In the fast-paced world of semiconductors, Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI) are two key players vying for investor attention. Both companies specialize in advanced process control systems that are essential for semiconductor manufacturing, yet their approaches and market strategies differ significantly. As we delve deeper into their operations and innovations, I aim to guide you in determining which company may offer the most promising investment opportunity. Let’s explore the strengths and potential of these two industry leaders.

Table of contents

Company Overview

Onto Innovation Inc. Overview

Onto Innovation Inc. is a leading player in the semiconductor industry, focusing on the design, development, and manufacture of advanced process control tools. The company specializes in macro defect inspection, 2D/3D optical metrology, and lithography systems, catering to a global clientele that includes semiconductor and advanced packaging device manufacturers. Founded in 1940 and headquartered in Wilmington, Massachusetts, Onto Innovation has carved a niche by providing innovative solutions that enhance process and yield management. With a market capitalization of approximately $6.95B, Onto has shown resilience and growth in a competitive landscape, evidenced by its diverse product offerings and comprehensive support services.

Nova Ltd. Overview

Nova Ltd., headquartered in Rehovot, Israel, is a prominent provider of process control systems for the semiconductor manufacturing sector. Incorporated in 1993, Nova specializes in metrology platforms that support various manufacturing processes, including lithography, etch, and advanced packaging. The company’s focus on delivering precise measurements and insights has positioned it as a trusted partner for integrated circuit manufacturers worldwide. With a market capitalization of around $9.16B, Nova continues to innovate and expand its portfolio, serving clients across multiple geographic regions such as the U.S., Taiwan, and China.

Key similarities between Onto Innovation and Nova Ltd. include their focus on the semiconductor industry and their provision of process control solutions. However, they differ in their specific product offerings and geographical focus, with Onto emphasizing macro defect inspection and Nova focusing on a broader range of metrology platforms for various manufacturing processes.

Income Statement Comparison

In this section, I present a comparative analysis of the most recent income statements of Onto Innovation Inc. and Nova Ltd. to help you gauge their financial performance.

| Metric | Onto Innovation Inc. | Nova Ltd. |

|---|---|---|

| Revenue | 987M | 672M |

| EBITDA | 249M | 205M |

| EBIT | 187M | 188M |

| Net Income | 202M | 184M |

| EPS | 4.09 | 6.31 |

Interpretation of Income Statement

Overall, both companies have shown significant growth in revenue, with Onto Innovation increasing from 816M to 987M, and Nova Ltd. rising from 518M to 672M. Notably, Onto’s net income surged from 121M to 202M, reflecting strong operational efficiency. While Onto improved its EBITDA margin, Nova maintained its stability in margins, showing effective cost management. The latest year’s performance indicates Onto’s accelerated growth trajectory, whereas Nova experienced a more moderate increase, suggesting potential market challenges. Overall, both firms remain solid investment choices, but I recommend monitoring their growth strategies closely.

Financial Ratios Comparison

In the table below, I present a comparative analysis of the most recent financial ratios for Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI). This will help you assess their financial health and performance.

| Metric | Onto Innovation Inc. (ONTO) | Nova Ltd. (NVMI) |

|---|---|---|

| ROE | 10.47% | 19.81% |

| ROIC | 8.74% | 13.39% |

| P/E | 41.76 | 31.20 |

| P/B | 4.37 | 6.18 |

| Current Ratio | 8.69 | 2.32 |

| Quick Ratio | 7.00 | 1.92 |

| D/E | 0.01 | 0.25 |

| Debt-to-Assets | 0.007 | 0.170 |

| Interest Coverage | N/A | 116.20 |

| Asset Turnover | 0.47 | 0.48 |

| Fixed Asset Turnover | 7.16 | 5.06 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The analysis reveals that Onto Innovation has strong liquidity ratios, with an exceptionally high current and quick ratio, indicating a solid short-term financial position. However, its high P/E ratio relative to Nova suggests that investors may have higher expectations for Onto’s growth. Nova Ltd. displays better profitability metrics such as ROE and ROIC, indicating a more efficient use of equity and capital. Both companies show zero dividends, which implies they might be reinvesting profits for growth.

Dividend and Shareholder Returns

Both Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI) do not currently pay dividends, focusing instead on reinvesting profits for growth during their high-growth phases. This strategy aligns with long-term shareholder value creation, especially as both companies exhibit strong net profit margins (204% for ONTO and 273% for NVMI). Notably, both firms engage in share buybacks, reflecting a commitment to enhancing shareholder value through capital returns. Overall, their approaches appear sustainable for long-term growth.

Strategic Positioning

In the semiconductor industry, Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI) are key players, each holding significant market shares in process control systems. ONTO, with a market cap of 6.95B, focuses on macro defect inspection and optical metrology, while NVMI, valued at 9.16B, specializes in metrology platforms for various semiconductor processes. Both companies face competitive pressure and technological disruptions, necessitating continuous innovation to maintain their positions in this rapidly evolving market.

Stock Comparison

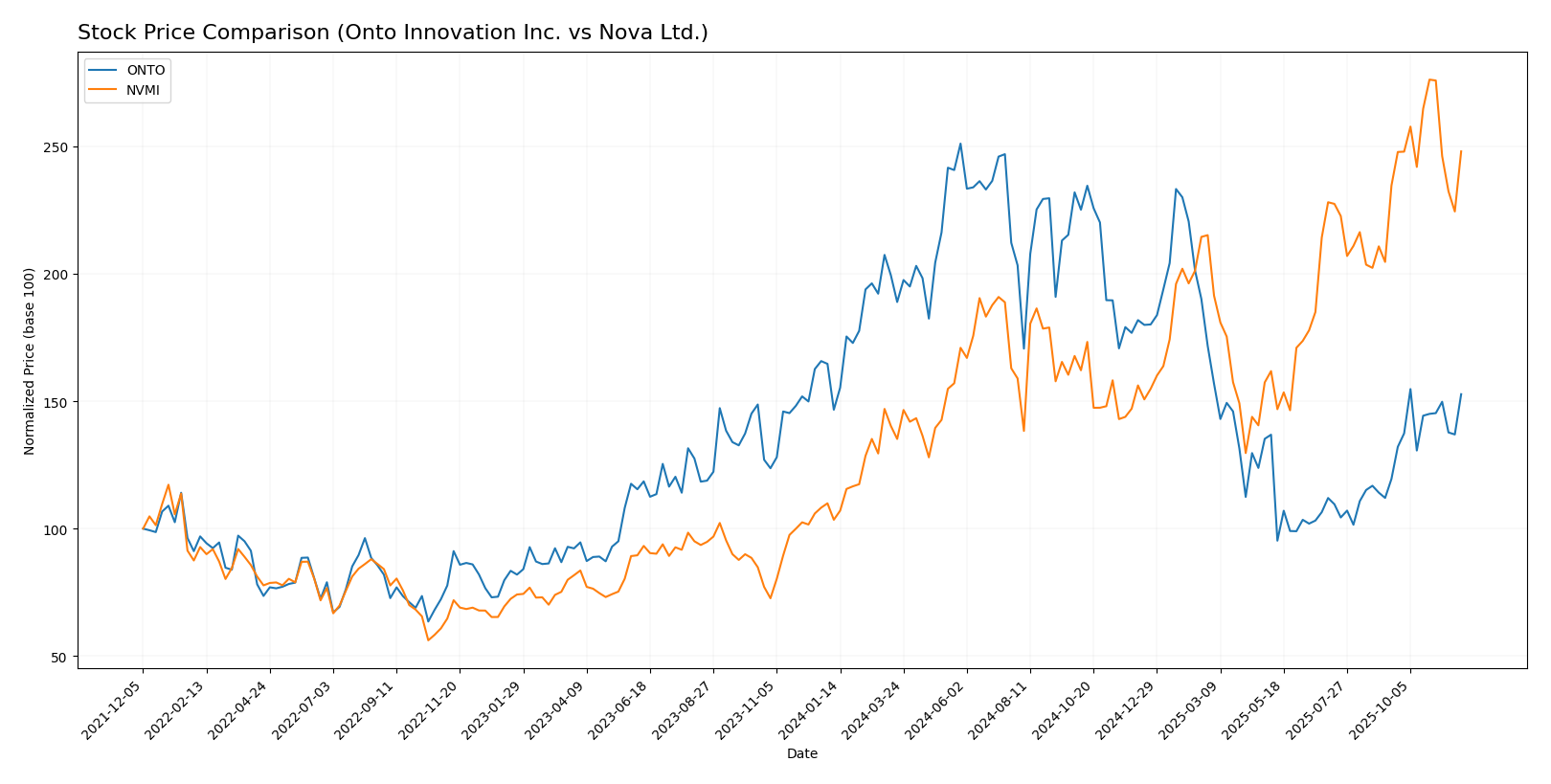

Over the past year, Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI) have exhibited notable price movements and trading dynamics, reflecting their respective market performances and investor sentiment.

Trend Analysis

Onto Innovation Inc. (ONTO) has shown a percentage change of 4.16% over the past year, indicating a bullish trend. The stock has experienced notable acceleration, with a standard deviation of 42.33, suggesting higher volatility. The highest price reached was 233.14, while the lowest was 88.5.

In the recent period from September 14, 2025, to November 30, 2025, the stock’s price change was 27.82%, with a standard deviation of 9.03. This further emphasizes the stock’s strong upward momentum.

Nova Ltd. (NVMI) has demonstrated a remarkable percentage change of 139.63% over the past year, confirming a bullish trend. However, the acceleration status indicates deceleration, with a standard deviation of 48.46, which points to considerable volatility. The stock’s highest price was 345.06, and the lowest was 129.32.

For the recent period from September 14, 2025, to November 30, 2025, the price change was 5.73%, with a standard deviation of 19.5. The trend slope is negative at -0.51, suggesting a potential stabilization after a period of significant growth.

In summary, while both stocks show bullish trends, ONTO demonstrates acceleration, whereas NVMI is experiencing a deceleration in momentum. Risk management should be a priority for investors given the observed volatility.

Analyst Opinions

Recent analyst recommendations for Onto Innovation Inc. (ONTO) show a rating of B, indicating a hold position based on solid performance indicators, particularly in return on assets (4). Analysts suggest that while growth is stable, caution is warranted due to a lower debt-to-equity score (1). For Nova Ltd. (NVMI), the consensus is B+, with analysts highlighting strong return on equity (4) and assets (5), suggesting a buy. Overall, the consensus for ONTO is hold, while NVMI leans towards buy for the current year.

Stock Grades

The latest stock ratings reveal a stable outlook for both Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI), with several maintain actions from reputable grading companies.

Onto Innovation Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

| B. Riley Securities | Maintain | Buy | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-08 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-06-24 |

Nova Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| B of A Securities | Maintain | Buy | 2025-06-24 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-24 |

| Citigroup | Maintain | Buy | 2025-05-09 |

| Benchmark | Maintain | Buy | 2025-05-09 |

| B of A Securities | Maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-14 |

| Benchmark | Maintain | Buy | 2025-02-14 |

| Needham | Maintain | Hold | 2025-02-14 |

Overall, both companies show a consistent trend of maintaining strong grades, reflecting a positive sentiment from analysts despite some caution indicated by the Hold and Neutral ratings in Onto Innovation’s case. Investors may consider these insights when evaluating their portfolios.

Target Prices

The current consensus target prices for Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI) suggest potential upward movement based on analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Onto Innovation Inc. | 180 | 120 | 153.33 |

| Nova Ltd. | 224 | 210 | 217 |

For Onto Innovation Inc., the consensus target price of 153.33 is above the current stock price of 141.8, indicating a potential for growth. Similarly, Nova Ltd.’s consensus price of 217 is below its current trading price of 310.351, suggesting a possible overvaluation.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI), two prominent players in the semiconductor industry.

| Criterion | Onto Innovation Inc. | Nova Ltd. |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | High (Net Margin: 20.4%) | High (Net Margin: 26.3%) |

| Innovation | Strong | Very Strong |

| Global presence | Strong | Strong |

| Market Share | Moderate | High |

| Debt level | Very Low (Debt/Equity: 0.007) | Moderate (Debt/Equity: 0.325) |

In summary, both companies demonstrate solid profitability and innovation capacities. However, Nova Ltd. stands out with its higher market share and stronger diversification strategy, while Onto Innovation maintains a very low debt level, showcasing its financial stability.

Risk Analysis

The table below outlines the key risks associated with Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI):

| Metric | Onto Innovation Inc. | Nova Ltd. |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant market and geopolitical risks, particularly given the global landscape’s volatility and regulatory scrutiny in the semiconductor industry. As of recent trends, advancements in technology have heightened competition, which could impact operational efficiency and profitability.

Which one to choose?

In comparing Onto Innovation Inc. (ONTO) and Nova Ltd. (NVMI), both companies exhibit strong fundamentals. ONTO has a market cap of $8.42B and a net profit margin of 20.43%, while NVMI’s market cap stands at $5.73B with a slightly higher net profit margin of 27.33%. However, ONTO’s lower price-to-earnings ratio of 41.76 compared to NVMI’s 31.20 suggests ONTO could be a better value for growth investors. Analysts rate ONTO with a “B” and NVMI with a “B+”, indicating a favorable outlook for both.

Investors focused on growth may prefer NVMI due to its higher recent price momentum (139.63% over the past year), while those prioritizing stability might favor ONTO, given its superior profit margins and strong cash position.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Onto Innovation Inc. and Nova Ltd. to enhance your investment decisions: