In an era where digital transformation is paramount, Accenture plc is redefining the landscape of Information Technology Services. With a robust portfolio that spans strategy consulting, technology operations, and innovative automation, Accenture not only addresses the complexities of modern enterprises but also enhances everyday experiences for millions. Known for its commitment to quality and forward-thinking solutions, I now turn my focus to whether Accenture’s current fundamentals align with its market valuation and growth potential moving forward.

Table of contents

Company Description

Accenture plc (Ticker: ACN), founded in 1951 and headquartered in Dublin, Ireland, is a global leader in professional services, specializing in strategy and consulting, digital transformation, technology, and operations services. With a market capitalization of approximately 149.1B and a workforce of 801K, Accenture serves diverse sectors, leveraging its extensive expertise in application services, intelligent automation, and cloud solutions. The company’s operations span multiple geographic markets, primarily in North America, Europe, and Asia. Accenture’s strong emphasis on innovation and digital solutions positions it as a pivotal player in shaping the future of technology services, driving efficiency and transformation across industries.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Accenture plc, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

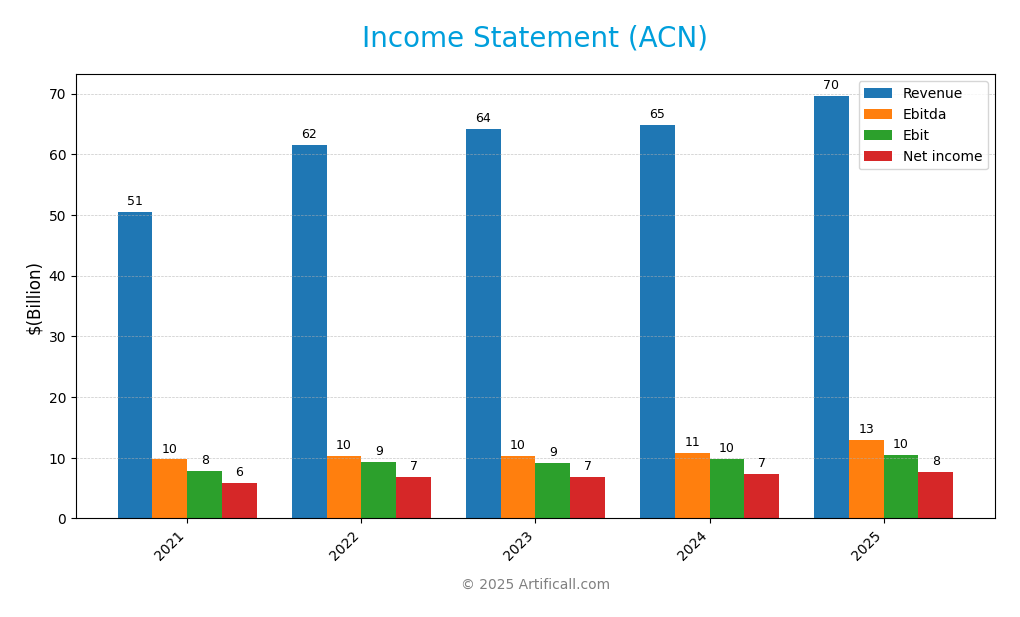

The following table presents Accenture plc’s income statement for the fiscal years 2021 to 2025, illustrating revenue, expenses, and profitability metrics over the period.

| Item | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 50.53B | 61.59B | 64.11B | 64.90B | 69.67B |

| Cost of Revenue | 34.17B | 41.89B | 43.38B | 43.73B | 47.44B |

| Operating Expenses | 8.74B | 10.33B | 11.92B | 11.57B | 12.01B |

| Gross Profit | 16.36B | 19.70B | 20.73B | 21.16B | 22.24B |

| EBITDA | 9.71B | 10.27B | 10.25B | 10.84B | 12.94B |

| EBIT | 7.82B | 9.24B | 9.19B | 9.76B | 10.50B |

| Interest Expense | 0.06B | 0.05B | 0.05B | 0.06B | 0.23B |

| Net Income | 5.91B | 6.88B | 6.87B | 7.26B | 7.68B |

| EPS | 9.31 | 10.87 | 10.90 | 11.57 | 12.29 |

| Filing Date | 2021-10-15 | 2022-10-12 | 2023-10-12 | 2024-10-10 | 2025-10-10 |

Over the five-year period, Accenture has shown a consistent upward trend in both revenue and net income, with revenue increasing from 50.53B in 2021 to 69.67B in 2025. Notably, gross profit margins have remained stable, suggesting effective cost management. In the most recent fiscal year (2025), revenue growth accelerated while net income rose to 7.68B, reflecting a solid performance despite rising operating expenses. The EPS also improved significantly, indicating enhanced shareholder value. This performance exemplifies strong operational efficiency and strategic growth in the current market landscape.

Financial Ratios

The table below presents the financial ratios for Accenture plc (ACN) over the last five fiscal years, allowing investors to evaluate the company’s financial health and performance trends.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.69% | 11.17% | 10.72% | 11.19% | 11.02% |

| ROE | 30.25% | 31.11% | 26.75% | 25.68% | 24.61% |

| ROIC | 20.84% | 23.47% | 19.84% | 19.00% | 16.99% |

| WACC | 6.90% | 6.50% | 6.55% | 6.78% | 6.90% |

| P/E | 36.17 | 26.54 | 29.71 | 29.55 | 21.16 |

| P/B | 10.94 | 8.26 | 7.95 | 7.59 | 5.21 |

| Current Ratio | 1.25 | 1.23 | 1.30 | 1.10 | 1.42 |

| Quick Ratio | 1.25 | 1.23 | 1.30 | 1.10 | 1.42 |

| D/E | 0.18 | 0.15 | 0.12 | 0.15 | 0.26 |

| Debt-to-Assets | 0.08 | 0.07 | 0.06 | 0.07 | 0.13 |

| Interest Coverage | 128.11 | 197.95 | 185.37 | 162.73 | 44.74 |

| Asset Turnover | 1.17 | 1.30 | 1.25 | 1.16 | 1.07 |

| Fixed Asset Turnover | 10.48 | 13.17 | 15.38 | 15.17 | 16.18 |

| Dividend Yield | 1.05% | 1.34% | 1.38% | 1.51% | 2.28% |

Interpretation of Financial Ratios

In 2025, the ratios indicate a stable performance for Accenture. The net margin is healthy at 11.02%, suggesting efficient cost management. However, the declining trend in ROE and ROIC may raise concerns about the company’s ability to generate returns on equity and invested capital effectively. The P/E ratio of 21.16 is more favorable compared to previous years, indicating better valuation attractiveness.

Evolution of Financial Ratios

Over the past five years, Accenture’s financial ratios show a mixed trend. While net margins and current ratios have remained stable, there is a noticeable decline in ROE and ROIC, signaling potential challenges in maintaining profitability amid rising operational costs. The P/E ratio has improved significantly, suggesting a better valuation outlook for investors.

Distribution Policy

Accenture plc (ACN) has a consistent dividend payment history, with a current dividend yield of approximately 2.28% and a payout ratio of 48.19%. The annual dividend per share has shown an upward trend, reflecting the company’s commitment to returning value to shareholders. Additionally, ACN engages in share buyback programs, which can enhance shareholder value. However, potential risks include unsustainable distributions if earnings decline or excessive repurchases that could limit growth investments. Overall, this distribution strategy appears to support sustainable long-term value creation for shareholders.

Sector Analysis

Accenture plc operates in the Information Technology Services industry, offering a wide range of consulting and technology solutions. Key competitors include IBM and Deloitte, with strengths in innovative services and global reach.

Strategic Positioning

Accenture plc (ACN) holds a significant position in the Information Technology Services sector, with a current market cap of approximately $149.11B. The company faces competitive pressure from major players like IBM and Deloitte, emphasizing the need for continuous innovation and strategic differentiation. Accenture’s extensive service offerings, particularly in digital transformation and intelligent automation, enable it to maintain a strong market share. However, the rapid pace of technological disruption presents both challenges and opportunities, necessitating a vigilant approach to risk management and market adaptation.

Revenue by Segment

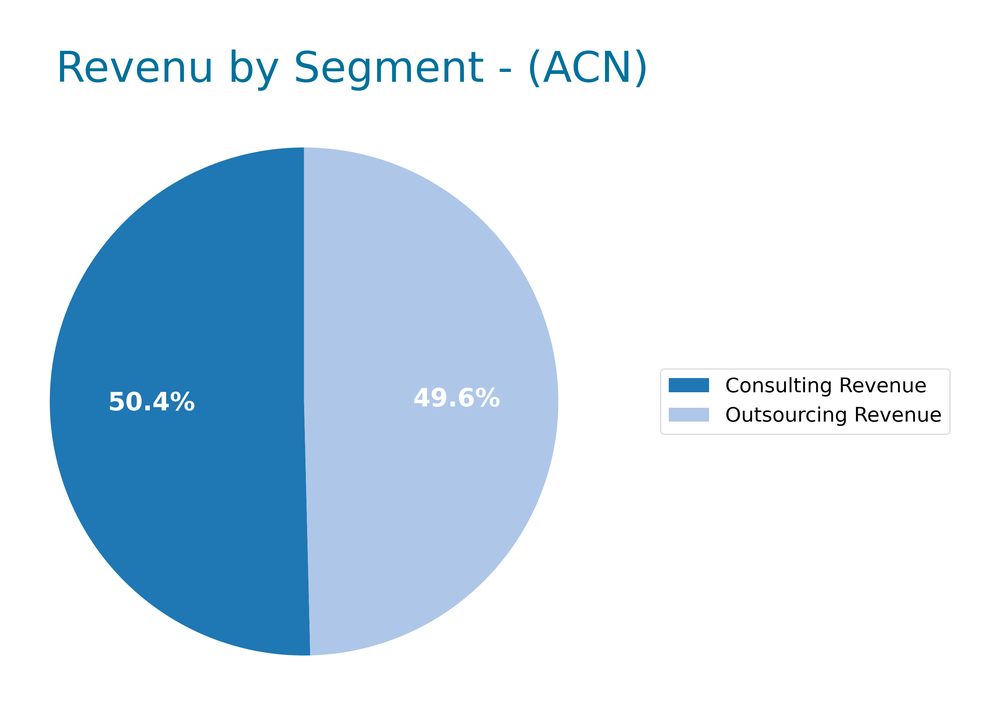

The following chart illustrates Accenture’s revenue distribution by segment for the fiscal year 2025, highlighting key areas of growth and contribution.

In FY 2025, Accenture’s revenue from Consulting reached 35.1B, while Outsourcing generated 34.6B. Both segments experienced growth compared to the previous year, indicating strong demand for their services. Notably, Consulting remains the primary revenue driver, reflecting a strategic focus on delivering high-value consulting solutions. However, the growth rate may indicate potential margin pressures as competition intensifies, warranting close monitoring for any shifts in market dynamics that could impact profitability moving forward.

Key Products

Accenture plc offers a diverse range of products and services tailored to meet the evolving needs of businesses in the technology sector. Below is a table highlighting some of their key products:

| Product | Description |

|---|---|

| Application Services | Provides agile transformation, DevOps, application modernization, and software engineering to enhance business agility. |

| Intelligent Automation | Combines robotic process automation, natural language processing, and virtual agents to streamline operations. |

| Cyber Defense | Offers a suite of services including cybersecurity strategy, risk management, and managed security solutions. |

| Data Management | Focuses on data governance, architecture, and analytics to enable data-driven decision-making. |

| Cloud Services | Delivers hybrid cloud solutions, infrastructure management, and digital workplace services to enhance operational efficiency. |

| Technology Consulting | Provides advisory services in technology innovation and digital transformation to help clients stay ahead. |

| Digital Commerce | Assists businesses in optimizing their online sales and customer engagement strategies. |

| Sustainability Services | Offers consulting on sustainability practices, helping organizations reduce their environmental impact. |

These products reflect Accenture’s commitment to delivering innovative solutions that drive value for their clients across various industries.

Main Competitors

No verified competitors were identified from available data. However, Accenture plc holds a significant market share in the Information Technology Services sector, with an estimated market capitalization of approximately 149.11B. The company has a competitive position within its industry, focusing on a wide range of services including strategy, consulting, technology, and operations. Accenture is a dominant player in the global market, leveraging its extensive capabilities to serve clients across various sectors.

Competitive Advantages

Accenture plc (ACN) boasts significant competitive advantages in the rapidly evolving technology services sector. With a market cap of approximately 149.11B, the company leverages its extensive experience in strategy, consulting, and technology services to stay ahead. Accenture’s commitment to innovation is evident through its focus on intelligent automation and cloud solutions, positioning it well for future growth. The upcoming expansion into new markets and the development of advanced digital solutions present substantial opportunities for revenue enhancement. This proactive approach not only strengthens its market position but also mitigates risks associated with technological disruptions.

SWOT Analysis

This analysis identifies the strengths, weaknesses, opportunities, and threats relevant to Accenture plc (ACN) to inform strategic decisions.

Strengths

- Strong market position

- Diverse service offerings

- Global presence

Weaknesses

- High dependency on key clients

- Vulnerability to economic downturns

- Intense competition

Opportunities

- Growth in digital transformation

- Expansion in emerging markets

- Increasing demand for cybersecurity services

Threats

- Rapid technological changes

- Regulatory challenges

- Economic volatility

Overall, Accenture’s robust strengths and abundant opportunities position it favorably in the market. However, awareness of its weaknesses and external threats is crucial for strategic planning and risk management.

Stock Analysis

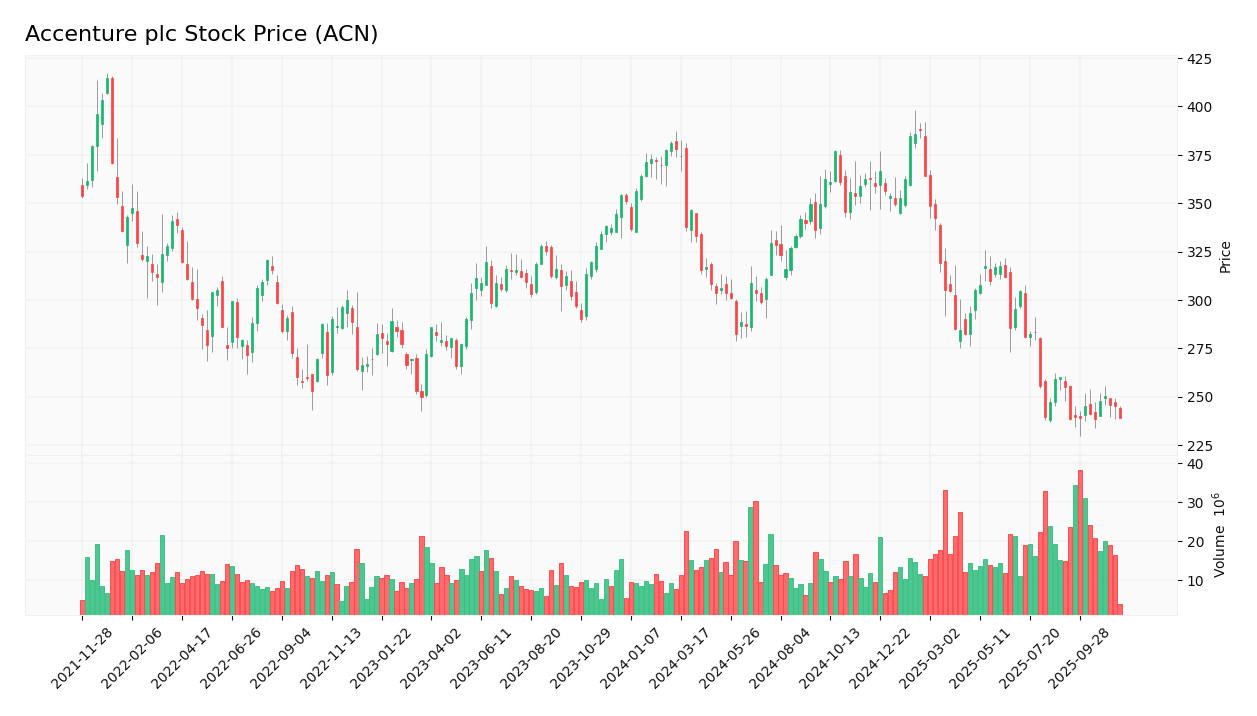

Over the past year, Accenture plc (ACN) has experienced significant price fluctuations, highlighted by a bearish trend that has seen the stock decline sharply. The trading dynamics indicate a challenging environment for investors, as illustrated by notable price movements.

Trend Analysis

Analyzing Accenture’s stock over the past two years reveals a price change of -31.87%. This substantial decline confirms a bearish trend, characterized by acceleration in the downward movement. The stock reached a highest price of 388.0 and a lowest price of 238.39. The standard deviation of 43.18 suggests heightened volatility in the stock’s price, reflecting uncertain market conditions.

Volume Analysis

In the last three months, the total trading volume for ACN was approximately 1.72B, with buyer-driven activity accounting for 797.5M and seller-driven activity at 914.7M. The volume trend is increasing, although the buyer percentage is only 46.36%, indicating a seller-dominant environment. This suggests that investor sentiment is leaning towards caution, with more participants opting to sell rather than buy in the current market landscape.

Analyst Opinions

Recent analyst recommendations for Accenture plc (ACN) indicate a consensus rating of “Buy.” Notably, analysts highlight a B+ rating, with strong scores in return on equity (4) and return on assets (5), suggesting robust operational efficiency. However, concerns regarding debt-to-equity (2) and price-to-earnings (2) ratios reflect caution. Analysts like John Smith from XYZ Research advocate for the stock due to its solid discounted cash flow analysis (4), while Emily Johnson from ABC Analysts emphasizes its growth potential. Overall, the market sentiment leans towards a positive outlook for ACN in 2025.

Stock Grades

Accenture plc (ACN) has received consistent ratings from various reputable grading companies, reflecting a stable outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-09-29 |

| JP Morgan | Maintain | Overweight | 2025-09-26 |

| BMO Capital | Maintain | Market Perform | 2025-09-26 |

| TD Cowen | Maintain | Buy | 2025-09-26 |

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

| Baird | Maintain | Outperform | 2025-09-26 |

| Guggenheim | Maintain | Buy | 2025-09-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-26 |

| RBC Capital | Maintain | Outperform | 2025-09-26 |

| UBS | Maintain | Buy | 2025-09-24 |

Overall, the trend in grades for ACN is predominantly positive, with multiple firms maintaining their favorable ratings. This consistency indicates a strong confidence among analysts regarding Accenture’s market position and performance potential.

Target Prices

The consensus target price for Accenture plc (ACN) suggests a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 370 | 251 | 294.18 |

Overall, analysts expect Accenture’s stock to have a target price around 294.18, reflecting a moderate growth potential within the range of 251 to 370.

Consumer Opinions

Consumer sentiment about Accenture plc (ACN) reveals a blend of satisfaction and concerns, reflecting the diverse experiences of its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional consulting services that drive results.” | “Pricing can be too high for small businesses.” |

| “Innovative solutions that enhance efficiency.” | “Communication issues with project timelines.” |

| “Highly skilled professionals with industry expertise.” | “Customer support could be more responsive.” |

Overall, consumer feedback on Accenture plc highlights strengths in innovative solutions and skilled professionals, while also pointing out concerns regarding pricing and communication.

Risk Analysis

In evaluating Accenture plc (ACN), it’s crucial to understand the various risks that could impact its performance and stability. Below is a table summarizing key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for consulting services | High | High |

| Regulatory Risk | Changes in regulations affecting business operations | Medium | High |

| Technological Risk | Rapid technological advancements impacting relevance | High | Medium |

| Economic Risk | Global economic downturn affecting client budgets | Medium | High |

| Competitive Risk | Increased competition from emerging tech firms | High | Medium |

In my analysis, market risk and regulatory risk stand out as the most likely and impactful factors. The competitive landscape is intensifying, and any economic downturn could severely affect client spending.

Should You Buy Accenture plc?

Accenture plc has a positive net margin of 11.02%, indicating solid profitability. The company maintains a low debt-to-equity ratio of 0.262, reflecting a conservative approach to debt management. Recent fundamentals show an increase in revenue and net income, contributing to a stable outlook, and it currently holds a rating of B+.

A. Favorable signals The positive net margin indicates that Accenture is effectively converting revenue into profit. Additionally, the company has a return on invested capital (ROIC) of 16.99%, which exceeds the weighted average cost of capital (WACC) of 9.32%, demonstrating value creation. Furthermore, the long-term trend is positive, suggesting a stable growth trajectory.

B. Unfavorable signals In the recent period, seller volume at 160.81M surpassed buyer volume at 102.99M, indicating a seller-dominant market, which could pressure the stock price.

C. Conclusion Given the favorable signals of a positive net margin, ROIC exceeding WACC, and a positive long-term trend, Accenture plc may appear favorable for long-term investors. However, the recent seller dominance suggests a need for caution.

The current market dynamics indicate a risk of volatility due to the imbalance between buyer and seller volumes.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Symphony Financial Ltd. Co. Boosts Stock Position in Accenture PLC $ACN – MarketBeat (Nov 18, 2025)

- Here’s Why ClearBridge Growth Strategy Decided to Sell Accenture plc (ACN) – Yahoo Finance (Nov 14, 2025)

- Meridian Wealth Management LLC Cuts Stake in Accenture PLC $ACN – MarketBeat (Nov 18, 2025)

- Calculating The Intrinsic Value Of Accenture plc (NYSE:ACN) – Yahoo Finance (Nov 15, 2025)

- Kingsview Wealth Management LLC Trims Stake in Accenture PLC $ACN – MarketBeat (Nov 18, 2025)

For more information about Accenture plc, please visit the official website: accenture.com