In the rapidly evolving semiconductor industry, two giants stand out: NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN). Both companies are pivotal players, yet they adopt distinct innovation strategies and market focuses. NVIDIA excels in graphics processing and AI computing, while Texas Instruments specializes in analog and embedded processing solutions. This article will delve into their strengths and weaknesses, guiding you to determine which company might be the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

NVIDIA Corporation Overview

NVIDIA Corporation, headquartered in Santa Clara, California, has established itself as a leader in the semiconductor industry, particularly known for its graphics processing units (GPUs). The company’s mission revolves around leveraging artificial intelligence (AI) and accelerated computing to enhance various sectors, including gaming, data centers, and automotive applications. With a market capitalization of approximately $4.33T, NVIDIA’s diverse product offerings include GeForce GPUs for gaming, AI-driven data center solutions, and automotive technologies. Its strategic collaborations and innovative approach position NVIDIA at the forefront of technological advancements, making it a key player in shaping the future of computing.

Texas Instruments Incorporated Overview

Texas Instruments Incorporated (TI), based in Dallas, Texas, has been a prominent semiconductor manufacturer since 1930. The company’s mission focuses on creating innovative analog and embedded processing solutions that cater to a wide range of applications, from industrial to automotive sectors. With a market cap of around $147B, TI’s product portfolio includes power management solutions, microcontrollers, and signal chain products. By providing versatile semiconductor solutions that enhance electronic designs, TI maintains a strong market presence and is dedicated to driving technological innovation across diverse industries.

Key Similarities and Differences

Both NVIDIA and Texas Instruments operate within the semiconductor industry, yet they cater to distinct market segments. NVIDIA primarily focuses on graphics and AI solutions, targeting gaming and data center markets, while Texas Instruments emphasizes analog and embedded processing products, serving a broader array of applications across various industries. Their differing approaches reflect unique business models that, while rooted in technology, highlight their specialization within the semiconductor landscape.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN), highlighting their financial performance metrics.

| Metric | NVIDIA Corporation (NVDA) | Texas Instruments Incorporated (TXN) |

|---|---|---|

| Revenue | 130.5B | 15.6B |

| EBITDA | 86.1B | 7.5B |

| EBIT | 84.3B | 5.9B |

| Net Income | 72.9B | 4.8B |

| EPS | 2.97 | 5.24 |

Interpretation of Income Statement

In the latest fiscal year, NVIDIA exhibited remarkable revenue growth, soaring to 130.5B, significantly up from previous years. This growth translated into a net income of 72.9B, showcasing the company’s robust operating effectiveness. Conversely, Texas Instruments reported a decline in revenue to 15.6B, with a net income of 4.8B, reflecting the ongoing challenges in the semiconductor industry. Despite these fluctuations, NVIDIA’s margins remained strong, suggesting improved efficiency, while TXN’s decline in revenue indicates potential market share loss or pricing pressure. Overall, NVIDIA’s performance signals a solid investment opportunity, whereas Texas Instruments presents caution due to its declining revenue trajectory.

Financial Ratios Comparison

In this section, I present a comparative analysis of key financial ratios for NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN), based on the most recent data.

| Metric | NVDA | TXN |

|---|---|---|

| ROE | 92% | 28% |

| ROIC | 75% | 15% |

| P/E | 40 | 24 |

| P/B | 37 | 9 |

| Current Ratio | 4.44 | 4.12 |

| Quick Ratio | 3.88 | 2.88 |

| D/E | 0.13 | 0.80 |

| Debt-to-Assets | 9% | 35% |

| Interest Coverage | 330 | 11 |

| Asset Turnover | 1.17 | 0.54 |

| Fixed Asset Turnover | 16.16 | 1.38 |

| Payout Ratio | 1.14% | 70% |

| Dividend Yield | 0.03% | 2.80% |

Interpretation of Financial Ratios

NVIDIA demonstrates exceptionally strong profitability and efficient use of capital, with a very high ROE and ROIC compared to Texas Instruments. The P/E and P/B ratios indicate that NVDA is trading at a premium, reflecting high growth expectations. On the other hand, TXN’s ratios suggest a more conservative approach, with a greater reliance on debt and higher payout ratios, which could raise concerns about financial flexibility. Overall, NVDA appears to be in a stronger position, though it carries higher valuation risks.

Dividend and Shareholder Returns

NVIDIA (NVDA) has a modest dividend with a payout ratio of approximately 1.1%, offering an annual yield of 0.03%. Its low payout is sustainable, supported by robust free cash flow, though ongoing share buybacks may pose risks if not managed prudently. In contrast, Texas Instruments (TXN) exhibits a strong commitment to returning value, with a payout ratio nearing 99.9% and a yield of 2.8%. This strategy, while rewarding shareholders, raises concerns about sustainability. Overall, both companies indicate a focus on shareholder returns, yet the differing levels of risk associated with their distributions warrant careful consideration.

Strategic Positioning

NVIDIA Corporation (NVDA) holds a dominant position in the semiconductor industry, particularly in graphics processing units (GPUs), with a significant market share in gaming and data center solutions. Its innovative technologies face competitive pressure from Texas Instruments (TXN), which excels in analog and embedded processing components. Both companies are navigating rapid technological disruptions, but NVIDIA’s AI-driven advancements provide a notable edge. I recommend keeping an eye on market trends as these dynamics evolve.

Stock Comparison

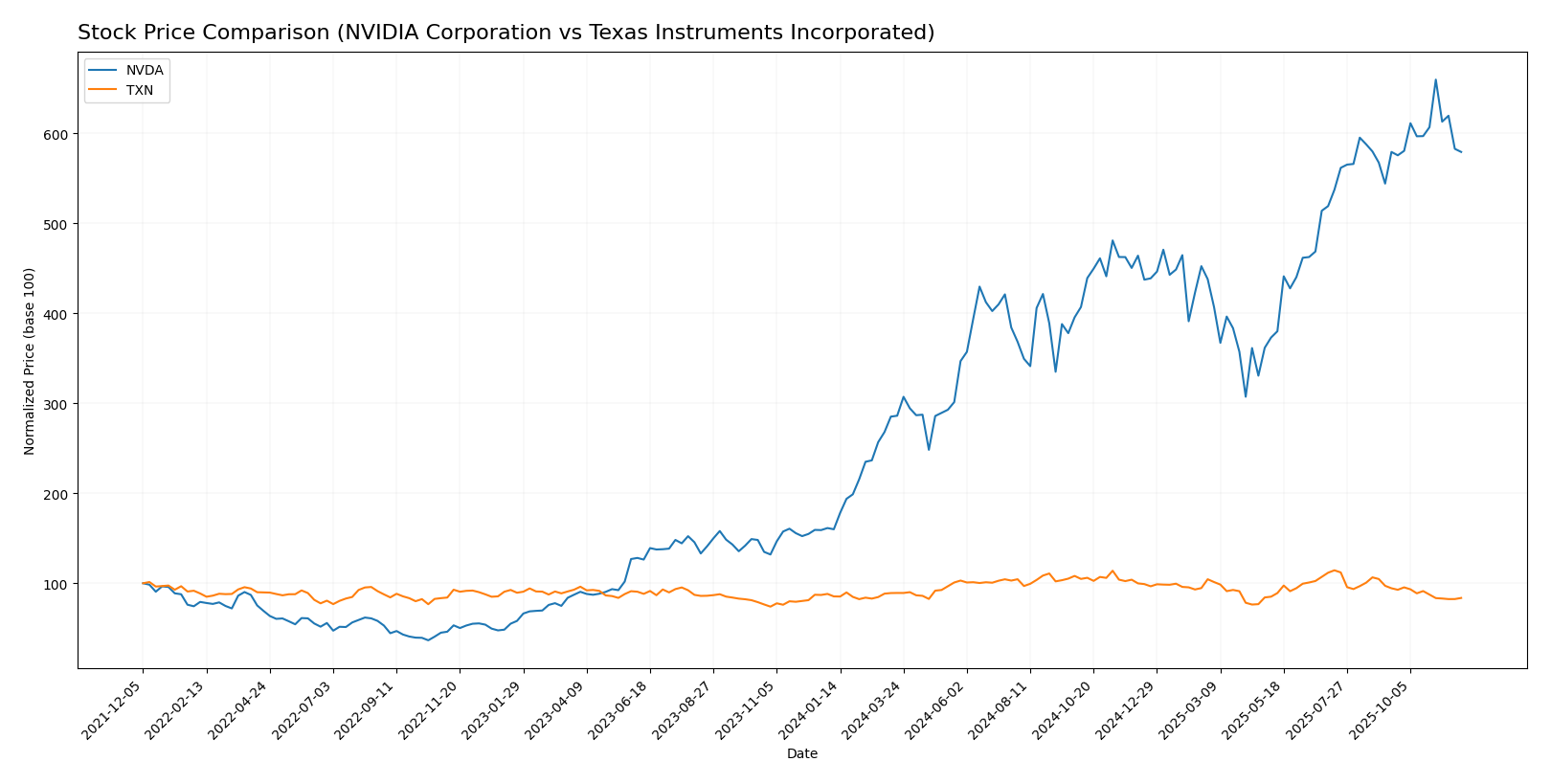

In this section, I will provide an analysis of NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN), focusing on their stock price movements and trading dynamics over the past year.

Trend Analysis

For NVIDIA Corporation (NVDA), the stock has experienced a remarkable price change of +262.16% over the past year. This substantial increase indicates a bullish trend, although the acceleration status shows deceleration. The stock reached a notable high of 202.49 and a low of 49.1, with a standard deviation of 35.0, suggesting some volatility in price movements. Recently, there has been no percentage change recorded in the stock from September 14, 2025, to November 30, 2025, indicating a stabilization after the significant rise.

In contrast, Texas Instruments Incorporated (TXN) has seen a price change of -2.02% over the past year, reflecting a bearish trend. The acceleration status is also showing deceleration. The stock’s highest price was 221.25, and the lowest was 147.6, with a standard deviation of 16.96, indicating moderate volatility. More recently, from September 14, 2025, to November 30, 2025, TXN experienced a decline of -11.41%, further confirming its bearish status.

In summary, NVDA shows strong growth potential despite recent stabilization, while TXN faces ongoing challenges with downward price pressure. Investors should consider these trends when making portfolio decisions.

Analyst Opinions

Recent analyst recommendations for NVIDIA Corporation (NVDA) indicate a strong buy sentiment, with a rating of B+ from multiple analysts, highlighting robust return on equity and assets. Analysts suggest that NVDA’s innovative edge in AI and gaming sectors underpins its growth potential. In contrast, Texas Instruments Incorporated (TXN) received a B rating, with analysts recommending a hold due to concerns about its price-to-earnings ratio and overall market conditions. The current consensus leans towards a buy for NVDA and a hold for TXN.

Stock Grades

In the latest evaluations, both NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN) received consistent grades from several reputable grading companies.

NVIDIA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Melius Research | maintain | Buy | 2025-11-20 |

| Argus Research | maintain | Buy | 2025-11-20 |

| Benchmark | maintain | Buy | 2025-11-20 |

| Keybanc | maintain | Overweight | 2025-11-20 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| JP Morgan | maintain | Overweight | 2025-11-20 |

| Bernstein | maintain | Outperform | 2025-11-20 |

| Citigroup | maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-20 |

| Barclays | maintain | Overweight | 2025-11-20 |

Texas Instruments Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2025-10-22 |

| Rosenblatt | maintain | Buy | 2025-10-22 |

| Truist Securities | maintain | Hold | 2025-10-22 |

| Wells Fargo | maintain | Equal Weight | 2025-10-22 |

| Goldman Sachs | maintain | Buy | 2025-10-22 |

| JP Morgan | maintain | Overweight | 2025-10-22 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-22 |

| Stifel | maintain | Hold | 2025-10-22 |

| TD Cowen | maintain | Buy | 2025-10-22 |

| Mizuho | downgrade | Underperform | 2025-10-20 |

Overall, both NVDA and TXN maintain strong ratings from multiple reputable sources, indicating a positive outlook within the investor community, despite a notable downgrade from Mizuho for Texas Instruments.

Target Prices

NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN) have reliable target price data available, indicating a consensus among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation | 352 | 200 | 261.77 |

| Texas Instruments Incorporated | 245 | 145 | 190.45 |

For NVIDIA, the consensus target price of 261.77 suggests a significant upside potential given its current trading price of 177.82. Meanwhile, Texas Instruments has a target consensus of 190.45, indicating moderate growth potential relative to its current price of 161.77.

Strengths and Weaknesses

Below is a comparison of the strengths and weaknesses of NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN).

| Criterion | NVIDIA Corporation (NVDA) | Texas Instruments Incorporated (TXN) |

|---|---|---|

| Diversification | High (Gaming, Data Center, Automotive) | Moderate (Analog and Embedded Processing) |

| Profitability | High (Net Profit Margin: 55.8%) | High (Net Profit Margin: 30.7%) |

| Innovation | Strong (AI and GPU technology) | Steady (Focus on Analog solutions) |

| Global presence | Strong (International markets) | Strong (Global sales network) |

| Market Share | Leader in GPUs | Strong position in Analog semiconductors |

| Debt level | Low (Debt to Equity: 0.13) | Moderate (Debt to Equity: 0.80) |

Key takeaways indicate that while NVIDIA excels in innovation and profitability with a diverse product range, Texas Instruments maintains strong profitability and a solid global presence with a more focused product line. Both companies have their unique strengths worth considering for investment.

Risk Analysis

Below is a summary of the key risks associated with NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN).

| Metric | NVDA | TXN |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Low |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face considerable market and geopolitical risks, especially in light of increasing competition and regulatory scrutiny in the semiconductor industry. Recent supply chain disruptions also pose a significant threat.

Which one to choose?

In comparing NVIDIA Corporation (NVDA) and Texas Instruments Incorporated (TXN), both companies show unique strengths. NVDA boasts a higher gross profit margin of 75% and a net profit margin of 55.8%, signaling strong profitability. The stock trend for NVDA is bullish, with a price change of 262.16% over the past year. Conversely, TXN’s margins are lower, with a gross profit margin of 58% and a net profit margin of 30.7%, and it has experienced a bearish trend with a -2.02% price change. Analysts rate NVDA with a “B+” overall, while TXN has a “B” rating, reflecting a slightly stronger performance for NVDA.

For growth-focused investors, NVDA appears favorable due to its robust profit margins and bullish trend, while those prioritizing stability might lean towards TXN due to its solid fundamentals and consistent dividends. However, both companies face industry risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NVIDIA Corporation and Texas Instruments Incorporated to enhance your investment decisions: