In the fast-paced semiconductor industry, two key players stand out: STMicroelectronics N.V. (STM) and Microchip Technology Incorporated (MCHP). Both companies are at the forefront of innovation, focusing on microcontrollers and embedded solutions that drive advancements across various sectors. Their overlapping markets and competitive strategies present an intriguing comparison for investors. In this article, I will evaluate these companies to help you determine which one could be the more compelling addition to your investment portfolio.

Table of contents

Company Overview

STMicroelectronics N.V. Overview

STMicroelectronics N.V. is a leading global semiconductor company that designs, develops, manufactures, and sells a wide range of semiconductor products. Headquartered in Schiphol, the Netherlands, STMicroelectronics operates in various segments, including Automotive and Discrete Group, Analog, MEMS and Sensors Group, and Microcontrollers and Digital ICs Group. The company is well-regarded for its innovative solutions in automotive, industrial, personal electronics, and communications markets. With a market capitalization of approximately $20.3B, STMicroelectronics emphasizes sustainability and advanced technology to enhance the performance of electronic devices across diverse applications.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated, based in Chandler, Arizona, specializes in developing and manufacturing smart, connected, and secure embedded control solutions. Founded in 1989, Microchip offers a comprehensive portfolio of microcontrollers, microprocessors, and development tools tailored for various applications, including automotive and industrial sectors. The company boasts a market capitalization of around $28.5B, and its focus on innovation and customer-centric solutions positions it as a formidable player in the semiconductor industry.

Key similarities between STMicroelectronics and Microchip Technology include their focus on semiconductor products and a commitment to innovation in technology. However, their business models differ in that STMicroelectronics emphasizes a broader range of products across multiple sectors, while Microchip Technology specializes in embedded control solutions and development tools for more specific applications.

Income Statement Comparison

The following table presents a side-by-side comparison of the income statements for STMicroelectronics N.V. and Microchip Technology Incorporated for their most recent fiscal years.

| Metric | STMicroelectronics N.V. | Microchip Technology Incorporated |

|---|---|---|

| Revenue | 13.27B | 4.40B |

| EBITDA | 3.72B | 1.04B |

| EBIT | 1.96B | 290M |

| Net Income | 1.56B | -500K |

| EPS | 1.73 | -0.005 |

Interpretation of Income Statement

In the latest fiscal year, STMicroelectronics experienced a decline in revenue from 17.29B in 2023 to 13.27B in 2024, indicating a significant drop. The net income also decreased sharply from 4.21B to 1.56B, reflecting a tighter margin. Conversely, Microchip Technology faced a substantial decline in revenue to 4.40B, leading to a net loss of 500K, compared to 1.91B in net income the previous year. This illustrates the challenges both companies are facing, particularly in revenue generation and profit margins, suggesting a need for strategic adjustments in their operations moving forward.

Financial Ratios Comparison

The following table presents a comparison of key financial metrics for STMicroelectronics N.V. (STM) and Microchip Technology Incorporated (MCHP) based on the most recent data available:

| Metric | STM | MCHP |

|---|---|---|

| ROE | 25.17% | -0.07% |

| ROIC | 19.47% | 2.08% |

| P/E | 14.43 | 20.61 |

| P/B | 1.29 | 7.08 |

| Current Ratio | 3.11 | 2.59 |

| Quick Ratio | 2.37 | 1.47 |

| D/E | 0.18 | 0.80 |

| Debt-to-Assets | 12.80% | 40.32% |

| Interest Coverage | 19.72 | 1.18 |

| Asset Turnover | 0.54 | 0.29 |

| Fixed Asset Turnover | 1.22 | 3.72 |

| Payout Ratio | 18.50% | N/A |

| Dividend Yield | 1.28% | 1.87% |

Interpretation of Financial Ratios

The ratios for STM indicate strong financial health, particularly in profitability (high ROE and ROIC), liquidity (current and quick ratios above 2), and low leverage (D/E ratio). In contrast, MCHP shows concerning figures, with negative ROE and a high debt-to-assets ratio, suggesting increased financial risk. Investors should consider these factors when evaluating potential investments in these companies.

Dividend and Shareholder Returns

STMicroelectronics N.V. (STM) pays dividends with a payout ratio of approximately 18.5%, indicating a sustainable approach to shareholder returns. The annual dividend yield is around 1.28%, supplemented by consistent share buybacks. In contrast, Microchip Technology Incorporated (MCHP) has a higher dividend payout ratio of about 31.1% but has faced recent negative net income, which raises concerns about sustainability. Both companies engage in share repurchase programs, suggesting a commitment to enhancing shareholder value. Overall, STM’s conservative dividend strategy appears more favorable for long-term value creation.

Strategic Positioning

In the semiconductor market, STMicroelectronics N.V. (STM) holds a market cap of $20.3B, while Microchip Technology Incorporated (MCHP) leads with $28.5B. STM primarily focuses on automotive and industrial applications, whereas MCHP specializes in microcontrollers and embedded solutions. Both companies face competitive pressure from emerging tech players and established giants, necessitating continuous innovation to mitigate risks associated with technological disruption. Each firm’s ability to adapt and leverage their strengths will be crucial to maintaining and enhancing market share.

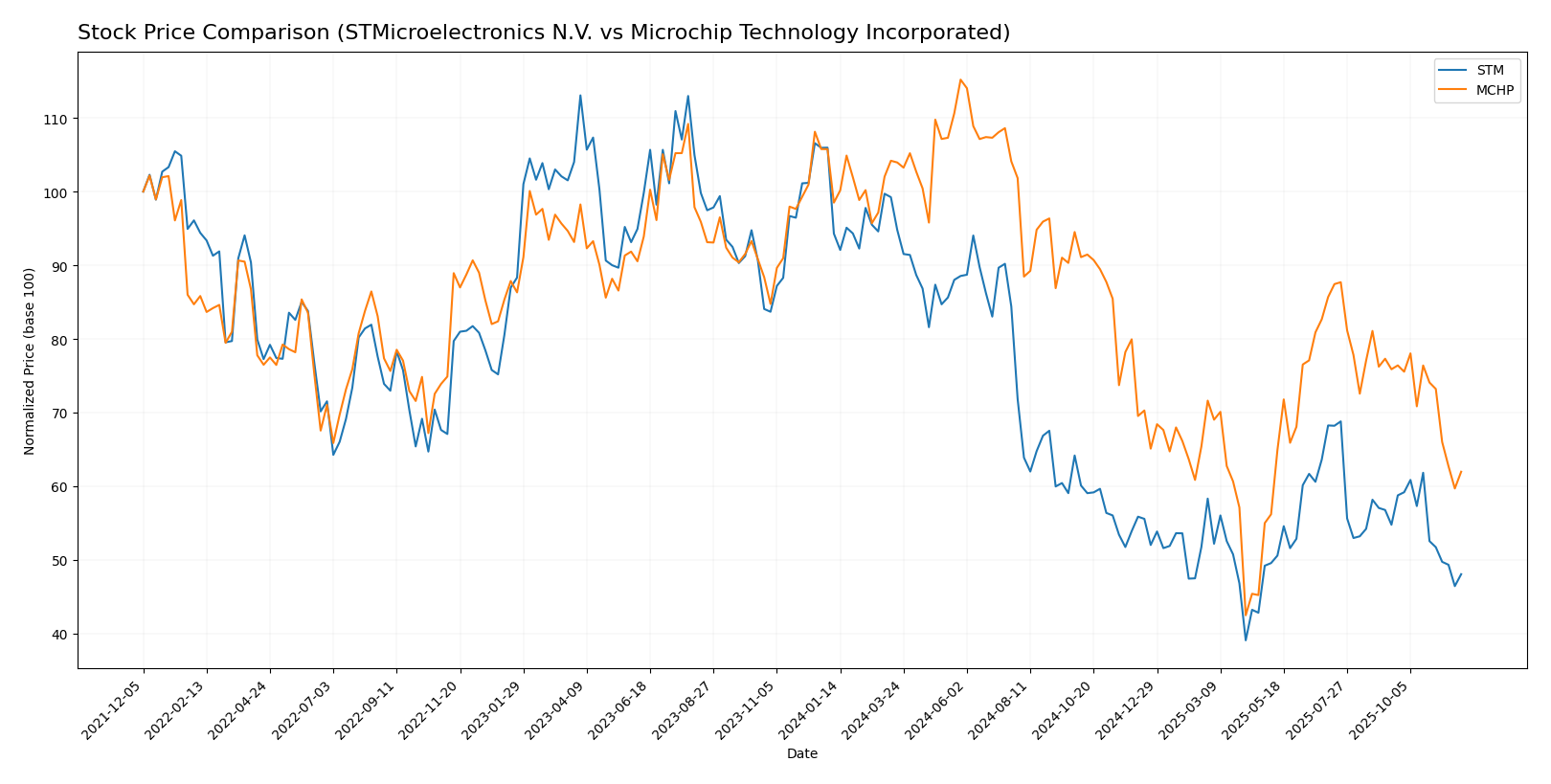

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of STMicroelectronics N.V. (STM) and Microchip Technology Incorporated (MCHP) over the past year, highlighting key fluctuations and trends that may influence investment decisions.

Trend Analysis

STMicroelectronics N.V. (STM) Over the past year, STM has experienced a significant price decline of -49.04%, indicating a bearish trend. The stock has demonstrated deceleration in its downward movement, with a recent price change of -12.25% from September 14, 2025, to November 30, 2025. The highest price recorded was 47.17, while the lowest was 18.49. The standard deviation of 8.0 suggests moderate volatility in trading activity.

Microchip Technology Incorporated (MCHP) Similarly, MCHP’s stock has also faced challenges, with an overall price decrease of -37.09%, marking a bearish trend. Like STM, MCHP shows signs of deceleration in its price trajectory, having declined by -18.33% during the same recent period. The stock reached a high of 98.23 and a low of 36.22. The standard deviation of 14.87 indicates higher volatility compared to STM.

In summary, both companies are currently in a bearish trend, with noteworthy price declines and decelerating movements in their recent trajectories. Investors should exercise caution and consider these trends when making investment decisions.

Analyst Opinions

Recent analyst recommendations for STMicroelectronics N.V. (STM) indicate a consensus rating of “Buy” with a B+ rating. Analysts highlight strong return on assets and a favorable price-to-book ratio as key strengths. In contrast, Microchip Technology Incorporated (MCHP) has received a consensus rating of “Sell” with a C- rating. Analysts point to poor return on equity and a concerning debt-to-equity ratio as primary concerns. Overall, STM shows promise for investors, while MCHP requires caution.

Stock Grades

In evaluating the performance and outlook of STMicroelectronics N.V. and Microchip Technology Incorporated, I found reliable stock grades from respected grading companies.

STMicroelectronics N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | maintain | Buy | 2025-10-24 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Susquehanna | maintain | Positive | 2025-07-25 |

| Susquehanna | maintain | Positive | 2025-07-22 |

| Baird | upgrade | Outperform | 2025-07-22 |

| Jefferies | upgrade | Buy | 2025-02-19 |

| Bernstein | downgrade | Market Perform | 2025-02-05 |

| Susquehanna | maintain | Positive | 2025-01-31 |

| Barclays | downgrade | Underweight | 2025-01-22 |

| JP Morgan | downgrade | Neutral | 2024-12-09 |

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| Citigroup | maintain | Buy | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Stifel | maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Needham | maintain | Buy | 2025-08-08 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

Overall, both companies exhibit strong support from analysts, with frequent “Buy” and “Positive” ratings indicating a favorable market sentiment. Notably, STMicroelectronics has seen both upgrades and downgrades, reflecting a dynamic evaluation of its market position, while Microchip Technology maintains a stable outlook with consistent “Buy” ratings across multiple firms.

Target Prices

The consensus target prices for STMicroelectronics N.V. and Microchip Technology Incorporated reflect a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| STMicroelectronics N.V. | 45 | 22 | 33.38 |

| Microchip Technology Inc. | 83 | 60 | 71.33 |

For STMicroelectronics, the current stock price of 22.74 is significantly below the target consensus of 33.38, indicating strong growth potential. Microchip Technology’s stock price of 52.91 is also below its consensus target of 71.33, suggesting further upside as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of STMicroelectronics N.V. (STM) and Microchip Technology Incorporated (MCHP) based on the most recent data.

| Criterion | STMicroelectronics (STM) | Microchip Technology (MCHP) |

|---|---|---|

| Diversification | Strong in automotive and industrial sectors | Broad range of microcontrollers and embedded solutions |

| Profitability | High net profit margin at 24.36% | Moderate net profit margin at 26.52% |

| Innovation | Leader in semiconductor technology | Focus on connected devices and embedded solutions |

| Global presence | Operates in multiple regions worldwide | Strong presence in Americas, Europe, and Asia |

| Market Share | Significant share in semiconductors | Competitive position in embedded systems |

| Debt level | Low debt-to-equity ratio at 0.18 | Higher debt-to-equity ratio at 0.80 |

Key takeaways from the analysis indicate that while both companies hold strong positions in the semiconductor industry, STM showcases a lower debt level and impressive profitability margins, whereas MCHP has a broader product range but higher financial leverage.

Risk Analysis

In the following table, I outline the key risks associated with two semiconductor companies: STMicroelectronics N.V. (STM) and Microchip Technology Incorporated (MCHP).

| Metric | STM | MCHP |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | High | Moderate |

Both companies face notable market risks due to fluctuations in demand for semiconductors, with STM exhibiting a moderate risk profile compared to MCHP’s high exposure. Recent trends indicate heightened regulatory scrutiny and geopolitical tensions affecting supply chains, particularly for MCHP.

Which one to choose?

When comparing STMicroelectronics (STM) and Microchip Technology (MCHP), STM appears to have a stronger financial position. STM boasts a gross profit margin of 39.34% and a net profit margin of 11.73% for 2024, while MCHP shows a lower gross profit margin of 56.07%, but a concerning net profit margin of nearly zero. The price-to-earnings ratio for STM is also more attractive at 14.43 compared to MCHP’s significantly high negative ratio. Analyst ratings reflect this disparity, with STM rated B+ and MCHP rated C-.

For growth-oriented investors, STM may be the more favorable choice given its solid fundamentals and healthy margins, while conservative investors may prefer MCHP due to its dividend yield of 3.75%. However, both companies face risks such as competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of STMicroelectronics N.V. and Microchip Technology Incorporated to enhance your investment decisions: