In the rapidly evolving landscape of technology and industrial solutions, Teradyne, Inc. (TER) and Columbus McKinnon Corporation (CMCO) stand out as key players in their respective sectors. While Teradyne specializes in semiconductor testing equipment, Columbus McKinnon focuses on intelligent motion solutions for material handling. Both companies are innovating within their industries, making them prime candidates for comparison. Join me as we explore which of these two firms presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Teradyne, Inc. Overview

Teradyne, Inc. is a leading provider of automatic test equipment, serving various sectors including semiconductors, industrial automation, and wireless devices. Founded in 1960 and headquartered in North Reading, Massachusetts, Teradyne operates through segments such as Semiconductor Test, System Test, Industrial Automation, and Wireless Test. The company’s mission is to enhance productivity and efficiency through innovative testing solutions, positioning itself as a crucial player in technology development, particularly in the semiconductor industry. With a market cap of $28.8B and a diverse portfolio of products, Teradyne continues to expand its influence in the rapidly evolving tech landscape.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation, established in 1875 and based in Buffalo, New York, specializes in intelligent motion solutions for material handling. The company designs and manufactures a wide range of products, including hoists, crane systems, and rigging equipment, aimed at various industries from construction to life sciences. With a market cap of $475M, Columbus McKinnon emphasizes ergonomic solutions and automation in lifting and positioning, striving to enhance safety and efficiency in workplaces worldwide. Their mission reflects a commitment to delivering innovative, reliable, and sustainable material handling solutions.

Key similarities between Teradyne and Columbus McKinnon include a focus on technology-driven solutions and robust market positions within their respective industries. However, they differ significantly in their sectors; Teradyne is entrenched in the semiconductor and technology space, while Columbus McKinnon operates in industrial and material handling sectors. This distinction influences their business models and target markets.

Income Statement Comparison

The following table compares the key income statement metrics for Teradyne, Inc. and Columbus McKinnon Corporation based on their most recent fiscal year results.

| Metric | Teradyne, Inc. (TER) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Revenue | 2.82B | 963M |

| EBITDA | 732M | 75M |

| EBIT | 613M | 27M |

| Net Income | 542M | -5M |

| EPS | 3.41 | -0.18 |

Interpretation of Income Statement

In the most recent fiscal year, Teradyne demonstrated solid growth, with revenue increasing to 2.82B, up from 2.68B the previous year, reflecting an upward trend. However, Columbus McKinnon faced challenges, reporting a revenue decrease to 963M from 1.01B in the prior year. Teradyne’s net income rose to 542M, showcasing improved profitability, while CMCO reported a net loss of 5M, indicating potential operational difficulties. Overall, Teradyne’s margins improved, while CMCO’s performance suggests a need for strategic adjustments to enhance profitability and operational efficiency.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent revenue and financial ratios for Teradyne, Inc. (TER) and Columbus McKinnon Corporation (CMCO).

| Metric | Teradyne, Inc. (TER) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| ROE | 19.24% | -0.58% |

| ROIC | 17.25% | 3.61% |

| P/E | 36.93 | -94.69 |

| P/B | 7.10 | 0.55 |

| Current Ratio | 2.91 | 1.81 |

| Quick Ratio | 1.84 | 1.04 |

| D/E | 0.03 | 0.61 |

| Debt-to-Assets | 0.02 | 0.31 |

| Interest Coverage | 165.54 | 1.68 |

| Asset Turnover | 0.76 | 0.55 |

| Fixed Asset Turnover | 4.88 | 9.07 |

| Payout ratio | 14.09% | -156.52% |

| Dividend yield | 0.38% | 1.65% |

Interpretation of Financial Ratios

The financial ratios indicate that Teradyne, Inc. displays robust performance with high returns on equity (ROE) and invested capital (ROIC), reflecting effective management and profitability. In contrast, Columbus McKinnon shows concerning financial health, with negative ROE and P/E ratios, indicating potential risk for investors. The significant debt levels relative to equity and assets in CMCO could raise alarms about financial stability. Overall, TER presents as a stronger investment choice based on these metrics.

Dividend and Shareholder Returns

Teradyne, Inc. (TER) pays dividends with a modest yield of 0.38% and a payout ratio of 14%. Their consistent dividend payments, supported by strong free cash flow, suggest a sustainable approach to shareholder returns. Conversely, Columbus McKinnon Corporation (CMCO) does not currently pay dividends, likely due to reinvestment needs stemming from a recent growth phase. They are focusing on capital expenditures and share buybacks, which may align with long-term value creation despite the absence of direct cash returns to shareholders.

Strategic Positioning

Teradyne, Inc. (TER) holds a robust market share in the semiconductor testing sector, primarily driven by its advanced testing platforms for automotive and cloud computing applications. With a market cap of $28.8B, it is well-positioned against competitors, although it faces increasing pressure from emerging technologies and automation. Columbus McKinnon Corporation (CMCO), valued at $475M, operates in the industrial automation space and competes by offering a diverse range of motion solutions. Both companies must navigate the challenges posed by technological disruption and competitive dynamics in their respective markets.

Stock Comparison

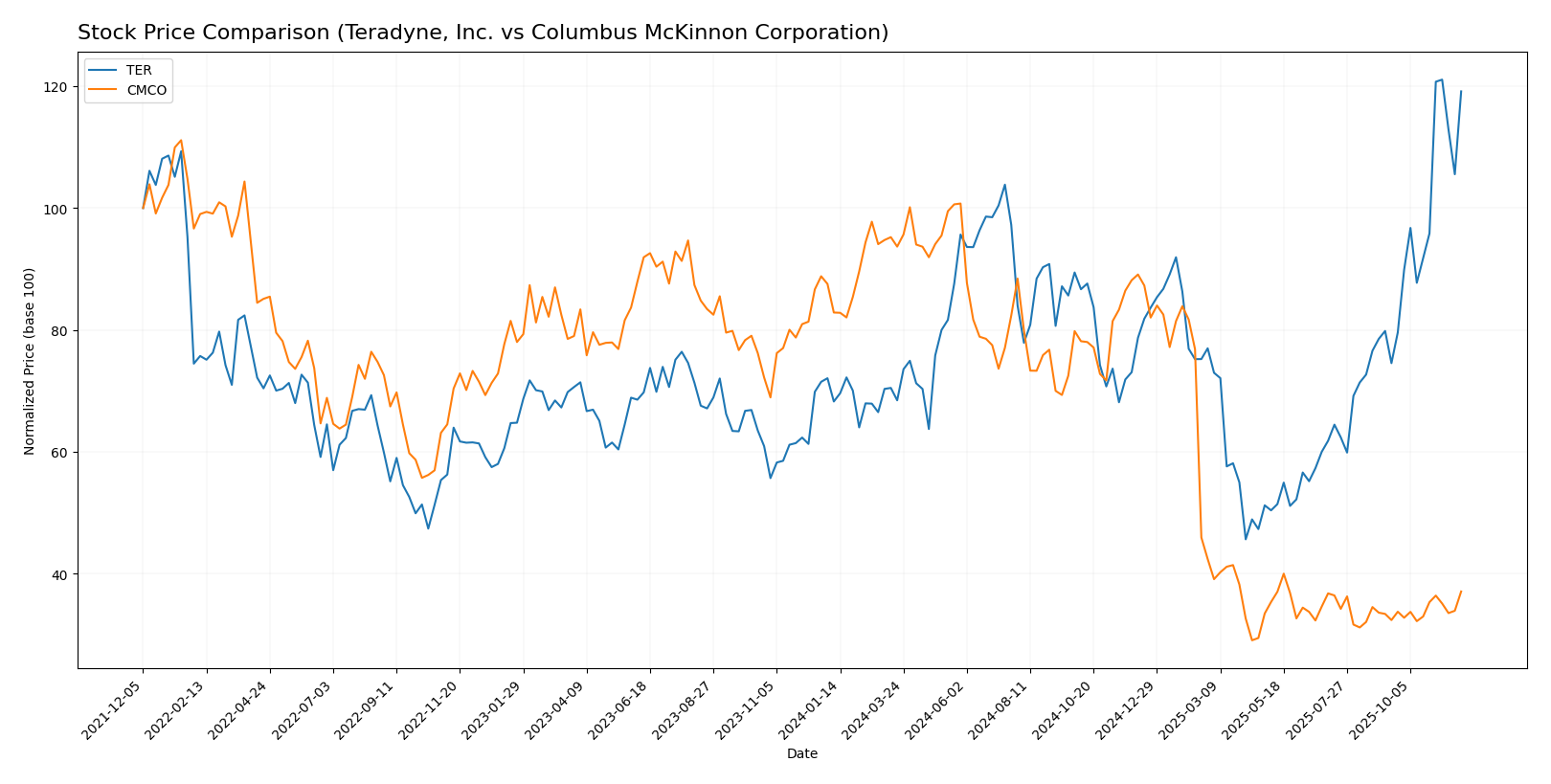

In this section, I will analyze the stock price movements and trading dynamics of Teradyne, Inc. (TER) and Columbus McKinnon Corporation (CMCO) over the past year, highlighting significant price changes and trends.

Trend Analysis

Teradyne, Inc. (TER) Over the past year, TER has experienced a substantial price increase of 74.55%, indicating a bullish trend. The stock has shown notable acceleration, with the highest price reaching 182.28 and the lowest at 68.72. The overall volatility, measured by a standard deviation of 24.46, suggests considerable fluctuations in the stock price. Recently, from September 14, 2025, to November 30, 2025, the stock rose by 59.82%, with a trend slope of 5.84, reinforcing the bullish sentiment.

Columbus McKinnon Corporation (CMCO) In contrast, CMCO has faced a significant decline, with a total price change of -55.24%, categorizing it in a bearish trend. The stock has also shown acceleration in its downward movement, with a high of 44.90 and a low of 12.96. The volatility is measured at a standard deviation of 11.25. In the recent analysis period, from September 14, 2025, to November 30, 2025, CMCO saw a minor increase of 14.47%, but with a trend slope of 0.12, indicating a lack of strong momentum in the upward direction.

Analyst Opinions

Recent analyst recommendations for Teradyne, Inc. (TER) suggest a “Buy” rating, with a solid overall score of 3. Analysts highlight its strong return on assets (5) and return on equity (4) as key strengths, despite lower scores in price-to-earnings and price-to-book ratios. Columbus McKinnon Corporation (CMCO) also earns a “Buy” rating, with an overall score of 3. Analysts commend its high discounted cash flow score (5) and price-to-book score (5), though its return on equity score (2) raises some caution. The consensus for both stocks is a “Buy” for the current year.

Stock Grades

I have gathered the latest stock grades from reputable grading companies for the companies Teradyne, Inc. (TER) and Columbus McKinnon Corporation (CMCO). Here’s a summary of the ratings:

Teradyne, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Goldman Sachs | maintain | Sell | 2025-10-30 |

| JP Morgan | maintain | Neutral | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

| Stifel | maintain | Hold | 2025-10-28 |

| Evercore ISI Group | maintain | Outperform | 2025-10-28 |

| UBS | maintain | Buy | 2025-10-20 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | downgrade | Neutral | 2025-02-11 |

| DA Davidson | maintain | Buy | 2024-02-05 |

| DA Davidson | maintain | Buy | 2022-10-04 |

| DA Davidson | maintain | Buy | 2022-10-03 |

| Barrington Research | maintain | Outperform | 2022-07-29 |

| Barrington Research | maintain | Outperform | 2022-07-28 |

| JP Morgan | downgrade | Neutral | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-25 |

| JP Morgan | downgrade | Neutral | 2022-05-25 |

Overall, Teradyne displays a mixed outlook with multiple “Buy” and “Hold” ratings, indicating a stable position in the market despite some “Sell” suggestions. On the other hand, Columbus McKinnon has experienced a recent downgrade to “Neutral,” suggesting a cautious approach for investors considering this stock.

Target Prices

The consensus target prices for Teradyne, Inc. and Columbus McKinnon Corporation indicate optimistic growth expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradyne, Inc. (TER) | 215 | 119 | 172.67 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

For Teradyne, the current stock price of 179.38 is below the consensus target of 172.67, suggesting potential for price appreciation. Conversely, Columbus McKinnon’s stock price of 16.53 is considerably lower than its target consensus of 49, which indicates strong growth potential.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Teradyne, Inc. and Columbus McKinnon Corporation based on the most recent data.

| Criterion | Teradyne, Inc. | Columbus McKinnon Corporation |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong | Weak |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Significant | Limited |

| Debt level | Low | High |

Key takeaways indicate that Teradyne boasts strong profitability, innovation, and a low debt level, while Columbus McKinnon struggles with profitability and carries a higher debt burden. Investors should weigh these factors when considering investment options.

Risk Analysis

In order to make informed investment decisions, it is essential to understand the various risks associated with the companies in your portfolio. Below is a summary table outlining key risks for Teradyne, Inc. (Ticker: TER) and Columbus McKinnon Corporation (Ticker: CMCO).

| Metric | Teradyne, Inc. | Columbus McKinnon Corporation |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

The most significant risks for these companies include market volatility for Teradyne and regulatory challenges for Columbus McKinnon. Recent trends in the semiconductor sector and manufacturing regulations are crucial factors affecting their operations and profitability.

Which one to choose?

In evaluating Teradyne, Inc. (TER) and Columbus McKinnon Corporation (CMCO), TER shows stronger fundamentals with a higher net profit margin of 19.23% compared to CMCO’s negative margins. TER also boasts a robust return on equity of 19.24%, while CMCO’s return on equity is negative. Analysts rate TER a solid B, reflecting its consistent performance, while CMCO holds a B+ rating due to its potential in discounted cash flow but weaker operational metrics. Stock trends indicate a bullish trajectory for TER, with a 74.55% price increase, contrasting with CMCO’s bearish trend, down 55.24%.

Investors attracted to growth may favor TER for its strong fundamentals and upward momentum, while those seeking potential recovery might consider CMCO, albeit with significant risks. Notably, both companies face industry challenges, including market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradyne, Inc. and Columbus McKinnon Corporation to enhance your investment decisions: