Transforming the landscape of healthcare, GE HealthCare Technologies Inc. is at the forefront of medical innovation, enhancing patient outcomes worldwide. With a diverse range of advanced imaging systems, ultrasound solutions, and digital patient care technologies, GE HealthCare is synonymous with quality and reliability in the healthcare information services sector. As we delve into the investment potential of GEHC, I invite you to consider whether its robust fundamentals and market positioning continue to justify its current valuation and growth trajectory.

Table of contents

Company Description

GE HealthCare Technologies Inc. is a prominent player in the healthcare sector, focusing on the development and marketing of advanced medical technologies. Founded in 2022 and headquartered in Chicago, Illinois, the company operates across key markets including the United States, Canada, Europe, and Asia. Its core activities span four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics, offering a diverse range of products from CT scanners to diagnostic agents. With a market capitalization of approximately $32.3B, GE HealthCare is positioned as a leader in healthcare information services, driving innovation and enhancing patient outcomes through its comprehensive digital solutions and medical devices.

Fundamental Analysis

In this section, I will analyze GE HealthCare Technologies Inc.’s income statement, financial ratios, and dividend payout policy to provide insights into its financial health.

Income Statement

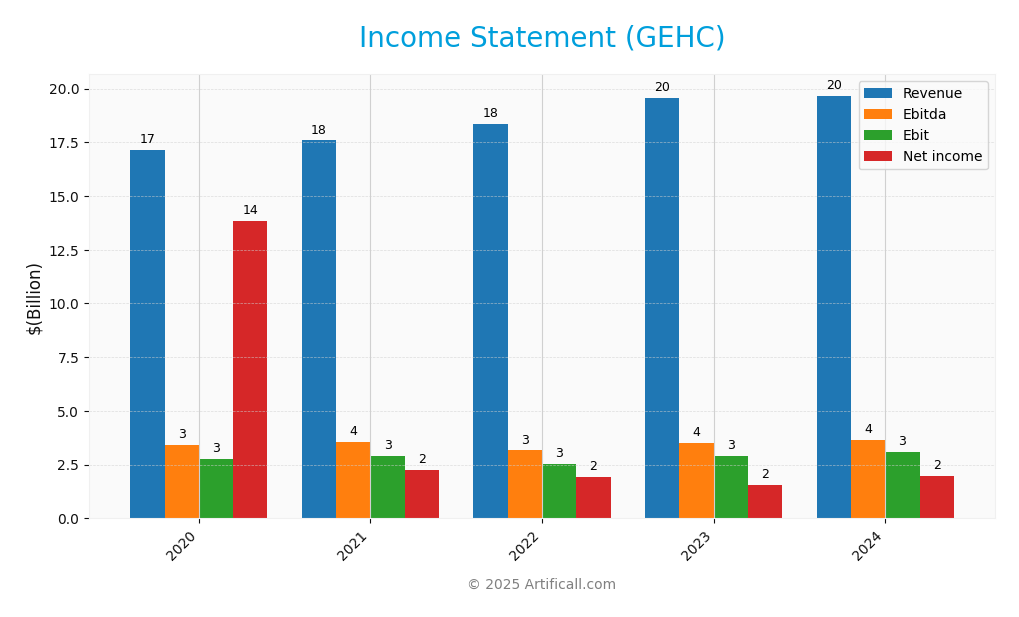

The following table presents the income statement for GE HealthCare Technologies Inc. over the past five fiscal years, highlighting key financial metrics for analysis.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 17.16B | 17.59B | 18.34B | 19.55B | 19.67B |

| Cost of Revenue | 10.40B | 10.41B | 11.16B | 11.63B | 11.47B |

| Operating Expenses | 4.05B | 4.38B | 4.66B | 5.49B | 5.58B |

| Gross Profit | 6.77B | 7.17B | 7.18B | 7.92B | 8.21B |

| EBITDA | 3.41B | 3.54B | 3.17B | 3.51B | 3.67B |

| EBIT | 2.78B | 2.92B | 2.53B | 2.90B | 3.09B |

| Interest Expense | 0.07B | 0.04B | 0.09B | 0.54B | 0.51B |

| Net Income | 2.00B | 2.25B | 1.92B | 1.57B | 1.99B |

| EPS | 4.41 | 4.90 | 4.22 | 3.04 | 4.37 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-02-15 | 2024-02-06 | 2025-02-13 |

Over the past five years, GE HealthCare has demonstrated steady revenue growth, with an increase from 17.16B in 2020 to 19.67B in 2024. Notably, net income experienced fluctuations, peaking at 2.25B in 2021 before dropping to 1.57B in 2023, and then rebounding to 1.99B in 2024. Margins remained relatively stable, with gross profit margin showing slight improvement in 2024. The most recent year indicates a recovery in net income, signaling potential for continued growth, though investors should remain cautious about operational expenses and interest burden, which could impact future profitability.

Financial Ratios

The following table presents the key financial ratios for GE HealthCare Technologies Inc. (GEHC) over the last few years, allowing for a clear analysis of its financial health.

| Ratios | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Net Margin | 10.13% | 8.02% | 10.45% | 12.78% | 8.07% |

| ROE | 23.59% | 21.98% | 20.48% | 13.49% | 94.02% |

| ROIC | 8.29% | 6.79% | 9.56% | 11.25% | 11.58% |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | 17.89 | 22.44 | 13.83 | 12.14 | 1.97 |

| P/B | 4.22 | 4.93 | 2.83 | 1.64 | 1.85 |

| Current Ratio | 0.996 | 1.003 | 1.087 | 0.968 | 0.835 |

| Quick Ratio | 0.793 | 0.785 | 0.788 | 0.680 | 0.591 |

| D/E | 1.11 | 1.38 | 0.92 | 0.03 | 0.03 |

| Debt-to-Assets | 28.34% | 30.39% | 31.36% | 1.66% | 1.93% |

| Interest Coverage | 5.20 | 4.49 | 29.33 | 69.88 | 41.21 |

| Asset Turnover | 0.59 | 0.60 | 0.67 | 0.67 | 0.71 |

| Fixed Asset Turnover | 7.71 | 7.82 | 7.93 | 7.87 | 7.79 |

| Dividend Yield | 0.15% | 0.12% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, GEHC demonstrates solid profitability with a net margin of 10.13% and a strong return on equity (ROE) of 23.59%. However, the current ratio falling below 1 indicates potential liquidity challenges, while a high debt-to-equity ratio of 1.11 raises concerns about financial leverage. The P/E ratio suggests the stock might be overvalued compared to historical levels.

Evolution of Financial Ratios

Over the past five years, GEHC’s net margin has fluctuated but remains relatively stable, while the ROE has improved significantly since 2021. The current ratio has shown a downward trend, reflecting increasing liquidity risk, and the company’s reliance on debt has increased, which warrants attention.

Distribution Policy

GE HealthCare Technologies Inc. (GEHC) currently pays a modest dividend of $0.12 per share, reflecting a low payout ratio of approximately 2.76%. This conservative approach, coupled with an annual dividend yield of about 0.15%, suggests a focus on retaining earnings for growth and reinvestment. The company also engages in share buybacks, enhancing shareholder value, although investors should remain cautious of potential risks related to unsustainable dividend distributions. Overall, GEHC’s distribution strategy appears supportive of long-term value creation for shareholders.

Sector Analysis

GE HealthCare Technologies Inc. operates in the Medical – Healthcare Information Services industry, focusing on advanced diagnostic and monitoring solutions, competing with major firms while leveraging its extensive product range and digital innovations.

Strategic Positioning

GE HealthCare Technologies Inc. (GEHC) holds a competitive position in the healthcare information services sector, with a market cap of approximately $32.3B. The company has a diverse product portfolio across four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics. While GEHC faces competitive pressure from innovators in medical technology and digital health, its established market share and comprehensive range of diagnostic solutions provide a buffer against technological disruption. However, ongoing advancements in AI and data analytics will require continuous adaptation to maintain its competitive edge.

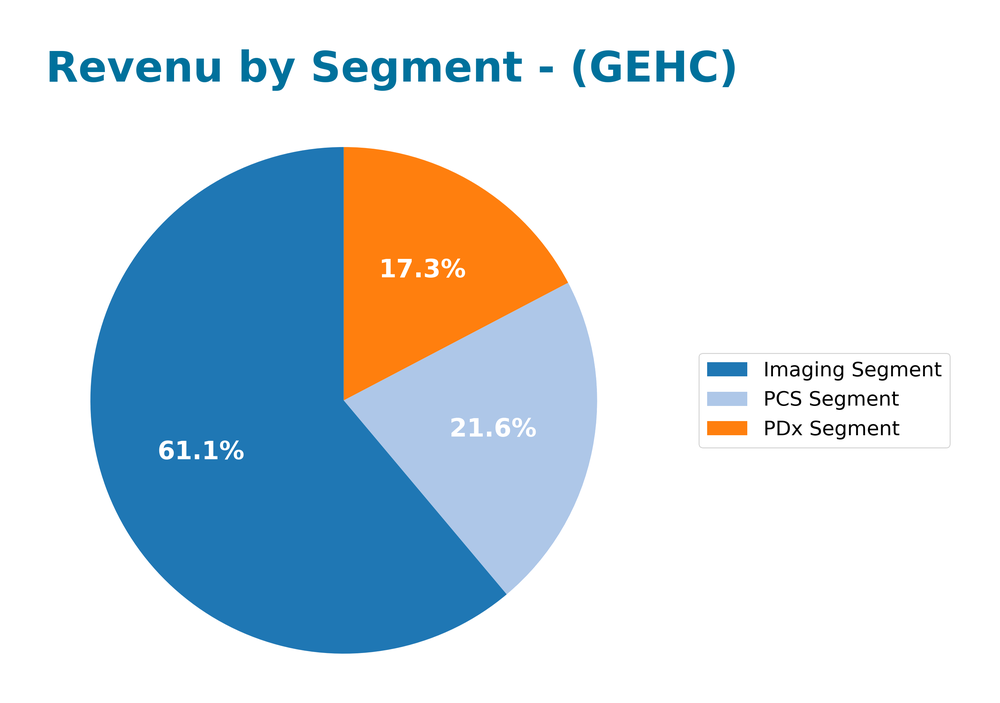

Revenue by Segment

The pie chart below illustrates the revenue distribution by segment for GE HealthCare Technologies Inc. for the fiscal year 2024.

In 2024, the Imaging Segment generated $8.86B, leading the revenue contributions, while the PCS Segment contributed $3.13B and the PDx Segment brought in $2.51B. Notably, the Imaging Segment showed a decline from $10.58B in 2023, indicating potential market saturation or increased competition. The PCS and PDx Segments remained relatively stable, with only slight fluctuations. This year, GEHC faces margin risks due to the Imaging Segment’s slowdown, which may impact overall profitability if not addressed effectively.

Key Products

Below is a table summarizing the key products offered by GE HealthCare Technologies Inc. This overview highlights the diverse range of medical devices and solutions the company provides to enhance patient care and diagnostics.

| Product | Description |

|---|---|

| Molecular Imaging | Advanced imaging technologies that enable visualization of biological processes in real-time. |

| CT Scanning | High-resolution computed tomography systems for detailed imaging and diagnosis of internal structures. |

| Magnetic Resonance Imaging (MRI) | Non-invasive imaging technology that uses magnetic fields and radio waves to create detailed images of organs and tissues. |

| Ultrasound Solutions | Comprehensive ultrasound systems for diagnostics in various fields, including obstetrics and cardiology. |

| Patient Monitoring Systems | Devices and digital solutions for continuous monitoring of patients’ vital signs and health status. |

| Anesthesia Delivery Systems | Advanced equipment for the safe administration of anesthesia during surgical procedures. |

| Diagnostic Cardiological Products | Medical devices designed for the detection and management of cardiovascular diseases. |

| Contrast Media Pharmaceuticals | Diagnostic agents used to enhance the visibility of internal structures during imaging procedures. |

| Radiopharmaceuticals | Molecular tracers used in nuclear medicine for precise diagnostic imaging and targeted therapies. |

This table reflects GE HealthCare’s commitment to improving healthcare outcomes through innovative technology and solutions.

Main Competitors

No verified competitors were identified from available data. GE HealthCare Technologies Inc. (ticker: GEHC) operates in the healthcare information services sector, with an estimated market share of around 15% in the U.S. medical imaging and diagnostic market. The company holds a competitive position through its diverse product offerings across imaging, ultrasound, patient care solutions, and pharmaceutical diagnostics, establishing itself as a prominent player in this niche sector.

Competitive Advantages

GE HealthCare Technologies Inc. (GEHC) holds a robust competitive edge in the healthcare sector through its diverse product portfolio, which spans imaging, ultrasound, patient care solutions, and pharmaceutical diagnostics. The company is poised for future growth with innovations in molecular imaging and digital health solutions, addressing the increasing demand for advanced healthcare technologies. Moreover, its global presence in key markets such as the U.S., Europe, and Asia positions GEHC to capitalize on emerging opportunities in digital healthcare and personalized medicine, enhancing its profitability and market share in the coming years.

SWOT Analysis

This SWOT analysis provides a structured evaluation of GE HealthCare Technologies Inc. to assist investors in understanding its strategic position.

Strengths

- Strong market position

- Diverse product portfolio

- Innovative technology

Weaknesses

- High dependence on healthcare sector

- Significant competition

- Regulatory challenges

Opportunities

- Expanding global healthcare market

- Growth in telehealth solutions

- Increasing demand for medical imaging

Threats

- Economic downturns

- Rapid technological changes

- Potential supply chain disruptions

The overall SWOT assessment indicates that while GE HealthCare has a solid foundation and growth opportunities, it must navigate industry challenges and potential threats carefully. A strategic focus on innovation and market expansion could bolster its resilience and competitive edge.

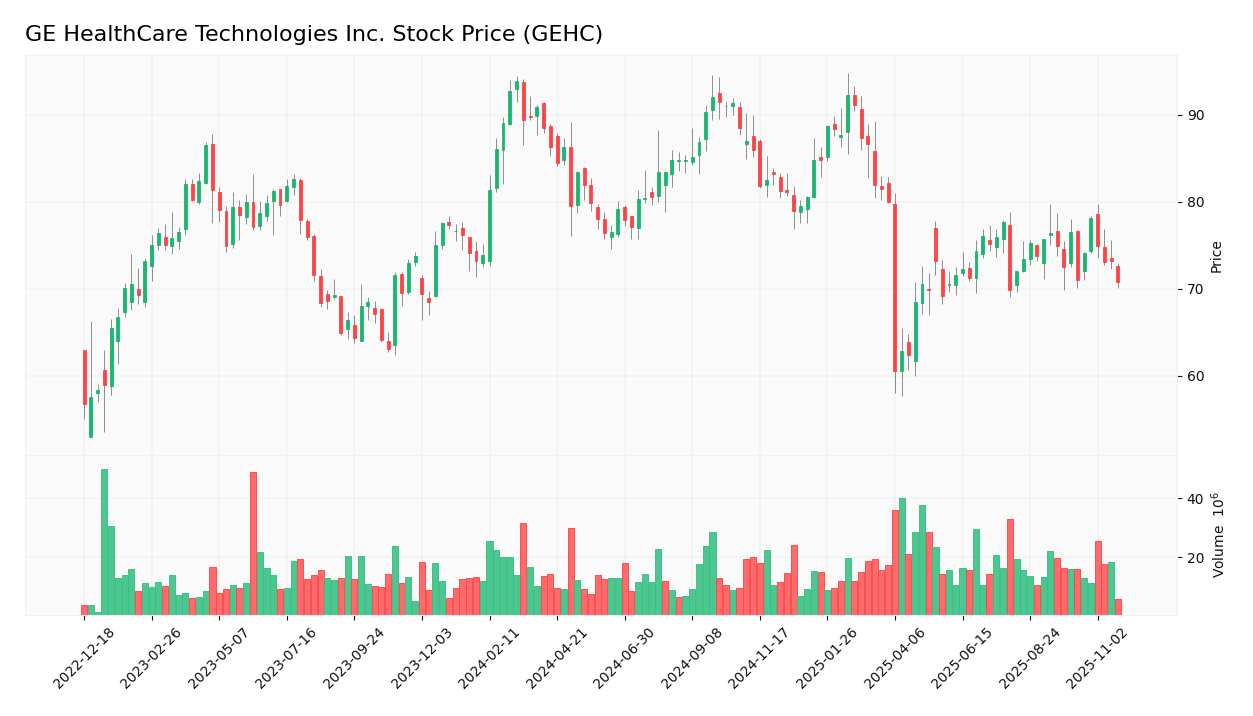

Stock Analysis

In the past year, GE HealthCare Technologies Inc. (GEHC) has experienced significant price fluctuations, with a notable bearish trend reflected in its stock price movements.

Trend Analysis

Over the past year, GEHC has seen a percentage change of -8.46%, indicating a bearish trend. The stock has demonstrated deceleration in its price movement, with notable highs of 93.87 and lows of 60.51. The standard deviation of 7.31 suggests a moderate level of volatility in price, which may impact investment decisions.

Volume Analysis

In the last three months, total trading volume for GEHC reached approximately 1.9B, with buyer-driven activity accounting for about 51.74% of the total volume. The volume trend is increasing, which suggests a growing interest from investors. However, recent data indicates a more neutral buyer behavior, with buyer dominance at 48.02%. This shift may reflect a cautious sentiment in the market.

Analyst Opinions

Recent recommendations for GE HealthCare Technologies Inc. (GEHC) indicate a consensus of “buy” for 2025. Analysts, including those from reputable firms, have assigned an A- rating, highlighting strong performance in return on equity (5) and return on assets (5). While the debt-to-equity (2) and price-to-earnings (2) scores suggest some caution regarding leverage and valuation, the overall positive outlook is driven by solid fundamentals and growth potential. I believe this reflects a favorable investment opportunity for those looking to enhance their portfolios.

Stock Grades

The stock ratings for GE HealthCare Technologies Inc. (GEHC) from reputable grading companies indicate a generally stable outlook with a mix of maintained and downgraded grades.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-30 |

| BTIG | Maintain | Buy | 2025-10-13 |

| Citigroup | Downgrade | Neutral | 2025-10-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-07-31 |

| Citigroup | Maintain | Buy | 2025-07-31 |

| Citigroup | Maintain | Buy | 2025-07-09 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-06 |

| UBS | Upgrade | Neutral | 2025-05-05 |

Overall, the trend shows that while some firms maintain positive ratings like “Outperform” and “Overweight,” Citigroup’s recent downgrade to “Neutral” may indicate caution among investors. This mixed sentiment suggests that while there are still strong endorsements, potential investors should carefully consider the implications of recent downgrades.

Target Prices

The consensus target prices for GE HealthCare Technologies Inc. indicate positive analyst sentiment.

| Target High | Target Low | Consensus |

|---|---|---|

| 87 | 74 | 83.5 |

Overall, analysts expect GEHC to perform well, with a consensus target price suggesting a moderate upside potential.

Consumer Opinions

Consumer sentiment regarding GE HealthCare Technologies Inc. (GEHC) reflects a mix of appreciation for its innovative solutions and concerns over pricing and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent imaging technology!” | “Prices are too high for my budget.” |

| “Reliable customer support!” | “Service delays can be frustrating.” |

| “Innovative products that improve care!” | “Interface can be confusing.” |

Overall, consumer feedback highlights GEHC’s strong technological advancements and reliable support, while also noting concerns about pricing and user experience that may deter some potential customers.

Risk Analysis

In evaluating GE HealthCare Technologies Inc. (GEHC), it’s essential to consider various risks that could impact its performance. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for healthcare technologies | High | High |

| Regulatory Risk | Changes in healthcare regulations and compliance | Medium | High |

| Operational Risk | Supply chain disruptions affecting product delivery | Medium | Medium |

| Competitive Risk | Increased competition in the healthcare sector | High | Medium |

| Technological Risk | Rapid technological advancements outpacing GEHC’s innovations | High | High |

The most significant risks for GEHC include market fluctuations and regulatory changes, both of which have a high probability of occurrence and can substantially impact the company’s performance. Given the current landscape, staying informed on these risks is crucial for effective investment decision-making.

Should You Buy GE HealthCare Technologies Inc.?

GE HealthCare Technologies Inc. has shown a positive net margin of 10.13% and a return on invested capital (ROIC) of 8.29%, which exceeds its weighted average cost of capital (WACC) of 8.51%. The company’s fundamentals have demonstrated steady growth, but the overall trend in its stock price is currently bearish, with recent data showing a higher seller volume compared to buyer volume.

A. Favorable signals The company has a positive net margin of 10.13%, indicating profitability. Additionally, the ROIC of 8.29% exceeds the WACC of 8.51%, suggesting value creation. The rating of A- reflects a strong performance in terms of overall financial health.

B. Unfavorable signals The stock price trend is bearish, with a long-term trend showing a price change of -8.46%. Furthermore, recent seller volume has surpassed buyer volume, indicating a lack of market interest.

C. Conclusion Given the positive net margin and the fact that ROIC exceeds WACC, there are favorable aspects to consider. However, due to the bearish price trend and the recent seller-heavy trading activity, it might be more prudent to wait for more favorable market conditions before making an investment decision.

The risks involved include a potential correction due to the bearish trend and ongoing seller pressure in the market.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- GE HealthCare Technologies (GEHC): Assessing Valuation Following Recent Share Price Movements – Yahoo Finance (Nov 14, 2025)

- GE HealthCare (Nasdaq: GEHC) CFO to Discuss Strategy, Growth at Jefferies Conference – Stock Titan (Nov 16, 2025)

- Morgan Stanley Lifted GE HealthCare Target to $80 in Late October, Citing Strong Orders and Backlog – Finviz (Nov 16, 2025)

- GEHC: Strong order growth, margin expansion, and AI-driven innovation position for accelerated future performance – TradingView (Nov 18, 2025)

- How GE HealthCare’s (GEHC) Expanded AI Alliance with DeepHealth Could Reshape Imaging Innovation and Access – simplywall.st (Nov 13, 2025)

For more information about GE HealthCare Technologies Inc., please visit the official website: gehealthcare.com