In the ever-evolving landscape of technology and industrial sectors, two companies stand out: Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI). While both operate in distinct industries—semiconductors and industrial machinery, respectively—they share a common goal of innovation and market growth. This comparison will delve into their strategies, market positions, and potential for future growth. As an investor, understanding these dynamics is crucial in determining which company offers the most intriguing investment opportunity.

Table of contents

Company Overview

Teradyne, Inc. Overview

Teradyne, Inc. is a leading player in the semiconductor testing industry, with a market position bolstered by its innovative automation solutions. Since its inception in 1960, Teradyne has focused on designing and manufacturing automatic test equipment for a variety of applications, including automotive, telecommunications, and consumer electronics. The company’s diverse product segments—Semiconductor Test, System Test, Industrial Automation, and Wireless Test—allow it to serve a wide range of clients, from integrated device manufacturers to fabless companies. With a current market capitalization of approximately $29B, Teradyne continues to push the boundaries of technology, making significant strides in industrial automation with collaborative robots and advanced testing solutions.

Hillenbrand, Inc. Overview

Founded in 1906, Hillenbrand, Inc. operates as a diversified industrial company with a strong market presence in the machinery sector. The company’s operations are divided into three main segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville. Hillenbrand specializes in designing and manufacturing equipment and systems for various industries, including food, pharmaceuticals, and automotive. Its Batesville segment provides essential products and services in the funeral industry, showcasing the company’s unique diversification. With a market cap of around $2.24B, Hillenbrand remains committed to innovation and customer-focused solutions across its diverse product lines.

Key similarities between Teradyne and Hillenbrand include their commitment to innovation and technology-driven solutions, catering to various industries. However, they differ significantly in their core markets, with Teradyne focused primarily on semiconductors and automation, while Hillenbrand has a broader industrial machinery focus, including niche markets like funeral services.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI), highlighting their financial performance metrics.

| Metric | Teradyne, Inc. | Hillenbrand, Inc. |

|---|---|---|

| Revenue | 2.82B | 2.67B |

| EBITDA | 732M | 231M |

| EBIT | 613M | 92M |

| Net Income | 542M | 43M |

| EPS | 3.41 | 0.74 |

Interpretation of Income Statement

In the most recent year, Teradyne, Inc. demonstrated a solid revenue growth of approximately 5.6% compared to the previous year, with net income also increasing significantly by around 21%. The EBITDA margin reflects a healthy level of operational efficiency at 25.9%. In contrast, Hillenbrand, Inc. faced a decline in revenue of about 16% and reported a substantial drop in profitability, with net income down from 570M to 43M, indicating challenges in cost management and operational efficiency. Overall, Teradyne appears to be in a much stronger financial position compared to Hillenbrand, highlighting the importance of assessing margins and overall growth trends in investment decisions.

Financial Ratios Comparison

In this section, I present a comparative analysis of the financial ratios for Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI) based on the most recent data available.

| Metric | Teradyne, Inc. | Hillenbrand, Inc. |

|---|---|---|

| ROE | 19.24% | 3.66% |

| ROIC | 17.25% | -32.60% |

| P/E | 36.93 | -9.28 |

| P/B | 7.10 | 1.34 |

| Current Ratio | 2.91 | 1.22 |

| Quick Ratio | 1.84 | 0.88 |

| D/E | 0.03 | 1.12 |

| Debt-to-Assets | 2.07% | 35.86% |

| Interest Coverage | 165.54 | 0.55 |

| Asset Turnover | 0.76 | 0.60 |

| Fixed Asset Turnover | 4.88 | 7.80 |

| Payout ratio | 14.09% | 121.69% |

| Dividend yield | 0.38% | 3.32% |

Interpretation of Financial Ratios

The financial ratios of Teradyne, Inc. indicate strong performance, with robust ROE and ROIC, suggesting efficient use of equity and capital. Conversely, Hillenbrand, Inc. shows concerning ratios, particularly a negative P/E and high debt levels, indicating potential financial distress. The low interest coverage ratio raises alarms regarding its ability to meet interest obligations. Overall, Teradyne presents a safer investment, while Hillenbrand may pose higher risks.

Dividend and Shareholder Returns

Teradyne, Inc. (TER) pays dividends with a modest annual yield of 0.38% and a payout ratio of approximately 14%. The company engages in share buybacks, further enhancing shareholder returns. In contrast, Hillenbrand, Inc. (HI) also pays dividends, yielding about 3.32%, but faces challenges with a negative net income, raising concerns over long-term sustainability. Both companies demonstrate a commitment to returning value, although the risks associated with their individual financial health vary.

Strategic Positioning

Teradyne, Inc. (TER) holds a significant market share in the semiconductor testing sector, benefiting from robust demand driven by advancements in technology such as 5G and IoT. With a market cap of $29B and a beta of 1.85, it faces competitive pressure from emerging players but remains a leader due to its comprehensive product portfolio. Hillenbrand, Inc. (HI), valued at $2.24B, operates across diverse industrial sectors, yet may experience disruption from automation trends. Both companies must navigate technological changes and competitive dynamics to sustain growth.

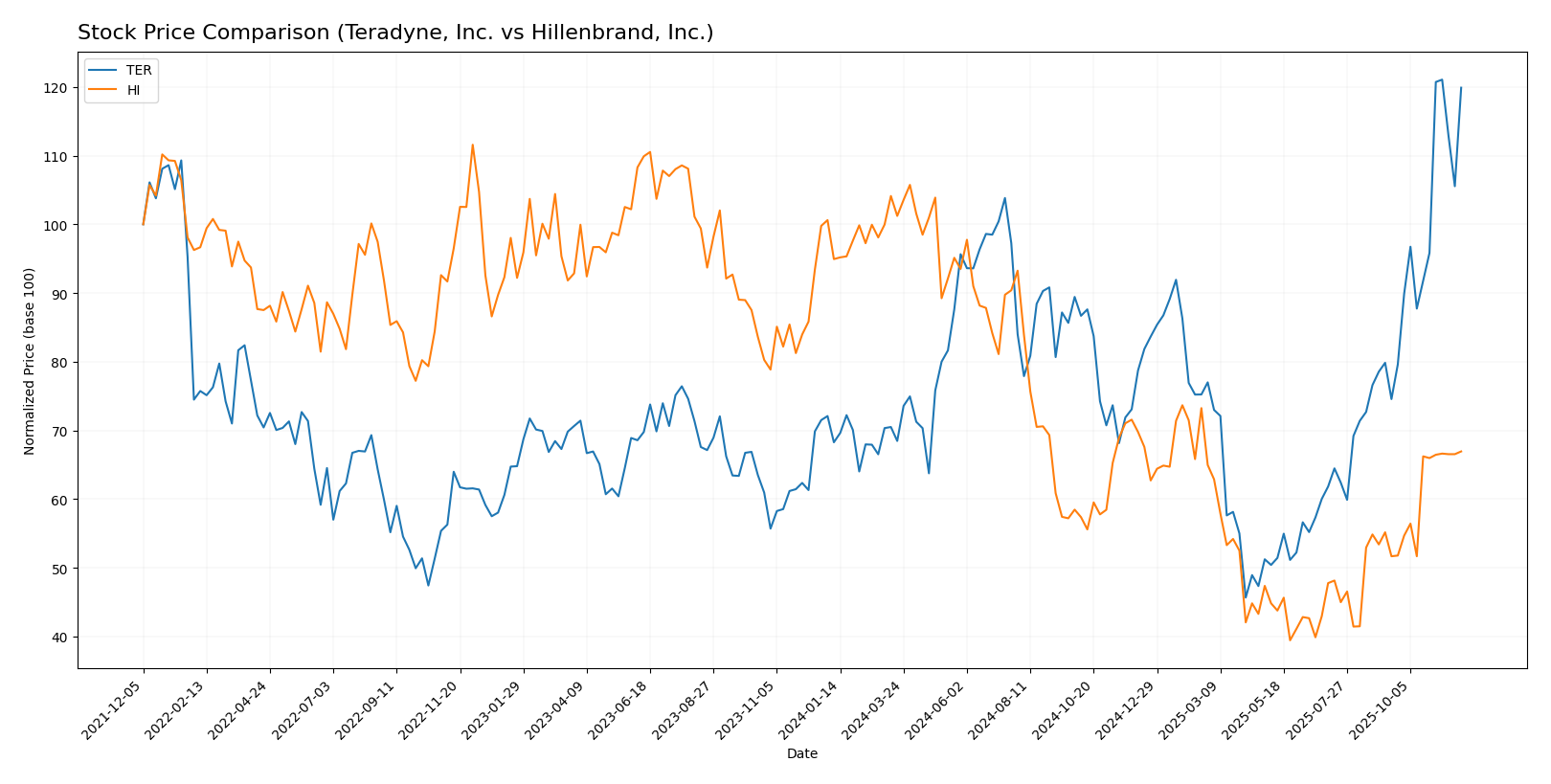

Stock Comparison

In this analysis, I will examine the weekly stock price movements of Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI) over the past year, highlighting key price dynamics and trends that may influence investment decisions.

Trend Analysis

For Teradyne, Inc. (TER), the stock has experienced a remarkable price change of 75.64% over the past year, indicating a bullish trend. The highest price reached was 182.28, while the lowest was 68.72. The trend shows acceleration, supported by a standard deviation of 24.49, suggesting considerable volatility. In the recent period from September 14, 2025, to November 30, 2025, the stock’s price changed by 60.83%, further reinforcing a strong bullish outlook with a trend slope of 5.89.

On the other hand, Hillenbrand, Inc. (HI) has faced a 29.5% decline over the past year, categorizing it as a bearish trend. The stock reached a high of 50.29 and a low of 18.75. This trend has also shown acceleration, with a standard deviation of 9.44, indicating some volatility. However, in the more recent timeframe from September 14, 2025, to November 30, 2025, the stock’s performance improved with a 29.55% increase, resulting in a neutral trend as it falls within the -2% to +2% range, alongside a trend slope of 0.8.

In summary, TER presents a compelling bullish opportunity, while HI is currently navigating a challenging bearish environment, although it has shown recent improvement.

Analyst Opinions

Recent analyst recommendations for Teradyne, Inc. (TER) suggest a “Buy” rating, supported by strong performance metrics in return on assets (5) and return on equity (4). Analysts focus on its solid fundamentals despite a lower price-to-earnings (1) and price-to-book (1) ratio. For Hillenbrand, Inc. (HI), the consensus also leans towards a “Buy,” with a rating of B+ and excellent scores in discounted cash flow (4) and return on assets (5). Overall, the consensus for both companies is a “Buy” for the current year, reflecting positive market sentiment.

Stock Grades

I have reviewed the latest stock grades for Teradyne, Inc. and Hillenbrand, Inc. to provide you with a clear picture of their current investment positions.

Teradyne, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Goldman Sachs | maintain | Sell | 2025-10-30 |

| JP Morgan | maintain | Neutral | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

| Stifel | maintain | Hold | 2025-10-28 |

| Evercore ISI Group | maintain | Outperform | 2025-10-28 |

| UBS | maintain | Buy | 2025-10-20 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

Hillenbrand, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-20 |

| DA Davidson | maintain | Neutral | 2025-10-16 |

| CJS Securities | downgrade | Market Perform | 2025-10-16 |

| Keybanc | downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | maintain | Neutral | 2025-05-01 |

| DA Davidson | maintain | Neutral | 2024-11-15 |

| Keybanc | maintain | Overweight | 2024-11-14 |

| DA Davidson | downgrade | Neutral | 2024-08-12 |

| DA Davidson | maintain | Buy | 2021-02-08 |

| DA Davidson | maintain | Buy | 2021-02-07 |

In summary, Teradyne, Inc. is receiving mixed signals, with a notable presence of “Buy” and “Sell” ratings, indicating a cautious outlook. Meanwhile, Hillenbrand, Inc. has seen downgrades from “Overweight” to “Sector Weight,” reflecting a shift in investor sentiment. Both stocks warrant careful consideration as you assess potential investment opportunities.

Target Prices

The recent target consensus for Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI) indicates a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradyne, Inc. | 215 | 119 | 172.67 |

| Hillenbrand, Inc. | 32 | 32 | 32 |

For Teradyne, the consensus target price of 172.67 suggests potential growth compared to its current price of 180.44. Conversely, Hillenbrand’s target consensus aligns closely with its current market price of 31.78, indicating a stable outlook.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI), based on the latest financial data.

| Criterion | Teradyne, Inc. (TER) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Diversification | High (multiple segments) | Moderate (three main segments) |

| Profitability | Strong margins (e.g., net profit margin of 19.23%) | Low margins (net profit margin of 2.02%) |

| Innovation | Leading in semiconductor testing solutions | Focused on industrial machinery |

| Global presence | Extensive (operates worldwide) | Moderate (U.S. and select international markets) |

| Market Share | Significant in semiconductors | Moderate in industrial machinery |

| Debt level | Very low (debt to equity ratio of 0.03) | High (debt to equity ratio of 1.12) |

Key takeaways: Teradyne shows robust profitability and very low debt levels, making it a strong candidate for investors. In contrast, Hillenbrand has higher leverage and lower profitability, suggesting more caution for potential investors.

Risk Analysis

In the following table, I outline the key risks for both companies to assist investors in evaluating potential investment decisions.

| Metric | Teradyne, Inc. (TER) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market risks due to volatility in their respective sectors. Teradyne experiences heightened operational risks stemming from supply chain disruptions, while Hillenbrand contends with regulatory challenges impacting its operational framework.

Which one to choose?

When comparing Teradyne, Inc. (TER) and Hillenbrand, Inc. (HI), the fundamentals suggest that TER may be a more attractive option for investors. TER showcases strong financial metrics, with a net profit margin of 19.23% and a current ratio of 2.91, indicating solid profitability and liquidity. In contrast, HI struggles with a negative net profit margin, reflecting challenges in generating consistent profits.

Analyst ratings are also favorable for TER, rated a B, while HI holds a slightly better B+ rating but with underlying operational weaknesses. Stock trends further favor TER, demonstrating a bullish trajectory with a 75.64% price increase over the last year, while HI has experienced a bearish trend.

For growth-oriented investors, I recommend focusing on TER, whereas those prioritizing higher dividends might find HI’s 3.31% yield appealing, despite its current operational challenges.

It’s important to note that both companies face risks related to market fluctuations and competitive pressures, which could impact their future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradyne, Inc. and Hillenbrand, Inc. to enhance your investment decisions: