In today’s rapidly evolving technology landscape, understanding which companies to invest in can be a daunting task. This article compares Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR), both key players in the software sector but with distinct focuses—Informatica in data management and MicroStrategy in analytics solutions. Their innovative strategies and market overlaps make them intriguing candidates for investors looking to capitalize on the growing demand for data-driven insights. Let’s dive in and determine which company stands out as the more compelling investment opportunity.

Table of contents

Company Overview

Informatica Inc. Overview

Informatica Inc. operates within the Software – Infrastructure sector, providing advanced data management solutions powered by artificial intelligence. Founded in 1993 and headquartered in Redwood City, California, the company aims to help organizations connect, manage, and unify data across multi-cloud and hybrid systems. With a market cap of approximately $7.54B, Informatica’s suite of products includes data integration, governance, quality, and master data management tools designed to mitigate data-related errors and enhance overall data consumption. The company is committed to delivering a comprehensive, 360-degree view of business-critical data to support analytics and governance initiatives.

MicroStrategy Incorporated Overview

MicroStrategy Incorporated, established in 1989 and based in Tysons Corner, Virginia, is a leader in enterprise analytics software and services. With a market cap of about $49.58B, the company provides a robust analytics platform that empowers businesses to derive insights through visualization, reporting, and hyperintelligence. MicroStrategy’s offerings cater to a diverse array of industries, emphasizing scalability, security, and seamless integration. The company also focuses on consulting and educational services to optimize the implementation and usage of its analytics solutions.

In terms of business models, Informatica focuses on data management and integration solutions, while MicroStrategy emphasizes analytics and enterprise intelligence. Both companies leverage technology to enhance data utility but target different aspects of the data lifecycle.

Income Statement Comparison

The following table illustrates a comparison of key income metrics for Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR) for the fiscal year 2024.

| Metric | Informatica Inc. (INFA) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Revenue | 1.64B | 463M |

| EBITDA | 339M | -1.85B |

| EBIT | 199M | -1.87B |

| Net Income | 9.93M | -1.17B |

| EPS | 0.033 | -6.06 |

Interpretation of Income Statement

In 2024, Informatica showed a modest revenue increase to 1.64B, alongside a positive net income of 9.93M, reflecting improved operational efficiency and stronger margins compared to previous years. In contrast, MicroStrategy faced significant challenges, reporting a revenue decline and a staggering net loss of 1.17B, primarily driven by high operating expenses and substantial depreciation. This stark divergence underscores the need for careful evaluation of operational strategies and market conditions when considering investments in these companies.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent financial ratios for Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR), allowing investors to evaluate their relative performance.

| Metric | Informatica (INFA) | MicroStrategy (MSTR) |

|---|---|---|

| ROE | 0.43% | -6.40% |

| ROIC | 0.56% | -4.38% |

| P/E | 788 | -48 |

| P/B | 3.39 | 3.06 |

| Current Ratio | 1.82 | 0.71 |

| Quick Ratio | 1.82 | 0.71 |

| D/E | 0.81 | 1.04 |

| Debt-to-Assets | 0.35 | 0.47 |

| Interest Coverage | 0.87 | -29.92 |

| Asset Turnover | 0.31 | 0.02 |

| Fixed Asset Turnover | 8.75 | 5.73 |

| Payout Ratio | 0.0012 | 0 |

| Dividend Yield | 0.00015% | 0% |

Interpretation of Financial Ratios

Informatica shows stronger financial health with positive returns on equity (ROE) and invested capital (ROIC), while MicroStrategy’s negative ratios indicate significant operational challenges. Informatica has a solid current and quick ratio above 1, suggesting good liquidity, whereas MicroStrategy’s ratios below 1 raise concerns about short-term obligations. Additionally, MicroStrategy faces severe debt issues, as indicated by its negative interest coverage ratio.

Dividend and Shareholder Returns

Informatica Inc. (INFA) offers a minimal dividend with a payout ratio of 0.0012 and a negligible yield of 0.00015%. This suggests a cautious approach to distributing earnings, potentially reflecting its ongoing recovery from negative net margins. Share buybacks may be a strategy to enhance shareholder value, albeit with risks of unsustainable distributions.

Conversely, MicroStrategy Incorporated (MSTR) does not pay dividends, focusing instead on growth and acquisitions during its challenging financial phase. While it engages in share buybacks, the lack of dividends may align with a strategy to prioritize long-term value creation over immediate returns. Both companies’ approaches can support sustainable value, provided they manage risks effectively.

Strategic Positioning

Informatica Inc. (INFA) holds a strong position in the software infrastructure sector, leveraging its AI-powered platform to manage data across multi-cloud systems. Its market share is bolstered by a diverse suite of products, but it faces competitive pressure from companies like MicroStrategy (MSTR), which excels in enterprise analytics software. Both companies must navigate technological disruptions and adapt to evolving market needs to maintain their positions.

Stock Comparison

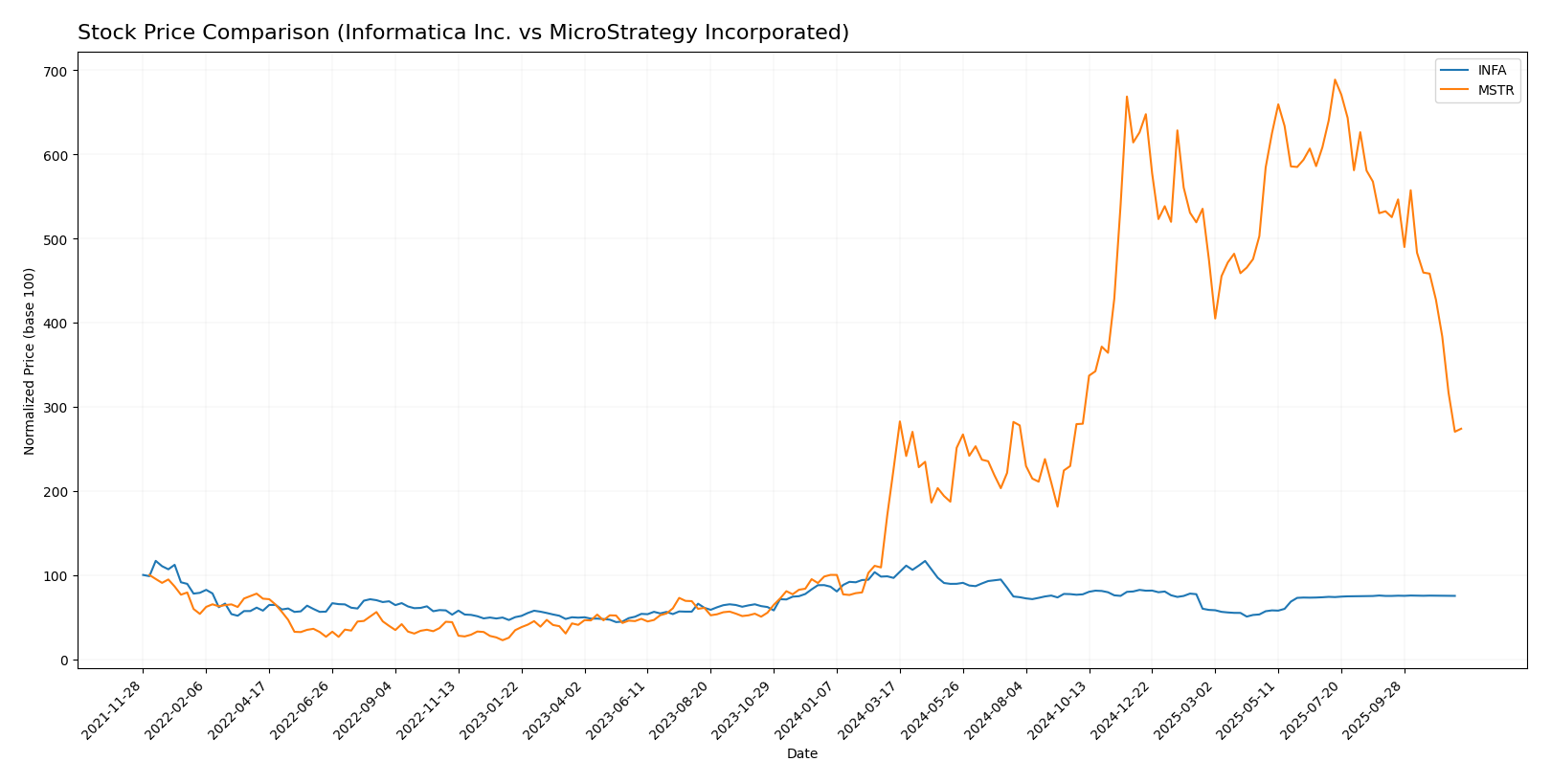

The stock performance of Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR) has exhibited significant movements over the past year, highlighting distinct trading dynamics and investor sentiment in each case.

Trend Analysis

Informatica Inc. (INFA) has experienced a percentage decline of -12.68% over the past year, indicating a bearish trend. The stock peaked at $38.48 and reached a low of $16.67, demonstrating notable volatility with a standard deviation of 4.46. The trend shows acceleration, suggesting a consistent downward pressure on the stock.

In contrast, MicroStrategy Incorporated (MSTR) has posted a remarkable percentage increase of 173.77% over the same period, reflecting a bullish trend. The stock’s highest price was $434.58, with a low of $48.10, which corresponds to a high level of volatility, as indicated by a standard deviation of 113.26. However, in the recent trend analysis from September 14, 2025, to November 30, 2025, MSTR shows a decline of -47.87%, with a trend slope of -16.55, suggesting a deceleration in the recent bullish momentum.

Both stocks are currently exhibiting increasing volume trends, with INFA having a total trading volume of 1.25B and MSTR at 8.91B. This indicates active trading but also highlights the need for caution given the recent price fluctuations.

Analyst Opinions

Recent analyst recommendations for Informatica Inc. (INFA) have not yet been published, leaving investors without a clear consensus. For MicroStrategy Incorporated (MSTR), analysts lean towards a cautious stance, with a rating of “C.” Notably, the overall score of 2 indicates concerns regarding its discounted cash flow and returns on equity and assets, despite a better debt-to-equity ratio and price-to-book score. Given the current data, the consensus for MSTR leans toward a “hold,” reflecting the cautious sentiment among analysts.

Stock Grades

In this section, I’ll present the latest stock ratings for Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR) based on reliable grading data.

Informatica Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | downgrade | Neutral | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| Baird | maintain | Neutral | 2025-05-28 |

| JP Morgan | downgrade | Neutral | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | maintain | Equal Weight | 2025-05-28 |

| Truist Securities | downgrade | Hold | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-27 |

| UBS | maintain | Neutral | 2025-05-16 |

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

The overall trend for Informatica Inc. shows a series of downgrades, particularly from Guggenheim and JP Morgan, indicating a cautious outlook. In contrast, MicroStrategy has experienced an upgrade from Monness, Crespi, Hardt, suggesting a more favorable sentiment among analysts, despite some recent downgrades from Wells Fargo.

Target Prices

The latest analyst consensus for the target prices of Informatica Inc. and MicroStrategy Incorporated indicates a positive outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. (INFA) | 27 | 25 | 26 |

| MicroStrategy Incorporated (MSTR) | 705 | 175 | 478.5 |

For Informatica Inc., the consensus target price of 26 is slightly above its current price of 24.79, suggesting modest growth potential. In contrast, MicroStrategy’s consensus price of 478.5 is significantly higher than its current price of 172.63, indicating strong bullish sentiment among analysts.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR) based on the latest data available.

| Criterion | Informatica Inc. (INFA) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Low (Net Margin: 0.61%) | Very low (Net Margin: -2.52%) |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Declining |

| Debt level | Moderate (Debt/Equity: 0.81) | High (Debt/Equity: 1.04) |

Key takeaways: Informatica shows stronger profitability and global presence, while MicroStrategy faces significant profitability challenges and high debt levels. Investors should weigh these factors carefully when considering these stocks for their portfolios.

Risk Analysis

The following table outlines various risks associated with Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR):

| Metric | Informatica Inc. (INFA) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low | Moderate |

In summary, MicroStrategy faces significant market and operational risks, particularly due to its high volatility and reliance on cryptocurrency investments. In contrast, Informatica has lower regulatory and environmental risks, but still contends with operational challenges.

Which one to choose?

When comparing Informatica Inc. (INFA) and MicroStrategy Incorporated (MSTR), several key factors emerge. INFA has shown a bearish trend with a recent price decline of 12.68%, coupled with a high price-to-earnings ratio (P/E) of 788, indicating potential overvaluation. On the other hand, MSTR exhibits a bullish trajectory, with a significant 173.77% price increase, although it faces volatility, shown by its recent decline of 47.87%. MSTR’s rating is a “C,” reflecting moderate performance in terms of return metrics and leverage.

For growth-focused investors, MSTR may be more appealing due to its recent price momentum. Conversely, those seeking stability might consider INFA, despite its current challenges. However, both companies face risks, including market dependence and valuation concerns.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Informatica Inc. and MicroStrategy Incorporated to enhance your investment decisions: