In the dynamic landscape of technology, data-driven companies are at the forefront of innovation. Today, I will compare Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR), both key players in the software industry but with distinct approaches to enterprise analytics. While Teradata focuses on multi-cloud data platforms, MicroStrategy emphasizes modern analytics experiences. By exploring their strategies and market positions, I aim to help you determine which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Teradata Corporation Overview

Teradata Corporation (TDC) is a leading provider of a connected multi-cloud data platform for enterprise analytics, headquartered in San Diego, California. The company focuses on enabling organizations to leverage their data across various sources through its flagship product, Teradata Vantage. This platform supports businesses in their transition to the cloud, simplifying their data ecosystems while providing consulting services to operationalize analytical opportunities. With a diverse clientele spanning financial services, healthcare, and telecommunications, Teradata positions itself as a vital partner in driving data-driven decision-making for organizations around the globe.

MicroStrategy Incorporated Overview

MicroStrategy Incorporated (MSTR) is a global provider of enterprise analytics software and services, headquartered in Tysons Corner, Virginia. The company offers an analytics platform that enhances data visualization, reporting, and mobile accessibility, empowering users to derive insights seamlessly across devices. MicroStrategy also provides extensive consulting and education services, helping clients achieve their desired outcomes from their data initiatives. With a strong presence in various sectors, including finance, healthcare, and education, MicroStrategy aims to deliver actionable insights that foster informed decision-making and drive business growth.

Key Similarities and Differences

Both Teradata and MicroStrategy operate within the technology sector, focusing on providing data analytics solutions to enterprises. However, Teradata emphasizes a multi-cloud data platform and consulting services, while MicroStrategy concentrates on delivering a comprehensive analytics experience and robust support services. Their distinct approaches reflect their unique value propositions in the competitive landscape of data analytics.

Income Statement Comparison

The following table presents a comparison of the income statements for Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR) for the most recent fiscal year, highlighting key financial metrics.

| Metric | Teradata Corporation (TDC) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Revenue | 1.75B | 463M |

| EBITDA | 293M | -1.85B |

| EBIT | 193M | -1.87B |

| Net Income | 114M | -1.17B |

| EPS | 1.18 | -6.06 |

Interpretation of Income Statement

In the most recent year, Teradata Corporation saw a decline in revenue to 1.75B, down from 1.83B the previous year, while its net income increased significantly to 114M, indicating improved profitability despite lower sales. Conversely, MicroStrategy reported 463M in revenue, a slight decline from 496M, but its net income fell sharply to -1.17B, reflecting ongoing operational challenges. The stark contrast in net income performance highlights the importance of margin management, with Teradata achieving stable margins while MicroStrategy continues to struggle with substantial operating losses.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent financial metrics for Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR).

| Metric | TDC | MSTR |

|---|---|---|

| ROE | 85.71% | -6.40% |

| ROIC | 16.89% | -4.38% |

| P/E | 26.34 | -47.80 |

| P/B | 22.58 | 3.06 |

| Current Ratio | 0.81 | 0.71 |

| Quick Ratio | 0.79 | 0.71 |

| D/E | 4.33 | 0.40 |

| Debt-to-Assets | 33.80% | 47.33% |

| Interest Coverage | 7.21 | -29.92 |

| Asset Turnover | 1.03 | 0.02 |

| Fixed Asset Turnover | 9.07 | 5.73 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

In comparing TDC and MSTR, TDC displays strong metrics, particularly in ROE and interest coverage, indicating effective profitability and debt management. Conversely, MSTR’s negative P/E and high debt ratios raise significant concerns about its financial health. The low current and quick ratios for both companies suggest potential liquidity issues, emphasizing the need for cautious investment strategies.

Dividend and Shareholder Returns

Teradata Corporation (TDC) does not pay dividends, opting instead to reinvest earnings into growth initiatives. This strategy is typical for companies in a high-growth phase, although it may raise concerns about short-term liquidity. TDC, however, has engaged in share buybacks, which can enhance shareholder value by reducing outstanding shares. In contrast, MicroStrategy Incorporated (MSTR) also does not distribute dividends, primarily due to ongoing losses and a focus on expansion. Their share buyback strategy could potentially support long-term value creation if managed prudently. Ultimately, both companies’ approaches highlight a commitment to growth, although the lack of dividends may deter income-focused investors.

Strategic Positioning

In the competitive landscape of the software industry, Teradata Corporation (TDC) holds a significant market share with its robust multi-cloud data platform, Teradata Vantage. It faces moderate competitive pressure from MicroStrategy Incorporated (MSTR), which excels in enterprise analytics software. Both companies are navigating technological disruption by enhancing their offerings to meet evolving customer demands. TDC’s focus on integrated migration and ecosystem simplification positions it well, while MSTR’s emphasis on hyperintelligence and mobility features keeps it at the forefront of analytics solutions.

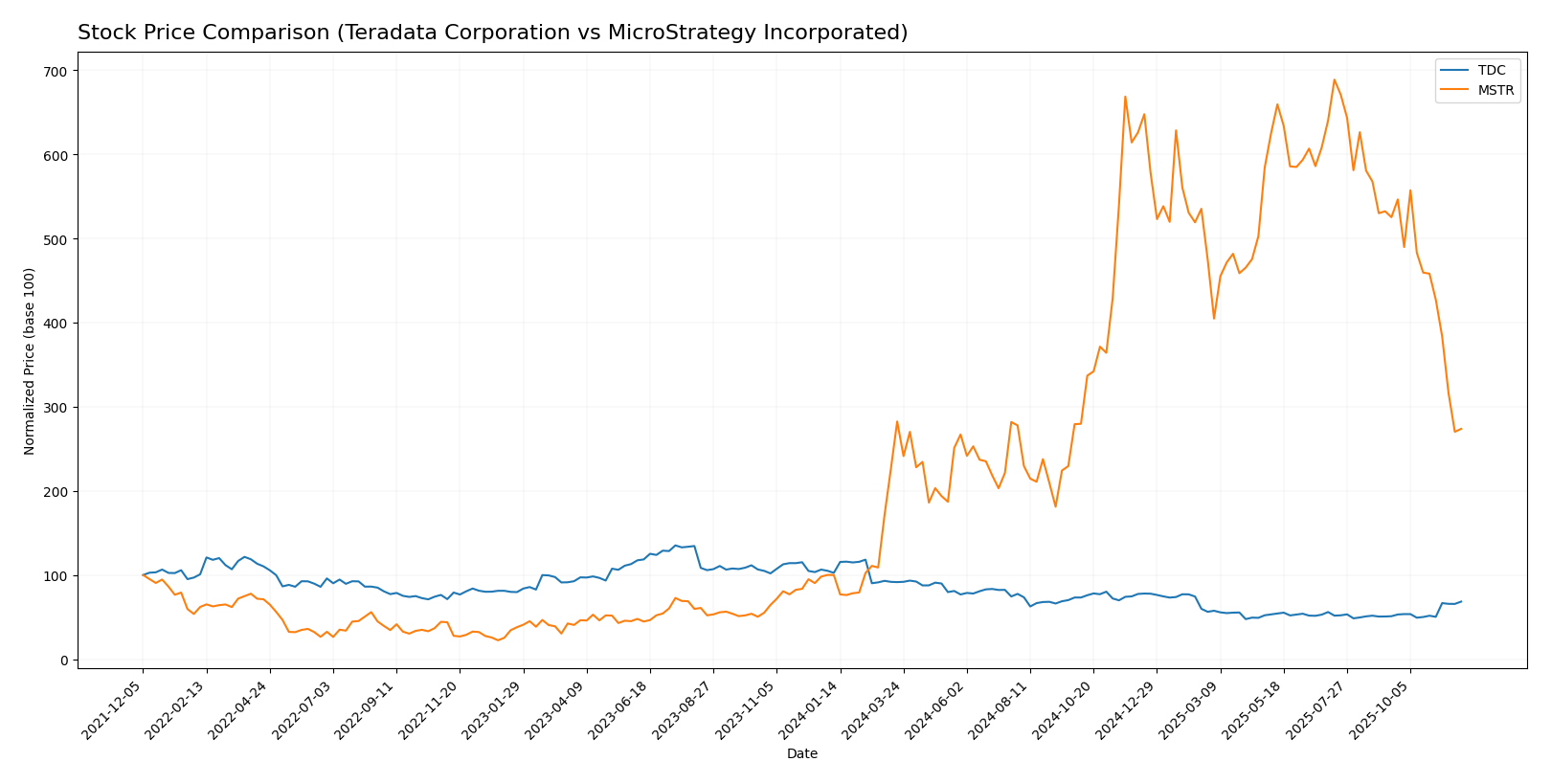

Stock Comparison

The weekly stock price movements for Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR) over the past year reveal significant dynamics, with TDC experiencing notable declines while MSTR has shown robust growth despite recent volatility.

Trend Analysis

For Teradata Corporation (TDC), the overall price change percentage over the last year stands at -33.31%. This indicates a bearish trend, marked by acceleration, with the stock reaching a high of 48.99 and a low of 19.73. The volatility, indicated by a standard deviation of 7.27, suggests that price fluctuations have been significant.

In the recent analysis period from September 14, 2025, to November 30, 2025, TDC’s price increased by 33.97%, but this was not sufficient to change the overall bearish sentiment.

Conversely, MicroStrategy Incorporated (MSTR) has shown an impressive overall price change of +173.65%, reflecting a bullish trend despite signs of deceleration. The stock’s price has fluctuated between a high of 434.58 and a low of 48.1, with a notable standard deviation of 113.26, indicating high volatility.

However, in the recent period from September 14, 2025, to November 30, 2025, MSTR’s price declined by 47.89%, which has raised concerns among investors, even as the overall trend remains positive.

Analyst Opinions

Recent analyst recommendations for Teradata Corporation (TDC) indicate a consensus rating of “Buy,” with a B+ score highlighting strong return on equity and asset performance. Analysts appreciate TDC’s solid fundamentals, particularly its favorable discounted cash flow analysis. In contrast, MicroStrategy Incorporated (MSTR) has received a “Sell” rating with a C score, reflecting concerns over its weak return metrics and high debt levels. Analysts like those from financial firms suggest caution with MSTR, recommending investors consider more stable alternatives.

Stock Grades

I’ve gathered the latest stock grades for Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR) from reputable grading companies, which can help you make informed investment decisions.

Teradata Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | upgrade | Market Outperform | 2025-11-10 |

| Evercore ISI Group | maintain | Outperform | 2025-11-05 |

| Barclays | maintain | Underweight | 2025-11-05 |

| TD Cowen | maintain | Hold | 2025-11-05 |

| UBS | maintain | Neutral | 2025-08-06 |

| Guggenheim | maintain | Buy | 2025-05-07 |

| Barclays | maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | maintain | Market Perform | 2025-03-18 |

| JMP Securities | maintain | Market Perform | 2025-02-13 |

| RBC Capital | maintain | Sector Perform | 2025-02-12 |

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Overall, TDC shows a notable upgrade to “Market Outperform,” indicating growing confidence among analysts. Meanwhile, MSTR has received a mix of upgrades and downgrades, but the majority maintain positive grades, suggesting a generally favorable outlook despite the recent downgrade to “Equal Weight.”

Target Prices

The target consensus for Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR) reflects varied expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradata Corporation | 24 | 24 | 24 |

| MicroStrategy Incorporated | 705 | 175 | 478.5 |

For Teradata, the consensus target price of 24 is below its current price of 28.38, suggesting a potential downside. In contrast, MicroStrategy’s consensus of 478.5 is significantly higher than its current price of 172.25, indicating a strong bullish sentiment among analysts.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR):

| Criterion | TDC | MSTR |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Positive margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Limited |

| Market Share | 2.7% | 1.5% |

| Debt level | High (4.33) | Moderate (1.04) |

Key takeaways from this analysis indicate that while TDC showcases better profitability and a stronger global presence, MSTR is struggling with profitability and innovation. Prioritize investments in firms with robust financial health and growth potential.

Risk Analysis

In the table below, I outline the various risks associated with Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR) for the most recent fiscal year.

| Metric | Teradata Corporation (TDC) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, especially MicroStrategy, which has a high exposure to volatility due to its focus on cryptocurrency investments. Recent financial performance highlights this, with MSTR reporting a net profit margin of -2.5% in 2024, indicating operational challenges.

Which one to choose?

In evaluating Teradata Corporation (TDC) and MicroStrategy Incorporated (MSTR), TDC appears to be the more favorable option for long-term investors. TDC has a solid market cap of 3B and shows a strong gross profit margin of 60.46% with a B+ rating from analysts, indicating better financial stability. In contrast, MSTR’s profitability metrics are concerning, as it reported a net income loss and a C rating, signaling greater risk.

TDC has an upward stock trend with a recent price increase of 33.97%, while MSTR has experienced significant volatility. For investors focused on growth, TDC offers a more stable investment, whereas those seeking high-risk, high-reward scenarios may still consider MSTR.

However, investors should be mindful of risks related to competition and market dependence affecting both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradata Corporation and MicroStrategy Incorporated to enhance your investment decisions: