In the ever-evolving energy sector, two prominent players in the uranium industry are making waves: Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN). Both companies are engaged in the exploration and production of uranium, a critical resource for nuclear energy. Their similarities in market focus and innovation strategies make them ideal candidates for comparison. In this article, I will analyze these companies to help you determine which one may be the more appealing investment opportunity.

Table of contents

Company Overview

Uranium Energy Corp. Overview

Uranium Energy Corp. (UEC) operates within the uranium sector, focusing on exploration, extraction, and processing of uranium and titanium concentrates across the United States, Canada, and Paraguay. Founded in 2003 and headquartered in Corpus Christi, Texas, UEC owns multiple projects, including the Palangana mine and Goliad project in Texas, highlighting its strategic positioning in the North American uranium landscape. With a market capitalization of approximately $5.56B and an active trading presence on the NYSE Arca, UEC aims to leverage the growing demand for clean energy solutions and nuclear power.

Denison Mines Corp. Overview

Denison Mines Corp. (DNN) is a Canadian company engaged in the acquisition and exploration of uranium properties, primarily focused on the Athabasca Basin in Saskatchewan, where it holds a 95% interest in the Wheeler River project. Established in 1997 and headquartered in Toronto, Denison has carved out a significant role in the uranium industry, with a market cap of about $2.19B. The company’s commitment to sustainable practices and responsible mining positions it favorably as the global energy market increasingly shifts toward low-carbon solutions.

Key Similarities and Differences

Both UEC and DNN are focused on uranium mining, but their geographic concentration and project specifics differ. UEC emphasizes a broader range of projects across North America and Paraguay, while DNN specializes in Canada, particularly the Athabasca Basin. UEC’s larger market cap reflects its more extensive operational footprint, whereas DNN’s concentrated approach allows for deeper engagement with its flagship projects.

Income Statement Comparison

The following table provides a side-by-side comparison of key income metrics for Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) for their most recent fiscal years.

| Metric | UEC | DNN |

|---|---|---|

| Revenue | 67M | 4M |

| EBITDA | -84.5M | -81.8M |

| EBIT | -88.9M | -91.7M |

| Net Income | -87.7M | -91.1M |

| EPS | -0.20 | -0.10 |

Interpretation of Income Statement

In the most recent fiscal year, UEC reported a significant drop in revenue to 67M from a previous year’s 164M, while DNN showed modest revenue of 4M, up from 1.9M the prior year. Both companies experienced negative net income, with UEC at -87.7M and DNN at -91.1M, reflecting ongoing operational challenges. UEC’s margins continue to decline, indicating operational inefficiencies, while DNN’s margins remain under pressure despite slight revenue growth. Overall, both companies face substantial financial hurdles, pointing to a persistent need for strategic improvements in operations and cost management.

Financial Ratios Comparison

The following table provides a comparative analysis of key financial ratios and metrics for Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) based on the most recent data.

| Metric | UEC | DNN |

|---|---|---|

| ROE | -8.91% | -16.15% |

| ROIC | -6.57% | -10.03% |

| P/E | -42.30 | 21.99 |

| P/B | 3.77 | 3.10 |

| Current Ratio | 8.85 | 3.65 |

| Quick Ratio | 5.85 | 3.54 |

| D/E | 0.0023 | 0 |

| Debt-to-Assets | 0.0021 | 0 |

| Interest Coverage | -50.71 | -586.32 |

| Asset Turnover | 0.06 | 0.006 |

| Fixed Asset Turnover | 0.09 | 0.015 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The analysis of UEC and DNN reveals significant challenges for both companies. UEC’s negative ROE and ROIC indicate a struggle to generate returns on equity and invested capital, while DNN’s ratios are even weaker. UEC’s current and quick ratios are robust, suggesting liquidity, yet both companies lack profitability as shown in their negative P/E ratios. Both companies face high debt levels in relation to their assets. Caution is advised when considering investments in either stock due to their current financial struggles.

Dividend and Shareholder Returns

Uranium Energy Corp. (UEC) does not pay dividends, reflecting its strategy focused on reinvestment in growth and exploration. Its net income has been negative, indicating financial challenges, though it engages in share buybacks, which may signal confidence in future recovery. Denison Mines Corp. (DNN) also refrains from dividend payments, prioritizing capital for R&D and acquisitions amidst fluctuating profits. Both companies’ approaches focus on long-term value creation, but the lack of immediate returns may pose risks for short-term investors.

Strategic Positioning

Uranium Energy Corp. (UEC) holds a market cap of approximately 5.56B, showcasing a robust position in the uranium sector. Its diverse portfolio of projects across North America facilitates a competitive edge. Conversely, Denison Mines Corp. (DNN), with a market cap of roughly 2.19B, primarily focuses on the Wheeler River project, indicating niche specialization. Both companies face competitive pressure from emerging technologies and global demand fluctuations, which could impact their market shares and operational strategies.

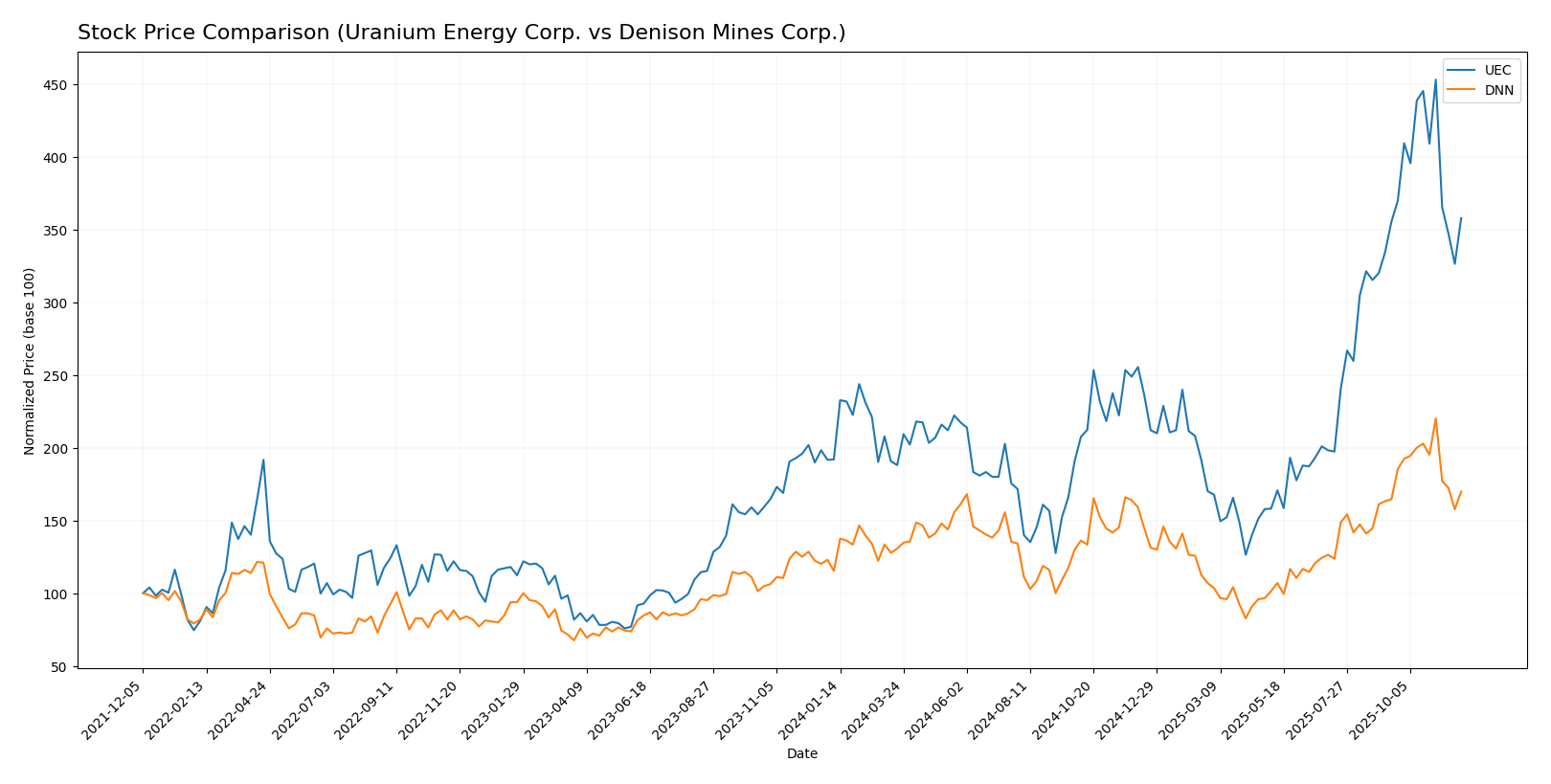

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) over the past year, highlighting key price changes and trends.

Trend Analysis

Uranium Energy Corp. (UEC) has experienced a dramatic price increase of 86.43% over the past year, indicating a bullish trend. The stock reached a notable high of 15.13 and a low of 4.22. However, the trend is currently showing signs of deceleration, with a recent price change of 0.67% from September 14, 2025, to November 30, 2025. The standard deviation during this recent period is 1.34, suggesting relatively low volatility.

Denison Mines Corp. (DNN) also reflects a strong upward trend, with a 47.29% price increase over the last year, categorizing it as bullish as well. The stock’s highest price was 3.17, while it dipped to a low of 1.19. Similar to UEC, DNN’s trend is experiencing deceleration, with a recent price change of 3.16% within the same timeframe of September 14, 2025, to November 30, 2025. The standard deviation here is 0.25, indicating low volatility.

In summary, both UEC and DNN are on bullish trajectories with substantial price growth, although their recent trends suggest a slowdown in momentum.

Analyst Opinions

Recent analyst recommendations for Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) have both received a rating of C-. Analysts suggest a cautious approach, with some advocating for a hold due to concerns over financial metrics such as debt-to-equity ratios and return on equity. Notably, while UEC has a score of 1 in several categories, it still faces significant challenges. The consensus for both companies leans towards a hold, indicating that investors should proceed with caution in the current year.

Stock Grades

In this section, I will present the latest stock grades for Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) based on reliable data from recognized grading companies.

Uranium Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

| BMO Capital | Downgrade | Market Perform | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-25 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-03 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-06 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-13 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-09 |

| Roth MKM | Maintain | Buy | 2024-10-23 |

| Roth MKM | Maintain | Buy | 2024-09-25 |

Denison Mines Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-10-23 |

| TD Securities | Maintain | Speculative Buy | 2023-06-27 |

| Raymond James | Maintain | Outperform | 2023-06-27 |

| TD Securities | Maintain | Speculative Buy | 2023-06-26 |

| Raymond James | Maintain | Outperform | 2023-06-26 |

| Credit Suisse | Downgrade | Underperform | 2017-07-18 |

| Credit Suisse | Downgrade | Underperform | 2017-07-17 |

| Roth Capital | Maintain | Buy | 2016-02-10 |

| Credit Suisse | Upgrade | Neutral | 2014-04-01 |

| Credit Suisse | Upgrade | Neutral | 2014-03-31 |

Overall, the trend for UEC shows a mix of maintained buys and a recent downgrade to market perform, indicating a cautious outlook. For DNN, the prevailing sentiment remains stable with maintained ratings, suggesting a consistent performance expectation from analysts.

Target Prices

The consensus target prices for Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN) reflect optimistic growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Uranium Energy Corp. | 19.75 | 14 | 17.08 |

| Denison Mines Corp. | 2.60 | 2.60 | 2.60 |

For UEC, the target consensus of 17.08 is significantly higher than its current price of 11.96, indicating potential upside. Meanwhile, DNN’s consensus matches its stock price of 2.45, suggesting that analysts expect limited movement in the near term.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN), two key players in the uranium industry.

| Criterion | Uranium Energy Corp. (UEC) | Denison Mines Corp. (DNN) |

|---|---|---|

| Diversification | Strong project portfolio in multiple locations | Focused mainly in Canada, particularly on Wheeler River |

| Profitability | Currently operating at a loss with negative profit margins | Recently positive net profit margins, but fluctuating |

| Innovation | Engaged in modern extraction technologies | Strong exploration and innovative mining methods |

| Global presence | Operations in US, Canada, and Paraguay | Primarily focused in Canada |

| Market Share | Moderate share in the US uranium market | Strong presence in Canadian market |

| Debt level | Very low debt-to-equity ratio (0.002) | No significant debt reported |

Key takeaways from this analysis indicate that while UEC has a broader geographical footprint and a diverse project portfolio, DNN shows promising profitability trends and innovative mining techniques, which could appeal to investors focusing on growth and expansion in the uranium sector.

Risk Analysis

Below is a table outlining the various risks associated with Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN):

| Metric | Uranium Energy Corp. (UEC) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | High | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant operational and regulatory risks due to the complex nature of uranium mining. With UEC’s recent negative profit margins and DNN’s fluctuating operational metrics, investors should exercise caution when considering their investments in these companies.

Which one to choose?

When comparing Uranium Energy Corp. (UEC) and Denison Mines Corp. (DNN), both companies exhibit challenges in profitability, with UEC showing a net profit margin of -131% and DNN at -22.6%. UEC’s financial ratios indicate a higher market cap of 3.71B versus DNN’s 2.31B, yet both companies carry a similar grade of C-. UEC’s stock trend has been bullish with an 86.4% price change over the last year, while DNN’s trend also remains bullish, albeit with a 47.3% increase. Analysts remain cautious about both due to industry volatility and competition.

Investors focused on potential growth may lean towards UEC for its robust stock trend, while those prioritizing more stable financials may prefer DNN. However, both companies face significant risks related to market dependence and operational profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Uranium Energy Corp. and Denison Mines Corp. to enhance your investment decisions: