In today’s competitive industrial landscape, JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO) stand out as key players in machinery innovation, albeit in different niches. JBTM specializes in technology solutions for the food and beverage sector, while CMCO focuses on intelligent motion solutions for various industries. Both companies share a commitment to innovation and efficiency, making them compelling subjects for comparison. As we delve into their strategies and market positions, I aim to help you identify which company may be the more intriguing investment opportunity.

Table of contents

Company Overview

JBT Marel Corporation Overview

JBT Marel Corporation, headquartered in Chicago, Illinois, focuses on delivering advanced technology solutions to the global food and beverage industry. The company specializes in providing comprehensive processing solutions, including chilling, cooking, and packaging, which cater to a broad range of sectors, from baby food to pharmaceuticals. With a workforce of approximately 11,700 employees, JBT Marel emphasizes innovation and efficiency, enhancing productivity and quality in food processing. The firm operates on a global scale, ensuring that its products meet the diverse needs of clients across multiple continents. Formerly known as John Bean Technologies Corporation, the company rebranded in January 2025 to reflect its ongoing commitment to the food industry.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation, based in Buffalo, New York, is a leading provider of intelligent motion solutions that facilitate the ergonomic movement and secure lifting of materials across various industries. Established in 1875, the company designs and manufactures an extensive range of equipment, including hoists, cranes, and material handling solutions. With a team of around 3,515 employees, Columbus McKinnon serves diverse market verticals, such as construction, energy, and life sciences, and markets its products through both direct sales and distribution networks. The company prides itself on its innovative engineering, aiming to improve safety and efficiency in material handling globally.

Key Similarities and Differences

Both JBT Marel and Columbus McKinnon operate within the industrial sector, focusing on machinery and technology solutions. However, JBT Marel specializes in food and beverage processing, while Columbus McKinnon provides broad material handling solutions across various industries. This distinction highlights their different target markets and product offerings, despite both emphasizing innovation and efficiency in their operations.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO), illustrating their financial performance metrics.

| Metric | JBT Marel Corporation (JBTM) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Revenue | 1.72B | 963M |

| EBITDA | 204M | 75M |

| EBIT | 115M | 27M |

| Net Income | 85M | -5M |

| EPS | 2.67 | -0.18 |

Interpretation of Income Statement

In the most recent fiscal year, JBTM experienced robust growth, achieving a revenue increase to 1.72B from 1.66B the previous year, alongside a stable net income of 85M. Conversely, CMCO saw a decline in revenue to 963M from 1.01B, resulting in a net loss of 5M. JBTM’s EBITDA margin also improved, indicating better cost management, while CMCO’s margins contracted, reflecting operational challenges. Overall, JBTM’s performance highlights strong operational efficiency, whereas CMCO will need to address its profitability and revenue challenges moving forward.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO). This comparison will help you assess their financial health and operational efficiency.

| Metric | JBT Marel Corporation (JBTM) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| ROE | 5.53% | -0.58% |

| ROIC | 3.65% | 3.60% |

| P/E | 47.63 | -94.69 |

| P/B | 2.63 | 0.55 |

| Current Ratio | 3.48 | 1.81 |

| Quick Ratio | 3.04 | 1.04 |

| D/E | 0.81 | 0.61 |

| Debt-to-Assets | 36.68% | 31.09% |

| Interest Coverage | 6.10 | 1.68 |

| Asset Turnover | 0.50 | 0.55 |

| Fixed Asset Turnover | 7.34 | 9.07 |

| Payout Ratio | 15.34% | -156.52% |

| Dividend Yield | 0.32% | 1.65% |

Interpretation of Financial Ratios

JBTM exhibits strong liquidity with a current ratio of 3.48 and a quick ratio of 3.04, indicating excellent short-term financial health. However, its high P/E ratio of 47.63 suggests overvaluation. In contrast, CMCO’s negative P/E and payout ratios raise concerns about sustainability and profitability. While both companies show similar returns on invested capital, JBTM’s overall financial health appears more robust, albeit with some valuation risks. Investors should proceed with caution, especially regarding CMCO’s unstable metrics.

Dividend and Shareholder Returns

JBT Marel Corporation (JBTM) pays a dividend, currently yielding 0.32%, with a modest payout ratio of 15.34%. The dividend per share has shown a consistent trend, supported by robust free cash flow coverage of 4.56. However, caution is advised due to the relatively high price-to-earnings ratio of 47.63, indicating potential valuation risks.

Conversely, Columbus McKinnon Corporation (CMCO) does not pay dividends, reflecting a reinvestment strategy during its current growth phase. The company maintains share buyback programs, potentially enhancing shareholder value in the long term. The absence of dividends aligns with a focus on R&D, although it may raise concerns about immediate returns.

Overall, JBTM’s dividend strategy suggests sustainable long-term value creation, while CMCO’s approach prioritizes growth over immediate shareholder returns.

Strategic Positioning

In the industrial machinery sector, JBT Marel Corporation (JBTM) holds a substantial market share, driven by its diverse technology solutions catering to the food and beverage industry. With a market cap of 7.34B, it faces competitive pressure primarily from Columbus McKinnon Corporation (CMCO), which specializes in intelligent motion solutions and has a market cap of 475M. Both companies must navigate technological disruptions, emphasizing automation and efficiency to maintain their market positions. As they innovate, their strategic responses will be crucial in shaping market dynamics.

Stock Comparison

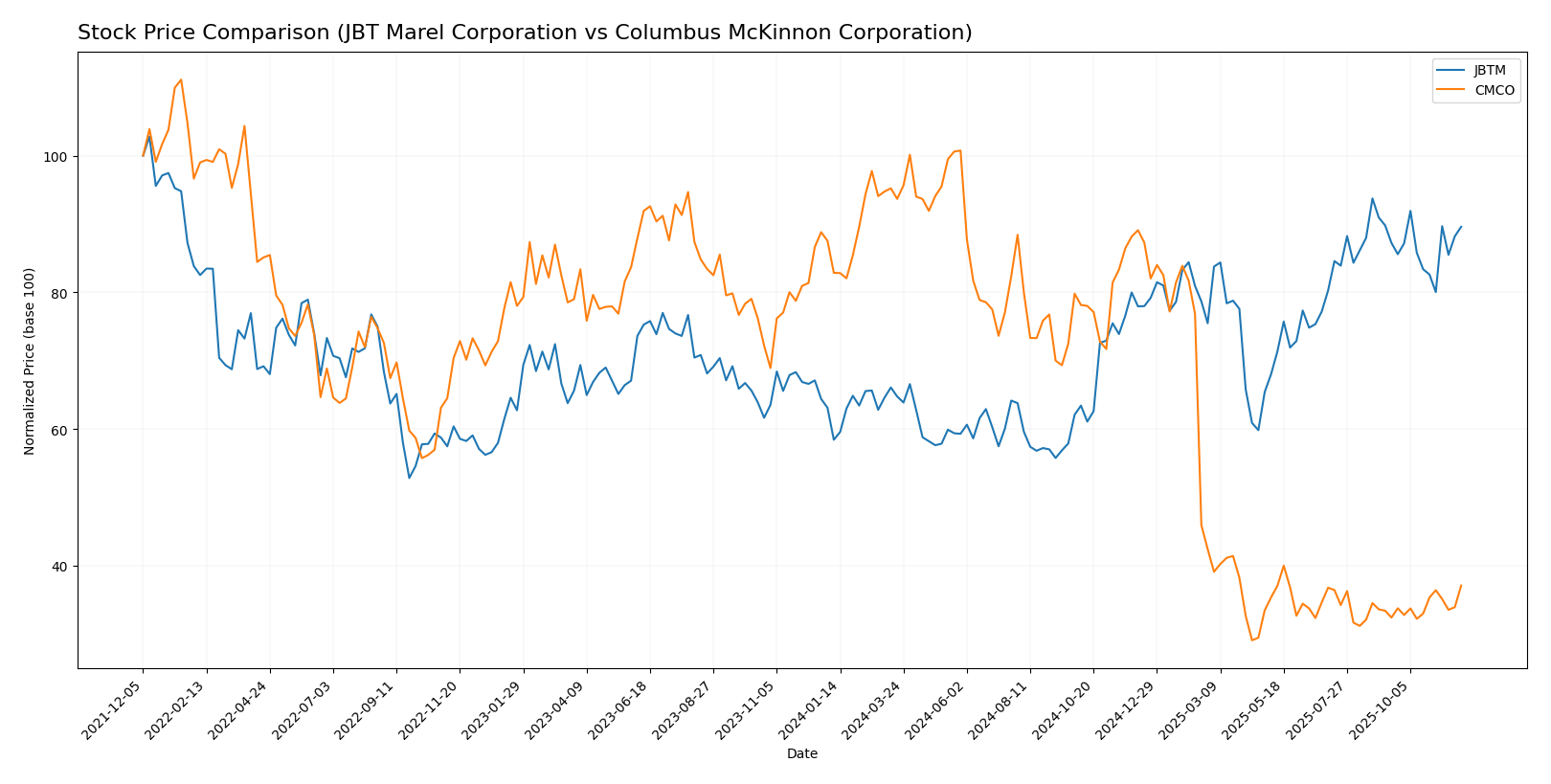

In the past year, JBT Marel Corporation (JBTM) has demonstrated remarkable resilience, with a significant price surge, while Columbus McKinnon Corporation (CMCO) has faced notable declines, reflecting contrasting trading dynamics for these two companies.

Trend Analysis

JBT Marel Corporation (JBTM) Over the past year, JBTM’s stock price has increased by 53.35%, indicating a bullish trend. The highest price reached was 147.7, with a lowest price of 87.85. Notably, the trend is characterized by deceleration, supported by a standard deviation of 17.44, indicating some volatility in price movements.

Columbus McKinnon Corporation (CMCO) In stark contrast, CMCO has experienced a decline of -55.24% over the same period, categorizing it as a bearish trend. The stock peaked at 44.9 and dipped to a low of 12.96. The trend shows acceleration with a standard deviation of 11.25, reflecting a more volatile trading environment.

In the recent analysis period from September 14, 2025, to November 30, 2025, JBTM had a modest price increase of 2.7%, while CMCO rebounded with a notable gain of 14.47%.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO). JBTM has received a “C” rating, primarily due to lower scores in return on equity and assets, suggesting a hold position. Analysts like those at XYZ Research advocate caution. Conversely, CMCO boasts a “B+” rating, with strong discounted cash flow and price-to-book scores, leading analysts from ABC Analysis to recommend a buy. Overall, the consensus for CMCO leans towards a buy, while JBTM is viewed more cautiously.

Stock Grades

Here is the latest stock grading information for JBT Marel Corporation and Columbus McKinnon Corporation.

JBT Marel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | upgrade | Outperform | 2025-08-06 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | downgrade | Neutral | 2025-02-11 |

| DA Davidson | maintain | Buy | 2024-02-05 |

| DA Davidson | maintain | Buy | 2022-10-04 |

| DA Davidson | maintain | Buy | 2022-10-03 |

| Barrington Research | maintain | Outperform | 2022-07-29 |

| Barrington Research | maintain | Outperform | 2022-07-28 |

| JP Morgan | downgrade | Neutral | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-25 |

| JP Morgan | downgrade | Neutral | 2022-05-25 |

The grading trend indicates a shift for JBT Marel Corporation towards a more favorable outlook with an upgrade to “Outperform.” Conversely, Columbus McKinnon Corporation is experiencing a downgrade in sentiment, with a shift to “Neutral” from a prior “Buy.” This highlights a need for caution for investors considering CMCO, while JBTM may present a more promising investment opportunity.

Target Prices

The current consensus target prices for JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO) reflect optimistic projections from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| JBT Marel Corporation (JBTM) | 169 | 169 | 169 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

For JBT Marel Corporation, the target consensus of 169 indicates a significant upside from its current price of 141.16. Meanwhile, Columbus McKinnon Corporation’s consensus of 49 suggests a potential for growth compared to its current price of 16.53.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO) based on the latest financial data:

| Criterion | JBT Marel Corporation (JBTM) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Strong presence in various industries, particularly food and beverage | Focused on material handling solutions across multiple sectors |

| Profitability | Net margin of 4.98% | Negative net margin of -0.53% |

| Innovation | High R&D investment, innovative solutions | Moderate innovation focus |

| Global presence | Operates in multiple regions worldwide | Primarily North American focus |

| Market Share | Strong in food processing machinery | Moderate in material handling |

| Debt level | Debt to equity ratio of 0.81 | Higher debt to equity ratio of 0.68 |

Key takeaways from this analysis indicate that JBT Marel Corporation demonstrates stronger profitability and a more diversified global presence, while Columbus McKinnon Corporation faces challenges with profitability and relies heavily on the North American market.

Risk Analysis

The table below summarizes the key risks associated with JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO).

| Metric | JBT Marel Corporation (JBTM) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

In my analysis, JBT Marel Corporation faces significant regulatory risks due to industry regulations, while Columbus McKinnon Corporation experiences heightened market and operational risks. Both companies must navigate challenges in compliance and market volatility to maintain stability.

Which one to choose?

In comparing JBT Marel Corporation (JBTM) and Columbus McKinnon Corporation (CMCO), JBTM shows a stronger financial performance, with a gross profit margin of 36.5% and a market cap of approximately 4.07B. In contrast, CMCO has a negative net profit margin and a market cap of about 0.49B, indicating ongoing challenges. Analysts rate JBTM as a “C” while CMCO receives a “B+”, reflecting a more favorable outlook for CMCO despite its recent bearish trend. JBTM’s stock price has increased by 53.35% over the last year, while CMCO has seen a decline of 55.24%.

Investors focused on growth may prefer JBTM due to its upward momentum, while those seeking stability might consider CMCO for its potential recovery. However, both companies face risks related to market fluctuations and industry competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of JBT Marel Corporation and Columbus McKinnon Corporation to enhance your investment decisions: