Wipro Limited is not just a player in the Information Technology Services sector; it’s a transformative force, redefining how businesses operate and engage with technology. Renowned for its innovative solutions, Wipro’s portfolio spans IT services, consulting, and business process services, catering to diverse industries from healthcare to finance. As we evaluate Wipro’s latest performance and market positioning, the key question arises: do its robust fundamentals still support its current valuation and future growth potential?

Table of contents

Company Description

Wipro Limited (NYSE: WIT), founded in 1945 and headquartered in Bengaluru, India, is a prominent player in the Information Technology Services sector. The company operates through three main segments: IT Services, IT Products, and India State Run Enterprise Services (ISRE). Wipro provides a comprehensive range of IT and consulting services, including digital strategy, custom application development, and cloud solutions, catering to diverse industries such as healthcare, retail, and financial services. With approximately 234K employees, Wipro primarily serves markets in India and around the globe. The company’s commitment to innovation and its robust service ecosystem positions it as a significant contributor to shaping the future of technology solutions.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Wipro Limited, focusing on the income statement, financial ratios, and dividend payout policy.

Income Statement

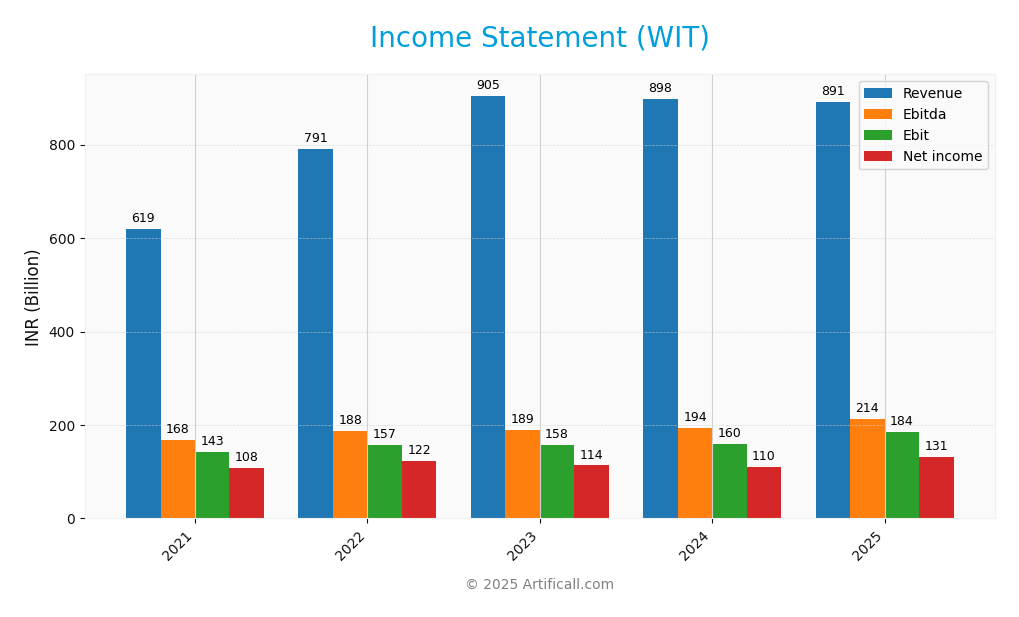

The following table provides a comprehensive overview of Wipro Limited’s income statement for recent fiscal years, highlighting key financial metrics essential for assessing the company’s performance.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 619.43B | 790.93B | 904.88B | 897.60B | 890.88B |

| Cost of Revenue | 423.21B | 555.87B | 645.45B | 631.50B | 617.80B |

| Operating Expenses | 76.17B | 99.13B | 124.30B | 130.01B | 121.81B |

| Gross Profit | 196.23B | 235.06B | 259.43B | 266.11B | 273.08B |

| EBITDA | 168.41B | 187.51B | 189.38B | 193.83B | 213.78B |

| EBIT | 143.18B | 156.60B | 157.79B | 159.76B | 184.20B |

| Interest Expense | 4.30B | 5.33B | 10.08B | 12.55B | 9.25B |

| Net Income | 107.95B | 122.19B | 113.50B | 110.45B | 131.35B |

| EPS | 9.56 | 11.18 | 10.36 | 10.45 | 12.56 |

| Filing Date | 2021-05-22 | 2022-05-22 | 2023-05-22 | 2024-05-22 | 2025-05-22 |

Interpretation of Income Statement

Over the past five fiscal years, Wipro Limited’s revenue has seen a slight decline from 904.88B in 2023 to 890.88B in 2025, indicating potential market challenges. However, net income has experienced a notable improvement, rising from 113.50B in 2023 to 131.35B in 2025, suggesting effective cost management strategies. The gross and operating margins have remained relatively stable, indicating that the company has successfully controlled its operating expenses despite declining revenue. In the most recent fiscal year, Wipro demonstrated resilience with a significant increase in EBITDA and net income, showcasing its ability to enhance profitability even amidst revenue fluctuations.

Financial Ratios

The table below summarizes the key financial ratios for Wipro Limited (Ticker: WIT) over the fiscal years 2021 to 2025.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 17.43% | 15.45% | 12.54% | 12.31% | 14.74% |

| ROE | 19.52% | 18.57% | 14.53% | 14.73% | 15.86% |

| ROIC | 14.04% | 12.90% | 10.69% | 10.39% | 10.33% |

| P/E | 24.37 | 26.27 | 17.84 | 22.58 | 20.84 |

| P/B | 4.76 | 4.88 | 2.59 | 3.33 | 3.30 |

| Current Ratio | 2.27 | 2.01 | 2.47 | 2.58 | 2.72 |

| Quick Ratio | 2.27 | 2.01 | 2.46 | 2.57 | 2.71 |

| D/E | 0.19 | 0.27 | 0.22 | 0.22 | 0.23 |

| Debt-to-Assets | 12.57% | 16.30% | 14.85% | 14.29% | 14.93% |

| Interest Coverage | 28.63 | 26.34 | 13.85 | 10.84 | 16.36 |

| Asset Turnover | 0.75 | 0.73 | 0.77 | 0.78 | 0.69 |

| Fixed Asset Turnover | 6.10 | 7.21 | 8.43 | 9.02 | 8.38 |

| Dividend Yield | 0.21% | 0.17% | 1.62% | 0.21% | 2.29% |

Interpretation of Financial Ratios

Wipro Limited’s financial ratios for FY 2025 indicate a robust financial health. The current ratio stands at 2.72, suggesting strong liquidity, well above the ideal threshold of 1. The solvency ratio is at 0.35, indicating a moderate ability to meet long-term obligations, though a lower ratio may raise concerns regarding long-term debt management. Profitability ratios are solid, with a net profit margin of 14.74% and an impressive return on equity of 15.86%, reflecting effective cost management and operational efficiency. However, the price-to-earnings ratio of 20.84 might suggest that the stock is relatively expensive compared to its earnings. Overall, the financial ratios show strength, but potential investors should remain cautious about the high valuation.

Evolution of Financial Ratios

Over the past five years, Wipro’s financial ratios demonstrate a generally positive trend, particularly in profitability and liquidity. The current ratio has increased from 2.27 in 2021 to 2.72 in 2025, indicating improved liquidity. However, the net profit margin has fluctuated, slightly increasing from 12.54% in 2023 to 14.74% in 2025, emphasizing the need for ongoing monitoring of profitability.

Distribution Policy

Wipro Limited (WIT) maintains a dividend payout ratio of approximately 48%, distributing about ₹6.00 per share, resulting in an annual yield of 2.29%. The company has engaged in share buybacks, supporting shareholder value. However, I advise caution as a high payout ratio can pose risks if earnings decline. Overall, Wipro’s distribution strategy appears sustainable, promoting long-term value creation for shareholders while balancing growth and returns.

Sector Analysis

Wipro Limited operates in the Information Technology Services industry, offering a diverse range of IT solutions and consulting services while facing competition from major players like TCS and Infosys.

Strategic Positioning

Wipro Limited (WIT) maintains a significant position in the Information Technology Services market, with a current market cap of approximately $28.3B. The company faces competitive pressure from major players such as Tata Consultancy Services and Infosys, which are continuously evolving their offerings. Wipro’s key products in IT services and consulting hold a noteworthy market share, yet the rapid pace of technological disruption necessitates ongoing innovation. The integration of AI and cloud solutions is crucial as I assess Wipro’s ability to adapt and grow amidst these challenges.

Key Products

Wipro Limited offers a diverse range of products and services within the information technology sector. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| IT Services | Comprehensive IT and IT-enabled services including digital strategy, custom application development, and cloud solutions. |

| IT Products | A variety of third-party IT products like networking solutions, enterprise security tools, and data storage solutions. |

| ISRE Services | IT services specifically tailored for government entities and departments in India, focusing on compliance and efficiency. |

| Consulting Services | Advisory services in technology consulting, business process optimization, and digital transformation strategies. |

| Customer Experience Solutions | Tools and services aimed at enhancing customer engagement and satisfaction through analytics and design services. |

These products reflect Wipro’s commitment to providing innovative solutions across various industries, from healthcare to financial services.

Main Competitors

No verified competitors were identified from available data. Wipro Limited (WIT) holds a market share in the information technology services sector, with a competitive position primarily in India and a growing presence globally. The company operates in various niche markets, including IT consulting, business process services, and digital strategy, which positions it well to leverage opportunities in the evolving tech landscape.

Competitive Advantages

Wipro Limited (WIT) leverages its extensive expertise in IT services to maintain a competitive edge in the rapidly evolving tech landscape. With a market cap of approximately 28.3B, the company benefits from a diversified portfolio that spans various sectors, including healthcare, banking, and manufacturing. Looking ahead, Wipro is poised to capitalize on emerging opportunities through the development of innovative digital solutions and expansion into new markets. The focus on cloud computing and AI-driven services will likely enhance its service offerings, enabling Wipro to meet the growing demand for digital transformation among enterprises.

SWOT Analysis

The purpose of this analysis is to evaluate Wipro Limited’s strengths, weaknesses, opportunities, and threats to inform strategic decisions.

Strengths

- Strong market position

- Diverse service offerings

- Established global presence

Weaknesses

- Limited brand recognition in some markets

- Dependence on key clients

- Competitive pricing pressure

Opportunities

- Growth in digital transformation

- Increasing demand for IT services

- Expansion in emerging markets

Threats

- Intense competition

- Economic uncertainties

- Rapid technology changes

Overall, Wipro Limited possesses a solid foundation with diverse offerings and a strong market presence, but it must navigate competitive pressures and economic fluctuations. The company should leverage digital transformation trends while addressing its weaknesses to enhance its strategic positioning.

Stock Analysis

Over the past year, Wipro Limited’s stock (WIT) has experienced notable price movements, culminating in a bearish trend that reflects the challenges faced by the company. The stock’s dynamics illustrate a struggle as it has seen fluctuations between a high of 3.77 and a low of 2.58.

Trend Analysis

Analyzing the stock’s performance over the past two years, WIT has recorded a percentage change of -0.37%. This decline indicates a bearish trend, further supported by a recent period drop of -2.53% from September 14, 2025, to November 30, 2025. The trend has shown a deceleration, with a standard deviation of 0.31 suggesting moderate volatility. Notably, the stock reached its highest price of 3.77 and its lowest at 2.58, reflecting a declining market sentiment.

Volume Analysis

In the last three months, WIT has seen a total trading volume of approximately 3.04B shares, with buyer activity accounting for 45.59% and seller activity at 49.19%. The volume trend is increasing, indicating heightened market participation. However, recent data suggests a slightly buyer-dominant sentiment with a buyer percentage of 53.05%. This shift may imply a potential stabilization in investor interest, although the overall seller-driven volume remains a concern.

Analyst Opinions

Recent analyst recommendations for Wipro Limited (WIT) indicate a consensus to “buy.” Analysts highlight the company’s strong fundamentals, with an A- rating reflecting robust discounted cash flow and return on equity scores. Specifically, the discounted cash flow score is at 5, while return on assets also scores 5, showcasing efficient asset utilization. However, the debt-to-equity and price-to-earnings scores are relatively lower at 2, suggesting caution regarding financial leverage. Overall, I find the consensus among analysts points towards a favorable outlook for investors considering WIT.

Stock Grades

Wipro Limited (WIT) has seen a variety of stock ratings from credible analysts, reflecting changing market sentiments.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | upgrade | Neutral | 2025-01-02 |

| Wedbush | maintain | Underperform | 2024-01-16 |

| JP Morgan | maintain | Underweight | 2023-05-24 |

| Bernstein | downgrade | Underperform | 2023-03-22 |

| Bernstein | downgrade | Underperform | 2023-03-21 |

| Goldman Sachs | upgrade | Buy | 2022-09-13 |

| Goldman Sachs | upgrade | Buy | 2022-09-12 |

| Morgan Stanley | downgrade | Underweight | 2022-07-14 |

| Morgan Stanley | downgrade | Underweight | 2022-07-13 |

| Macquarie | upgrade | Outperform | 2022-06-02 |

The overall trend indicates a recent upgrade to “Neutral” by UBS, suggesting a stabilization in sentiment, although several analysts still maintain lower grades reflecting ongoing caution. Notably, Goldman Sachs had previously issued “Buy” ratings, indicating fluctuating confidence in Wipro’s potential.

Target Prices

The current consensus target price for Wipro Limited (WIT) reflects a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 7.7 | 7 | 7.35 |

Analysts expect Wipro Limited’s stock to trend towards the consensus target of 7.35, indicating a generally positive sentiment with a clear range of expectations.

Consumer Opinions

Consumer sentiment regarding Wipro Limited (WIT) reflects a mix of appreciation and criticism, showcasing both the strengths and weaknesses of the company.

| Positive Reviews | Negative Reviews |

|---|---|

| “Wipro’s customer support is top-notch.” | “Their project delivery timelines often slip.” |

| “Innovative solutions that meet our needs.” | “Communication could be improved.” |

| “Strong expertise in technology.” | “Prices are higher compared to competitors.” |

| “Reliable partner for long-term projects.” | “Some services lack customization options.” |

Overall, consumer feedback highlights Wipro’s strong customer support and innovative solutions as key strengths, while concerns about project timelines and communication issues are recurring weaknesses.

Risk Analysis

In evaluating Wipro Limited (WIT), it is essential to consider various risks that could affect its performance and investment potential.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for IT services globally. | High | High |

| Regulatory Risk | Changing regulations in key markets like the US. | Medium | High |

| Cybersecurity Risk | Potential data breaches affecting client trust. | High | High |

| Operational Risk | Disruptions in service delivery due to remote work. | Medium | Medium |

| Currency Risk | Exchange rate volatility impacting revenue. | High | Medium |

The most significant risks for Wipro include market and cybersecurity risks, especially in the context of increasing global competition and rising cyber threats. Recent breaches in the industry highlight the urgency to bolster cybersecurity measures.

Should You Buy Wipro Limited?

Wipro Limited has demonstrated a positive net margin of 14.74%, indicating profitability. The company’s debt-to-equity ratio stands at a relatively low 0.232, reflecting a manageable level of debt. Over the past year, the company has maintained a steady overall rating of A-, suggesting solid fundamentals.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company is experiencing a bearish stock trend, with a recent price change of -2.53%, suggesting negative momentum. Moreover, the recent seller volume exceeds buyer volume, indicating that there are more sellers than buyers in the market.

Conclusion Given the unfavorable signals surrounding Wipro Limited, it might be prudent to wait for a more favorable market environment before considering an investment.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Wipro Limited (NYSE:WIT) Receives Average Recommendation of “Reduce” from Brokerages – MarketBeat (Nov 23, 2025)

- SquareX and Wipro Ventures (NYSE: WIT) launch browser detection and response partnership – Stock Titan (Nov 24, 2025)

- CLSA Maintains a Buy Rating on Wipro Limited (WIT) – Yahoo Finance (Oct 13, 2025)

- SquareX announces Wipro Ventures as Strategic Partner for Browser Detection and Response, Turning Any Browser into Enterprise-Grade Secure Browser with a Simple Extension – Laotian Times (Nov 24, 2025)

- Wipro Limited Announces Restructuring with Sale of Drivestream India Stake – TipRanks (Nov 03, 2025)

For more information about Wipro Limited, please visit the official website: wipro.com