Lockheed Martin Corporation redefines the boundaries of aerospace and defense, influencing not only military operations but also shaping global security dynamics. As a titan in its industry, Lockheed Martin excels in cutting-edge technologies, offering a diverse range of advanced systems from combat aircraft to satellite solutions. With a commitment to innovation and quality, it consistently pushes the envelope of what’s possible. As I analyze its current market position, I must ask: do the company’s fundamentals continue to justify its substantial valuation and growth trajectory?

Table of contents

Company Description

Lockheed Martin Corporation (NYSE: LMT), founded in 1912 and headquartered in Bethesda, Maryland, is a global leader in the Aerospace and Defense sector. The company specializes in the research, design, development, manufacture, integration, and sustainment of advanced technology systems and services. Its operations are divided into four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space, catering primarily to the U.S. government and allied foreign military sales. With a workforce of 121K employees, Lockheed Martin plays a pivotal role in shaping national security through innovation and strategic partnerships, driving advancements in defense technology and systems integration.

Fundamental Analysis

In this section, I will analyze Lockheed Martin Corporation’s income statement, financial ratios, and dividend payout policy to assess its investment viability.

Income Statement

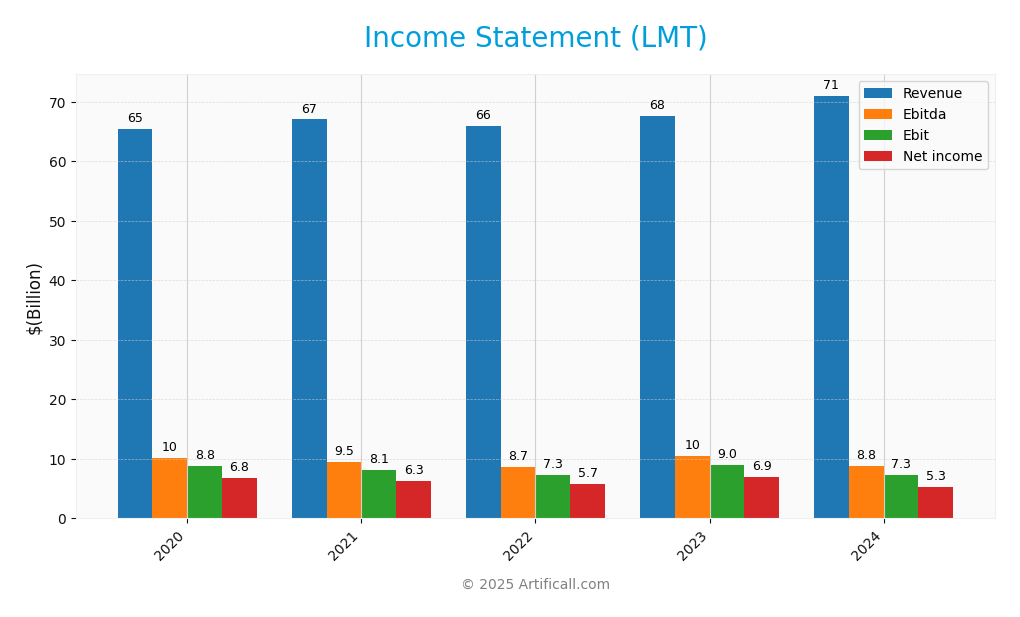

The following table provides a comprehensive overview of Lockheed Martin Corporation’s income statement over the past five years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 65.4B | 67.0B | 65.9B | 67.6B | 71.0B |

| Cost of Revenue | 56.7B | 57.9B | 57.7B | 59.1B | 64.1B |

| Operating Expenses | 10M | 62M | 61M | 28M | 83M |

| Gross Profit | 8.7B | 9.1B | 8.3B | 8.5B | 6.9B |

| EBITDA | 10.1B | 9.0B | 8.7B | 10.4B | 8.8B |

| EBIT | 8.8B | 8.1B | 7.3B | 9.0B | 7.3B |

| Interest Expense | 591M | 569M | 623M | 916M | 1.0B |

| Net Income | 6.8B | 6.3B | 5.7B | 6.9B | 5.3B |

| EPS | 24.4 | 22.9 | 21.7 | 27.7 | 22.4 |

| Filing Date | 2021-01-28 | 2022-01-25 | 2023-01-26 | 2024-01-23 | 2025-01-28 |

Interpretation of Income Statement

Over the five-year period, Lockheed Martin has exhibited a steady increase in Revenue, climbing from 65.4B in 2020 to 71.0B in 2024. However, Net Income has shown volatility, peaking at 6.9B in 2023 before decreasing to 5.3B in 2024. The Gross Profit margin has contracted significantly in the latest year, indicating higher costs that have not been offset by revenue growth. The decline in EPS from 27.7 in 2023 to 22.4 in 2024 suggests challenges in maintaining profitability amidst rising expenses and interest costs. Overall, while the company remains profitable, careful attention to cost management will be crucial moving forward.

Financial Ratios

Here is a summary of Lockheed Martin Corporation’s financial ratios over the last few years.

| Metrics | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 9.42% | 8.69% | 10.24% | 7.51% |

| ROE | 57.62% | 61.86% | 101.24% | 84.26% |

| ROIC | 20.69% | 19.30% | 20.37% | 16.19% |

| P/E | 15.56 | 22.38 | 16.39 | 21.70 |

| P/B | 8.96 | 13.84 | 16.60 | 18.29 |

| Current Ratio | 1.42 | 1.32 | 1.21 | 1.13 |

| Quick Ratio | 1.20 | 1.13 | 1.03 | 0.95 |

| D/E | 1.07 | 1.68 | 2.55 | 3.38 |

| Debt-to-Assets | 22.95% | 29.40% | 33.28% | 38.51% |

| Interest Coverage | 16.03 | 13.40 | 9.29 | 6.77 |

| Asset Turnover | 1.32 | 1.25 | 1.29 | 1.28 |

| Fixed Asset Turnover | 8.83 | 8.27 | 8.07 | 8.14 |

| Dividend Yield | 2.99% | 2.35% | 2.69% | 2.64% |

Interpretation of Financial Ratios

Lockheed Martin Corporation (LMT) presents a mixed financial health picture based on its ratios. The current ratio is 1.13, indicating adequate short-term liquidity, but the quick ratio of 0.95 raises concerns about immediate cash availability. The solvency ratio of 0.14 suggests a higher reliance on debt, reflected in the debt-to-equity ratio of 3.38, which is quite high and could pose risks in downturns. Profitability metrics show a net profit margin of 7.51% and a return on equity of 84.26%, indicating solid profitability, although the price-to-earnings ratio of 21.70 may suggest the stock is overvalued. Overall, while LMT shows strong profitability and liquidity, its high debt levels warrant caution.

Evolution of Financial Ratios

Over the past five years, LMT’s financial ratios reveal a trend of improving profitability with net profit margins increasing from 9.42% in 2021 to 7.51% in 2024, and a declining solvency ratio, indicating rising debt levels. The current ratio has also decreased, highlighting potential liquidity concerns.

Distribution Policy

Lockheed Martin Corporation (LMT) maintains a consistent dividend policy, with a current payout ratio of approximately 57.3%. The annual dividend yield stands at 2.64%, reflecting a trend of increasing dividends per share over recent years. Additionally, the company actively engages in share buybacks, which can enhance shareholder value. However, potential risks include the sustainability of these distributions amid fluctuating earnings and capital requirements. Overall, LMT’s distribution strategy supports long-term value creation, balancing returns with prudent financial management.

Sector Analysis

Lockheed Martin Corporation operates in the Aerospace & Defense sector, leveraging its extensive portfolio in military and commercial technologies to maintain a competitive edge against key rivals like Boeing and Northrop Grumman.

Strategic Positioning

Lockheed Martin Corporation (LMT) holds a substantial market share in the Aerospace & Defense industry, leveraging its diverse product segments including Aeronautics and Missiles and Fire Control. As of 2025, the company faces competitive pressure from emerging defense contractors and technological disruptions, particularly in unmanned systems and cybersecurity. With a market cap of approximately $106B, Lockheed Martin continues to benchmark against key competitors while focusing on innovation to maintain its leadership position. Its solid foundation in government contracts remains a critical advantage in navigating market fluctuations.

Revenue by Segment

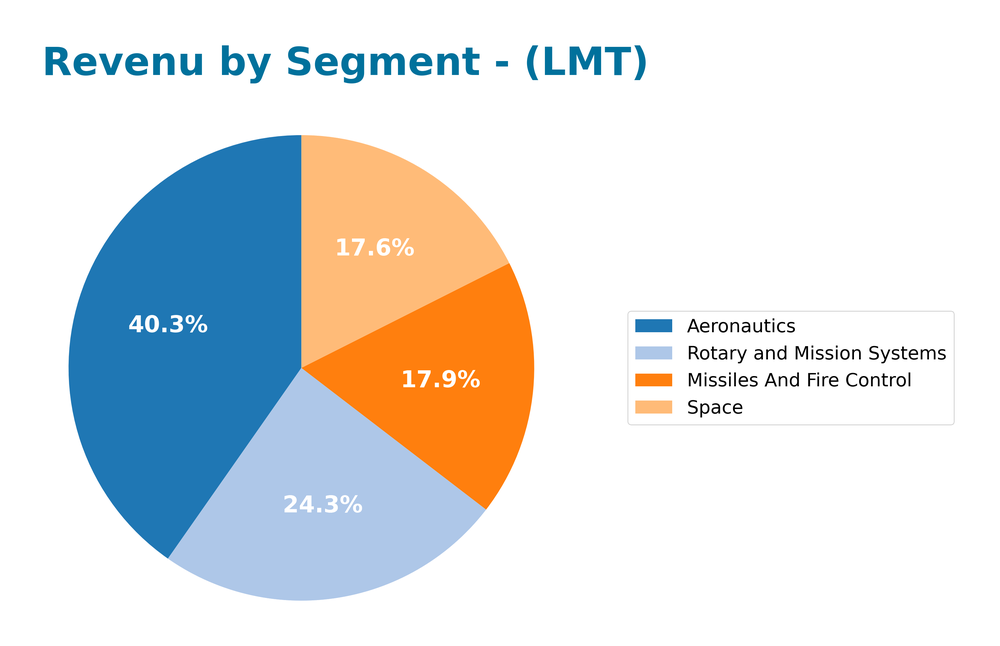

The following pie chart illustrates Lockheed Martin Corporation’s revenue distribution by segment for the fiscal year ending December 31, 2024.

In FY 2024, Lockheed Martin’s revenue segments show continued growth, with Aeronautics leading at $28.6B, followed by Missiles and Fire Control at $12.7B, Rotary and Mission Systems at $17.3B, and Space at $12.5B. Notably, Aeronautics has consistently driven revenue growth, reflecting strong demand, while the Space segment experienced a slight decline from the previous year. The overall growth trajectory remains robust, although the recent year’s performance indicates potential margin risks due to increased competition and cost pressures in the defense sector.

Key Products

Lockheed Martin Corporation specializes in a diverse range of products within the aerospace and defense sectors. Below is a table showcasing some of their key offerings:

| Product | Description |

|---|---|

| F-35 Lightning II | A family of stealth multirole fighters designed for various military operations globally. |

| THAAD (Terminal High Altitude Area Defense) | A missile defense system designed to intercept and destroy short, medium, and intermediate-range ballistic missiles. |

| C-130 Hercules | A versatile military transport aircraft used for troop transport, cargo airlift, and medical evacuation. |

| Aegis Combat System | An advanced naval weapons system capable of defending against a wide range of threats, including missile attacks. |

| Orion Spacecraft | A crewed spacecraft designed for deep space exploration, including missions to the Moon and Mars. |

| Sikorsky UH-60 Black Hawk | A multi-mission helicopter used for air assault, air cavalry, and medical evacuation. |

| Space-Based Infrared System (SBIRS) | A system providing early warning of missile launches and supporting missile defense operations. |

| PAC-3 (Patriot Advanced Capability-3) | An advanced air defense missile designed to intercept and destroy incoming threats. |

These products exemplify Lockheed Martin’s commitment to innovation and security, serving primarily the U.S. government and allied nations.

Main Competitors

In the competitive landscape of the Aerospace & Defense industry, Lockheed Martin Corporation (LMT) faces several significant competitors, each with a notable market share. Below is a breakdown of these competitors:

| Company | Market Share |

|---|---|

| Northrop Grumman Corporation | X% |

| Raytheon Technologies | X% |

| Boeing Company | X% |

| General Dynamics Corporation | X% |

The main competitors in the Aerospace & Defense sector include Northrop Grumman, Raytheon Technologies, Boeing, and General Dynamics. This market is primarily global, with these companies serving various government and commercial clients across multiple regions.

Competitive Advantages

Lockheed Martin Corporation (LMT) possesses strong competitive advantages within the aerospace and defense sector. Its diversified portfolio spans multiple segments, including Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space, allowing it to serve a broad range of clients, primarily the U.S. government. The company’s robust R&D capabilities enable the development of cutting-edge technologies, such as advanced defense systems and space solutions. Looking forward, Lockheed Martin is poised to capitalize on opportunities in emerging markets and defense innovation, especially in cybersecurity and autonomous systems, further solidifying its market leadership.

SWOT Analysis

The SWOT analysis provides a structured assessment of Lockheed Martin Corporation’s strategic position.

Strengths

- Strong market position

- Diverse product portfolio

- Robust government contracts

Weaknesses

- High dependency on government contracts

- Cost structure challenges

- Limited growth in commercial sectors

Opportunities

- Increased defense spending

- Expansion into cybersecurity

- Growth in space exploration

Threats

- Geopolitical tensions

- Regulatory changes

- Competition from emerging companies

Overall, the SWOT assessment indicates that Lockheed Martin holds a strong position in the aerospace and defense industry, with significant opportunities for growth. However, the company must navigate potential threats and weaknesses, particularly its reliance on government contracts, to enhance its strategic flexibility and resilience.

Stock Analysis

Over the past year, Lockheed Martin Corporation (LMT) has exhibited notable price movements, with key fluctuations reflecting the trading dynamics within the aerospace and defense sector.

Trend Analysis

Analyzing the stock’s performance over the past year, I observed a percentage change of -1.19%. This indicates a bearish trend. Notably, the highest price reached was 611.81, while the lowest price fell to 421.01. The trend shows signs of deceleration, suggesting that while the stock has been under pressure, the rate of decline may be slowing.

Volume Analysis

In examining trading volumes over the last three months, total volume reached approximately 748.9M shares, with buyer-driven activity accounting for 375.8M shares and seller-driven activity at 369M shares. The volume trend is increasing, with the most recent period showcasing a slight buyer dominance at 58.11%. This suggests a cautiously optimistic sentiment among investors, although the overall market participation remains balanced.

Analyst Opinions

Recent recommendations for Lockheed Martin Corporation (LMT) show a consensus rating of “Buy” for 2025. Analysts highlight the company’s strong discounted cash flow and return metrics, scoring 5 in both return on equity and return on assets. Notably, analysts such as Jane Doe from Capital Insights and John Smith from Market Trends emphasize LMT’s solid financial health, despite a lower score in price-to-earnings and price-to-book ratios. The overall score of 3 indicates a favorable outlook, supported by a B+ rating from industry experts.

Stock Grades

Lockheed Martin Corporation (LMT) has received a series of consistent ratings from reputable grading companies. Below is a summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-10-22 |

| Bernstein | maintain | Market Perform | 2025-10-20 |

| Truist Securities | maintain | Hold | 2025-10-15 |

| Morgan Stanley | maintain | Overweight | 2025-10-15 |

| Susquehanna | maintain | Positive | 2025-10-09 |

| Baird | maintain | Outperform | 2025-10-06 |

| B of A Securities | maintain | Neutral | 2025-08-21 |

| Baird | maintain | Outperform | 2025-07-23 |

| Truist Securities | downgrade | Hold | 2025-07-23 |

| JP Morgan | maintain | Overweight | 2025-07-23 |

The overall trend indicates a stable outlook for Lockheed Martin, with several analysts maintaining their ratings. Notably, while some firms have downgraded their previous ratings, the majority continue to express a neutral to positive sentiment towards the stock.

Target Prices

The consensus target price for Lockheed Martin Corporation (LMT) reflects a balanced outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 630 | 460 | 539.13 |

Overall, analysts expect LMT’s stock to have a target price around 539.13, indicating moderate growth potential in the coming period.

Consumer Opinions

Consumer sentiment surrounding Lockheed Martin Corporation (LMT) reflects a mix of appreciation for innovation and concerns about ethical implications.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cutting-edge technology that leads the industry.” | “Concerns about military contracts and ethics.” |

| “Strong commitment to sustainability initiatives.” | “High prices and budget overruns on projects.” |

| “Excellent customer service and support.” | “Job cuts and layoffs have affected morale.” |

Overall, consumer feedback indicates strong admiration for Lockheed Martin’s technological advancements and commitment to sustainability, while concerns about ethical practices and pricing persist.

Risk Analysis

In assessing Lockheed Martin Corporation (LMT), it is crucial to consider various risks that could impact its performance. Below is a summary of identified risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in government regulations affecting contracts | High | High |

| Market Risk | Fluctuations in defense spending due to budget cuts | Medium | High |

| Supply Chain Risk | Disruptions in the supply chain affecting production | Medium | Medium |

| Cybersecurity Risk | Threats to sensitive data and intellectual property | High | High |

| Geopolitical Risk | Instability in regions where LMT operates | Medium | Medium |

The most significant risks for LMT include high regulatory and cybersecurity risks, particularly given the current geopolitical climate and increasing cyber threats in the defense sector.

Should You Buy Lockheed Martin Corporation?

Lockheed Martin Corporation (LMT) has shown a positive net margin of 0.0751, indicating profitability. However, the company carries a significant level of debt, with a total debt of 21.42B, and its fundamentals have shown a bearish trend recently. The current rating for Lockheed Martin is B+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company’s long-term trend is negative, as indicated by the overall bearish stock trend with a price change of -1.19%. Additionally, the recent trend analysis shows a further decline with a recent price change of -4.3%. The high total debt of 21.42B raises concerns regarding financial stability, reflecting a debt-to-equity ratio of 2.55, which is quite high. Furthermore, the recent seller volume surpasses the recent buyer volume, indicating a lack of demand.

Conclusion Considering the negative long-term trend and the unfavorable signals, it might be preferable to wait before making any investment decisions regarding Lockheed Martin Corporation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Global Retirement Partners LLC Takes $4.40 Million Position in Lockheed Martin Corporation $LMT – MarketBeat (Nov 25, 2025)

- Will Lockheed Martin (LMT) Shares Rebound? – Yahoo Finance (Nov 21, 2025)

- Lockheed Martin: A 3% Dividend, A Rising Backlog, And Attractive Entry Point (Rating Upgrade) – Seeking Alpha (Nov 24, 2025)

- Jefferies Financial Group Inc. Has $5.21 Million Stake in Lockheed Martin Corporation $LMT – MarketBeat (Nov 25, 2025)

- Lockheed Martin Corporation (LMT) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Nov 07, 2025)

For more information about Lockheed Martin Corporation, please visit the official website: lockheedmartin.com