In the dynamic world of semiconductors, two companies stand out for their innovative strategies and market presence: Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO). Both firms operate within the same industry, focusing on cutting-edge technologies that drive the production of integrated circuits. By comparing their growth trajectories, product offerings, and market strategies, I aim to help you determine which company presents the most compelling investment opportunity. Let’s dive into the details and discover where the smart money should go.

Table of contents

Company Overview

Lam Research Corporation Overview

Lam Research Corporation (LRCX), established in 1980 and headquartered in Fremont, California, specializes in semiconductor processing equipment vital for integrated circuit fabrication. The company’s mission revolves around providing innovative solutions that enhance the efficiency and performance of semiconductor manufacturing. With a robust market presence, Lam Research boasts a market capitalization of approximately $191B and offers a diverse range of products, including advanced systems for dielectric etch and atomic layer deposition. They cater to a global customer base within the semiconductor industry, emphasizing technological advancements and operational excellence.

Onto Innovation Inc. Overview

Onto Innovation Inc. (ONTO), founded in 1940 and based in Wilmington, Massachusetts, is focused on creating process control tools that optimize semiconductor manufacturing. The company’s mission is to drive technological innovation through its suite of inspection tools, metrology systems, and analytical software. Onto has a market capitalization of around $6.7B and serves a diverse array of sectors, including advanced packaging and industrial applications. The firm stands out for its commitment to enhancing yield management and process control, ensuring that manufacturers can meet ever-increasing demands for precision and efficiency.

Key similarities between Lam Research and Onto Innovation include their primary focus on the semiconductor industry and their commitment to innovation and technology. However, they differ in their specific offerings, with Lam emphasizing equipment manufacturing while Onto focuses on process control and analytical tools.

Income Statement Comparison

The following table provides a comparison of the most recent income statements for Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO) for fiscal year 2025.

| Metric | Lam Research (LRCX) | Onto Innovation (ONTO) |

|---|---|---|

| Revenue | 18.44B | 0.99B |

| EBITDA | 6.34B | 0.25B |

| EBIT | 5.96B | 0.19B |

| Net Income | 5.36B | 0.20B |

| EPS | 4.17 | 4.09 |

Interpretation of Income Statement

In fiscal year 2025, Lam Research shows significant revenue growth to 18.44B, reflecting a robust demand for semiconductor equipment, while Onto Innovation reported a revenue of 0.99B, indicating steady performance but limited scale. LRCX’s net income also increased to 5.36B, showcasing efficient cost management and strong operating margins. Conversely, ONTO’s net income of 0.20B suggests modest profitability. The significant differences in both scale and margins highlight LRCX’s market dominance, although Onto’s consistent performance demonstrates potential for growth in its niche segment. Overall, Lam Research’s growth trajectory appears more favorable, yet investors should consider the inherent risks of market fluctuations and economic conditions.

Financial Ratios Comparison

The table below provides a comparative analysis of the most recent revenue and financial ratios for Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO).

| Metric | [Company A: LRCX] | [Company B: ONTO] |

|---|---|---|

| ROE | 54.3% | 10.5% |

| ROIC | 33.9% | 8.7% |

| P/E | 23.4 | 41.8 |

| P/B | 12.7 | 4.3 |

| Current Ratio | 2.21 | 8.69 |

| Quick Ratio | 1.55 | 6.99 |

| D/E | 0.48 | 0.01 |

| Debt-to-Assets | 22.3% | 1.0% |

| Interest Coverage | 33.1 | N/A |

| Asset Turnover | 0.86 | 0.47 |

| Fixed Asset Turnover | 7.59 | 7.16 |

| Payout Ratio | 21.5% | 0% |

| Dividend Yield | 0.92% | 0% |

Interpretation of Financial Ratios

Lam Research Corporation demonstrates strong financial health with a high ROE (54.3%) and ROIC (33.9%), indicating effective management of equity and capital. Its debt ratios are low (D/E at 0.48), suggesting good leverage management. In contrast, Onto Innovation displays a solid current ratio (8.69) but higher market valuations (P/E of 41.8). However, its lack of dividends and minimal debt levels may raise questions regarding growth sustainability. Overall, LRCX appears more robust, while ONTO’s higher valuations warrant cautious consideration.

Dividend and Shareholder Returns

Lam Research Corporation (LRCX) pays dividends with a current yield of 0.9% and a payout ratio of approximately 21%. The dividend per share has shown a steady upward trend, supported by robust free cash flow. In contrast, Onto Innovation Inc. (ONTO) does not distribute dividends, opting instead to reinvest earnings into growth initiatives. However, ONTO has been engaging in share buybacks. Both strategies may foster long-term shareholder value, though LRCX’s dividends provide immediate returns while ONTO focuses on future growth potential.

Strategic Positioning

Lam Research Corporation (LRCX) holds a dominant position in the semiconductor equipment market, commanding a significant market share with its diverse product offerings tailored for integrated circuit fabrication. In contrast, Onto Innovation Inc. (ONTO) specializes in process control tools and metrology, operating in a niche but competitive segment. Both companies face competitive pressure from emerging technologies and new entrants, necessitating continuous innovation to maintain their market standing. The semiconductor industry’s rapid advancements further underscore the importance of agility in technology adaptation for sustained success.

Stock Comparison

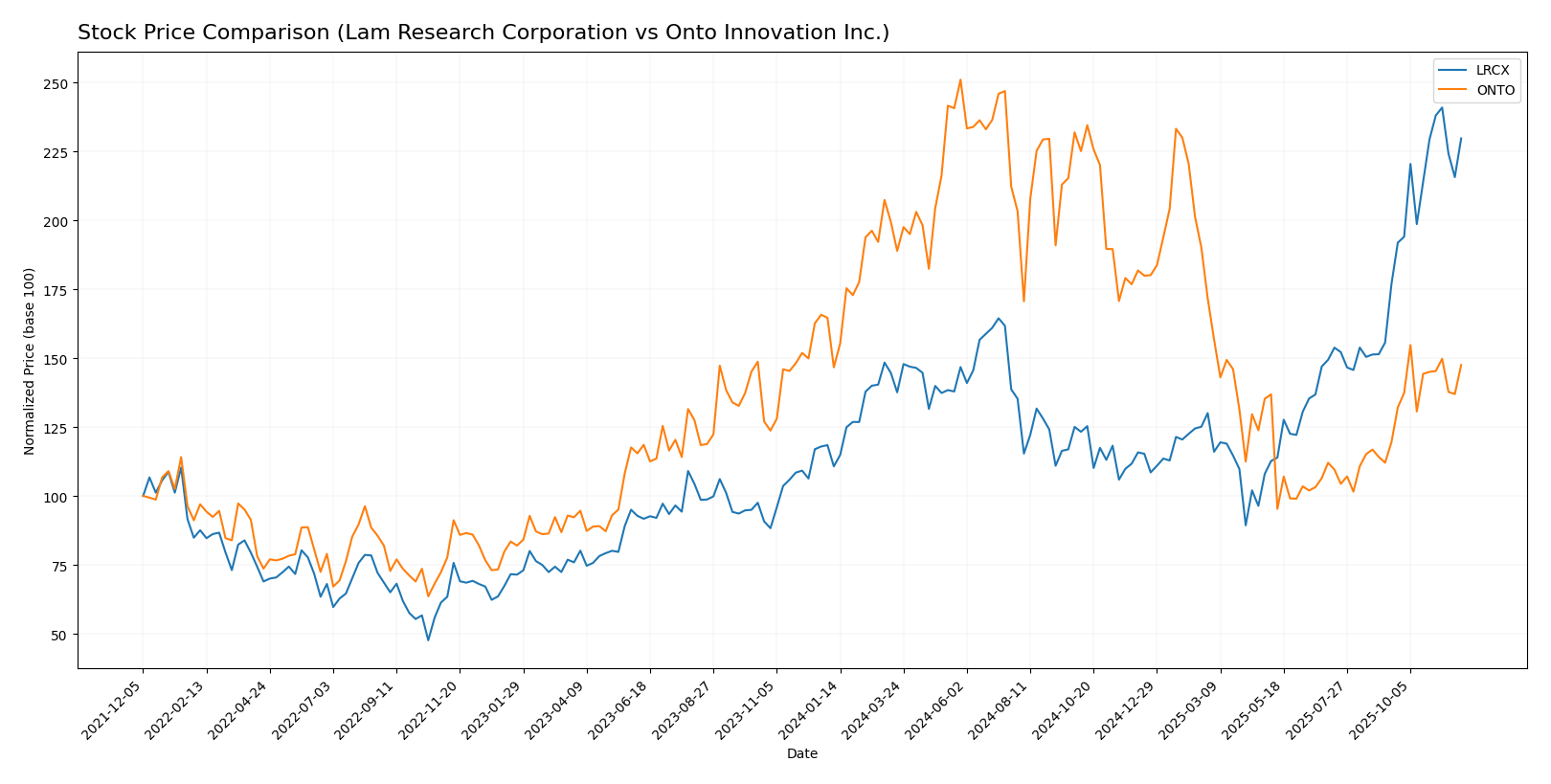

In this section, I will analyze the stock price movements of Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO) over the past year, highlighting significant price changes and trading dynamics.

Trend Analysis

Lam Research Corporation (LRCX) Over the past year, LRCX has experienced a remarkable price change of +107.44%, indicating a bullish trend. The stock has shown acceleration in its upward movement, with notable price fluctuations, including a high of 159.35 and a low of 59.09. The standard deviation of 21.41 suggests a moderate level of volatility. In the recent period from September 14, 2025, to November 30, 2025, the price change was +29.9%, with a standard deviation of 12.72, indicating continued bullish momentum.

Onto Innovation Inc. (ONTO) For ONTO, the price change over the past year stands at +0.59%, which places it in a neutral trend category. Despite this, the stock has shown acceleration, with a high of 233.14 and a low of 88.5. The standard deviation of 42.36 indicates higher volatility compared to LRCX. In the recent analysis from September 14, 2025, to November 30, 2025, ONTO’s price change was +23.44%, maintaining its bullish trend momentum, albeit at a slower pace than LRCX.

Analyst Opinions

Recent analyst recommendations for Lam Research Corporation (LRCX) indicate a strong “Buy” rating, with analysts highlighting its impressive return on equity and solid cash flow metrics. Notably, analysts have given LRCX a B+ rating, reflecting confidence in its growth potential. Conversely, Onto Innovation Inc. (ONTO) received a “Hold” recommendation, with a B rating, as analysts cite concerns over its debt-to-equity ratio and less favorable market conditions. The consensus for LRCX is a “Buy,” while ONTO remains a more cautious “Hold” for the current year.

Stock Grades

I have analyzed the most recent stock grades from reliable grading companies for two notable companies: Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO). Here are the latest ratings:

Lam Research Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| UBS | maintain | Buy | 2025-10-23 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-23 |

| Stifel | maintain | Buy | 2025-10-23 |

| Susquehanna | maintain | Positive | 2025-10-23 |

| B. Riley Securities | maintain | Buy | 2025-10-23 |

| Mizuho | maintain | Outperform | 2025-10-23 |

| JP Morgan | maintain | Overweight | 2025-10-23 |

| Oppenheimer | maintain | Outperform | 2025-10-23 |

Onto Innovation Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | maintain | Buy | 2025-11-18 |

| Needham | maintain | Buy | 2025-11-18 |

| Evercore ISI Group | maintain | Outperform | 2025-11-05 |

| Oppenheimer | maintain | Outperform | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

| B. Riley Securities | maintain | Buy | 2025-10-10 |

| Jefferies | upgrade | Buy | 2025-09-23 |

| Benchmark | maintain | Buy | 2025-08-08 |

| Cantor Fitzgerald | maintain | Neutral | 2025-06-24 |

In summary, both companies demonstrate a strong trend in maintaining positive grades, particularly with multiple “Buy” and “Outperform” ratings from prominent analysts. This indicates a favorable outlook for investors considering these stocks for their portfolios.

Target Prices

The current target price consensus from analysts for Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO) suggests a positive outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lam Research Corporation | 200 | 98 | 157.42 |

| Onto Innovation Inc. | 180 | 120 | 153.33 |

For Lam Research Corporation, the consensus target price of 157.42 is slightly above the current stock price of 151.93, indicating a potential upside. Similarly, Onto Innovation has a target consensus of 153.33 compared to its current price of 136.99, also pointing towards growth potential. Overall, analysts project positive expectations for both companies.

Strengths and Weaknesses

The following table highlights the strengths and weaknesses of Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO) based on the most recent data available.

| Criterion | Lam Research Corporation (LRCX) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Diversification | High (varied semiconductor solutions) | Moderate (focused on inspection and metrology) |

| Profitability | Strong (net profit margin: 29.1%) | Moderate (net profit margin: 20.4%) |

| Innovation | High (continuous product development) | Moderate (emphasis on process control tools) |

| Global presence | Extensive (operates worldwide) | Moderate (primarily in North America and Asia) |

| Market Share | Significant (leading in semiconductors) | Growing (expanding in niche markets) |

| Debt level | Manageable (debt-to-equity ratio: 0.48) | Very low (debt-to-equity ratio: 0.01) |

In summary, Lam Research Corporation exhibits strong profitability and innovation, alongside a significant market share, while Onto Innovation shows potential with low debt levels but is more focused in its market approach.

Risk Analysis

The following table summarizes the key risks associated with Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO).

| Metric | LRCX | ONTO |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | High | Moderate |

Lam Research faces significant market and geopolitical risks, particularly due to its reliance on global semiconductor demand and supply chain vulnerabilities. Onto Innovation, while generally less exposed, still contends with market fluctuations and operational risks in a competitive landscape.

Which one to choose?

When comparing Lam Research Corporation (LRCX) and Onto Innovation Inc. (ONTO), LRCX shows stronger fundamentals, with a higher net profit margin of 29.06% compared to ONTO’s 20.43%. LRCX’s price-to-earnings ratio is more favorable at 23.36 versus ONTO’s 41.76, suggesting better valuation for potential investors. Analyst ratings also favor LRCX, which holds a B+ rating compared to ONTO’s B. Additionally, LRCX’s stock trend is bullish with a notable 107.44% increase, indicating robust performance momentum.

However, ONTO boasts a solid current ratio of 8.69, reflecting strong liquidity. Investors focused on growth may prefer LRCX, while those prioritizing stability and liquidity may favor ONTO. It’s crucial to note that both companies face risks related to market competition and valuation pressures.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Lam Research Corporation and Onto Innovation Inc. to enhance your investment decisions: