In today’s rapidly evolving tech landscape, understanding which companies are poised for growth is crucial for investors. I will compare Teradata Corporation (TDC) and Domo, Inc. (DOMO), two players in the software sector, each pushing the envelope in data analytics and business intelligence. Their different approaches to innovation and market strategies create an interesting dynamic worth exploring. Join me as we delve into their strengths and weaknesses to determine which company may be a more appealing investment opportunity.

Table of contents

Company Overview

Teradata Corporation Overview

Teradata Corporation (TDC) is a leading provider of a connected multi-cloud data platform aimed at enterprise analytics. Founded in 1979 and headquartered in San Diego, California, Teradata’s flagship offering, Teradata Vantage, empowers organizations to harness their data across various cloud ecosystems. The company focuses on simplifying data management while supporting clients in their digital transformation journeys. With a diverse clientele spanning sectors such as financial services, healthcare, and telecommunications, Teradata’s expertise in business consulting enhances its value proposition, enabling firms to operationalize analytical opportunities effectively.

Domo, Inc. Overview

Domo, Inc. (DOMO) specializes in a cloud-based business intelligence platform that facilitates real-time data access across organizations. Established in 2010 and based in American Fork, Utah, Domo’s platform connects all levels of an organization, from executives to frontline employees, allowing them to leverage insights for informed decision-making. The company aims to democratize data access, enabling users to manage business operations seamlessly via smartphones. Its innovative approach positions Domo as a significant player in the software application industry, serving a global market.

Key similarities between Teradata and Domo lie in their focus on data-driven solutions and cloud-based platforms. However, Teradata operates primarily in the enterprise analytics sector, while Domo emphasizes real-time business intelligence insights for all organizational levels. Both companies leverage technology to enhance data accessibility, although their target markets and user functionalities differ significantly.

Income Statement Comparison

The following table presents a comparison of the most recent income statements from Teradata Corporation (TDC) and Domo, Inc. (DOMO), allowing us to analyze their financial performance.

| Metric | Teradata Corporation (TDC) | Domo, Inc. (DOMO) |

|---|---|---|

| Revenue | 1.75B | 317M |

| EBITDA | 293M | -50M |

| EBIT | 193M | -59M |

| Net Income | 114M | -82M |

| EPS | 1.18 | -2.13 |

Interpretation of Income Statement

In the most recent fiscal year, Teradata Corporation reported a revenue of 1.75B, a decrease from the previous year, while still maintaining a positive net income of 114M, indicating solid profitability. In contrast, Domo, Inc. experienced a slight revenue increase but reported a net income loss of 82M, reflecting ongoing challenges. Teradata’s EBITDA margin remains strong, whereas Domo’s negative EBITDA highlights significant operational difficulties. Overall, while TDC shows resilience in profitability, DOMO’s growth comes with substantial risks, making it a less attractive option for conservative investors.

Financial Ratios Comparison

The following table presents a comparison of key financial ratios between Teradata Corporation (TDC) and Domo, Inc. (DOMO) based on the most recent data available.

| Metric | TDC | DOMO |

|---|---|---|

| ROE | 85.71% | -46.23% |

| ROIC | 16.89% | -197.65% |

| P/E | 26.34 | -5.01 |

| P/B | 22.58 | -3.61 |

| Current Ratio | 0.81 | 0.56 |

| Quick Ratio | 0.79 | 0.56 |

| D/E | 4.33 | -0.76 |

| Debt-to-Assets | 33.80% | 63.23% |

| Interest Coverage | 7.21 | N/A |

| Asset Turnover | 1.03 | 1.48 |

| Fixed Asset Turnover | 9.07 | 8.17 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Teradata exhibits strong financial health with a high return on equity (ROE) of 85.71% and a manageable debt-to-assets ratio of 33.80%. In contrast, Domo shows concerning negative values across key ratios, including a negative ROE and high debt metrics, suggesting significant operational challenges. Investors should exercise caution with Domo due to its poor financial performance indicators.

Dividend and Shareholder Returns

Teradata Corporation (TDC) does not pay dividends, reflecting its focus on reinvestment for growth. With a dividend payout ratio of 0 and ongoing share buybacks, TDC prioritizes capital allocation towards innovation and strategic acquisitions. Conversely, Domo, Inc. also refrains from dividend payments due to negative net income, emphasizing its growth trajectory. Both companies’ approaches suggest a commitment to long-term value creation, although risks remain regarding financial sustainability.

Strategic Positioning

Teradata Corporation (TDC) and Domo, Inc. (DOMO) operate in the competitive software sector, focusing on data analytics and business intelligence respectively. TDC holds a market cap of $2.7B with a significant presence in enterprise analytics, leveraging its multi-cloud platform. DOMO, with a market cap of $455M, faces intense pressure in the crowded business intelligence space but focuses on real-time data accessibility. Both companies must navigate technological disruptions to maintain their market positions.

Stock Comparison

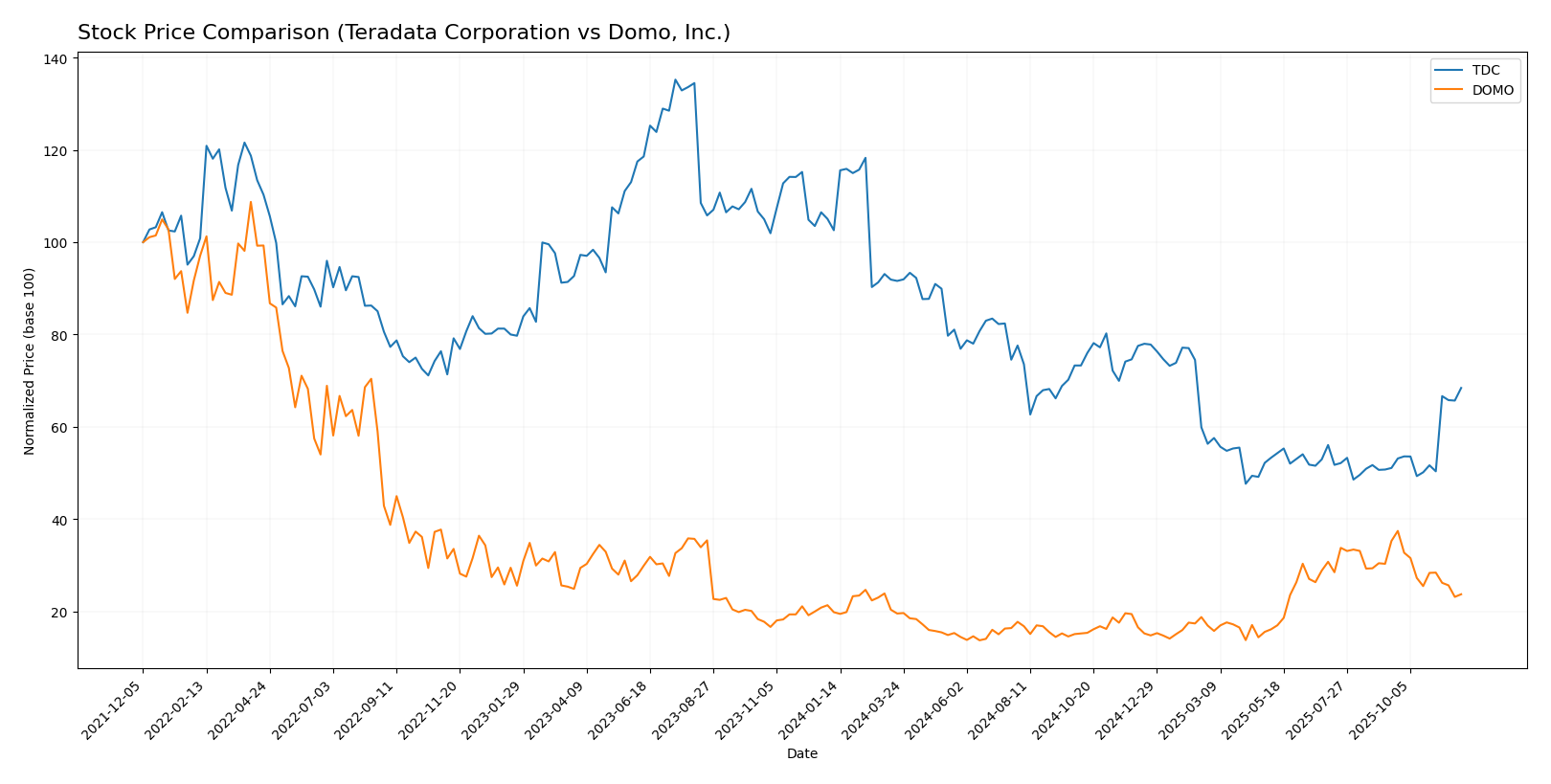

In analyzing the weekly stock price movements of Teradata Corporation (TDC) and Domo, Inc. (DOMO) over the past year, I have observed significant fluctuations that reflect the underlying trading dynamics of each company.

Trend Analysis

Teradata Corporation (TDC) has experienced a substantial price change of -33.31% over the past year, indicating a bearish trend. Notably, the stock has shown acceleration in this downward movement, with a standard deviation of 7.27 suggesting considerable volatility. The highest price recorded was 48.99, while the lowest was 19.73.

In a more recent evaluation from September 14, 2025, to November 30, 2025, TDC exhibited a price increase of 33.97%. This shorter-term analysis shows a trend slope of 0.67, with a standard deviation of 2.99, which indicates a potential recovery phase, although the overall long-term trend remains negative.

Domo, Inc. (DOMO), on the other hand, has shown a positive price change of 19.61% over the past year, categorizing it as a bullish trend. However, the trend is currently in a state of deceleration, with a standard deviation of 2.99 reflecting moderate volatility. The stock reached a high of 18.06 and a low of 6.62 during this period.

In the recent period from September 14, 2025, to November 30, 2025, DOMO’s price fell by 32.78%, indicating a negative shift in the short term with a trend slope of -0.55 and a standard deviation of 2.1. This could suggest an adjustment following the previous bullish movement.

Overall, while TDC is struggling with a bearish long-term trend, DOMO has managed to maintain a bullish stance despite recent setbacks. As always, I advise caution and thorough risk management when considering these stocks for investment.

Analyst Opinions

Recent analyst recommendations show a mixed outlook for Teradata Corporation (TDC) and Domo, Inc. (DOMO). TDC received a “B+” rating, with analysts highlighting strong return on equity (5) and a solid discounted cash flow score (4), suggesting a buy consensus. In contrast, DOMO’s “C” rating reflects concerns, particularly in discounted cash flow (1) and other financial metrics, leaning towards a hold recommendation. Overall, the consensus for TDC is a buy, while DOMO is viewed as a hold for this year.

Stock Grades

I have gathered the latest stock grades from credible sources for two companies, Teradata Corporation (TDC) and Domo, Inc. (DOMO). Below are the details.

Teradata Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | Maintain | Market Perform | 2025-03-18 |

| JMP Securities | Maintain | Market Perform | 2025-02-13 |

| RBC Capital | Maintain | Sector Perform | 2025-02-12 |

Domo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| DA Davidson | Maintain | Neutral | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-25 |

| JMP Securities | Maintain | Market Outperform | 2025-06-25 |

| DA Davidson | Maintain | Neutral | 2025-05-22 |

| Lake Street | Maintain | Hold | 2025-05-22 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-05-22 |

| JMP Securities | Maintain | Market Outperform | 2025-05-22 |

In summary, Teradata Corporation shows a positive trend with an upgrade to Market Outperform, indicating stronger market expectations. Domo, Inc. maintains a stable outlook with consistent ratings from various firms, suggesting a solid performance in its sector.

Target Prices

The consensus target prices from analysts for the selected companies are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradata Corporation (TDC) | 24 | 24 | 24 |

| Domo, Inc. (DOMO) | 50 | 15 | 24.5 |

For Teradata Corporation, analysts expect the stock to reach a consensus of $24, which is below its current price of $28.4. In contrast, Domo, Inc. has a broader target range with a consensus of $24.5, while its current price of $11.49 suggests significant upside potential.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Teradata Corporation (TDC) and Domo, Inc. (DOMO) based on recent financial performance and market positioning.

| Criterion | Teradata Corporation (TDC) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | High (multi-cloud data platform) | Moderate (focused on business intelligence) |

| Profitability | 6.5% net profit margin | -25.8% net profit margin |

| Innovation | Strong (continuous product enhancements) | Moderate (need for improved product offerings) |

| Global presence | Extensive (global client base) | Limited (focus primarily in the US and Japan) |

| Market Share | Growing in enterprise analytics | Struggling to gain significant market share |

| Debt level | High (debt-to-equity ratio of 4.33) | Very high (debt-to-equity ratio negative) |

Key takeaways reveal that while Teradata demonstrates solid profitability and a strong global presence, Domo faces significant challenges, particularly in profitability and debt management. Investors should weigh these factors carefully when considering their options.

Risk Analysis

In this section, I present a risk analysis for Teradata Corporation (TDC) and Domo, Inc. (DOMO) to help you understand their potential vulnerabilities.

| Metric | Teradata Corporation (TDC) | Domo, Inc. (DOMO) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Low | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant market and operational risks, especially Domo, which operates under high volatility and has a challenging financial outlook. As of early 2025, Domo has reported persistent negative margins, indicating potential distress.

Which one to choose?

When comparing Teradata Corporation (TDC) and Domo, Inc. (DOMO), TDC stands out as the more stable option. TDC has demonstrated strong fundamentals, with a B+ rating and a return on equity score of 5. Its latest financials show a revenue of $1.75B and a net income of $114M, reflecting a positive trend despite a recent bearish stock trend with a -33.31% price change over the past year. In contrast, DOMO, rated C, has struggled with profitability, posting a net loss and negative cash flow despite a bullish overall trend.

For investors focused on stability and growth potential, TDC may be preferable, while those seeking high-risk, high-reward opportunities might explore DOMO.

However, potential risks include TDC’s high valuation and market competition, as well as DOMO’s ongoing financial struggles.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradata Corporation and Domo, Inc. to enhance your investment decisions: