In the rapidly evolving landscape of quantum technology, two companies stand out: Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ). Both firms are at the forefront of innovation within the technology sector, focusing on unique aspects of quantum computing and cybersecurity. Rigetti specializes in building quantum computers, while Arqit develops advanced encryption solutions. As we explore their market strategies and potential, I’ll help you determine which of these intriguing companies might be the right addition to your investment portfolio.

Table of contents

Company Overview

Rigetti Computing, Inc. Overview

Rigetti Computing, Inc. is a pioneer in the field of quantum computing, focused on developing integrated quantum systems and superconducting quantum processors. Founded in 2013 and headquartered in Berkeley, California, Rigetti aims to revolutionize computational capabilities by making quantum computing accessible through its Quantum Cloud Services platform. With a market capitalization of approximately $8.6B, Rigetti is positioned as a key player in the technology sector, particularly in computer hardware. The company has a workforce of 137 employees and has shown significant growth since its IPO in April 2021.

Arqit Quantum Inc. Overview

Arqit Quantum Inc. specializes in cybersecurity, leveraging both satellite and terrestrial platforms to provide innovative solutions. Based in London, UK, Arqit’s flagship product, QuantumCloud, allows devices to create secure encryption keys seamlessly. With a market capitalization of about $394M, the company operates in the software infrastructure industry and has been actively trading since its IPO in April 2021. Arqit employs 82 individuals and is recognized for its forward-thinking approach to security, especially in an increasingly digital world.

Key similarities between Rigetti and Arqit include their focus on quantum technology and a commitment to innovative solutions within the technology sector. However, they differ in their core offerings, with Rigetti concentrating on quantum computing hardware and Arqit focusing on cybersecurity software solutions.

Income Statement Comparison

The following table summarizes the most recent income statements for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ), highlighting key financial metrics for your analysis.

| Metric | RGTI | ARQQ |

|---|---|---|

| Revenue | 10.79M | 0.29M |

| EBITDA | -190.83M | -20.19M |

| EBIT | -197.73M | -23.75M |

| Net Income | -200.99M | -54.58M |

| EPS | -1.09 | -10.79 |

Interpretation of Income Statement

In the most recent year, RGTI reported a revenue decline while ARQQ faced significant revenue challenges, dropping substantially from prior periods. RGTI’s net income worsened, reflecting deeper losses, while ARQQ’s net income also showed a notable decline, indicating ongoing operational difficulties. Both companies are grappling with negative EBITDA and EBIT, underscoring a lack of profitability and operational efficiency. RGTI’s and ARQQ’s financials suggest that both firms are in a tough market environment, possibly requiring strategic adjustments to improve future performance.

Financial Ratios Comparison

The table below presents a comparative analysis of financial ratios for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) based on the most recent data available.

| Metric | RGTI | ARQQ |

|---|---|---|

| ROE | -1.59 | -4.62 |

| ROIC | -0.25 | -1.67 |

| P/E | -14.02 | -0.53 |

| P/B | 22.26 | 2.44 |

| Current Ratio | 17.42 | 1.94 |

| Quick Ratio | 17.42 | 1.94 |

| D/E | 0.07 | 0.08 |

| Debt-to-Assets | 0.03 | 0.08 |

| Interest Coverage | -21.05 | -110.72 |

| Asset Turnover | 0.038 | 0.011 |

| Fixed Asset Turnover | 0.205 | 0.272 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit concerning financial health, with negative returns on equity (ROE) and invested capital (ROIC), indicating poor profitability. RGTI shows a significantly higher current and quick ratio, suggesting better liquidity compared to ARQQ. However, both firms lack dividends, reflecting their reinvestment focus amidst operational challenges. RGTI’s lower debt ratios indicate a more conservative approach, while ARQQ struggles with severe interest coverage issues. Caution is warranted for potential investors in these stocks.

Dividend and Shareholder Returns

Rigetti Computing, Inc. (RGTI) does not pay dividends, reflecting its focus on reinvesting in growth and innovation during a challenging financial period. The company has faced negative net income and high expenses, indicating risks in sustainability. Meanwhile, Arqit Quantum Inc. (ARQQ) also refrains from dividends, prioritizing research and development during its high-growth phase. Both companies engage in share buybacks, which may bolster shareholder value, but their lack of dividends may not foster sustainable long-term returns.

