In the fast-evolving technology sector, investors often seek opportunities that promise growth and innovation. Today, I will compare two intriguing companies: MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO). Both operate within the semiconductor and communication equipment industries, showcasing innovative solutions that enhance connectivity. This analysis will help you determine which of these dynamic companies holds the most promise for your investment portfolio. Let’s dive in and discover the potential that lies ahead!

Table of contents

Company Overview

MaxLinear, Inc. Overview

MaxLinear, Inc. is a leading provider of high-performance analog and mixed-signal communications systems-on-chip (SoCs), specializing in radiofrequency (RF) solutions for a variety of applications including connected homes and industrial systems. Established in 2003 and headquartered in Carlsbad, California, MaxLinear focuses on integrating advanced components of high-speed communication systems, delivering products essential for broadband connectivity, including DOCSIS modems and 4G/5G infrastructure. With a market cap of approximately $1.37B, the company maintains a strong position in the semiconductor industry, catering to a diverse clientele comprising OEMs, distributors, and module makers.

Credo Technology Group Holding Ltd Overview

Founded in 2008 and based in San Jose, California, Credo Technology Group Holding Ltd specializes in high-speed connectivity solutions, particularly for optical and electrical Ethernet applications. The company offers a range of products including integrated circuits and active electrical cables, leveraging its proprietary serializer/deserializer (SerDes) technologies. With a market cap of around $28.11B, Credo has rapidly established itself in the communication equipment sector, serving clients across the globe and focusing on innovation in networking technologies.

Key similarities between MaxLinear and Credo include their focus on high-performance technology within the semiconductor and communication equipment sectors. However, while MaxLinear offers a wider array of broadband solutions, Credo concentrates on high-speed connectivity applications. This distinction highlights their respective strategic focuses in a competitive market.

Income Statement Comparison

Below is a comparison of the latest income statements for MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO), highlighting their financial performance.

| Metric | MaxLinear, Inc. | Credo Technology Group Holding Ltd |

|---|---|---|

| Revenue | 361M | 437M |

| EBITDA | -182M | 60M |

| EBIT | -228M | 38M |

| Net Income | -245M | 52M |

| EPS | -2.93 | 0.31 |

Interpretation of Income Statement

In 2024, MaxLinear, Inc. saw a significant drop in revenue to 361M from 693M in 2023, reflecting a concerning trend. Net income also declined sharply, resulting in a loss of 245M. In contrast, Credo Technology showed positive results, with revenue increasing to 437M and net income at 52M, indicating healthy growth. While MaxLinear’s margins suffered, Credo’s EBITDA margin improved, demonstrating operational efficiency. Overall, MaxLinear’s performance raises caution for investors, whereas Credo presents a more favorable investment outlook with its profitability and growth trajectory.

Financial Ratios Comparison

The following table provides a comparative analysis of key financial metrics for MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO) for the most recent fiscal year.

| Metric | [Company A: MXL] | [Company B: CRDO] |

|---|---|---|

| ROE | -47.49% | 7.66% |

| ROIC | -24.97% | 5.01% |

| P/E | -6.74 | 138.19 |

| P/B | 3.20 | 10.58 |

| Current Ratio | 1.77 | 6.62 |

| Quick Ratio | 1.28 | 5.79 |

| D/E | 0.29 | 0.03 |

| Debt-to-Assets | 17.23% | 1.98% |

| Interest Coverage | -15.52 | 0.00 |

| Asset Turnover | 0.41 | 0.54 |

| Fixed Asset Turnover | 4.65 | 5.54 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

MaxLinear’s negative return metrics and high debt ratios raise significant concerns about its financial health, particularly highlighted by a current ratio of 1.77, which suggests potential liquidity issues. Conversely, Credo Technology shows a solid current ratio of 6.62 and a positive ROE, indicating stronger financial stability and profitability, despite a high P/E ratio that may suggest overvaluation. Overall, CRDO appears to be the more robust investment option at this time.

Dividend and Shareholder Returns

MaxLinear, Inc. (MXL) does not pay dividends, reflecting a strategy focused on reinvestment during its current growth phase. With a negative net income and ongoing challenges, it prioritizes capital for R&D and acquisitions, although it engages in share buybacks. On the other hand, Credo Technology Group Holding Ltd (CRDO) also does not distribute dividends, which aligns with its high-growth objectives. Both companies are currently channeling resources towards long-term value creation, albeit with inherent risks tied to their financial performances.

Strategic Positioning

MaxLinear, Inc. (MXL) operates in the semiconductor industry, holding a notable market share in high-performance analog and RF solutions. The competitive pressure is significant, especially from emerging technologies that threaten traditional communication systems. Meanwhile, Credo Technology Group (CRDO) focuses on high-speed connectivity for Ethernet applications, positioning itself strongly against peers by leveraging innovative SerDes technologies. Both companies face technological disruption that could reshape market dynamics, requiring careful monitoring of industry trends and competitor movements.

Stock Comparison

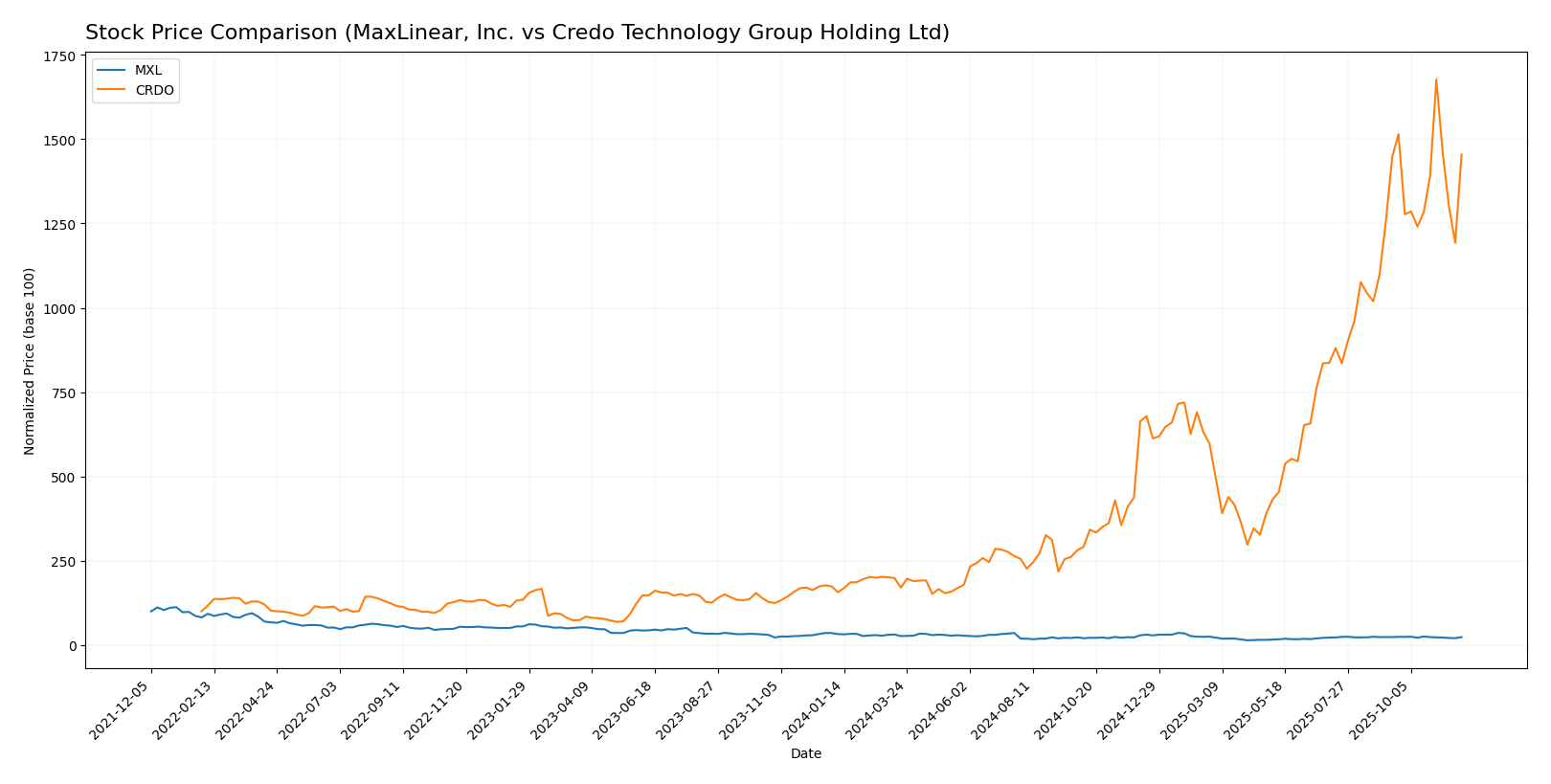

In this section, I will analyze the weekly stock price movements of MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO) over the past year, highlighting key price dynamics and performance trends.

Trend Analysis

For MaxLinear, Inc. (MXL), the overall price change over the past year is -27.85%, indicating a bearish trend. The stock has experienced notable highs at 24.05 and lows at 9.31. Currently, the trend shows deceleration, and the standard deviation of 3.56 suggests some volatility in the stock price.

