In the rapidly evolving uranium industry, two companies stand out: Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE). Both are strategically positioned within the market, yet they employ distinct approaches to innovation and growth. UROY focuses on acquiring and managing a portfolio of uranium royalties, while NXE is dedicated to exploration and development of uranium properties. This article will help you determine which of these companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (UROY) operates as a pure-play uranium royalty company, focusing on acquiring and managing a diverse portfolio of uranium interests across various locations. Founded in 2017 and headquartered in Vancouver, Canada, UROY holds royalty interests in prominent uranium projects, including McArthur River and Cigar Lake in Saskatchewan, as well as other projects in the U.S. and Namibia. With a market cap of approximately 491M, UROY aims to provide investors with exposure to the uranium sector without the operational risks associated with mining.

NexGen Energy Ltd. Overview

NexGen Energy Ltd. (NXE) is an exploration and development company engaged in acquiring, exploring, and developing uranium properties, primarily in Canada. Its flagship asset is the Rook I project, located in the highly prospective Athabasca Basin of Saskatchewan, covering over 35K hectares. Established in 2013, NexGen has positioned itself as a leader in uranium exploration with a market cap of around 5.5B. The company focuses on advancing its projects towards production, capitalizing on the growing demand for clean energy sources.

Key similarities and differences in their business models lie in their operational focus. While UROY is centered on royalty interests, minimizing operational risks, NXE is actively involved in exploration and development, with a direct path to production. Both companies aim to capitalize on the burgeoning uranium market but do so through distinctly different approaches.

Income Statement Comparison

The following table provides a comparative view of the most recent income statements for Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE), highlighting key financial metrics.

| Metric | UROY | NXE |

|---|---|---|

| Revenue | 15.6M | 0 |

| EBITDA | -4.8M | -76.8M |

| EBIT | -4.9M | -78.2M |

| Net Income | -5.7M | -77.6M |

| EPS | -0.045 | -0.14 |

Interpretation of Income Statement

In the most recent fiscal year, UROY reported a significant decrease in revenue to 15.6M CAD, down from 42.7M CAD the previous year, resulting in a net loss of 5.7M CAD. Meanwhile, NXE continues to struggle with no revenue generated and a net loss of 77.6M CAD. Despite UROY’s declining revenue, it managed to maintain a relatively smaller EBITDA loss compared to NXE’s substantial losses, indicating potential operational efficiency issues at NXE. Both companies exhibit negative earnings per share (EPS), reflecting ongoing financial challenges and the need for strategic adjustments to improve their bottom lines.

Financial Ratios Comparison

The following table compares the financial ratios of Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE) based on the most recent available data.

| Metric | UROY | NXE |

|---|---|---|

| ROE | -1.92% | -6.58% |

| ROIC | -1.73% | -4.39% |

| P/E | -56.00 | -67.80 |

| P/B | 1.07 | 4.46 |

| Current Ratio | 233.49 | 1.03 |

| Quick Ratio | 233.49 | 1.03 |

| D/E | 0.0007 | 0.387 |

| Debt-to-Assets | 0.0007 | 0.276 |

| Interest Coverage | -11.02 | -2.33 |

| Asset Turnover | 0.052 | 0 |

| Fixed Asset Turnover | 82.51 | 0 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

Both companies show significant financial challenges, as indicated by negative returns on equity (ROE) and invested capital (ROIC). UROY exhibits a notably high current and quick ratio, suggesting strong liquidity, while NXE’s ratios indicate potential solvency risks with higher debt levels. The absence of dividends emphasizes their focus on growth and recovery. Investors should approach these stocks cautiously, given their current financial instability.

Dividend and Shareholder Returns

Both Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE) do not pay dividends, reflecting their focus on reinvestment strategies and growth phases. UROY reported a negative net income alongside significant operational challenges, while NXE is also in a high-growth phase. Both companies engage in share buybacks, which may indicate confidence in their future prospects. However, the absence of dividends raises questions about immediate shareholder value. This approach can align with long-term growth objectives but carries risks if operational performance does not improve.

Strategic Positioning

In the uranium sector, NexGen Energy Ltd. (NXE) holds a significant market share with a market cap of 5.47B, primarily driven by its Rook I project. This positions it favorably against competitors like Uranium Royalty Corp. (UROY), which, despite its substantial portfolio of royalty interests, has a market cap of 491M. Competitive pressure remains intense amid technological advancements and market fluctuations, necessitating robust risk management strategies for investors.

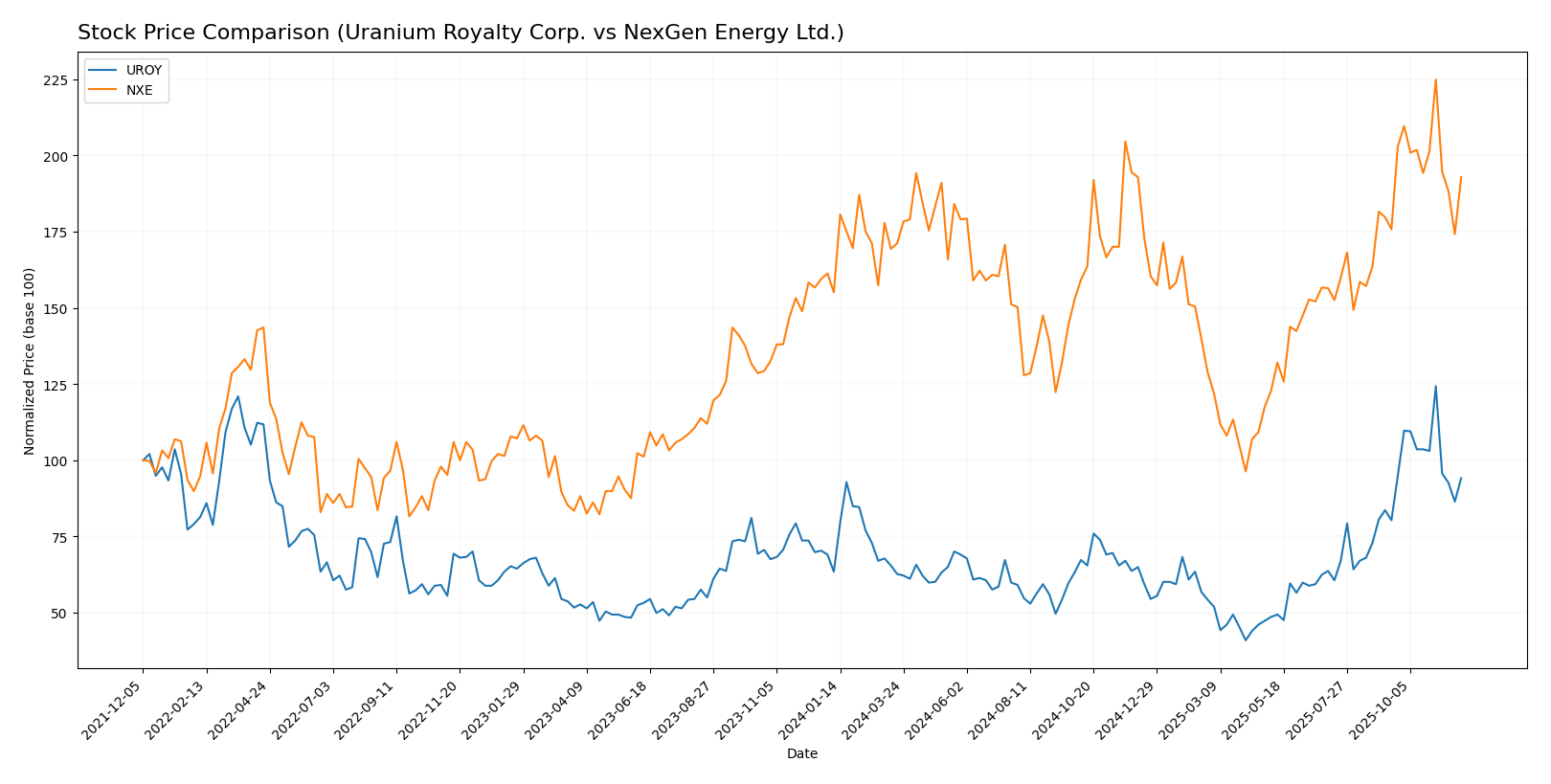

Stock Comparison

In the past year, the stock prices of Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE) have exhibited significant movements, reflecting the dynamic nature of the uranium sector. Both companies have shown potential resilience, but their trends reveal different trajectories in terms of price performance and trading behavior.

Trend Analysis

Uranium Royalty Corp. (UROY) has experienced a price increase of 48.39% over the past year, indicating a bullish trend. However, the acceleration status is in deceleration, which suggests that while the stock has gained substantially, the rate of increase is slowing down. The highest price recorded was $4.86, and the lowest was $1.60. The standard deviation of 0.62 indicates moderate volatility in the stock price.

In the recent analysis period from September 14, 2025, to November 30, 2025, UROY’s price change was 17.2%, with a slight downward trend slope of -0.01. This suggests a temporary leveling off after substantial gains.

NexGen Energy Ltd. (NXE) achieved a price increase of 24.37% over the last year, also reflecting a bullish trend. Similar to UROY, NXE shows deceleration in its price acceleration, with a highest price of $9.76 and a lowest price of $4.18. Its standard deviation of 1.13 indicates higher volatility compared to UROY.

During the recent period from September 14, 2025, to November 30, 2025, NXE’s price changed by 9.7%, with a trend slope of -0.03, suggesting a slight decline in momentum.

In summary, both UROY and NXE exhibit bullish trends with notable gains over the past year. However, the signs of deceleration in their recent movements warrant cautious observation as we navigate the evolving market landscape.

Analyst Opinions

Recent analyst evaluations suggest a cautious outlook for Uranium Royalty Corp. (UROY) with a rating of C, reflecting concerns about its financial metrics despite a reasonable debt-to-equity score. Analysts recommend holding at this time. In contrast, NexGen Energy Ltd. (NXE) has a D+ rating, indicating significant risks, particularly in cash flow and earnings performance, leading to a consensus sell recommendation. Overall, the current consensus for UROY is hold, while NXE is clearly a sell for 2025.

Stock Grades

I have found reliable grade data for Uranium Royalty Corp. (UROY), which is crucial for understanding its current market position.

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Overall, UROY has consistently received a “Buy” rating from HC Wainwright & Co., indicating a strong and stable outlook for the company. However, there were no verified stock grades available for NexGen Energy Ltd. (NXE), which limits my ability to provide an analysis on that stock at this time.

Target Prices

No verified target price data is available from recognized analysts for Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE). The market sentiment appears to be cautious given the lack of consensus.

Strengths and Weaknesses

In this section, I will outline the strengths and weaknesses of Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE) based on the most recent data.

| Criterion | UROY | NXE |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Negative margins | Negative margins |

| Innovation | Emerging projects | Advanced exploration |

| Global presence | Strong in Canada | Strong in Canada |

| Market Share | Low | Moderate |

| Debt level | Very low (0.07%) | High (27.56%) |

Key takeaways: UROY shows high diversification and low debt, but struggles with profitability. NXE has advanced exploration capabilities but carries a higher debt burden.

Risk Analysis

The following table outlines the primary risks associated with Uranium Royalty Corp. and NexGen Energy Ltd.

| Metric | Uranium Royalty Corp. | NexGen Energy Ltd. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | High |

Both companies face significant market and regulatory risks, particularly due to the volatility in uranium prices and changing environmental regulations. Uranium Royalty Corp. has a high market risk, while NexGen Energy Ltd. is particularly exposed to operational risks related to project development timelines.

Which one to choose?

When comparing Uranium Royalty Corp. (UROY) and NexGen Energy Ltd. (NXE), UROY exhibits a stronger financial position with a market cap of 317M CAD and a current ratio of 233, indicating excellent liquidity. In contrast, NXE has a market cap of 5.26B CAD but a lower current ratio of 1.03, reflecting some liquidity concerns. UROY’s stock trend has been bullish, with a recent price increase of 17.2%, whereas NXE’s increase was 9.7%. Analysts have rated UROY as a “C” while NXE received a “D+”, suggesting UROY may be more favorable despite both companies facing challenges in profitability.

For growth-focused investors, UROY may be preferable due to its liquidity and improving trends. However, those prioritizing established market presence might lean towards NXE.

It’s important to note that both companies face risks related to market volatility and competition in the uranium sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Uranium Royalty Corp. and NexGen Energy Ltd. to enhance your investment decisions: