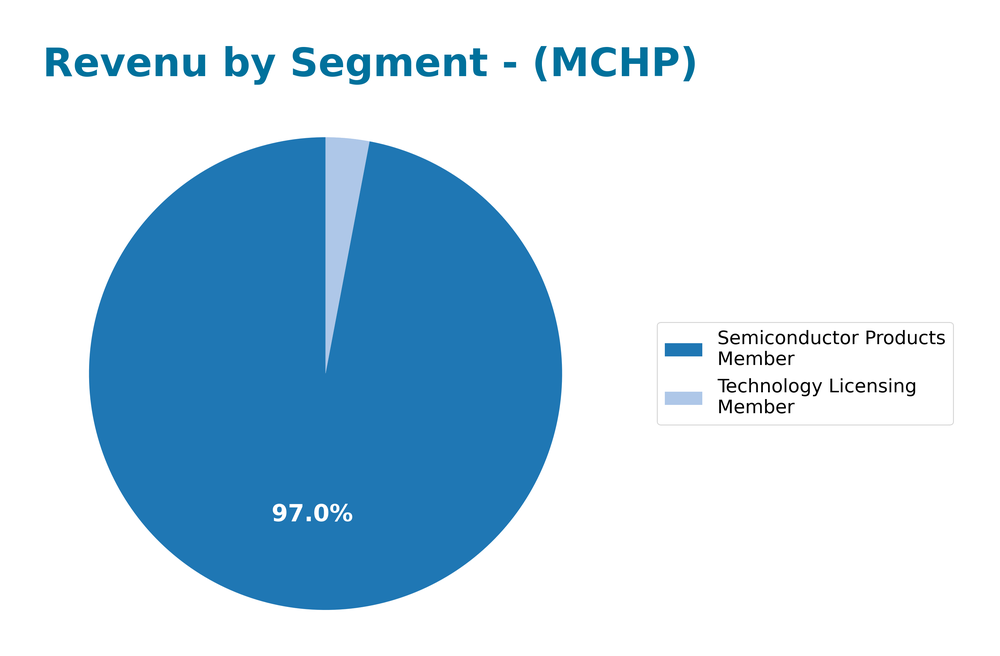

Revenue by Segment

The following chart illustrates Microchip Technology Incorporated’s revenue segmentation for the fiscal year ending March 31, 2025, highlighting the distribution of income generated from different business segments.

In 2025, Microchip’s revenue from the Semiconductor Products Member reached 4.27B, while the Technology Licensing Member contributed 131M. This represents a notable decline from the previous year’s 7.53B and 103M, indicating a significant reduction in the Semiconductor segment’s performance, which is the primary driver of the business. The continued downward trend raises concerns about demand fluctuations and margin pressures in the semiconductor sector, necessitating a cautious approach for investors as the company navigates these challenges.

Key Products

Microchip Technology Incorporated offers a diverse range of products in the semiconductor industry, focusing on embedded control solutions. Below is a table highlighting some of their key products and descriptions.

| Product | Description |

|---|---|

| Microcontrollers | General purpose 8-bit, 16-bit, and 32-bit microcontrollers used in various applications including automotive and industrial. |

| Embedded Microprocessors | 32-bit processors designed for complex applications requiring advanced processing capabilities. |

| Field-Programmable Gate Arrays (FPGAs) | Versatile devices that can be programmed to perform specific tasks, often used in communications and automotive systems. |

| Analog and Mixed-Signal Products | Products for power management, thermal management, and various interface applications tailored for specific use cases. |

| Memory Products | Includes serial and parallel flash memories, catering to devices with small footprint requirements. |

| Development Tools | A suite of tools that help system designers program and optimize the performance of microcontrollers and microprocessors. |

| Aerospace Products | Specialized products designed for the demanding requirements of aerospace applications, ensuring reliability and durability. |

| Wafer Foundry Services | Manufacturing services that support the production of semiconductor devices for various clients. |

This assortment of products positions Microchip as a significant player in the semiconductor market, contributing to various sectors such as automotive, industrial, and communications.

Main Competitors

No verified competitors were identified from available data. However, Microchip Technology Incorporated holds a significant position in the semiconductor industry, with an estimated market share of approximately 5% in the global market. The company specializes in providing embedded control solutions, positioning itself as a key player in various sectors including automotive, industrial, and communications.

Competitive Advantages

Microchip Technology Incorporated (MCHP) holds a strong position in the semiconductor industry with its diverse portfolio of microcontrollers and embedded solutions, catering to various sectors such as automotive, industrial, and communications. The company benefits from robust R&D capabilities, allowing it to innovate and introduce new products tailored to emerging technologies like IoT and AI. Looking ahead, MCHP is poised to capitalize on growth opportunities in new markets, including electric vehicles and renewable energy applications, which will further enhance its competitive edge and market share.

SWOT Analysis

This analysis aims to identify the strengths, weaknesses, opportunities, and threats facing Microchip Technology Incorporated (MCHP).

Strengths

- Strong market position

- Diverse product portfolio

- Robust R&D capabilities

Weaknesses

- High dependency on semiconductor market

- Vulnerability to supply chain disruptions

- Limited brand recognition compared to larger competitors

Opportunities

- Growing demand for IoT devices

- Expansion into emerging markets

- Strategic partnerships and acquisitions

Threats

- Intense competition

- Regulatory challenges

- Economic downturns affecting tech spending

Overall, the SWOT analysis highlights Microchip’s solid foundation and growth potential in the semiconductor sector, but also underscores the need for strategic risk management to navigate industry challenges effectively.

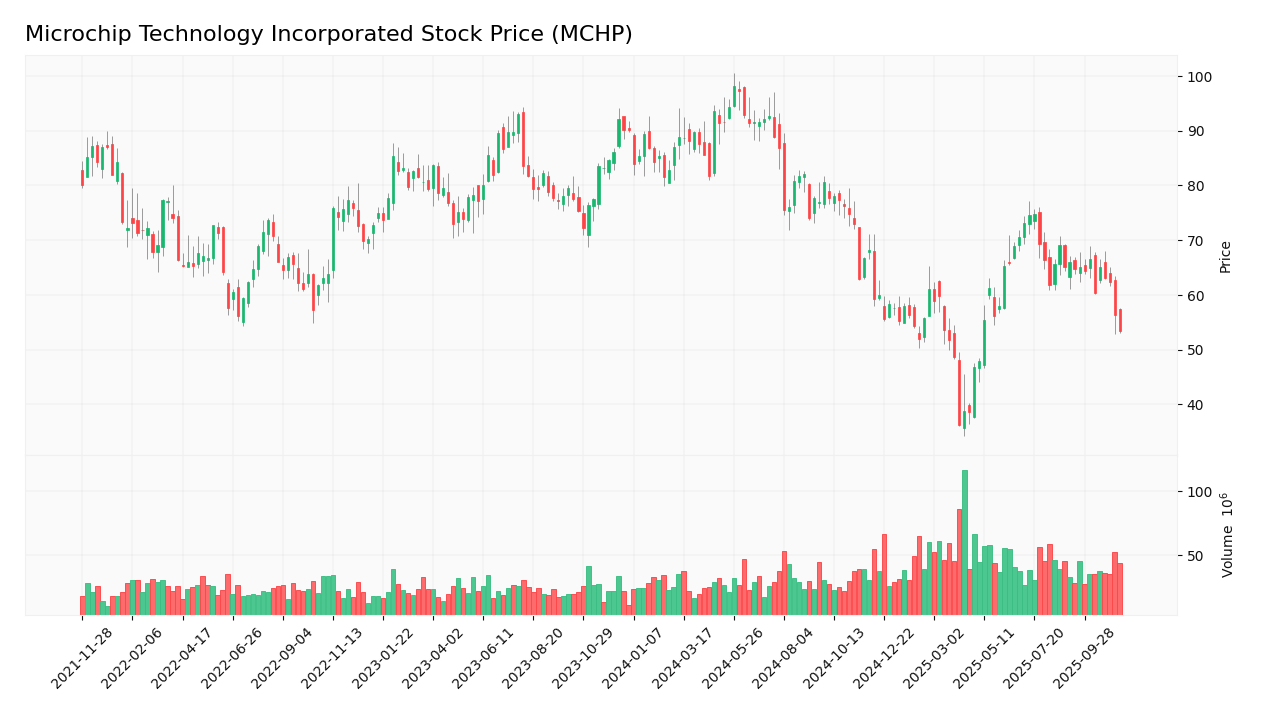

Stock Analysis

Over the past year, Microchip Technology Incorporated (MCHP) has experienced significant price movements, marked by a notable decline that reflects the current trading dynamics. The stock has been subject to considerable volatility, which is evident in the price chart below.

Trend Analysis

Analyzing the stock’s performance over the last 12 months, MCHP has seen a percentage decrease of -40.7%, indicating a bearish trend. This decline has been characterized by deceleration, suggesting that the rate of decrease is slowing down. The stock reached a high of 98.23 and a low of 36.22 during this period, showcasing substantial price volatility with a standard deviation of 14.85.

In a more recent analysis covering the period from August 31, 2025, to November 16, 2025, the stock has further declined by -17.72%. This recent trend is also bearish, with a trend slope of -0.85.

Volume Analysis

Looking at trading volumes over the last three months, the average volume stands at approximately 37.69M shares, indicating a seller-driven market dynamic. The average buy volume is around 12.49M, while the average sell volume is significantly higher at approximately 25.20M, which suggests that selling pressure is predominant. The volume trend has been noted as bullish, with an increasing trend slope of 673.50K, implying a potential increase in market participation despite the prevailing bearish price trend.

Analyst Opinions

Recent analyst recommendations for Microchip Technology Incorporated (MCHP) show a cautious outlook, with a consensus rating of “sell.” Analysts have highlighted concerns regarding the company’s financial ratios, particularly its low scores in return on equity and return on assets. The overall score is rated as “C-” by leading analysts, indicating various challenges, including high debt levels and subpar price-to-earnings metrics. I recommend exercising caution if considering MCHP for your portfolio, as the current consensus suggests a more bearish stance.

Stock Grades

Microchip Technology Incorporated (MCHP) continues to receive consistent evaluations from several reputable grading firms. Below is a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| Stifel | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Needham | Maintain | Buy | 2025-08-08 |

| Raymond James | Maintain | Strong Buy | 2025-08-08 |

The overall trend in grades for MCHP indicates a stable outlook, with several firms maintaining their positive ratings. Notably, the presence of multiple “Buy” ratings suggests investor confidence in the company’s potential for growth, while the “Equal Weight” and “Neutral” grades reflect a more cautious approach from some analysts.

Target Prices

The consensus target prices for Microchip Technology Incorporated (MCHP) reflect a balanced outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 83 | 60 | 71.33 |

Overall, analysts expect MCHP to reach a target price around 71.33, indicating a moderate growth potential with a range of 60 to 83.

Consumer Opinions

Consumer sentiment about Microchip Technology Incorporated (MCHP) remains a mixed bag, reflecting both satisfaction and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer support and service.” | “Prices are higher than competitors.” |

| “Reliable products with great performance.” | “Frequent product shortages.” |

| “Innovative technology solutions.” | “Complicated installation process.” |

| “Sustainable practices are commendable.” | “Limited warranty options.” |

Overall, consumer feedback indicates strong satisfaction with product reliability and customer service, while pricing and availability issues are common concerns that need addressing.

Risk Analysis

In evaluating Microchip Technology Incorporated (MCHP), it’s crucial to consider the following risks that could impact its performance and valuation.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand due to economic cycles. | High | High |

| Supply Chain Risk | Dependency on global suppliers may lead to production delays. | Medium | High |

| Regulatory Risk | Changes in technology regulations can affect operations. | Medium | Medium |

| Competition Risk | Increased competition from emerging tech companies. | High | Medium |

| Cybersecurity Risk | Potential for data breaches affecting customer trust. | Medium | High |

The current semiconductor market is experiencing volatility, driven by global economic instability and supply chain disruptions. With a high probability of market fluctuations and significant potential impacts, careful consideration of these risks is essential for investors.

Should You Buy Microchip Technology Incorporated?

Microchip Technology (MCHP) has faced recent challenges, reporting a net margin of -0.01% for FY 2025, while its WACC stands at 8.84%. Although the company has a solid gross profit margin of 56.1% and a prior ROIC of 6.6%, the recent trend indicates a bearish outlook with declining volumes.

Given the current financial metrics, including a negative net margin and a bearish long-term trend, I recommend that investors wait for improvements in fundamentals and a bullish reversal before considering adding this stock to their portfolio. The volatility in buyer and seller volumes further emphasizes caution, as the market is currently experiencing seller dominance.

Specific risks to consider include significant competition within the semiconductor industry, potential supply chain disruptions, and overall market dependence on technological advancements.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- 127,000 Shares in Microchip Technology Incorporated $MCHP Bought by SG Capital Management LLC – MarketBeat (Nov 16, 2025)

- Microchip Technology (NASDAQ:MCHP) Has Affirmed Its Dividend Of $0.455 – simplywall.st (Nov 12, 2025)

- KBC Group NV Increases Stake in Microchip Technology Incorporated $MCHP – MarketBeat (Nov 16, 2025)

- Microchip Technology Inc (MCHP) Q2 2026 Earnings Call Highlights: Strong Sequential Growth Amid … – Yahoo Finance (Nov 06, 2025)

- How Subdued Guidance and Inventory Pressures Could Shape Microchip Technology’s (MCHP) Earnings Trajectory – Yahoo Finance (Nov 15, 2025)

For more information about Microchip Technology Incorporated, please visit the official website: microchip.com