Strategic Positioning

In the current landscape of quantum computing, Rigetti Computing, Inc. (RGTI) commands a significant market share with its advanced quantum processors and integrated Quantum Cloud Services platform. With a market cap of 8.61B, it faces competitive pressure from emerging players like Arqit Quantum Inc. (ARQQ), which focuses on cybersecurity through quantum technology. Both companies must navigate technological disruptions, as advancements in quantum computing continue to reshape the industry, demanding agility and innovation to maintain their positions.

Stock Comparison

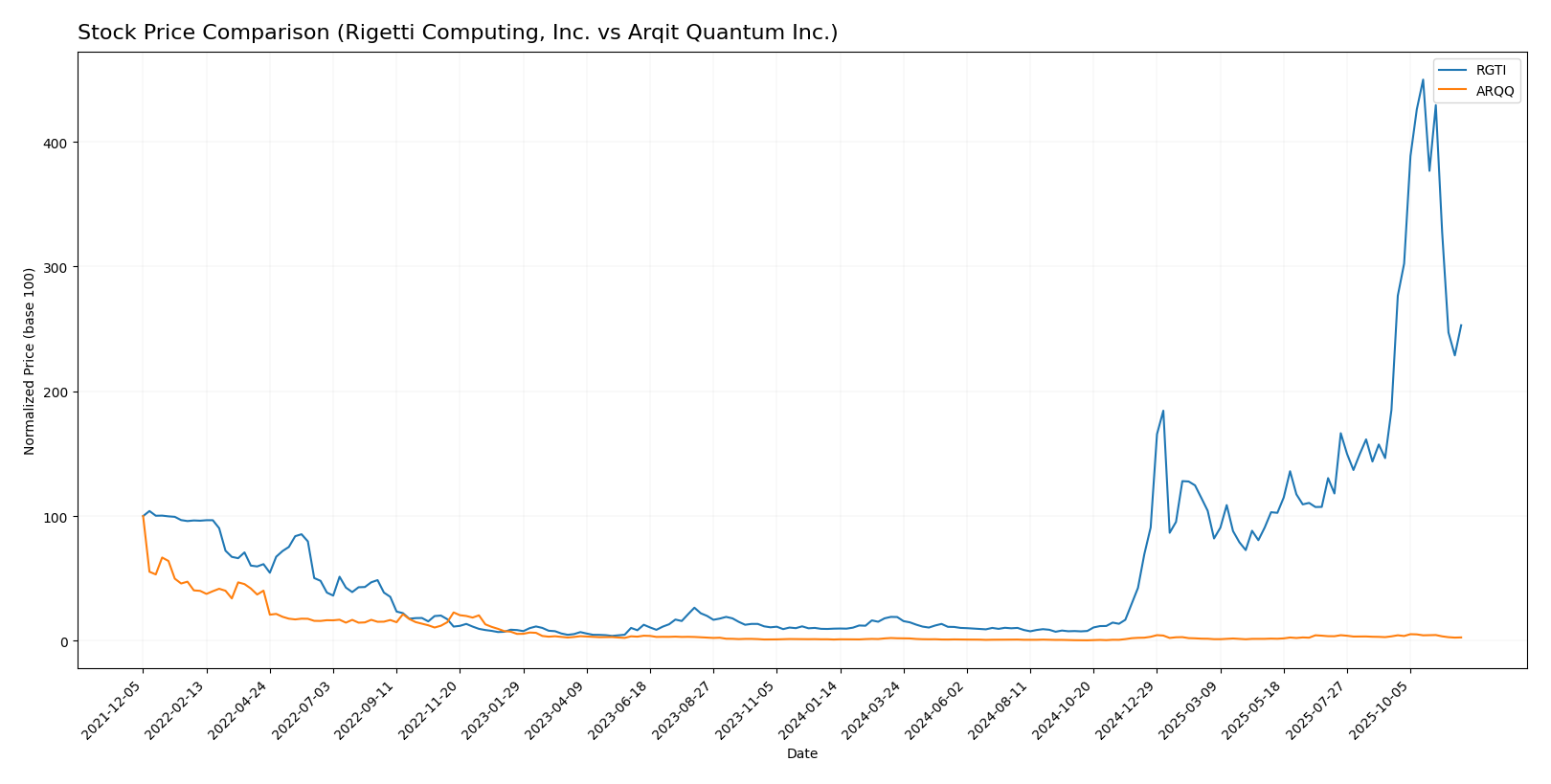

Over the past year, Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) have exhibited significant price movements, reflecting diverse trading dynamics that warrant close examination.

Trend Analysis

For RGTI, the overall price change over the past year stands at an impressive +2482.18%. This indicates a strong bullish trend, although the acceleration is showing signs of deceleration. The stock has reached notable highs of $46.38 and lows of $0.75. The recent analysis from September 14, 2025, to November 30, 2025, shows a price change of +36.62%, with a trend slope of -0.16. The standard deviation of 8.74 suggests some volatility, but overall, the stock remains in a bullish trajectory.

In contrast, ARQQ has experienced a price change of +156.12% over the same timeframe, also categorizing the trend as bullish. However, recent performance from September 14, 2025, to November 30, 2025, reveals a decline of -23.64%, with a trend slope of -1.4. This indicates a challenging short-term outlook, particularly given the standard deviation of 8.24. The stock’s highs and lows are $49.92 and $4.19, respectively, suggesting that while the longer-term trend is still bullish, recent performance has been under pressure.

In summary, RGTI demonstrates a strong long-term upward momentum despite recent deceleration, while ARQQ reflects a mixed outlook with a solid long-term gain but recent declines. As always, careful consideration of market conditions and individual risk tolerance is advised before making investment decisions.

Analyst Opinions

Recent analyst recommendations indicate a cautious stance on both Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ). RGTI has received a “C-” rating with concerns highlighted by analysts regarding its financial metrics, particularly with a low overall score of 1, suggesting a potential sell. In contrast, ARQQ holds a slightly better “C” rating, but still reflects significant risks, driving a consensus to hold rather than buy. Analysts recommend careful monitoring of both stocks, considering their current performance and future outlook.

Stock Grades

In the current investment landscape, understanding stock grades can help you make informed decisions. Here are the latest grades for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ).

Rigetti Computing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

Arqit Quantum Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Overall, Rigetti Computing shows a mix of stability and cautious downgrades, with several maintain ratings from reputable firms. Conversely, Arqit Quantum Inc. maintains a consistent “Buy” rating across all evaluations, suggesting strong investor confidence despite the lack of upward revisions.

Target Prices

The consensus target prices for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) suggest varied expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rigetti Computing, Inc. | 42 | 18 | 33.33 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

For RGTI, the consensus target price of 33.33 indicates an upside potential from the current price of 26.08. In contrast, ARQQ’s target price of 60 suggests strong expectations, significantly above its current price of 25.74.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) based on recent data.

| Criterion | Rigetti Computing, Inc. (RGTI) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate (focus on quantum computing) | Low (primarily cybersecurity) |

| Profitability | Negative margins (-18.63%) | Negative margins (-186.28%) |

| Innovation | High (quantum technology) | Moderate (cybersecurity solutions) |

| Global presence | Limited (primarily US) | Growing (UK focus) |

| Market Share | Niche player | Emerging player |

| Debt level | Low (debt to equity ratio: 0.07) | Moderate (debt to equity ratio: 0.12) |

Key takeaways show that while Rigetti has a strong focus on innovation and low debt, it struggles with profitability. In contrast, Arqit offers a growing presence in cybersecurity but faces significant profitability challenges. Both companies are operating in niche markets with high potential but also high risks.

Risk Analysis

The following table summarizes the key risks associated with Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ).

| Metric | Rigetti Computing (RGTI) | Arqit Quantum (ARQQ) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant operational and market risks due to their innovative nature and dependence on technology. Regulatory pressures, particularly for ARQQ, may have substantial impacts on business continuity and growth.

Which one to choose?

When comparing Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ), I note that both companies are currently grappling with significant financial challenges. RGTI shows a gross profit margin of 52.8% but is struggling with a negative net profit margin of -18.6%. In contrast, ARQQ has a negative net profit margin of -186.3% despite a gross profit margin of -5.4%. Analysts rate RGTI with a C- and ARQQ with a C, indicating a slight advantage for RGTI in terms of fundamentals. However, RGTI has a bullish stock trend with a remarkable 2482% price change, while ARQQ’s recent trend has declined by 23.6%.

For investors focused on growth, RGTI appears to offer a more favorable trajectory, while those prioritizing stability may find ARQQ’s situation concerning.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rigetti Computing, Inc. and Arqit Quantum Inc. to enhance your investment decisions: