In the rapidly evolving landscape of industrial automation, two prominent players stand out: Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN). Both companies operate within the industrial machinery sector, focusing on innovative solutions that enhance production efficiency. Their overlapping markets and distinct approaches to technology adoption make them compelling candidates for comparison. As an investor, understanding the nuances between these companies can illuminate which might be the more promising addition to your portfolio. Let’s explore the strengths and strategies of each to determine which company deserves your attention.

Table of contents

Company Overview

Rockwell Automation, Inc. Overview

Rockwell Automation, Inc. is a leader in industrial automation and digital transformation solutions. Established in 1903 and headquartered in Milwaukee, Wisconsin, Rockwell operates through three primary segments: Intelligent Devices, Software & Control, and Lifecycle Services. This extensive range of offerings includes hardware, software, and consulting services aimed at enhancing productivity across various industries, such as automotive, semiconductor, and food and beverage. With a market capitalization of approximately $44.6B, Rockwell’s commitment to innovation is evident in its advanced solutions, which are delivered through a combination of direct sales and independent distributors.

Nordson Corporation Overview

Founded in 1935 and headquartered in Westlake, Ohio, Nordson Corporation specializes in the engineering and manufacturing of systems for dispensing and controlling adhesives, coatings, and other fluids. The company operates through two segments: Industrial Precision Solutions and Advanced Technology Solutions. With a market cap of roughly $13.5B, Nordson’s products serve diverse sectors including semiconductor and consumer goods, showcasing a strong focus on automation and precision. Their robust distribution network combines direct sales with a network of distributors, ensuring widespread market reach.

Key Similarities and Differences

Both Rockwell Automation and Nordson Corporation operate within the industrial machinery sector, focusing on automation solutions. However, Rockwell emphasizes a broader spectrum of digital transformation services, while Nordson concentrates on fluid dispensing technologies. This distinction highlights Rockwell’s wider industry applicability compared to Nordson’s specialized approach.

Income Statement Comparison

The following table displays the most recent income statement metrics for Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN), highlighting their financial performance.

| Metric | Rockwell Automation, Inc. (ROK) | Nordson Corporation (NDSN) |

|---|---|---|

| Revenue | 8.34B | 2.69B |

| EBITDA | 1.40B | 0.81B |

| EBIT | 1.07B | 0.67B |

| Net Income | 0.87B | 0.47B |

| EPS | 7.69 | 8.17 |

Interpretation of Income Statement

In the latest fiscal year, Rockwell Automation experienced a revenue increase to 8.34B, while Nordson Corporation’s revenue rose to 2.69B. Despite this, ROK’s net income of 0.87B indicates a decrease compared to prior years, reflecting tighter margins. Conversely, NDSN’s stability in both revenue and net income suggests a consistent performance. Overall, the growth rate for ROK has slowed, hinting at potential market saturation, whereas NDSN shows resilience, making it an attractive option for conservative investors.

Financial Ratios Comparison

The table below presents a comparison of the most recent financial ratios for Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN):

| Metric | Rockwell Automation, Inc. | Nordson Corporation |

|---|---|---|

| ROE | 0.39 | 0.16 |

| ROIC | 0.16 | 0.10 |

| P/E | 23.76 | 24.90 |

| P/B | 9.21 | 4.87 |

| Current Ratio | 1.46 | 2.41 |

| Quick Ratio | 1.04 | 1.51 |

| D/E | 0.94 | 0.79 |

| Debt-to-Assets | 0.30 | 0.39 |

| Interest Coverage | 12.54 | 7.58 |

| Asset Turnover | 0.80 | 0.45 |

| Fixed Asset Turnover | 8.76 | 4.21 |

| Payout Ratio | 0.39 | 0.35 |

| Dividend Yield | 1.65% | 1.13% |

Interpretation of Financial Ratios

Comparing ROK and NDSN reveals robust performance by Rockwell Automation, particularly in ROE and interest coverage, indicating effective profitability and debt management. The higher P/B ratio suggests that ROK might be overvalued relative to its assets, while NDSN’s lower ratios reflect a more conservative approach. Both companies maintain healthy liquidity, but ROK’s current and quick ratios are notably lower, raising potential concerns about short-term obligations. Overall, ROK shows stronger financial health, yet both present unique investment considerations.

Dividend and Shareholder Returns

Rockwell Automation, Inc. (ROK) has a dividend payout ratio of approximately 60%, with a yield of 1.87%. This signals a commitment to shareholder returns, although potential risks include unsustainable distributions if earnings decline.

In contrast, Nordson Corporation (NDSN) pays a lower dividend yield of 1.24% with a payout ratio of 30%. Both companies engage in share buyback programs, which can enhance shareholder value, though ongoing financial performance will determine their sustainability. Overall, both companies show a focus on long-term shareholder value creation despite differing strategies.

Strategic Positioning

Rockwell Automation, Inc. (ROK) holds a significant market share in the industrial automation sector, driven by its comprehensive offerings across Intelligent Devices, Software & Control, and Lifecycle Services. With a market cap of approximately $44.6B, it faces competitive pressure from Nordson Corporation (NDSN), which specializes in precision dispensing and coating technologies, holding a market cap of around $13.5B. Both companies must navigate technological disruptions while maintaining their competitive edges through innovation and strategic partnerships.

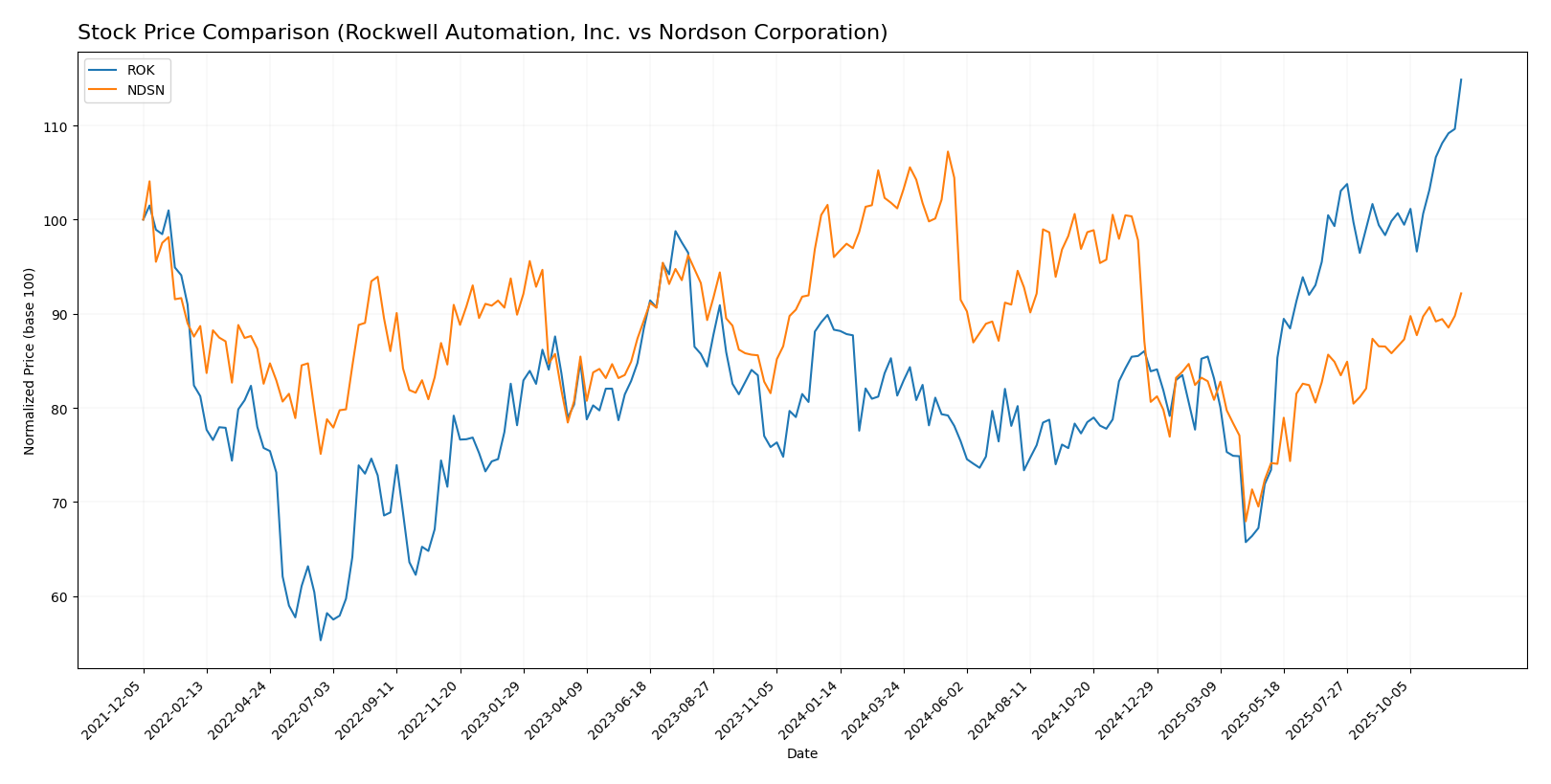

Stock Comparison

In examining the stock price movements over the past year, both Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN) have exhibited distinct trading dynamics that warrant attention.

Trend Analysis

For Rockwell Automation, Inc. (ROK), the overall price change over the past year is +30.08%. This indicates a bullish trend with notable acceleration, as the stock reached a high of 396.82 and a low of 227.11. The volatility, measured by a standard deviation of 36.72, suggests significant price fluctuations. Over the recent period from September 14, 2025, to November 30, 2025, ROK experienced a price change of +15.04%, with a standard deviation of 17.94, confirming the momentum of its upward trajectory.

In contrast, Nordson Corporation (NDSN) has experienced an overall price change of -4.01% over the same timeframe, categorizing it as a bearish trend. The stock has also shown acceleration, with highs at 278.89 and lows at 176.73, accompanied by a standard deviation of 23.84, indicating moderate volatility. However, in the recent analysis period from September 14, 2025, to November 30, 2025, NDSN’s price change was +7.41%, suggesting a temporary rebound despite its overall trend.

In summary, ROK showcases a strong bullish momentum, while NDSN’s bearish trend reflects ongoing challenges, notwithstanding recent positive shifts.

Analyst Opinions

Recent recommendations show a mixed outlook for Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN). Analysts have rated ROK with a C-, indicating a cautious stance, primarily due to low scores in return metrics and debt management. In contrast, NDSN received a B+, with analysts citing strong performance in return on assets and equity. The consensus for ROK leans toward a hold, while NDSN is viewed more favorably, suggesting a buy for investors looking for growth opportunities.

Stock Grades

In the current investment landscape, stock ratings from reputable grading companies can provide valuable insights. Here are the latest grades for Rockwell Automation, Inc. and Nordson Corporation.

Rockwell Automation, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Outperform | 2025-11-21 |

| B of A Securities | Maintain | Buy | 2025-11-20 |

| JP Morgan | Maintain | Neutral | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-10 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

| Barclays | Maintain | Overweight | 2025-08-14 |

Nordson Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

| Keybanc | Upgrade | Overweight | 2025-03-04 |

| Baird | Maintain | Neutral | 2025-02-21 |

| Loop Capital | Upgrade | Buy | 2025-01-22 |

| Seaport Global | Upgrade | Buy | 2024-12-17 |

The overall trend in grades for both companies shows a consistent maintenance of ratings, with a few upgrades indicating positive investor sentiment for Nordson Corporation. Rockwell Automation maintains strong support from analysts with a majority rating it as outperform or overweight.

Target Prices

Reliable target price data indicates that analysts have set clear expectations for Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rockwell Automation, Inc. | 402 | 345 | 377.6 |

| Nordson Corporation | 285 | 240 | 263 |

Overall, analysts expect ROK to reach a consensus price of 377.6, which is slightly below its current price of 396.92. For NDSN, the target consensus is 263 compared to its current price of 239.71, indicating potential upside for investors.

Strengths and Weaknesses

The following table provides an overview of the strengths and weaknesses of Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN).

| Criterion | Rockwell Automation (ROK) | Nordson Corporation (NDSN) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Strong net margins (15.3%) | Strong net margins (17.4%) |

| Innovation | High investment in R&D | Focus on advanced technology |

| Global presence | Strong international reach | Strong international reach |

| Market Share | Solid in automation sector | Solid in dispensing systems |

| Debt level | Moderate (Debt/Equity: 1.17) | Moderate (Debt/Equity: 0.79) |

Key takeaways include that both companies exhibit strong profitability and global presence. However, Nordson shows higher diversification and a slightly better net profit margin, making it a compelling option for investors seeking stability in the industrial sector.

Risk Analysis

The table below outlines the key risks associated with Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN), along with a brief analysis of their implications.

| Metric | Rockwell Automation (ROK) | Nordson Corporation (NDSN) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | Moderate | High |

| Environmental Risk | High | Moderate |

| Geopolitical Risk | Moderate | Low |

Both companies face significant market and operational risks due to their reliance on global supply chains and manufacturing processes. Recent geopolitical tensions and environmental regulations may further impact their operations, particularly for ROK, which has a higher exposure to market volatility.

Which one to choose?

When comparing Rockwell Automation, Inc. (ROK) and Nordson Corporation (NDSN), fundamental analysis reveals contrasting profiles. ROK has seen a bullish stock trend with a notable price change of 30.08% over the past year, yet carries a lower rating of C- from analysts. In contrast, NDSN’s recent performance reflects a bearish trend with a decline of 4.01%, but it enjoys a higher rating of B+ and better profit margins, including a net profit margin of 17.37% compared to ROK’s 10.44%.

Investors focused on growth may prefer ROK for its recent momentum, while those prioritizing stability and solid fundamentals may find NDSN more appealing.

However, both companies face risks from market dependence and competition within their industries.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rockwell Automation, Inc. and Nordson Corporation to enhance your investment decisions: