In the evolving landscape of energy, Exelon Corporation (EXC) and Centrus Energy Corp. (LEU) represent two distinct yet interconnected facets of the sector. While Exelon focuses on regulated electric utility services, Centrus specializes in nuclear fuel supply and technical solutions. This comparison is particularly relevant due to their overlapping roles in the nuclear energy space, where innovation and sustainability are paramount. Join me as we explore which of these companies presents a more compelling opportunity for investors.

Table of contents

Company Overview

Exelon Corporation Overview

Exelon Corporation (NASDAQ: EXC) is a leading utility services holding company based in Chicago, Illinois. With a market capitalization of approximately $46.2B, Exelon is a major player in the energy sector, owning a diverse portfolio of energy generation facilities, including nuclear, fossil, wind, hydroelectric, biomass, and solar. The company specializes in energy generation, delivery, and marketing, serving a broad spectrum of customers from residential to commercial and governmental sectors. Exelon’s mission emphasizes sustainable energy solutions and reliable service delivery, positioning it as a key contributor to the energy landscape in the U.S. and Canada.

Centrus Energy Corp. Overview

Centrus Energy Corp. (AMEX: LEU), headquartered in Bethesda, Maryland, is an essential supplier of nuclear fuel and services for the global nuclear power industry, with a market cap of around $4.4B. The company operates primarily through two segments: Low-Enriched Uranium (LEU) and Technical Solutions. It provides critical components for nuclear power plants, including separative work units and natural uranium. Centrus’s focus on innovation and engineering services enhances its competitive edge and supports the nuclear sector’s sustainability efforts.

Key Similarities and Differences

Both Exelon and Centrus Energy operate within the energy industry, emphasizing sustainability and innovative solutions. However, Exelon predominantly focuses on utility services and power generation, while Centrus specializes in supplying nuclear fuel and related technical services. This distinction in their business models highlights Exelon’s broader utility focus compared to Centrus’s specialized nuclear sector engagement.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Exelon Corporation and Centrus Energy Corp., highlighting key financial metrics for evaluation.

| Metric | Exelon Corporation (EXC) | Centrus Energy Corp. (LEU) |

|---|---|---|

| Revenue | 23.03B | 442M |

| EBITDA | 8.18B | 86.5M |

| EBIT | 4.58B | 75.7M |

| Net Income | 2.46B | 73.2M |

| EPS | 2.45 | 4.49 |

Interpretation of Income Statement

In the most recent fiscal year, Exelon Corporation (EXC) demonstrated strong revenue growth, increasing from 21.73B to 23.03B, alongside a net income rise from 2.33B to 2.46B. This indicates improved operational efficiency, as evidenced by stable EBITDA margins. Conversely, Centrus Energy Corp. (LEU) also experienced significant growth in revenue, from 320M to 442M, with net income increasing from 84.4M to 73.2M, showcasing its expanding market presence. However, LEU’s profitability margins are lower than those of EXC, reflecting differing operational scales and market dynamics. Overall, both companies exhibit positive trends, yet EXC’s larger scale may provide more stability and risk management potential.

Financial Ratios Comparison

The table below summarizes the most recent revenue and key financial ratios for Exelon Corporation (EXC) and Centrus Energy Corp. (LEU).

| Metric | Exelon Corporation (EXC) | Centrus Energy Corp. (LEU) |

|---|---|---|

| ROE | 9.14% | 45.35% |

| ROIC | 3.93% | 4.02% |

| P/E | 15.35 | 9.81 |

| P/B | 1.40 | 25.62 |

| Current Ratio | 0.87 | 2.93 |

| Quick Ratio | 0.78 | 2.46 |

| D/E | 1.73 | 0.97 |

| Debt-to-Assets | 43.28% | 21.92% |

| Interest Coverage | 2.26 | 40.31 |

| Asset Turnover | 0.21 | 0.40 |

| Fixed Asset Turnover | 0.29 | 47.02 |

| Payout Ratio | 61.95% | 0% |

| Dividend Yield | 4.04% | 0% |

Interpretation of Financial Ratios

Exelon Corporation shows moderate profitability with a reasonable P/E ratio, but its high debt-to-equity ratio indicates potential risk. In contrast, Centrus Energy Corp. exhibits strong profitability with a very high ROE and interest coverage, alongside a low dividend payout ratio, which may suggest a focus on reinvesting earnings. However, the extremely high P/B ratio could indicate overvaluation concerns. Therefore, while Centrus may present a more favorable growth potential, investors should be cautious of its valuation metrics.

Dividend and Shareholder Returns

Exelon Corporation (EXC) offers a robust dividend with a yield of approximately 4.04% and a payout ratio of about 62%. This indicates a balanced approach to returning value, though I remain cautious of potential risks if distributions become unsustainable. Conversely, Centrus Energy Corp. (LEU) does not pay dividends, focusing on reinvestment for growth. While this strategy could enhance long-term shareholder value, it does not provide immediate returns. Both companies show share buyback programs, which may support stock price appreciation.

Strategic Positioning

Exelon Corporation (EXC) maintains a robust market share in the regulated electric sector, benefiting from its diverse energy portfolio, including nuclear and renewable sources. With a market cap of $46.2B, it faces competitive pressure from emerging technologies and changing energy regulations. Centrus Energy Corp. (LEU), valued at $4.4B, operates in the uranium sector, supplying nuclear fuel amidst increasing global demand, yet it must navigate volatility and regulatory challenges. Both companies are positioned in dynamic markets with varying degrees of technological disruption.

Stock Comparison

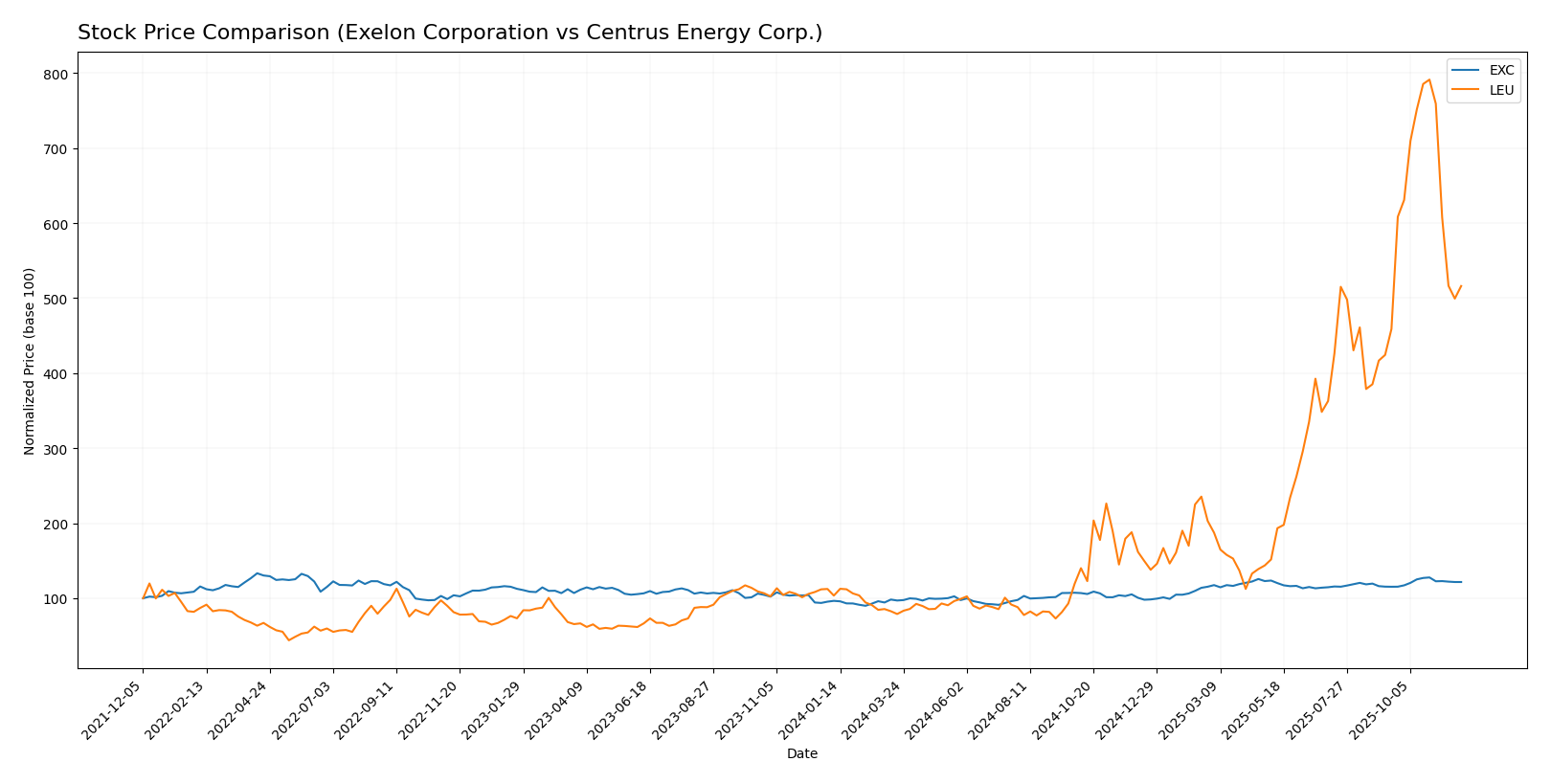

This section provides an analytical overview of the stock price movements and trading dynamics of Exelon Corporation (EXC) and Centrus Energy Corp. (LEU) over the past year, highlighting key price changes and trends.

Trend Analysis

For Exelon Corporation (EXC), the stock has exhibited a 26.0% increase in price over the past year, indicating a bullish trend. The highest price reached was $48.04, while the lowest was $33.84. The trend shows acceleration, supported by a standard deviation of 3.92, reflecting moderate volatility. Recently, from September 14, 2025, to November 30, 2025, EXC experienced a 5.46% increase, with a standard deviation of 1.46, suggesting stable trading conditions.

In contrast, Centrus Energy Corp. (LEU) has seen an impressive 398.38% increase in its stock price over the same period, also indicating a bullish trend. The stock peaked at $383.00 and dipped to $35.36. However, this trend shows deceleration, with a high standard deviation of 91.0, indicating significant volatility. From September 14, 2025, to November 30, 2025, LEU had a 12.47% increase, though the trend slope of -2.76 suggests a slowing momentum during this recent period.

Overall, both stocks reflect strong upward trends, but investors should remain mindful of the varying volatility levels associated with each.

Analyst Opinions

Recent analyst recommendations for Exelon Corporation (EXC) indicate a “Buy” rating with a solid overall score of 3. Analysts highlight its strong return on assets and discounted cash flow metrics as key positives. Centrus Energy Corp. (LEU) received a “Hold” rating, with a score of B-, reflecting concerns over its price-to-earnings ratio, despite a strong return on equity. The consensus for EXC is a “Buy,” while LEU remains neutral with a “Hold.” This balanced approach helps mitigate risk while navigating market conditions in 2025.

Stock Grades

In the current market landscape, I have gathered stock grades from reputable grading firms for two companies: Exelon Corporation (EXC) and Centrus Energy Corp. (LEU). Here’s a closer look at their ratings.

Exelon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-10-22 |

| Keybanc | maintain | Underweight | 2025-10-15 |

| Jefferies | maintain | Buy | 2025-10-15 |

| Barclays | maintain | Overweight | 2025-10-14 |

| UBS | maintain | Neutral | 2025-10-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-25 |

| Keybanc | maintain | Underweight | 2025-07-16 |

| UBS | maintain | Neutral | 2025-07-11 |

| UBS | maintain | Neutral | 2025-06-02 |

| Morgan Stanley | maintain | Equal Weight | 2025-05-22 |

Centrus Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-26 |

| Evercore ISI Group | maintain | Outperform | 2025-08-08 |

| B of A Securities | downgrade | Neutral | 2025-08-07 |

| JP Morgan | maintain | Neutral | 2025-08-07 |

| B. Riley Securities | maintain | Buy | 2025-06-23 |

| Evercore ISI Group | maintain | Outperform | 2025-06-18 |

| B. Riley Securities | maintain | Buy | 2024-10-30 |

| Roth MKM | maintain | Neutral | 2024-10-30 |

Overall, the grades for both companies indicate a cautious sentiment. Exelon Corporation shows a mix of “Equal Weight,” “Underweight,” and “Buy” ratings, while Centrus Energy Corp. has maintained a balance of “Neutral” and “Buy” ratings, suggesting a stable outlook but with varying degrees of confidence from analysts.

Target Prices

The current consensus target prices for Exelon Corporation (EXC) and Centrus Energy Corp. (LEU) reflect optimistic outlooks from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Exelon Corporation (EXC) | 57 | 42 | 51.67 |

| Centrus Energy Corp. (LEU) | 275 | 245 | 257.33 |

Analysts are projecting a target consensus of approximately $51.67 for EXC and $257.33 for LEU. Given their current prices of $45.70 and $249.92, respectively, both stocks appear to have potential upside based on analyst expectations.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Exelon Corporation (EXC) and Centrus Energy Corp. (LEU) based on recent data.

| Criterion | Exelon Corporation (EXC) | Centrus Energy Corp. (LEU) |

|---|---|---|

| Diversification | Strong presence in various energy sectors (nuclear, wind, solar) | Focused mainly on nuclear fuel and services |

| Profitability | Net profit margin of 10.68% | Net profit margin of 26.36% |

| Innovation | Continuous investment in renewable energy technologies | Limited innovation outside nuclear sector |

| Global presence | Operates mainly in the U.S. and Canada | International presence but focused on specific markets |

| Market Share | Significant share in regulated electric utility market | Smaller share in the uranium sector |

| Debt level | High debt-to-equity ratio of 1.73 | Low debt-to-equity ratio of 0.97 |

In summary, Exelon shows strength in diversification and market presence, while Centrus Energy excels in profitability and debt management. However, both companies have unique weaknesses that investors must consider.

Risk Analysis

The following table outlines the key risks associated with Exelon Corporation (EXC) and Centrus Energy Corp. (LEU).

| Metric | Exelon Corporation (EXC) | Centrus Energy Corp. (LEU) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | Medium |

| Environmental Risk | High | Medium |

| Geopolitical Risk | Medium | High |

In summary, both companies face significant regulatory and environmental risks. Exelon, being in the regulated electric sector, is heavily influenced by policy changes, while Centrus faces geopolitical risks tied to uranium supply chains. As global energy dynamics shift, monitoring these risks will be crucial for investors.

Which one to choose?

When comparing Exelon Corporation (EXC) and Centrus Energy Corp. (LEU), both companies show potential but cater to different investor preferences. EXC has a market cap of $37.75B and demonstrates solid fundamentals with a B rating, indicating stable performance with a 4% dividend yield. Its recent stock trend is bullish with a 26% price increase over the past year. In contrast, LEU has surged by 398% but shows signs of deceleration in its growth, reflected in its B- rating. Investors interested in high growth may lean towards LEU, while those seeking stability and dividends might prefer EXC.

However, potential risks include market volatility and competition in the energy sector, which could impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Exelon Corporation and Centrus Energy Corp. to enhance your investment decisions: