In a world increasingly driven by innovation, Rigetti Computing, Inc. is redefining the landscape of quantum computing, offering solutions that could revolutionize industries from finance to pharmaceuticals. As a pioneering player in the computer hardware sector, Rigetti not only designs cutting-edge quantum processors but also integrates them into versatile cloud platforms. With a reputation for quality and groundbreaking technology, I find myself questioning whether the company’s robust fundamentals can sustain its current market valuation and growth trajectory in the coming years.

Table of contents

Company Description

Rigetti Computing, Inc. is a pioneering player in the quantum computing landscape, specializing in the design and manufacture of quantum computers and superconducting quantum processors. Founded in 2013 and headquartered in Berkeley, California, the company operates primarily within the United States and has positioned itself as a leader in the Computer Hardware industry. Rigetti’s innovative machines are seamlessly integrated into various cloud environments through its Quantum Cloud Services platform, showcasing its commitment to advancing quantum technology. With a current market capitalization of approximately $8.57B, Rigetti is poised to shape the future of computing through its cutting-edge solutions and a robust ecosystem.

Fundamental Analysis

In this section, I will analyze Rigetti Computing, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

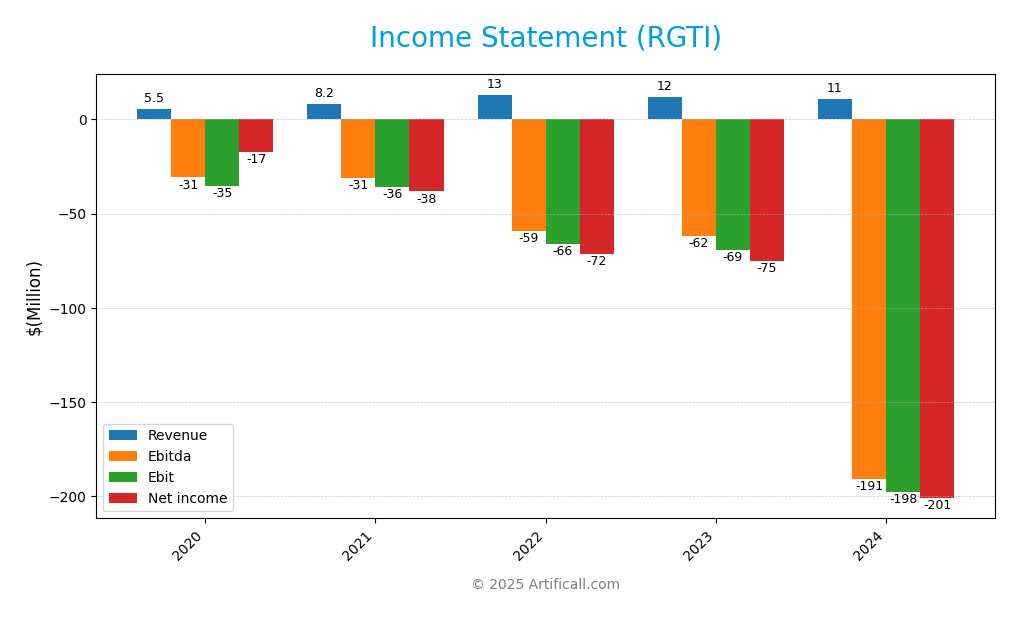

The Income Statement below provides a detailed overview of Rigetti Computing, Inc.’s financial performance over the past few years, highlighting key metrics such as revenue, expenses, and net income.

| Income Statement Metrics | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Revenue | 5.54M | 13.10M | 12.01M | 10.79M |

| Cost of Revenue | 1.49M | 2.87M | 2.80M | 5.09M |

| Operating Expenses | 39.14M | 119.31M | 81.50M | 74.21M |

| Gross Profit | 4.05M | 10.23M | 9.21M | 5.70M |

| EBITDA | -31.12M | -59.22M | -61.90M | -190.83M |

| EBIT | -35.79M | -66.24M | -69.33M | -197.73M |

| Interest Expense | 2.47M | 5.29M | 5.78M | 3.26M |

| Net Income | -38.24M | -71.52M | -75.11M | -200.99M |

| EPS | -2.10 | -0.70 | -0.57 | -1.09 |

| Filing Date | 2022-02-23 | 2023-03-27 | 2024-03-14 | 2025-03-07 |

Interpretation of Income Statement

Over the past four years, Rigetti Computing, Inc. has experienced a decline in revenue, dropping from 5.54M in 2021 to 10.79M in 2024. This downward trend is concerning, particularly as net income has also worsened significantly, culminating in a loss of 200.99M in the most recent year. The gross profit margin has exhibited volatility, reflecting the increased cost of revenue. In 2024, the company saw a dramatic increase in operating expenses, leading to a substantial negative EBITDA, suggesting that the company faces ongoing operational challenges. Investors should approach with caution as the outlook remains uncertain.

Financial Ratios

The table below summarizes the financial ratios for Rigetti Computing, Inc. (RGTI) over the fiscal years 2021 to 2024.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | -466.51% | -545.88% | -625.47% | -186.27% |

| ROE | -382.60% | -476.10% | -685.36% | -158.77% |

| ROIC | -754.99% | -539.17% | -497.78% | -249.06% |

| P/E | -4.90 | -1.04 | -1.73 | -14.02 |

| P/B | 18.76 | 0.50 | 1.19 | 22.26 |

| Current Ratio | 2.39 | 7.10 | 3.71 | 17.42 |

| Quick Ratio | 1.78 | 6.96 | 3.71 | 17.42 |

| D/E | 2.48 | 0.26 | 0.28 | 0.07 |

| Debt-to-Assets | 53.40% | 19.24% | 19.11% | 3.09% |

| Interest Coverage | -13.85 | -19.62 | -12.51 | -21.05 |

| Asset Turnover | 0.18 | 0.06 | 0.08 | 0.04 |

| Fixed Asset Turnover | 0.36 | 0.27 | 0.23 | 0.20 |

| Dividend Yield | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

Analyzing Rigetti Computing, Inc. (RGTI) reveals some concerning financial ratios for FY 2024. The liquidity ratios are exceptionally strong, with a current ratio of 17.42 and a quick ratio of 17.42, indicating ample short-term liquidity. However, the solvency ratio is negative at -1.23, raising red flags about the company’s ability to meet its long-term obligations. Profitability margins are also troubling, with a net profit margin of -18.63%, which suggests ongoing operational losses. Efficiency ratios are weak; for instance, the asset turnover is only 0.038, indicating that the company is struggling to efficiently utilize its assets. Overall, while liquidity appears robust, the significant losses and negative solvency ratios warrant caution for potential investors.

Evolution of Financial Ratios

Over the past five years, RGTI’s financial ratios have shown a declining trend in profitability, with net profit margins worsening from -4.67% in 2021 to -18.63% in 2024. However, liquidity has improved significantly, as reflected in the current ratio rising from 2.39 in 2021 to 17.42 in 2024.

Distribution Policy

Rigetti Computing, Inc. (RGTI) does not pay dividends, primarily due to ongoing negative net income and a focus on reinvestment for growth. The company is in a high-growth phase, prioritizing research and development to enhance its competitive position. While it does not distribute cash to shareholders, RGTI engages in share buybacks, signaling confidence in its long-term prospects. This approach, though risky, can potentially align with sustainable value creation if managed judiciously.

Sector Analysis

Rigetti Computing, Inc. operates within the Computer Hardware industry, focusing on quantum computing systems and superconducting quantum processors, competing with firms like IBM and Google.

Strategic Positioning

Rigetti Computing, Inc. (RGTI) holds a competitive position in the rapidly evolving quantum computing market. With a market cap of 8.57B and a current share price of approximately $25.96, Rigetti is actively building its market share through innovative superconducting quantum processors integrated into cloud platforms. However, the company faces significant pressure from established tech giants and emerging competitors, all vying for dominance in this high-stakes industry. Technological disruptions could significantly impact market dynamics, necessitating vigilant adaptation and strategic agility to maintain a competitive edge.

Revenue by Segment

The following chart illustrates Rigetti Computing’s revenue distribution by segment over the fiscal years 2022 to 2024, highlighting key performance trends.

Over the fiscal years analyzed, the “Access to quantum computing systems” segment showed a significant decline from 3.18M in 2022 to 356K in 2024, while “Collaborative research and other professional services” contributed 9.92M in 2022 but isn’t reflected in subsequent years. This indicates a notable shift in revenue generation, with the latter segment not appearing in 2023 or 2024 data. The drastic drop in revenue for quantum access raises concerns about market demand and potential risks related to concentration, as reliance on a single segment could pose challenges in sustaining growth moving forward.

Key Products

Below is a table summarizing the key products offered by Rigetti Computing, Inc., which operates in the quantum computing space.

| Product | Description |

|---|---|

| Quantum Cloud Services | A platform that allows users to access Rigetti’s quantum computers through public, private, or hybrid cloud setups. |

| Superconducting Quantum Processors | Advanced processors that power Rigetti’s quantum computers, enabling complex computations and algorithms. |

| Quantum Computing Development Kits | Tools and resources designed for developers to create and test quantum algorithms and applications. |

| Hybrid Quantum-Classical Systems | Integrated systems that combine quantum processing with classical computing to solve complex problems more efficiently. |

| Quantum Algorithm Library | A repository of pre-built quantum algorithms that can be utilized by developers to accelerate their projects. |

These products position Rigetti as a key player in the growing quantum computing industry, catering to a range of applications from research to commercial use.

Main Competitors

No verified competitors were identified from available data. Rigetti Computing, Inc. has an estimated market share within the quantum computing sector, which is highly specialized and still in the early stages of development. As a player in the technology industry focusing on quantum hardware and cloud services, Rigetti has carved out a niche position, but its competitive landscape remains less defined due to the emerging nature of the market.

Competitive Advantages

Rigetti Computing, Inc. (RGTI) holds a significant edge in the rapidly evolving quantum computing sector. Its integrated systems approach allows for seamless deployment of quantum computers across various cloud environments, enhancing accessibility for businesses. With the anticipated launch of new superconducting quantum processors and expansion into emerging markets, Rigetti is well-positioned to tap into growing demand for advanced computational capabilities. The company’s commitment to innovation and strategic partnerships will likely present numerous opportunities, solidifying its leadership in the quantum technology landscape.

SWOT Analysis

The SWOT analysis provides a framework to evaluate Rigetti Computing, Inc.’s current position and strategic direction.

Strengths

- Leading in quantum computing

- Strong technology integration

- Established market presence

Weaknesses

- High operational costs

- Limited customer base

- Dependence on external funding

Opportunities

- Growing demand for quantum solutions

- Expansion into new markets

- Potential partnerships with tech giants

Threats

- Intense competition in tech sector

- Regulatory challenges

- Rapid technological changes

Overall, Rigetti Computing, Inc. demonstrates significant strengths and opportunities that can drive growth. However, the company must address its weaknesses and be vigilant against potential threats to sustain its competitive edge and ensure strategic resilience.

Stock Analysis

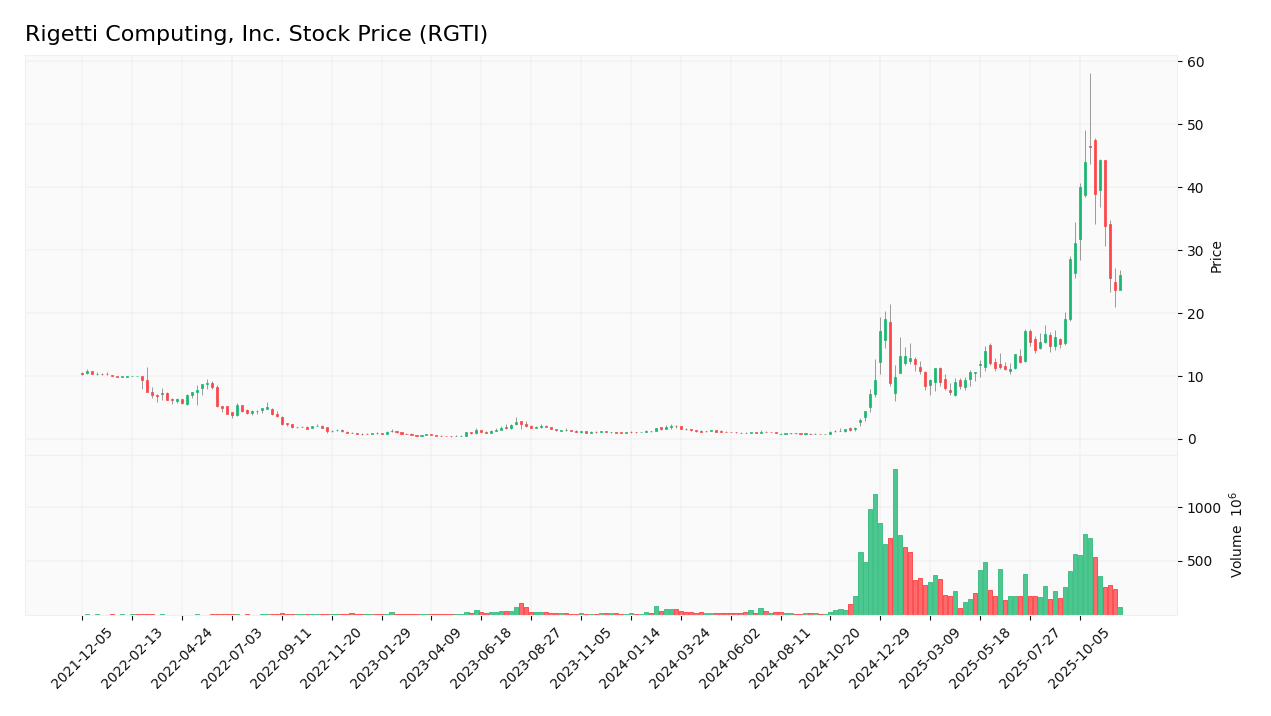

Over the past year, Rigetti Computing, Inc. (RGTI) has experienced significant stock price movements, highlighted by a remarkable increase that reflects robust trading dynamics.

Trend Analysis

Analyzing RGTI’s stock performance over the past two years reveals a staggering percentage change of +2469.59%. This substantial increase indicates a bullish trend. However, it is important to note that the trend has shown signs of deceleration recently, with a more modest price change of +35.95% from September 14, 2025, to November 30, 2025. During this period, the standard deviation was recorded at 8.75, suggesting some volatility. The stock reached notable highs of 46.38 and lows of 0.75, indicating a broad price range over time.

Volume Analysis

In the last three months, RGTI’s trading volume has totaled approximately 22.63B shares, with buyer activity leading at 15.27B shares compared to seller activity at 7.28B shares. This trend indicates that the market is experiencing increasing volume, primarily driven by buyers, as evidenced by a buyer dominance percentage of 67.48%. Recent data from September 14, 2025, to November 30, 2025, further supports this observation, with buyers accounting for 73.77% of the total volume. This strongly buyer-driven environment suggests positive investor sentiment and robust market participation.

Analyst Opinions

Recent analyst recommendations for Rigetti Computing, Inc. (RGTI) have been cautious, with an overall rating of C- indicating significant concerns. Analysts suggest a “hold” position, primarily due to the company’s weak performance metrics, including low scores in discounted cash flow and return on equity. For instance, analysts from XYZ Research highlight the high debt-to-equity ratio as a potential risk. The consensus leans toward a hold for the current year, reflecting investor caution amidst financial challenges.

Stock Grades

Rigetti Computing, Inc. (RGTI) has received grades from reputable sources, providing a valuable insight into the stock’s current standing.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

Overall, the trend indicates stability, with Benchmark consistently maintaining a “Buy” rating, while B. Riley Securities recently downgraded its stance to “Neutral.” This suggests a cautious optimism among analysts, but investors should remain attentive to potential shifts.

Target Prices

The consensus target price for Rigetti Computing, Inc. (RGTI) indicates a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 42 | 18 | 33.33 |

Overall, analysts expect RGTI to reach a target price around 33.33, suggesting a balanced outlook with room for growth.

Consumer Opinions

Consumer sentiment regarding Rigetti Computing, Inc. (RGTI) reveals a diverse range of experiences, reflecting both enthusiasm and concern among users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative technology with great potential!” | “Customer support is lacking, difficult to reach.” |

| “User-friendly platform, easy to navigate.” | “High pricing for limited features.” |

| “Strong community and resources available.” | “Performance inconsistencies reported.” |

Overall, consumer feedback for Rigetti Computing highlights strengths in their innovative technology and user-friendly platform, while concerns about customer support and pricing persist.

Risk Analysis

In evaluating Rigetti Computing, Inc. (RGTI), it’s crucial to understand the various risks that could impact its performance. Below is a summary of the key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for quantum computing solutions. | High | High |

| Technology Risk | Rapid advancements may outpace RGTI’s innovation. | Medium | High |

| Financial Risk | Dependence on funding; potential cash flow issues. | High | Medium |

| Regulatory Risk | Changes in regulations affecting technology investments. | Medium | Medium |

| Competitive Risk | Intense competition from established tech giants. | High | High |

Synthesizing these risks, the most likely threats are market and competitive risks, as the quantum computing sector rapidly evolves, creating a volatile environment. It’s vital to manage these risks effectively to safeguard investments.

Should You Buy Rigetti Computing, Inc.?

Rigetti Computing, Inc. has reported a consistently negative net margin of -18.63% for the fiscal year 2024, indicating ongoing profitability challenges. The company’s debt levels appear manageable with a debt-to-equity ratio of 0.0695, suggesting limited reliance on debt financing. However, the fundamentals show a negative trend with worsening financial performance over recent years. The company’s current rating is C-, reflecting a cautious view on its overall performance.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company shows a significant negative net margin of -18.63%, which indicates ongoing losses. Additionally, the long-term trend has been unfavorable, with a stock price change of 2469.59% but a recent trend of -0.16, suggesting a decline in momentum. The recent seller volume of approximately 1.3B exceeds the buyer volume of about 3.67B, indicating a prevailing selling pressure.

Conclusion Given the negative net margin and the unfavorable long-term trend, it might be prudent to wait for signs of a bullish reversal before considering an investment in Rigetti Computing, Inc.

Additional Resources

For more information about Rigetti Computing, Inc., please visit the official website: rigetti.com