In the recent period, the price change is slightly negative at -0.63%, with a standard deviation of 1.0, suggesting a relatively stable environment. The trend slope of -0.16 confirms the ongoing bearish momentum.

On the other hand, Credo Technology Group Holding Ltd (CRDO) has exhibited a remarkable overall price change of +828.44%, indicating a bullish trend. The stock has reached a high of 187.62 and a low of 16.92, showcasing strong performance. Despite this, the trend is experiencing deceleration, with a standard deviation of 44.49 signifying significant volatility.

In the recent analysis, CRDO’s price change is slightly positive at +0.47%, and the standard deviation of 14.9 indicates some fluctuations. The trend slope of -0.14 suggests that the bullish momentum may be slowing down.

In summary, while CRDO demonstrates a strong upward trajectory, MXL is currently facing challenges that investors should consider carefully.

Analyst Opinions

Recent recommendations for MaxLinear, Inc. (MXL) indicate a cautious stance, with analysts rating it as a “C.” The low scores in return on equity and assets suggest operational challenges. Conversely, Credo Technology Group Holding Ltd (CRDO) has garnered a more favorable “B-” rating. Analysts highlight its strong return on equity and assets as positive indicators. Overall, the consensus leans towards a “hold” for MXL, while CRDO is viewed more favorably, though still warrants careful consideration.

Stock Grades

In this section, I’ll present the latest stock ratings from reliable grading companies for two companies: MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO).

MaxLinear, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-10-24 |

| Benchmark | Maintain | Buy | 2025-10-17 |

| Benchmark | Maintain | Buy | 2025-09-02 |

| Loop Capital | Maintain | Hold | 2025-08-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-24 |

| Benchmark | Maintain | Buy | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-16 |

Credo Technology Group Holding Ltd Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-04 |

| Needham | Maintain | Buy | 2025-09-04 |

| Stifel | Maintain | Buy | 2025-09-04 |

| Susquehanna | Maintain | Positive | 2025-09-04 |

| Roth Capital | Maintain | Buy | 2025-09-04 |

| TD Cowen | Maintain | Buy | 2025-09-04 |

| Mizuho | Maintain | Outperform | 2025-09-04 |

| Stifel | Maintain | Buy | 2025-09-02 |

Overall, the trend in stock grades for both companies indicates a stable outlook, with several grades being maintained at “Buy” or “Overweight,” suggesting investor confidence. Notably, both companies have received consistent positive feedback from multiple grading firms, which may imply a favorable market position.

Target Prices

The target consensus for MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO) indicates positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MaxLinear, Inc. (MXL) | 25 | 13 | 19 |

| Credo Technology Group (CRDO) | 175 | 135 | 161 |

For MaxLinear, the target consensus of 19 suggests potential upside from the current price of approximately 15.65. In contrast, Credo’s consensus target of 161 indicates a strong expectation for growth, given its current price of about 162.50.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO) based on recent data.

| Criterion | MaxLinear, Inc. (MXL) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Negative margins | Positive margins |

| Innovation | Strong | Strong |

| Global presence | Moderate | Strong |

| Market Share | Low | Growing |

| Debt level | Moderate | Very Low |

Key takeaways indicate that while Credo Technology exhibits stronger profitability and a robust global presence, MaxLinear is innovatively strong but struggles with profitability and market share. Caution is advised when considering investments in either company.

Risk Analysis

The following table summarizes the key risks associated with MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO).

| Metric | MaxLinear, Inc. (MXL) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Low |

MaxLinear, Inc. faces significant market and operational risks, particularly due to its high beta of 1.829, indicating higher volatility. In contrast, Credo Technology has a stronger operational margin and lower debt levels, positioning it more favorably amidst market fluctuations.

Which one to choose?

When comparing MaxLinear, Inc. (MXL) and Credo Technology Group Holding Ltd (CRDO), the fundamentals indicate a stark contrast. MXL has experienced declining revenues, with a significant net loss of $245M in FY 2024, alongside a bearish stock trend, down nearly 28% over the past year. In contrast, CRDO has shown a remarkable revenue growth trajectory, boasting a 828% price increase in the same timeframe, alongside a net income of $52M in FY 2025.

Financial metrics reveal that CRDO holds a superior gross profit margin of 64.77% compared to MXL’s 53.37%. Analysts rate CRDO at B- for overall performance against MXL’s C, suggesting a stronger investment opportunity. However, investors should consider the risks, such as MXL’s high debt-to-equity ratio and CRDO’s market volatility.

Recommendation: Investors focused on growth may prefer CRDO, while those prioritizing stability might consider MXL cautiously.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of MaxLinear, Inc. and Credo Technology Group Holding Ltd to enhance your investment decisions: