In the dynamic world of uranium investments, two companies stand out: Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU). Both are key players in the uranium sector, focusing on extraction and exploration within the United States. Their strategies for innovation and market positioning offer a fascinating comparison for investors seeking growth opportunities in this niche industry. Join me as I explore which of these companies presents the most compelling investment potential for your portfolio.

Table of contents

Company Overview

Uranium Energy Corp. Overview

Uranium Energy Corp. (ticker: UEC) is a prominent player in the uranium mining sector, focusing on exploration, extraction, and processing of uranium and titanium concentrates across the U.S., Canada, and Paraguay. Founded in 2003 and headquartered in Corpus Christi, Texas, the company operates several key projects, including the Palangana and Goliad mines in Texas and the Reno Creek project in Wyoming. With a market capitalization of approximately $5.71B, UEC aims to capitalize on the growing global demand for clean nuclear energy, positioning itself as a sustainable energy provider. The company has adopted a strategic approach to maintain operational efficiency and reduce costs, which is critical in the highly volatile energy sector.

Energy Fuels Inc. Overview

Energy Fuels Inc. (ticker: UUUU) is another significant entity in the uranium industry, specializing in the extraction and recovery of uranium through both conventional and in situ methods. Founded in 1987 and based in Lakewood, Colorado, Energy Fuels operates several projects including the Nichols Ranch and Jane Dough properties, as well as the White Mesa Mill in Utah. With a market capitalization of around $3.42B, the company is actively engaged in various stages of uranium and vanadium project development. Energy Fuels aims to fulfill the increasing demand for nuclear fuel through innovative and responsible mining practices while also exploring opportunities in the broader energy market.

Key similarities and differences

Both Uranium Energy Corp. and Energy Fuels Inc. operate within the uranium mining industry, focusing on extraction and processing. However, UEC has a more diverse geographical presence with projects in South America, whereas UUUU primarily concentrates on the U.S. market. Additionally, UEC emphasizes titanium alongside uranium, while Energy Fuels has a notable interest in vanadium. These strategic differences highlight their unique approaches to capitalizing on the growing nuclear energy sector.

Income Statement Comparison

The following table provides a comparison of the income statements for Uranium Energy Corp. and Energy Fuels Inc., highlighting key financial metrics for the latest fiscal year.

| Metric | Uranium Energy Corp. (UEC) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Market Cap | 5.71B | 3.42B |

| Revenue | 66.84M | 78.11M |

| EBITDA | -84.50M | -43.02M |

| EBIT | -88.99M | -48.21M |

| Net Income | -87.66M | -47.77M |

| EPS | -0.20 | -0.28 |

| Fiscal Year | 2025 | 2024 |

Interpretation of Income Statement

In the latest fiscal year, Uranium Energy Corp. reported a significant drop in revenue to 66.84M, a stark contrast to Energy Fuels Inc., which generated 78.11M, indicating relative strength in its market positioning. Both companies recorded negative net incomes, with UEC facing a more considerable loss at 87.66M versus 47.77M for UUUU. The widening EBITDA margins suggest operational inefficiencies, particularly for UEC, which may raise concerns for investors. Overall, both companies are navigating challenging financial landscapes, and it’s crucial to monitor their strategic responses moving forward.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent financial ratios for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU). This helps to evaluate their financial health and operational efficiency.

| Metric | UEC | UUUU |

|---|---|---|

| ROE | -8.91% | -9.05% |

| ROIC | -6.57% | -6.67% |

| P/E | -42.30 | -18.47 |

| P/B | 3.77 | 1.67 |

| Current Ratio | 8.85 | 3.88 |

| Quick Ratio | 5.85 | 2.76 |

| D/E | 0.002 | 0.004 |

| Debt-to-Assets | 0.002 | 0.003 |

| Interest Coverage | -50.71 | 0 |

| Asset Turnover | 0.060 | 0.128 |

| Fixed Asset Turnover | 0.086 | 1.415 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both UEC and UUUU exhibit negative returns on equity (ROE) and return on invested capital (ROIC), indicating challenges in profitability. UEC’s P/E ratio is significantly worse than UUUU’s, reflecting investor skepticism about its future earnings potential. While UEC has a strong current and quick ratio, suggesting good short-term liquidity, UUUU shows better asset turnover. Overall, both companies display financial challenges, but UUUU shows slightly better operational efficiency and market valuation metrics. Caution is advised for investors considering these stocks.

Dividend and Shareholder Returns

Neither Uranium Energy Corp. (UEC) nor Energy Fuels Inc. (UUUU) currently pays dividends, reflecting a focus on reinvestment and growth strategies. Both companies are in high-growth phases, prioritizing capital for R&D and operational expansion over shareholder distributions. UEC engages in share buybacks, though it faces risks such as negative net income and limited cash flow. This approach may hinder sustainable long-term value creation for shareholders if operational performance does not improve.

Strategic Positioning

Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) are two key players in the uranium industry, each holding significant market shares. UEC, with a market cap of approximately 5.71B, has a beta of 1.34, indicating moderate volatility. In comparison, UUUU has a market cap of around 3.42B and a higher beta of 2.05, suggesting greater risk. Both companies face competitive pressure from each other and other emerging firms, along with the constant threat of technological disruption in uranium extraction and processing methods.

Stock Comparison

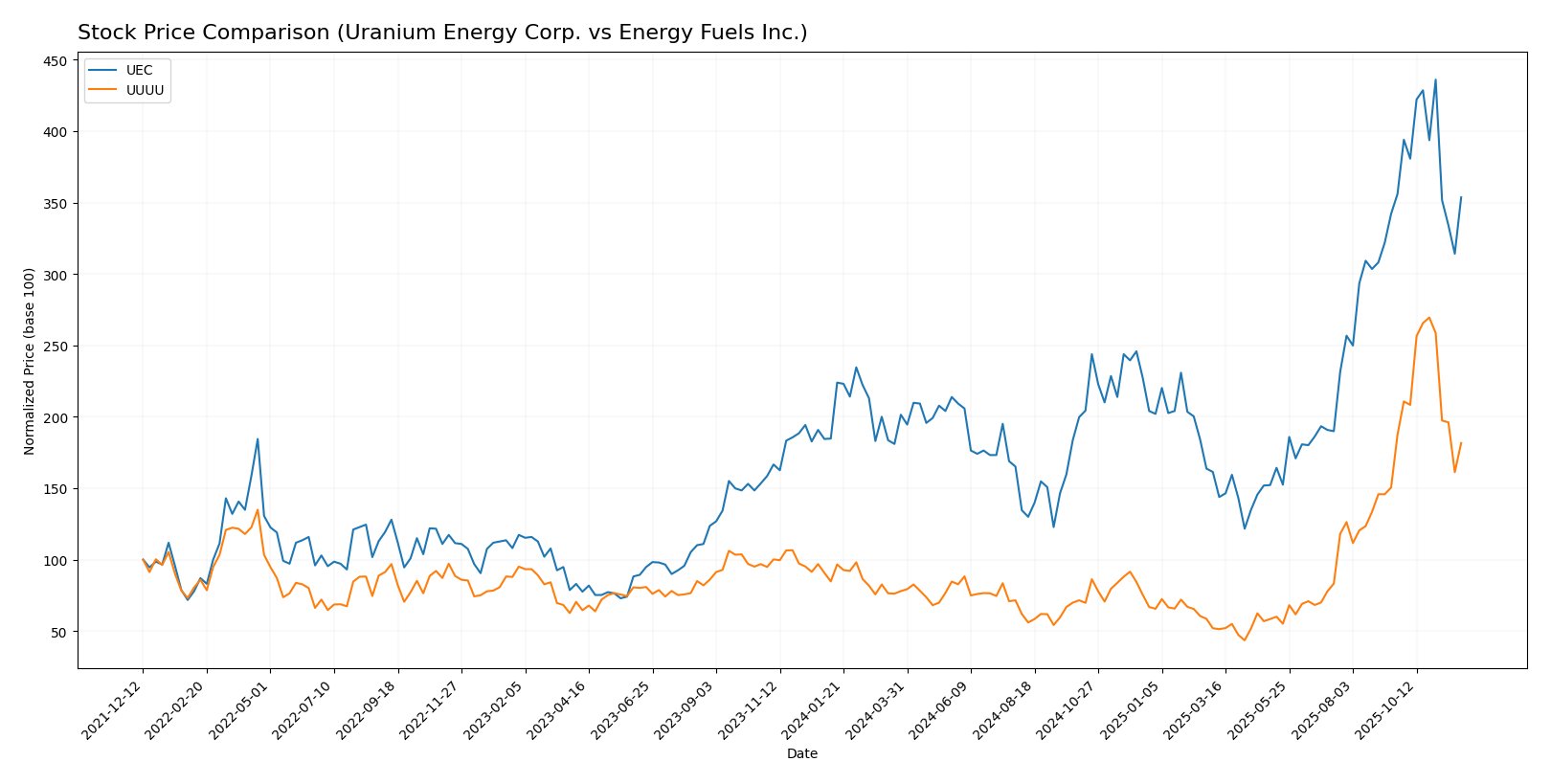

Over the past year, both Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) have exhibited significant price movements, reflecting the dynamic nature of the uranium market and investor sentiment.

Trend Analysis

Uranium Energy Corp. (UEC) has experienced a remarkable price change of +91.42% over the past year. Although the stock is currently on a bullish trend, it has shown signs of deceleration recently, with a smaller price increase of +3.37% from September 14, 2025, to November 30, 2025. The highest price during this period reached $15.13, while the lowest was $4.22. The standard deviation of 2.47 indicates moderate volatility in its price movements.

Energy Fuels Inc. (UUUU) has outperformed UEC with a price change of +114.29% over the past year, also maintaining a bullish trend. Similar to UEC, UUUU’s recent performance shows a price increase of +20.7% from September 14, 2025, to November 30, 2025. The stock peaked at $21.37 and dipped to a low of $3.45 during the year. A standard deviation of 3.95 suggests higher volatility compared to UEC.

In conclusion, both stocks are currently in a bullish trend over the long term, but are showing signs of deceleration in their recent performance. Investors should consider these trends and the associated volatility when making investment decisions.

Analyst Opinions

Recent analyst recommendations for Uranium Energy Corp. (UEC) indicate a cautious stance with a rating of C-. Analysts highlight concerns regarding debt levels despite potential growth in uranium demand. In contrast, Energy Fuels Inc. (UUUU) has received a weaker D+ rating, with analysts pointing to poor financial metrics and high debt-to-equity ratios as significant risks. Overall, the consensus for both companies leans toward a hold, as investors are advised to monitor market conditions closely before making any major investment decisions.

Stock Grades

In this section, I will present the latest stock grades for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) based on credible sources.

Uranium Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Buy | 2025-09-26 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-25 |

| BMO Capital | downgrade | Market Perform | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-03 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-06 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-13 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-09 |

| Roth MKM | maintain | Buy | 2024-10-23 |

| Roth MKM | maintain | Buy | 2024-09-25 |

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | maintain | Buy | 2025-10-21 |

| B. Riley Securities | maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-08 |

| Canaccord Genuity | maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-11 |

Overall, both companies show a consistent trend of “Buy” ratings from multiple analysts, particularly HC Wainwright & Co., which has maintained its positive outlook on UEC and UUUU. However, Energy Fuels Inc. recently received a downgrade to “Sell” from Roth Capital, indicating a potential shift in sentiment. Investors should consider these trends when making investment decisions.

Target Prices

The following table presents the consensus target prices for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), based on reliable analyst data.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Uranium Energy Corp. | 19.75 | 14 | 17.08 |

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

Analysts expect Uranium Energy Corp. to reach a consensus target of 17.08, while Energy Fuels Inc. has a target of 19.13. Both companies have target prices significantly higher than their current stock prices, suggesting potential upside.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), providing a comparative analysis based on the most recent data.

| Criterion | Uranium Energy Corp. (UEC) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Diversification | Limited projects primarily focused on uranium | Broader range of uranium and vanadium properties |

| Profitability | Negative profit margins (-1.31) | Positive profit margins (2.63) |

| Innovation | Moderate investment in technology | Strong focus on technological advancements |

| Global presence | Operates in the U.S., Canada, and Paraguay | Primarily U.S.-based operations |

| Market Share | Moderate within uranium industry | Increasing share in both uranium and vanadium markets |

| Debt level | Very low debt levels (0.002) | Low debt levels (0.003) |

Key takeaways indicate that while UEC has a lower debt level, it struggles with profitability compared to UUU, which has a more diversified property portfolio and a positive profit margin. Investors should weigh these factors carefully when considering investments in these companies.

Risk Analysis

The following table outlines the key risks associated with Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) as of 2025.

| Metric | UEC | UUUU |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Medium | High |

| Operational Risk | High | Medium |

| Environmental Risk | Medium | Low |

| Geopolitical Risk | Medium | Medium |

Both companies face significant market and operational risks due to their involvement in the uranium sector, which is sensitive to regulatory changes and geopolitical events. UEC has a notably higher operational risk due to its negative profit margins, while UUUU’s recent performance indicates regulatory scrutiny may impact its operations.

Which one to choose?

In comparing Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), UEC demonstrates a stronger market cap at $3.71B and a more favorable gross profit margin of 36.62%, despite struggling with negative profit margins and high debt ratios. UUUU, with a market cap of $882M, has shown significant recent revenue growth, but its D+ rating indicates concerns about financial health and debt management. The bullish stock trend for both companies suggests potential upside, yet UEC’s recent performance appears more stable.

For growth-focused investors, UEC may be the preferred choice due to its higher market cap and gross margins despite underlying risks. Conversely, those prioritizing valuation might lean towards UUUU, which has shown a significant percentage increase in stock price but comes with higher volatility.

Risks to consider include competition in the uranium sector and potential supply chain disruptions that may impact both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Uranium Energy Corp. and Energy Fuels Inc. to enhance your investment decisions: