In today’s rapidly evolving tech landscape, comparing companies within the same industry can reveal valuable insights for investors. In this analysis, I will delve into two prominent players in the software application sector: MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO). Both companies harness innovative analytics solutions to serve diverse industries, yet they adopt distinct strategies and market positions. Join me as we explore which of these companies holds the most promise for your investment portfolio.

Table of contents

Company Overview

MicroStrategy Incorporated Overview

MicroStrategy Incorporated (MSTR) is a leading provider of enterprise analytics software, catering to a diverse range of industries including finance, healthcare, and education. Founded in 1989 and headquartered in Tysons Corner, Virginia, MicroStrategy’s mission is to empower organizations with actionable insights through its comprehensive analytics platform. With a market capitalization of approximately $49.6B, the company offers a suite of products that enhance data accessibility and visualization, ultimately enabling better decision-making processes for businesses. MicroStrategy operates through various channels, providing consulting and technical support to ensure high-quality service delivery.

Domo, Inc. Overview

Domo, Inc. (DOMO) operates a cloud-based business intelligence platform that connects data across organizations, from executives to frontline employees. Established in 2010 and based in American Fork, Utah, Domo aims to facilitate real-time data management and insights. With a market capitalization of around $454M, Domo’s platform enables businesses to streamline operations and enhance performance by providing immediate access to data through mobile devices. Its focus on user accessibility and integration sets it apart in the competitive landscape of analytics solutions.

Key Similarities and Differences

Both MicroStrategy and Domo operate in the software application industry, focusing on analytics and business intelligence. However, MicroStrategy offers a more robust enterprise-level platform with extensive consulting services, while Domo emphasizes a user-friendly, cloud-based solution aimed at enhancing real-time connectivity across organizations. This fundamental difference defines their target audiences and overall market strategies.

Income Statement Comparison

The following table presents a comparative analysis of the most recent income statements for MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO), highlighting key financial metrics.

| Metric | MSTR | DOMO |

|---|---|---|

| Revenue | 463M | 317M |

| EBITDA | -1.85B | -50M |

| EBIT | -1.87B | -59M |

| Net Income | -1.17B | -82M |

| EPS | -6.06 | -2.13 |

Interpretation of Income Statement

In the latest fiscal year, MicroStrategy reported a decline in revenue to 463M, a drop from 496M the prior year, while Domo’s revenue remained relatively stable at 317M compared to 319M. Both companies showed negative net income, with MSTR significantly impacted by elevated operating expenses and poor margins, resulting in a net loss of 1.17B. Domo also faced losses but managed to keep them lower at 82M. Overall, both companies are experiencing challenges in profitability, indicating a need for improved cost management and strategic initiatives to enhance margins.

Financial Ratios Comparison

The following table compares the most recent financial ratios of MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO), providing insights into their performance metrics.

| Metric | MSTR | DOMO |

|---|---|---|

| ROE | -6.40% | 46.23% |

| ROIC | -4.38% | 197.65% |

| P/E | -47.80 | -3.98 |

| P/B | 3.06 | -1.84 |

| Current Ratio | 0.71 | 0.56 |

| Quick Ratio | 0.71 | 0.56 |

| D/E | 0.40 | -0.76 |

| Debt-to-Assets | 0.28 | 0.63 |

| Interest Coverage | -29.92 | -2.99 |

| Asset Turnover | 0.02 | 1.48 |

| Fixed Asset Turnover | 5.73 | 8.17 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

MSTR’s ratios indicate significant financial distress, particularly with a negative ROE and high debt levels relative to assets, suggesting potential solvency issues. Conversely, DOMO displays a robust performance with a high ROE and asset turnover, signaling effective use of equity and assets. However, both companies exhibit negative P/E ratios, indicating a lack of profitability. Caution is advised when considering investments in either company.

Dividend and Shareholder Returns

Neither MicroStrategy (MSTR) nor Domo (DOMO) pays dividends, reflecting a focus on reinvestment for growth amid ongoing financial challenges. MSTR has a negative net income and is in a high-growth phase, while DOMO’s strategy prioritizes R&D and market expansion. Both companies engage in share buybacks, indicating a commitment to returning value. However, the absence of dividends raises questions about sustainable long-term shareholder value creation, necessitating careful monitoring of their financial health and growth trajectories.

Strategic Positioning

MicroStrategy (MSTR) dominates the enterprise analytics software sector with a market cap of approximately $49.6B, providing a robust platform that integrates advanced analytics and data governance. Domo (DOMO), while significantly smaller with a market cap of $455M, offers a cloud-based business intelligence solution that competes on real-time data accessibility. Competitive pressure remains high, particularly as technological disruptions continue to reshape the landscape, requiring both companies to innovate continually to maintain their market positions.

Stock Comparison

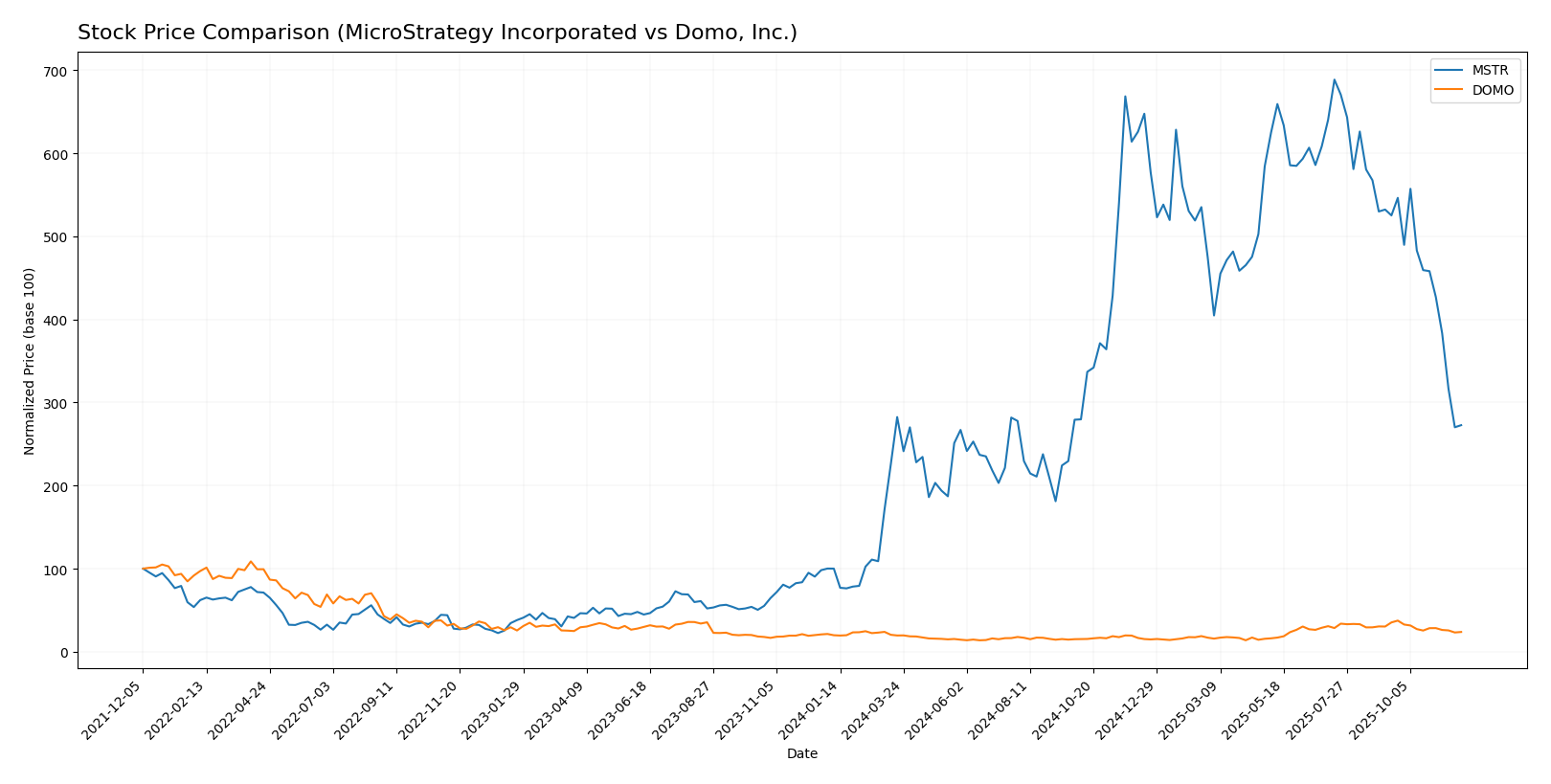

In this section, I will present an analysis of the stock price movements for MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) over the past year, highlighting key price dynamics and recent trading patterns.

Trend Analysis

MicroStrategy Incorporated (MSTR) Over the past 12 months, MSTR has experienced a significant price change of +172.67%. The overall trend is bullish, although it is currently showing signs of deceleration. The stock reached a notable high of 434.58 and a low of 48.1, indicating considerable volatility with a standard deviation of 113.26. In the recent period from September 14, 2025, to November 30, 2025, MSTR’s price changed by -48.08%, suggesting a bearish trend within this shorter timeframe, with a standard deviation of 60.99.

Domo, Inc. (DOMO) For DOMO, the stock price has increased by 19.87% over the past year, marking a bullish trend despite signs of deceleration. The highest price recorded was 18.06, while the lowest was 6.62, with a standard deviation of 2.99 reflecting lower volatility than MSTR. In the recent analysis period from September 14, 2025, to November 30, 2025, DOMO saw a price decline of -32.63%, indicating a bearish trend in the short term, supported by a standard deviation of 2.1.

In summary, while both companies have shown bullish trends over the longer term, recent short-term trends indicate challenges, with both experiencing significant declines. As always, it is crucial to remain cautious and consider potential risks when evaluating these stocks for your investment portfolio.

Analyst Opinions

Recent analyst recommendations for MicroStrategy (MSTR) and Domo (DOMO) have both garnered a “C” rating, indicating a cautious stance. Analysts highlight MSTR’s challenges with return on assets and equity, while Domo shows strong return on equity but faces concerns in other areas. Notable analysts suggest a hold strategy for both stocks, given their mixed performance indicators. Currently, the consensus for both MSTR and DOMO is to hold, reflecting investor caution amid fluctuating market conditions.

Stock Grades

Here’s an overview of the recent stock ratings for MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) from reputable grading companies.

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Domo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JMP Securities | maintain | Market Outperform | 2025-09-10 |

| Cantor Fitzgerald | maintain | Overweight | 2025-08-28 |

| DA Davidson | maintain | Neutral | 2025-08-28 |

| TD Cowen | upgrade | Buy | 2025-08-26 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-25 |

| JMP Securities | maintain | Market Outperform | 2025-06-25 |

| DA Davidson | maintain | Neutral | 2025-05-22 |

| Lake Street | maintain | Hold | 2025-05-22 |

| Cantor Fitzgerald | maintain | Overweight | 2025-05-22 |

| JMP Securities | maintain | Market Outperform | 2025-05-22 |

In summary, MicroStrategy has seen a mix of upgrades and downgrades, with a recent notable upgrade to Neutral. Domo has maintained a consistent rating of Market Outperform and Overweight, suggesting a stable outlook among analysts.

Target Prices

Based on the latest consensus from analysts, here are the target prices for selected companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MicroStrategy Incorporated (MSTR) | 705 | 175 | 478.5 |

| Domo, Inc. (DOMO) | 50 | 15 | 24.5 |

Analysts show a strong bullish sentiment for MicroStrategy, with a consensus target of 478.5, significantly above its current price of 172.83. Meanwhile, Domo’s consensus target of 24.5 suggests growth potential from its current price of 11.47, indicating a favorable outlook for investors.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO):

| Criterion | MicroStrategy (MSTR) | Domo (DOMO) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Niche | Niche |

| Debt level | High (Debt/Equity: 1.04) | High (Debt/Equity: -0.84) |

Key takeaways highlight that both companies face challenges in profitability, with significant negative margins. However, MicroStrategy shows a stronger global presence and higher innovation, while Domo exhibits lower diversification and a concerning debt level.

Risk Analysis

The following table outlines the key risks associated with MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) as of the most recent fiscal year.

| Metric | MicroStrategy (MSTR) | Domo (DOMO) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | Low |

Both companies face significant market and operational risks, with MicroStrategy being particularly susceptible to market volatility due to its high beta of 3.37. Domo, while facing moderate market risks, contends with higher regulatory risks as it operates in a heavily regulated software environment.

Which one to choose?

When comparing MicroStrategy (MSTR) and Domo (DOMO), both companies show distinct financial profiles. MSTR has a market cap of 56B, with a gross profit margin of 72% but negative profit margins across the board, indicating ongoing operational challenges. Its stock trend is currently bearish, with a significant recent price decline of 48%. Conversely, Domo, with a market cap of 326M, shows a lower gross profit margin of 74%, yet it maintains a more stable operational cash flow and lower volatility in price movements, with a bullish overall trend despite recent declines.

For growth-oriented investors, Domo offers better potential due to its strong operational metrics, while those seeking value might consider MicroStrategy despite its higher risks associated with volatility and operational losses.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of MicroStrategy Incorporated and Domo, Inc. to enhance your investment decisions: