In the evolving landscape of the uranium sector, Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY) stand out as key players with distinct business models and strategies. Energy Fuels focuses on the extraction and recovery of uranium, leveraging its extensive operational portfolio in the U.S., while Uranium Royalty operates as a royalty company, diversifying its interests across various projects in North America and beyond. In this article, I will analyze these two companies to help you determine the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Energy Fuels Inc. Overview

Energy Fuels Inc. (ticker: UUUU) is a leading player in the uranium sector, primarily engaged in the extraction and recovery of uranium resources in the United States. The company operates several key projects, including the Nichols Ranch project in Wyoming and the White Mesa Mill in Utah, positioning itself as a crucial contributor to the domestic supply of uranium. With a market capitalization of approximately $3.39B, Energy Fuels is well-capitalized for growth and innovation in a market that is increasingly focused on sustainable energy solutions. The company is committed to advancing uranium mining practices and addressing the growing demand for nuclear energy.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (ticker: UROY) operates as a pure-play uranium royalty company, acquiring and managing a diversified portfolio of uranium interests. Headquartered in Vancouver, Canada, the company focuses on securing royalty agreements on significant projects across North America and internationally, including the renowned McArthur River and Cigar Lake projects in Saskatchewan. With a market cap of about $486M, Uranium Royalty aims to capitalize on the rising uranium prices and the global shift towards nuclear energy as a cleaner alternative. Their strategy centers on generating revenue through royalties rather than direct mining operations.

Key similarities between Energy Fuels and Uranium Royalty include their focus on the uranium market and commitment to sustainable energy solutions. However, they diverge significantly in their business models: Energy Fuels is directly involved in uranium mining and processing, while Uranium Royalty specializes in acquiring and managing royalty interests in uranium projects. This distinction reflects differing risk profiles and operational approaches within the sector.

Income Statement Comparison

Below is a comparative analysis of the most recent income statements for Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY), highlighting key financial metrics.

| Metric | Energy Fuels Inc. (UUUU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Revenue | 78.1M | 15.6M |

| EBITDA | -43.0M | -4.8M |

| EBIT | -48.2M | -4.9M |

| Net Income | -47.8M | -5.7M |

| EPS | -0.28 | -0.0446 |

Interpretation of Income Statement

In the latest fiscal year, Energy Fuels Inc. exhibited significant revenue growth compared to the previous year, rising from 37.9M to 78.1M. However, it still reported a net loss of 47.8M, indicating ongoing operational challenges. Uranium Royalty Corp., on the other hand, saw a decline in revenue from 42.7M to 15.6M, resulting in a net loss of 5.7M. Both companies are grappling with negative EBITDA and EBIT, reflecting difficulties in achieving profitability. The sharp drop in UROY’s revenue signals a need for strategic adjustments, while UUUU’s increased revenue, despite losses, suggests potential for recovery if operational efficiencies are improved.

Financial Ratios Comparison

The following table compares the most recent financial ratios for Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY).

| Metric | Energy Fuels Inc. (UUUU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| ROE | -9.05% | -1.92% |

| ROIC | -6.67% | -1.73% |

| P/E | -18.47 | -56.00 |

| P/B | 1.67 | 1.07 |

| Current Ratio | 3.88 | 233.49 |

| Quick Ratio | 2.76 | 233.49 |

| D/E | 0.004 | 0.001 |

| Debt-to-Assets | 0.0036 | 0.0007 |

| Interest Coverage | 0 | -11.02 |

| Asset Turnover | 0.13 | 0.05 |

| Fixed Asset Turnover | 1.42 | 82.51 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

Both companies are currently facing significant challenges, as indicated by their negative ROE and ROIC. Energy Fuels Inc. shows a relatively better position with a lower debt-to-equity ratio and a positive current ratio, suggesting better liquidity. However, UROY’s exceptionally high current ratio indicates strong short-term financial health but may also reflect an inefficient use of assets. Potential investors should remain cautious, particularly given the negative earnings metrics.

Dividend and Shareholder Returns

Energy Fuels Inc. (UUUU) does not pay dividends, reflecting its focus on reinvestment during a challenging financial phase, evidenced by negative net margins. The company engages in share buybacks, which may indicate a commitment to enhancing shareholder value despite the lack of cash distributions. Conversely, Uranium Royalty Corp. (UROY) also refrains from paying dividends, prioritizing growth and operational improvements. Both companies’ strategies could lead to long-term value creation, but investor risk remains due to their current financial instability.

Strategic Positioning

Energy Fuels Inc. (UUUU) holds a significant position in the uranium market with a market cap of 3.39B, reflecting its extensive operations in uranium extraction and recovery in the U.S. Conversely, Uranium Royalty Corp. (UROY) operates as a royalty company, managing a diverse portfolio valued at 486M. Both companies face competitive pressure from fluctuating uranium prices and emerging technologies, which could disrupt traditional extraction methods. As an investor, I recommend assessing these dynamics carefully before making investment decisions.

Stock Comparison

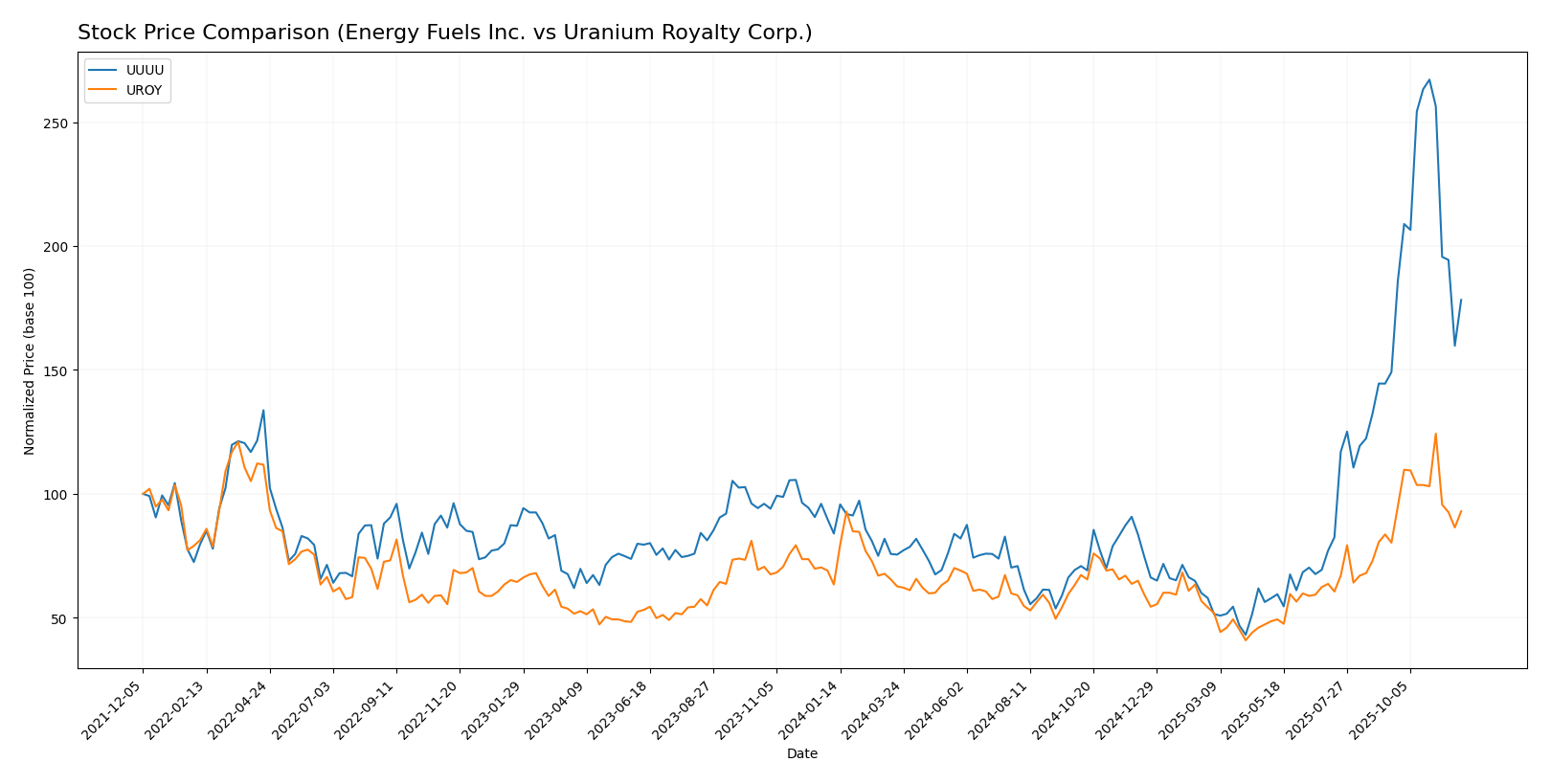

In this section, I will analyze and compare the stock price movements of Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY) over the past year, highlighting key price dynamics and trading behaviors.

Trend Analysis

Energy Fuels Inc. (UUUU) Over the past year, UUUU has experienced a significant price change of +112.2%, indicating a bullish trend. The stock reached a notable high of 21.37 and a low of 3.45, though the trend shows signs of deceleration. The recent price change from September 14, 2025, to November 30, 2025, is +19.53%, with a standard deviation of 3.14, suggesting some volatility. Despite this, the overall bullish trend indicates continued investor interest.

Uranium Royalty Corp. (UROY) In the same timeframe, UROY has demonstrated a price increase of +46.57%, also reflecting a bullish trend. The stock’s highest price was 4.86, while the lowest was 1.6. Similar to UUUU, the trend is decelerating. The recent price change from September 14, 2025, to November 30, 2025, stands at +15.76%, with a standard deviation of 0.44, which indicates lower volatility relative to UUUU. This suggests a more stable investor sentiment, although the recent buyer dominance has decreased.

In summary, both stocks exhibit bullish trends with substantial gains over the past year, though UUUU shows higher volatility compared to UROY.

Analyst Opinions

Recent analyst recommendations for Energy Fuels Inc. (UUUU) indicate a cautious stance, with a rating of D+ from analysts due to weak financial metrics such as return on equity and debt-to-equity ratios. Conversely, Uranium Royalty Corp. (UROY) has garnered a more favorable rating of C, supported by a relatively stable debt-to-equity score. Analysts emphasize the need for both companies to improve their financial health to attract investors. The current consensus for UROY leans toward a hold, while UUU is viewed as a sell given its lackluster performance.

Stock Grades

In the ever-evolving landscape of stock ratings, it’s essential to stay informed about the latest evaluations from credible sources. Here’s a look at the current grades for Energy Fuels Inc. and Uranium Royalty Corp.

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-21 |

| B. Riley Securities | Maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-08 |

| Canaccord Genuity | Maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | Maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-11 |

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Overall, Energy Fuels Inc. has seen a recent downgrade to “Sell” from Roth Capital, indicating a shift in sentiment, while Uranium Royalty Corp. maintains a consistent “Buy” rating across multiple assessments, suggesting strong confidence from analysts. As always, I advise exercising caution and conducting thorough research before making investment decisions.

Target Prices

Based on the latest information, I have identified target prices for Energy Fuels Inc. (UUUU), while no reliable data is available for Uranium Royalty Corp. (UROY).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

Analysts expect Energy Fuels Inc. to reach a consensus target price of 19.13, significantly higher than its current trading price of 14.275. This suggests a potential upside in the stock value. For Uranium Royalty Corp., no verified target price data is available from recognized analysts.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY) based on recent performance metrics.

| Criterion | Energy Fuels Inc. (UUUU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (Net Profit Margin: -61.15%) | Low (Net Profit Margin: -36.26%) |

| Innovation | Moderate | High |

| Global presence | Limited | Moderate |

| Market Share | Low | Moderate |

| Debt level | Very Low (Debt to Assets: 0.36%) | Very Low (Debt to Assets: 0.07%) |

Key takeaways: Energy Fuels shows limited profitability and a moderate level of diversification, while Uranium Royalty boasts high innovation and better market share prospects despite both companies struggling with profitability.

Risk Analysis

Below is a table summarizing the key risks associated with Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY).

| Metric | Energy Fuels Inc. (UUUU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Risk | High due to uranium price volatility | Moderate; reliant on uranium market trends |

| Regulatory Risk | High; subject to environmental regulations | Moderate; operates in multiple jurisdictions |

| Operational Risk | High; dependent on mining operations | Low; primarily a royalty company |

| Environmental Risk | High; mining has significant environmental impacts | Moderate; risks tied to operational partners |

| Geopolitical Risk | Moderate; influenced by U.S. energy policies | Moderate; international operations expose to geopolitical tensions |

In synthesizing these risks, Energy Fuels Inc. faces high operational and environmental risks due to its direct involvement in mining, while Uranium Royalty Corp. presents a lower risk profile primarily due to its royalty model. However, both companies are subject to market volatility and regulatory scrutiny, especially in the evolving energy sector.

Which one to choose?

When comparing Energy Fuels Inc. (UUUU) and Uranium Royalty Corp. (UROY), a few key factors stand out. UUUU has shown significant revenue growth, reaching $78M in 2024, but carries a heavier debt burden and lower profitability margins, resulting in a D+ rating from analysts. Conversely, UROY, despite lower revenue figures of $15.6M, has a C rating and better management of its debt-to-equity ratio, which may appeal to conservative investors.

UROY’s stock trend remains bullish with a 46.57% price increase, while UUUU has a more volatile trend with a 112.2% increase over the year. Investors focused on growth may prefer UUUU due to its rapid revenue increase, while those prioritizing stability may favor UROY.

Both companies face risks from market dependence and competition in the uranium sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Energy Fuels Inc. and Uranium Royalty Corp. to enhance your investment decisions: