In the competitive landscape of the industrial machinery sector, two companies stand out: Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI). Both firms are known for their innovative strategies and significant market presence, making them ideal candidates for comparison. Nordson specializes in dispensing and application systems, while Hillenbrand operates across various segments, including process solutions and funeral services. As an investor, understanding the nuances between these two can help you make informed decisions. Let’s explore which company offers the most compelling investment opportunity.

Table of contents

Company Overview

Nordson Corporation Overview

Nordson Corporation (NDSN) is a leader in precision dispensing and coating solutions, dedicated to engineering and manufacturing systems that apply adhesives, coatings, and other fluids. Founded in 1935 and headquartered in Westlake, Ohio, Nordson operates through two primary segments: Industrial Precision Solutions (IPS) and Advanced Technology Solutions (ATS). The IPS segment focuses on dispensing and coating systems for various industries, while the ATS segment develops specialized automated systems for semiconductor and printed circuit board applications. With a market capitalization of approximately $13.37B, Nordson plays a vital role in enhancing manufacturing processes across a multitude of sectors.

Hillenbrand, Inc. Overview

Hillenbrand, Inc. (HI), established in 1906 and based in Batesville, Indiana, is a diversified industrial company that operates through three segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville. The company specializes in designing and manufacturing process equipment for industries such as food, pharmaceuticals, and construction, as well as providing funeral service products through its Batesville segment. With a market cap of around $2.23B, Hillenbrand emphasizes innovation and customer service, catering to a broad array of industrial needs.

Key similarities between Nordson and Hillenbrand include their focus on the industrial machinery sector and commitment to innovation. However, they differ significantly in their market segments; Nordson specializes in precision dispensing systems, while Hillenbrand operates in diverse areas, including funeral services and process equipment. This distinction highlights their unique approaches to serving different industries.

Income Statement Comparison

The following table compares the most recent income statements of Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI) to provide insights into their financial performance.

| Metric | Nordson Corporation (NDSN) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Revenue | 2.69B | 2.67B |

| EBITDA | 810.58M | 230.60M |

| EBIT | 674.41M | 92.10M |

| Net Income | 467.28M | 43.10M |

| EPS | 8.17 | 0.74 |

Interpretation of Income Statement

In the most recent year, Nordson Corporation experienced steady revenue growth, reaching 2.69B, while Hillenbrand’s revenue slightly decreased from the previous year to 2.67B. Nordson’s net income of 467.28M reflects strong operational efficiency, with an EBITDA margin of approximately 30%. In contrast, Hillenbrand’s net income of 43.10M indicates financial challenges, evidenced by a notable decline in both revenue and profitability margins. Overall, while Nordson shows resilience and growth, Hillenbrand’s performance suggests the need for strategic adjustments to enhance profitability and revenue generation.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent financial ratios for Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI), allowing us to gauge their financial health and operational efficiency.

| Metric | NDSN | HI |

|---|---|---|

| ROE | 15.94% | 3.66% |

| ROIC | 9.65% | -32.60% |

| P/E | 30.56 | -9.28 |

| P/B | 4.87 | 1.34 |

| Current Ratio | 2.41 | 1.22 |

| Quick Ratio | 1.51 | 0.88 |

| D/E | 0.79 | 1.12 |

| Debt-to-Assets | 38.67% | 39.25% |

| Interest Coverage | 7.58 | 0.55 |

| Asset Turnover | 0.45 | 0.60 |

| Fixed Asset Turnover | 4.21 | 7.80 |

| Payout ratio | 34.55% | -121.69% |

| Dividend yield | 1.13% | 3.32% |

Interpretation of Financial Ratios

Nordson Corporation exhibits strong financial ratios, particularly in ROE and interest coverage, indicating robust profitability and ability to meet interest obligations. In contrast, Hillenbrand faces significant challenges, as evidenced by its negative P/E and ROIC, suggesting operational inefficiencies and financial distress. The high debt-to-equity ratio for HI raises concerns about leverage and financial stability. Investors should approach HI with caution, while NDSN appears to be a more stable investment choice.

Dividend and Shareholder Returns

Nordson Corporation (NDSN) offers a solid dividend with a payout ratio of approximately 34.5%, yielding around 1.13%. The company has demonstrated a consistent trend in dividend payments, supported by strong free cash flow coverage. Conversely, Hillenbrand, Inc. (HI) does not pay dividends, focusing instead on reinvestment for growth, which is evident from its negative net income. Nonetheless, HI has initiated share buybacks, indicating a commitment to returning value to shareholders. Overall, NDSN’s approach appears more sustainable for long-term value creation compared to HI’s.

Strategic Positioning

In the industrial machinery sector, Nordson Corporation (NDSN) holds a robust market share, driven by its advanced dispensing systems and automation technology. The company enjoys competitive advantages through its innovative product offerings in adhesive and coating technologies. Hillenbrand, Inc. (HI), with its diverse operations across process solutions and molding technologies, faces competitive pressure but has carved its niche in industrial and consumer goods sectors. Both companies are navigating technological disruptions while striving to enhance operational efficiencies and market presence.

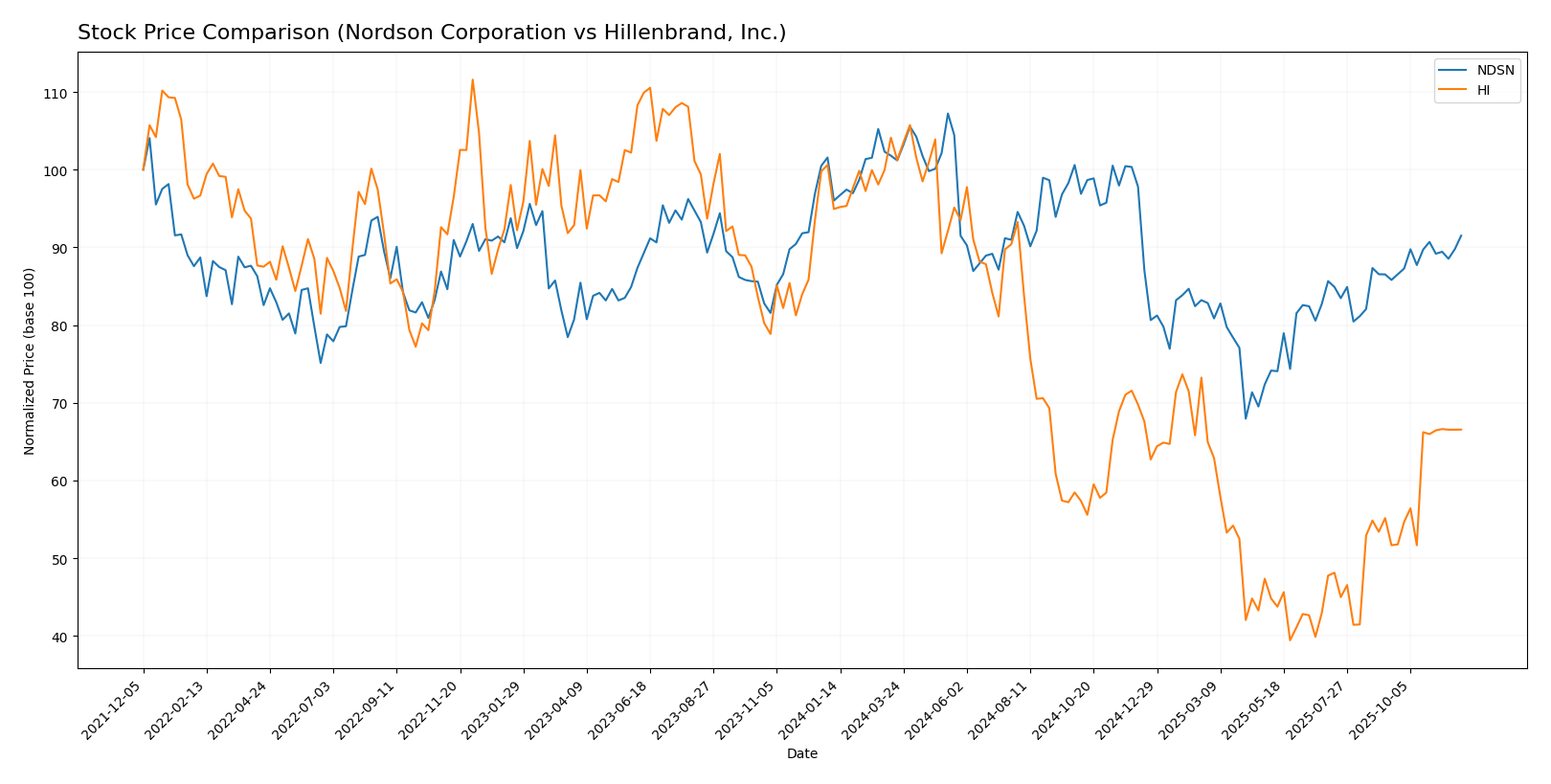

Stock Comparison

Over the past year, the stock prices of Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI) have exhibited significant movements and trading dynamics, reflecting broader market trends and company-specific developments.

Trend Analysis

For Nordson Corporation (NDSN), the overall price change over the past year is -4.7%, indicating a bearish trend. The stock has shown notable volatility with a standard deviation of 23.83, characterized by a recent high of 278.89 and a low of 176.73. The trend is currently accelerating, suggesting that the price may continue to decline.

In contrast, Hillenbrand, Inc. (HI) has experienced an overall price change of -29.9%, also reflecting a bearish trend. The volatility here is slightly lower, with a standard deviation of 9.44. Notably, the stock reached a high of 50.29 and a low of 18.75, with the trend also accelerating.

Despite the bearish overall trends for both companies, NDSN has shown a recent uptick of 6.65% since mid-September 2025, while HI has rebounded significantly with a 28.82% increase in the same period. This recent performance indicates a potential short-term recovery phase for both stocks, although caution is advised due to their overall declining trends.

Analyst Opinions

Recent analyst recommendations for Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI) both reflect a rating of B+. Analysts highlight solid performance indicators, particularly in return on assets and discounted cash flow scores, suggesting strong operational efficiency. For NDSN, analysts note its low debt-to-equity ratio as a positive sign for financial stability. Similarly, HI benefits from a robust price-to-book ratio, enhancing its appeal. The consensus for both companies leans towards a buy for the current year, indicating optimism in their growth potential.

Stock Grades

I have gathered the latest stock grades from reputable grading companies for two companies: Nordson Corporation and Hillenbrand, Inc. Here’s a summary of their ratings.

Nordson Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2025-08-25 |

| Baird | maintain | Neutral | 2025-08-22 |

| Keybanc | maintain | Overweight | 2025-07-15 |

| Oppenheimer | upgrade | Outperform | 2025-05-30 |

| Baird | maintain | Neutral | 2025-05-30 |

| Keybanc | maintain | Overweight | 2025-04-08 |

| Keybanc | upgrade | Overweight | 2025-03-04 |

| Baird | maintain | Neutral | 2025-02-21 |

| Loop Capital | upgrade | Buy | 2025-01-22 |

| Seaport Global | upgrade | Buy | 2024-12-17 |

Hillenbrand, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-20 |

| DA Davidson | maintain | Neutral | 2025-10-16 |

| CJS Securities | downgrade | Market Perform | 2025-10-16 |

| Keybanc | downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | maintain | Neutral | 2025-05-01 |

| DA Davidson | maintain | Neutral | 2024-11-15 |

| Keybanc | maintain | Overweight | 2024-11-14 |

| DA Davidson | downgrade | Neutral | 2024-08-12 |

| DA Davidson | maintain | Buy | 2021-02-08 |

| DA Davidson | maintain | Buy | 2021-02-07 |

In summary, Nordson Corporation has maintained a strong position with several upgrades to “Outperform” and “Buy,” indicating positive sentiment among analysts. Conversely, Hillenbrand, Inc. has seen a mix of downgrades and maintenance of neutral ratings, suggesting a more cautious outlook from analysts.

Target Prices

The following target prices have been established by analysts for the respective companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nordson Corporation | 285 | 240 | 263 |

| Hillenbrand, Inc. | 32 | 32 | 32 |

Analysts expect Nordson Corporation’s stock price to reach a consensus of 263, which is higher than its current price of 238. In contrast, Hillenbrand, Inc. has a consensus target price of 32, closely aligned with its current price of 31.65.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI) based on the most recent data.

| Criterion | Nordson Corporation (NDSN) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 17.37%) | Weak (Net Margin: 1.95%) |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Significant | Moderate |

| Debt level | Manageable (Debt/Equity: 0.79) | High (Debt/Equity: 1.12) |

Key takeaways from the analysis indicate that Nordson Corporation exhibits robust profitability and a strong market presence, whereas Hillenbrand, Inc. struggles with profitability and has a relatively high debt level.

Risk Analysis

In this section, I will outline the key risks associated with two companies, Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI), which may impact their performance.

| Metric | Nordson Corporation (NDSN) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, particularly Hillenbrand, which has shown volatility in its financials, including a recent net profit margin of -0.066. Investors should monitor these factors closely.

Which one to choose?

In evaluating Nordson Corporation (NDSN) and Hillenbrand, Inc. (HI), both companies present a “B+” rating, indicating solid potential. NDSN boasts a higher market cap of $14.28B compared to HI’s $1.91B, with superior profitability metrics, including a net profit margin of 17.37% versus HI’s 1.61%. NDSN also demonstrates better debt management, with a debt-to-equity ratio of 0.79 compared to HI’s 1.12. However, both companies are currently in a bearish stock trend, with NDSN experiencing a 4.7% price change and HI a more substantial 29.9% decline.

Investors focused on stability and superior financial health may prefer NDSN, while those seeking higher risks and potential rewards might consider HI due to its recent price recovery. It’s essential to remain cautious as both companies face industry risks, including competition and valuation pressures.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Nordson Corporation and Hillenbrand, Inc. to enhance your investment decisions: