In the dynamic world of healthcare technology, two companies stand out for their innovative approaches: Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT). Both operate within overlapping markets focused on enhancing medical procedures through advanced technology, yet their strategies and product offerings differ significantly. Intuitive Surgical leads in minimally invasive surgical systems, while Novanta excels in photonics and precision motion components. Join me as we evaluate which of these companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Intuitive Surgical, Inc. Overview

Intuitive Surgical, Inc. (ISRG) is a leader in the field of minimally invasive surgery, specializing in the development and manufacturing of robotic surgical systems. Founded in 1995 and headquartered in Sunnyvale, California, the company’s flagship product, the da Vinci Surgical System, enhances surgical precision and efficiency. ISRG focuses on improving patient outcomes and expanding access to advanced surgical techniques globally. With a market capitalization of approximately $205B, it operates in the healthcare sector, providing a suite of complementary services that support the adoption and integration of its technology within healthcare institutions.

Novanta Inc. Overview

Novanta Inc. (NOVT) is a key player in the photonics and precision motion sectors, designing and manufacturing components for medical and industrial applications. Established in 1968 and based in Bedford, Massachusetts, Novanta’s product range includes advanced laser systems, medical imaging solutions, and motion control technologies. With a market capitalization around $4B, the company emphasizes innovation and high-quality engineering, serving original equipment manufacturers (OEMs) worldwide. Its diverse offerings position Novanta as a critical partner in enhancing the functionality and performance of medical devices and industrial systems.

Key Similarities and Differences

Both Intuitive Surgical and Novanta operate in the healthcare technology space, focusing on enhancing medical procedures through innovative solutions. However, their business models differ: Intuitive Surgical centers on robotic surgical systems and services, while Novanta provides a broader array of photonics and precision components for various applications, including medical and industrial technologies. This distinction highlights Intuitive’s specialized approach versus Novanta’s diversified portfolio.

Income Statement Comparison

The following table presents a comparison of the income statements for Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) for the fiscal year 2024, highlighting key financial metrics.

| Metric | [Company A: ISRG] | [Company B: NOVT] |

|---|---|---|

| Revenue | 8.35B | 0.95B |

| EBITDA | 2.81B | 0.18B |

| EBIT | 2.35B | 0.12B |

| Net Income | 2.32B | 0.06B |

| EPS | 6.54 | 1.78 |

Interpretation of Income Statement

In 2024, Intuitive Surgical demonstrated strong revenue growth of 17.2% compared to 2023, with net income increasing by 29.2%, reflecting improved operational efficiency. The EBITDA margin also improved, indicating effective cost management amidst rising sales. Conversely, Novanta saw modest revenue growth of 7.7% but faced a decline in net income, which suggests potential challenges in managing costs effectively. The disparity in margins demonstrates the operational strengths of ISRG compared to NOVT, highlighting the need for investors to consider these performance indicators when evaluating potential investments.

Financial Ratios Comparison

The following table presents a comparison of key financial metrics for Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) based on the most recent available data.

| Metric | ISRG | NOVT |

|---|---|---|

| ROE | 14.1% | 8.6% |

| ROIC | 11.9% | 7.2% |

| P/E | 79.8 | 85.7 |

| P/B | 11.3 | 7.4 |

| Current Ratio | 4.1 | 2.6 |

| Quick Ratio | 3.2 | 1.7 |

| D/E | 0.0089 | 0.6316 |

| Debt-to-Assets | 0.0078 | 0.3392 |

| Interest Coverage | N/A | 4.3 |

| Asset Turnover | 0.44 | 0.68 |

| Fixed Asset Turnover | 1.75 | 6.08 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

ISRG shows stronger profitability metrics such as ROE and ROIC compared to NOVT, indicating effective capital utilization. However, ISRG’s high P/E ratio suggests it may be overvalued relative to earnings, while NOVT’s higher debt ratios raise concerns about financial leverage. ISRG’s liquidity ratios are robust, indicating strong short-term financial health. Investors should weigh these factors carefully against their risk tolerance before making investment decisions.

Dividend and Shareholder Returns

Both Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) do not pay dividends, indicating a focus on growth and reinvestment strategies rather than immediate shareholder returns. ISRG, with a zero dividend payout ratio, channels funds into R&D and acquisitions, while NOVT follows a similar path. Both companies also engage in share buybacks, which can enhance shareholder value over time. This approach aligns with long-term value creation, albeit with inherent risks related to market volatility and operational performance.

Strategic Positioning

Intuitive Surgical (ISRG) holds a commanding market share in the minimally invasive surgical systems sector, driven by the widespread adoption of its da Vinci Surgical System. With a market cap of $205B, it faces competitive pressure primarily from emerging technologies and companies like Novanta Inc. (NOVT), which specializes in precision motion and photonics solutions, with a market cap of $4B. Both companies must navigate technological disruptions to maintain their market positions effectively.

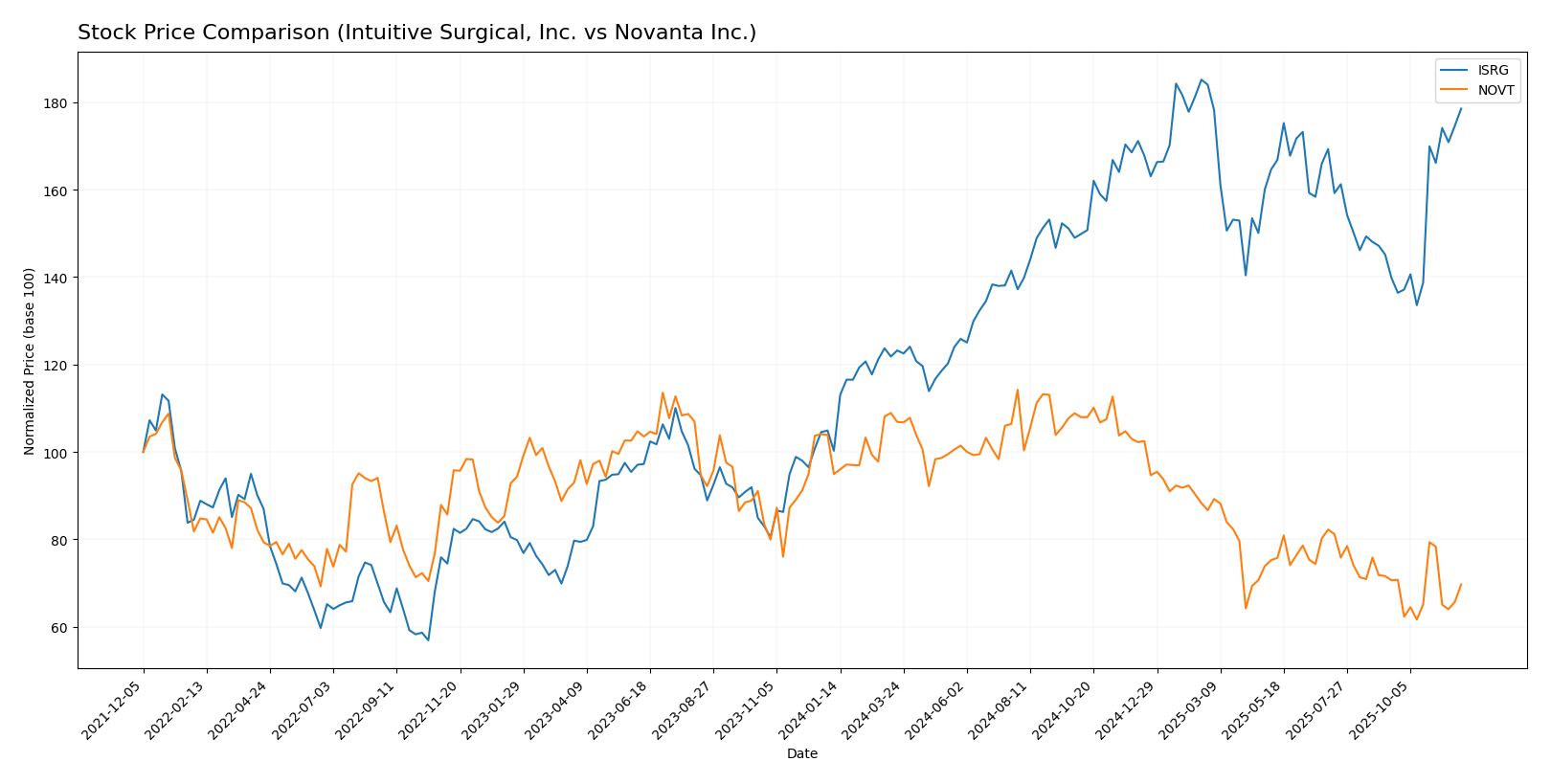

Stock Comparison

In analyzing the stock price movements of Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) over the past year, we observe significant price dynamics. ISRG has experienced a remarkable upward trajectory, while NOVT has faced notable declines.

Trend Analysis

For Intuitive Surgical (ISRG), the overall price change over the past year is +78.06%, indicating a strong bullish trend. The stock has shown acceleration, with notable highs reaching $595.55 and lows at $322.50. Recent performance from September 14, 2025, to November 30, 2025, also reflects a positive change of +27.7%, further supporting the bullish outlook. The volatility, as measured by a standard deviation of 56.68, indicates some fluctuations, but the overall trend remains robust.

Conversely, Novanta Inc. (NOVT) has seen a price change of -26.6% over the past year, which categorizes it as a bearish trend. The stock has also demonstrated acceleration, with highs at $185.16 and lows at $99.96. In the recent period from September 14, 2025, to November 30, 2025, the stock has experienced a slight decline of -1.38%, reinforcing the bearish sentiment. The standard deviation of 9.08 suggests lower volatility compared to ISRG, but the overall trend remains negative.

In summary, ISRG stands out as a strong investment candidate, while NOVT presents a cautionary approach for potential investors.

Analyst Opinions

Recent analyst recommendations for Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) both hold a rating of B-. Analysts highlight ISRG’s strong return on assets (5) and equity (4) as positive indicators, despite lower scores in price-to-earnings and price-to-book ratios. For NOVT, the main arguments focus on its solid return on assets (4) and decent discounted cash flow score (3). However, both companies show mixed results in other metrics. The consensus for both stocks leans towards a “hold” rather than a buy or sell for the current year.

Stock Grades

I have gathered the most recent stock grades from reputable grading companies for two companies: Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT). Here’s a summary of their current ratings.

Intuitive Surgical, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-10-23 |

| Wells Fargo | maintain | Overweight | 2025-10-22 |

| BTIG | maintain | Buy | 2025-10-22 |

| RBC Capital | maintain | Outperform | 2025-10-22 |

| Truist Securities | maintain | Buy | 2025-10-22 |

| Piper Sandler | maintain | Overweight | 2025-10-22 |

| Raymond James | maintain | Outperform | 2025-10-22 |

| Truist Securities | maintain | Buy | 2025-10-15 |

| BTIG | maintain | Buy | 2025-10-13 |

| Evercore ISI Group | maintain | In Line | 2025-10-07 |

Novanta Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Neutral | 2025-08-11 |

| Baird | maintain | Neutral | 2025-03-03 |

| Baird | maintain | Neutral | 2024-11-06 |

| Baird | maintain | Neutral | 2024-08-07 |

| Baird | maintain | Neutral | 2023-05-11 |

| Baird | maintain | Neutral | 2023-05-10 |

| William Blair | upgrade | Outperform | 2022-05-11 |

| William Blair | upgrade | Outperform | 2022-05-10 |

| Berenberg | maintain | Hold | 2020-11-13 |

| Baird | maintain | Neutral | 2020-05-13 |

Overall, Intuitive Surgical shows a mix of strong buy ratings and maintain actions, indicating a stable outlook among analysts. In contrast, Novanta has consistently received neutral ratings from Baird, suggesting a cautious sentiment with limited upward movement expected in the near term.

Target Prices

The consensus target prices for the following companies indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intuitive Surgical, Inc. | 685 | 575 | 618 |

| Novanta Inc. | 160 | 160 | 160 |

For Intuitive Surgical, the target consensus of 618 suggests that analysts expect the stock to appreciate from its current price of 574.23. Meanwhile, Novanta’s consensus target of 160 aligns with its current price of 112.95, indicating potential upside.

Strengths and Weaknesses

The table below summarizes key strengths and weaknesses of Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT) based on the latest available data.

| Criterion | Intuitive Surgical, Inc. (ISRG) | Novanta Inc. (NOVT) |

|---|---|---|

| Diversification | Moderate; focused on surgical tech | Moderate; photonics and motion control |

| Profitability | High net margin (27.8%) | Low net margin (6.8%) |

| Innovation | Strong; leading surgical systems | Active; diverse tech solutions |

| Global presence | Strong; operates internationally | Moderate; primarily North America |

| Market Share | Leading in robotic surgery | Growing in photonics and automation |

| Debt level | Very low (debt to equity: 0.008) | Moderate (debt to equity: 0.632) |

Key takeaways indicate that Intuitive Surgical excels in profitability and global presence with minimal debt, while Novanta shows potential through innovation but operates with a higher debt level and lower profitability margins. Consider these aspects when evaluating investment opportunities.

Risk Analysis

Below is a summary table of the key risks associated with each company.

| Metric | Intuitive Surgical, Inc. (ISRG) | Novanta Inc. (NOVT) |

|---|---|---|

| Market Risk | High (Beta: 1.69) | Moderate (Beta: 1.59) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

In synthesizing these risks, I find that both companies face significant market risk due to high beta values, indicating greater volatility. Regulatory and operational challenges are also notable, particularly in the healthcare and technology sectors, where compliance and innovation are critical.

Which one to choose?

When comparing Intuitive Surgical, Inc. (ISRG) and Novanta Inc. (NOVT), the fundamentals indicate that ISRG is more favorable for investors. ISRG boasts a higher gross profit margin of 67.5% versus NOVT’s 44.4%, along with a net profit margin of 27.8% compared to NOVT’s 6.8%. Analysts rate both companies with a grade of B-, but ISRG outperforms in return on equity (14.1% vs. 8.6%).

ISRG’s stock trend is bullish with a 78.1% price increase over the past year, while NOVT has experienced a bearish trend, declining 26.6%.

Investors focused on growth may prefer ISRG, while those prioritizing stability may find NOVT appealing despite its current challenges. However, both companies face risks including market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Intuitive Surgical, Inc. and Novanta Inc. to enhance your investment decisions: