In the fast-evolving landscape of technology, indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) stand out as intriguing contenders in the semiconductor and hardware markets, respectively. Both companies are driving innovation in automotive applications, yet they approach the sector from different angles—INDI focuses on automotive semiconductors while MVIS specializes in lidar technology for autonomous driving. This article will delve into their strategies and performances, ultimately helping you determine which company may be a more compelling investment opportunity.

Table of contents

Company Overview

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. specializes in automotive semiconductors and software solutions, targeting advanced driver assistance systems, connected car technologies, and electrification applications. Founded in 2007 and headquartered in Aliso Viejo, California, indie focuses on enhancing user experiences through products such as ultrasound devices for parking assistance, infotainment systems, and telematics solutions. With a market cap of approximately $704M, indie has positioned itself as a key player in the expanding automotive tech sector, particularly as the industry shifts towards more connected and electrified vehicles.

MicroVision, Inc. Overview

MicroVision, Inc. is at the forefront of developing lidar sensors critical for automotive safety and autonomous driving. Established in 1993 and based in Redmond, Washington, the company employs advanced laser beam scanning technology to enhance vehicle navigation and safety. MicroVision’s diverse product lineup includes micro-display technologies for augmented reality applications and consumer lidar solutions for smart home integration. With a market cap of around $279M, MicroVision is carving out its niche in the hardware and equipment space, addressing the growing demand for automation and smart technologies.

Key similarities between indie Semiconductor and MicroVision lie in their focus on technology-driven automotive applications, with both companies targeting the growth of electric and autonomous vehicles. However, while indie emphasizes semiconductor solutions, MicroVision is dedicated to lidar technology and its associated applications.

Income Statement Comparison

Below is a comparison of the most recent income statement metrics for indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS). This analysis highlights key financial figures that can aid in investment decisions.

| Metric | indie Semiconductor, Inc. | MicroVision, Inc. |

|---|---|---|

| Revenue | 217M | 4.7M |

| EBITDA | -94M | -71M |

| EBIT | -137M | -75M |

| Net Income | -133M | -97M |

| EPS | -0.76 | -0.46 |

Interpretation of Income Statement

In the latest fiscal year, indie Semiconductor (INDI) experienced a slight decline in revenue to 217M from 223M in the previous year, while net income worsened, moving from -118M to -133M. This reflects a challenging environment, with margins under pressure and overall operating costs remaining high. Conversely, MicroVision (MVIS) saw a significant drop in revenue, down from 7.3M to 4.7M, indicating a contraction in sales. Net income also declined from -82.8M to -97M. Both companies face substantial operational losses, suggesting caution for potential investors as they navigate their recovery strategies.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent financial ratios for both companies, which can help you gauge their performance more effectively.

| Metric | [Company A: INDI] | [Company B: MVIS] |

|---|---|---|

| ROE | -31.73% | -198.72% |

| ROIC | -19.25% | -83.29% |

| P/E | -5.35 | -2.83 |

| P/B | 1.70 | 5.63 |

| Current Ratio | 4.82 | 1.79 |

| Quick Ratio | 4.23 | 1.74 |

| D/E | 0.95 | 1.06 |

| Debt-to-Assets | 42.34% | 11.60% |

| Interest Coverage | -18.37 | -19.19 |

| Asset Turnover | 0.23 | 0.04 |

| Fixed Asset Turnover | 4.30 | 0.20 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit negative profitability metrics, indicating challenges in generating profit relative to equity and invested capital. Company A (INDI) shows a stronger liquidity position with higher current and quick ratios, suggesting better short-term financial health. However, Company B (MVIS) has a lower debt-to-assets ratio, indicating less leverage risk. The absence of dividends in both firms reflects their focus on reinvestment, which could be a concern for income-focused investors.

Dividend and Shareholder Returns

Both indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) do not pay dividends, with no distribution to shareholders noted in their financials. INDI’s strategy includes reinvestment for growth, reflecting a focus on innovation over immediate shareholder returns. MVIS, similarly, prioritizes development despite ongoing losses. Both companies are involved in share buyback programs, indicating a commitment to enhancing shareholder value. While this approach can foster long-term growth, the absence of dividends raises concerns about sustainability and immediate returns for investors.

Strategic Positioning

In the competitive landscape of automotive technology, indie Semiconductor, Inc. (INDI) holds a market cap of 704M and focuses on advanced driver assistance systems, boasting a diverse product range. Meanwhile, MicroVision, Inc. (MVIS) specializes in lidar technology, with a market cap of 279M. Both companies face significant competitive pressure from larger firms and technological disruptions aiming at enhancing safety and user experience in vehicles. As investments in electric and autonomous vehicles grow, their strategic positioning will be critical for long-term success.

Stock Comparison

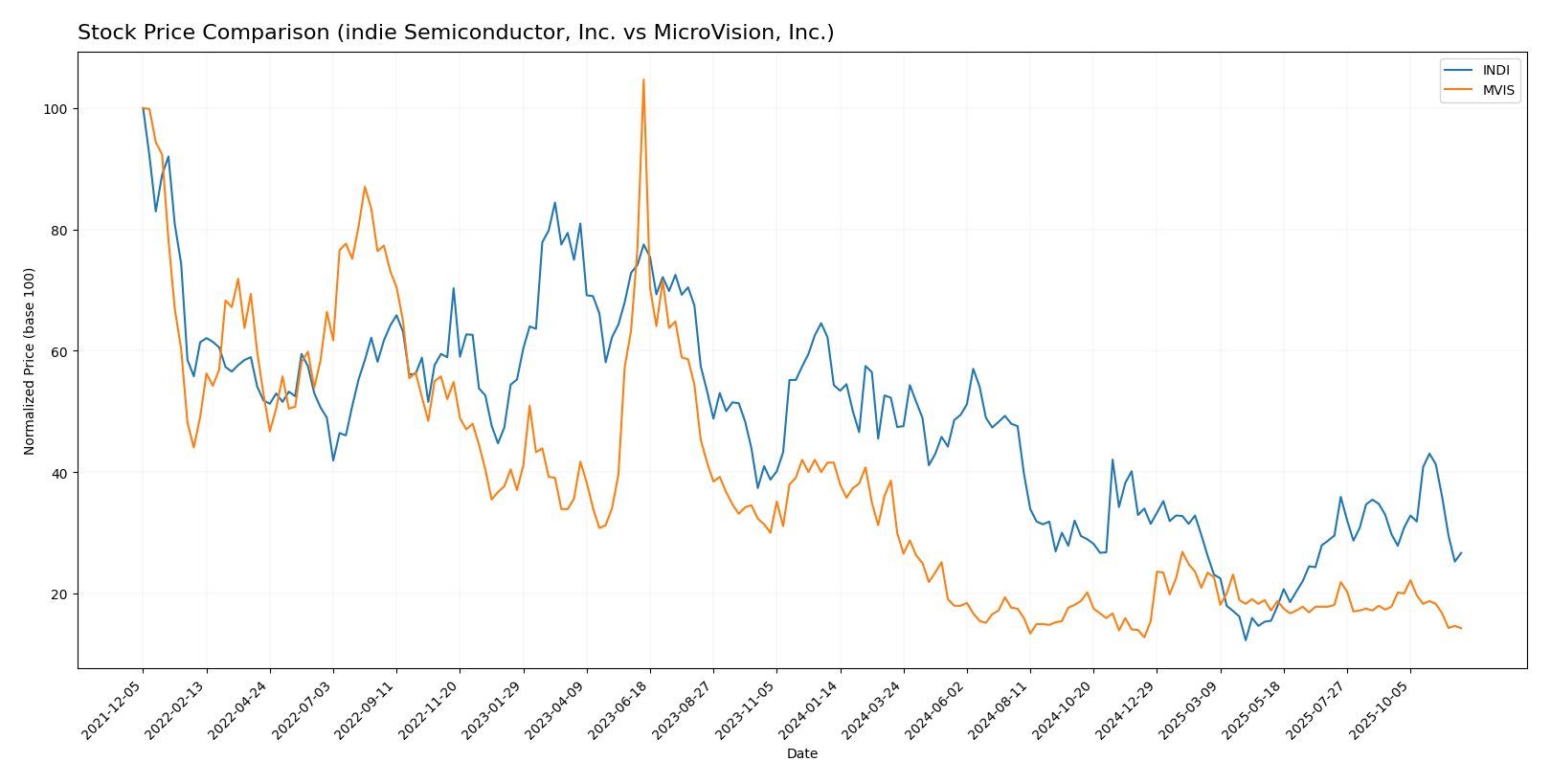

In this analysis, I will evaluate the weekly stock price movements and trading dynamics of indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) over the past year, focusing on key price changes and market trends.

Trend Analysis

indie Semiconductor, Inc. (INDI) Over the past year, INDI’s stock has experienced a significant decline, with a percentage change of -50.92%. This indicates a bearish trend, characterized by an acceleration in price drop. The stock reached a high of 7.49 and a low of 1.6, reflecting notable volatility with a standard deviation of 1.5. In the recent trend from September 14, 2025, to November 30, 2025, the stock’s price fell by -10.43%, further confirming the bearish sentiment.

MicroVision, Inc. (MVIS) Similarly, MVIS has also faced a challenging year, exhibiting a percentage change of -65.65%, which classifies it under a bearish trend with deceleration in the rate of decline. The stock reached a peak of 2.66 and a low of 0.82, with a lower volatility indicated by a standard deviation of 0.42. The recent trend from September 14, 2025, to November 30, 2025, shows a further drop of -19.86%, reinforcing the bearish outlook.

Both stocks are currently under pressure, and I advise caution when considering these investments.

Analyst Opinions

Recent analyst recommendations for indie Semiconductor, Inc. (INDI) indicate a cautious stance, with a rating of C. Analysts highlight concerns regarding its return on equity and assets, suggesting limited growth potential. In contrast, MicroVision, Inc. (MVIS) has received a lower rating of D+, primarily due to poor financial metrics and high debt levels. Both companies are currently viewed unfavorably, with consensus leaning towards a sell for MVIS and a hold for INDI. It’s essential to consider these ratings while forming investment strategies.

Stock Grades

I have gathered the latest stock grades for indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS). Below are the reliable grades provided by recognized grading companies.

indie Semiconductor, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-11-10 |

| Benchmark | maintain | Buy | 2025-06-25 |

| Benchmark | maintain | Buy | 2025-06-11 |

| Benchmark | maintain | Buy | 2025-05-21 |

| Benchmark | maintain | Buy | 2025-05-13 |

| Craig-Hallum | maintain | Buy | 2025-05-13 |

| Keybanc | maintain | Overweight | 2025-05-13 |

| Benchmark | maintain | Buy | 2025-04-09 |

| Benchmark | maintain | Buy | 2025-02-21 |

| Keybanc | maintain | Overweight | 2025-02-21 |

MicroVision, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | maintain | Buy | 2025-11-12 |

| WestPark Capital | maintain | Buy | 2025-10-21 |

| WestPark Capital | maintain | Buy | 2025-09-05 |

| D. Boral Capital | maintain | Buy | 2025-09-02 |

| WestPark Capital | maintain | Buy | 2025-08-27 |

| D. Boral Capital | maintain | Buy | 2025-08-11 |

| D. Boral Capital | maintain | Buy | 2025-05-21 |

| D. Boral Capital | maintain | Buy | 2025-05-13 |

| WestPark Capital | maintain | Buy | 2025-03-27 |

| D. Boral Capital | maintain | Buy | 2025-03-25 |

Overall, both companies have maintained strong buy ratings from multiple grading firms, reflecting a consistent positive sentiment in the market. The trend shows a robust confidence in their ongoing performance.

Target Prices

The current target price consensus for the companies under review reflects cautious optimism based on recent analyst evaluations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| indie Semiconductor, Inc. | 8 | 8 | 8 |

| MicroVision, Inc. | 5 | 5 | 5 |

For indie Semiconductor, the target consensus suggests significant upside potential compared to its current price of 3.47. Similarly, MicroVision’s target consensus indicates room for growth relative to its current price of 0.91.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of two companies, indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS).

| Criterion | indie Semiconductor, Inc. (INDI) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins, high potential | Negative margins, high potential |

| Innovation | Strong focus on automotive tech | Advanced lidar technology |

| Global presence | Limited | Limited |

| Market Share | Niche player | Niche player |

| Debt level | Moderate (debt to equity 0.95) | High (debt to equity 1.06) |

Key takeaways indicate that both companies face challenges with profitability and market share but have unique innovations in their respective fields. INDI may be better positioned in terms of debt management compared to MVIS.

Risk Analysis

The following table outlines the key risks associated with each company, helping investors understand potential vulnerabilities.

| Metric | indie Semiconductor, Inc. (INDI) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Market Risk | High (Beta: 2.56) | Moderate (Beta: 1.54) |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Very High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Considering recent performance and market conditions, both companies face significant operational risks, particularly MicroVision, which struggles with operational profitability. Indie Semiconductor’s market risk is elevated due to its high beta, indicating volatility. Investors should proceed with caution, focusing on risk management strategies.

Which one to choose?

In comparing indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS), both companies show significant challenges, particularly in profitability and operational efficiency. INDI has a market cap of $709M with a net profit margin of -61.2%, while MVIS, with a market cap of $274M, reports a net margin of -20.6%. INDI’s recent stock trend is bearish, with a price drop of 50.9%, whereas MVIS has seen a larger decline of 65.7%. Analyst ratings reflect this disparity, with INDI rated as “C” and MVIS at “D+”.

Investors focused on potential recovery may find INDI more appealing due to its slightly better overall rating, while those prioritizing value in a high-risk sector could consider MVIS. However, both companies face risks related to competition and market dependence, warranting caution.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of indie Semiconductor, Inc. and MicroVision, Inc. to enhance your investment decisions: