In the rapidly evolving uranium sector, two companies stand out: Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG). Both firms are engaged in uranium extraction and exploration, making them direct competitors in a market that is critical for the global energy transition. Energy Fuels boasts a more extensive operational footprint, while Ur-Energy focuses on innovative project development. As we delve into this comparison, I aim to help you identify the more compelling investment opportunity.

Table of contents

Company Overview

Energy Fuels Inc. Overview

Energy Fuels Inc. (UUUU), headquartered in Lakewood, Colorado, is a leading player in the uranium sector, focusing on the extraction and recovery of uranium in the United States. With a market capitalization of approximately $3.39B, the company operates several key projects, including the Nichols Ranch and the Alta Mesa project, and is also involved in uranium/vanadium properties across multiple states. The company’s commitment to sustainable energy solutions aligns with the growing demand for clean energy sources. Under the leadership of CEO Mark S. Chalmers, Energy Fuels aims to bolster its position in the global uranium market as interest in nuclear energy surges.

Ur-Energy Inc. Overview

Ur-Energy Inc. (URG), based in Littleton, Colorado, specializes in the acquisition, exploration, and operation of uranium mineral properties. With a market cap of about $460M, Ur-Energy’s flagship Lost Creek project spans approximately 48,000 acres in Wyoming, positioning the company as a key player in the U.S. uranium landscape. Founded in 2004 and led by CEO John W. Cash, Ur-Energy focuses on developing its resources with a keen eye on environmental stewardship and operational efficiency, catering to the increasing demand for uranium as a clean energy source.

Key Similarities and Differences

Both Energy Fuels and Ur-Energy operate in the uranium sector and focus on resource extraction and development. However, Energy Fuels has a broader range of projects and a higher market capitalization, while Ur-Energy’s focus is primarily on its flagship Lost Creek project. Their strategic approaches to sustainability and resource management reflect their commitment to meeting the evolving demands of the energy market.

Income Statement Comparison

The following table compares the key financial metrics of Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG) for the most recent fiscal year.

| Metric | Energy Fuels Inc. | Ur-Energy Inc. |

|---|---|---|

| Revenue | 78.1M | 33.7M |

| EBITDA | -43.0M | -59.9M |

| EBIT | -48.2M | -63.1M |

| Net Income | -47.8M | -53.2M |

| EPS | -0.28 | -0.17 |

Interpretation of Income Statement

In the most recent year, Energy Fuels Inc. (UUUU) showed a significant increase in revenue at 78.1M, compared to 37.9M in the previous year, indicating a positive growth trend. However, both companies reported negative net income, with UUUU at -47.8M and URG at -53.2M. While UUUU’s margins appear to be stabilizing, URG has not seen similar improvements. UUUU’s losses narrowed, suggesting potential operational efficiencies. In contrast, URG’s losses widened, reflecting challenges in managing operational costs. Overall, UUUU has shown a more favorable trend despite both companies struggling with profitability.

Financial Ratios Comparison

The table below provides a comparative overview of key financial metrics between Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG). These ratios are essential in evaluating the financial health and performance of these companies.

| Metric | Energy Fuels Inc. (UUUU) | Ur-Energy Inc. (URG) |

|---|---|---|

| ROE | -9.05% | -40.05% |

| ROIC | -6.67% | -36.01% |

| P/E | -18.47 | -6.87 |

| P/B | 1.67 | 2.75 |

| Current Ratio | 3.88 | 5.99 |

| Quick Ratio | 2.76 | 4.91 |

| D/E | 0.004 | 0.009 |

| Debt-to-Assets | 0.004 | 0.006 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.13 | 0.17 |

| Fixed Asset Turnover | 1.42 | 0.00 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit negative return metrics (ROE and ROIC), indicating operational inefficiencies. Energy Fuels shows a healthier current and quick ratio than Ur-Energy, suggesting better short-term liquidity. However, both companies have low debt levels, reflecting minimal financial leverage. The lack of dividends points to reinvestment strategies rather than shareholder returns. Investors should remain cautious due to the high operational losses and negative earnings.

Dividend and Shareholder Returns

Both Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG) do not pay dividends, reflecting their high-growth strategies and ongoing capital investments. Both companies prioritize reinvesting earnings into operations and exploration, crucial for maximizing long-term value creation.

Neither company has a dividend payout ratio, indicating an absence of distributions. However, they are engaging in share buybacks, which can signal confidence in their future potential. This approach may support sustainable growth, but the inherent risks include reliance on future profitability and market conditions.

Strategic Positioning

Energy Fuels Inc. (UUUU) holds a significant market share in the uranium sector, bolstered by its diverse project portfolio and established operational infrastructure, including the White Mesa Mill. Its market cap stands at approximately $3.39B, reflecting strong investor confidence. In contrast, Ur-Energy Inc. (URG), with a market cap of around $460M, faces competitive pressure due to its smaller scale and limited project base, though it has potential for growth through its flagship Lost Creek project. Technological advancements and regulatory changes could further disrupt the market dynamics for both companies.

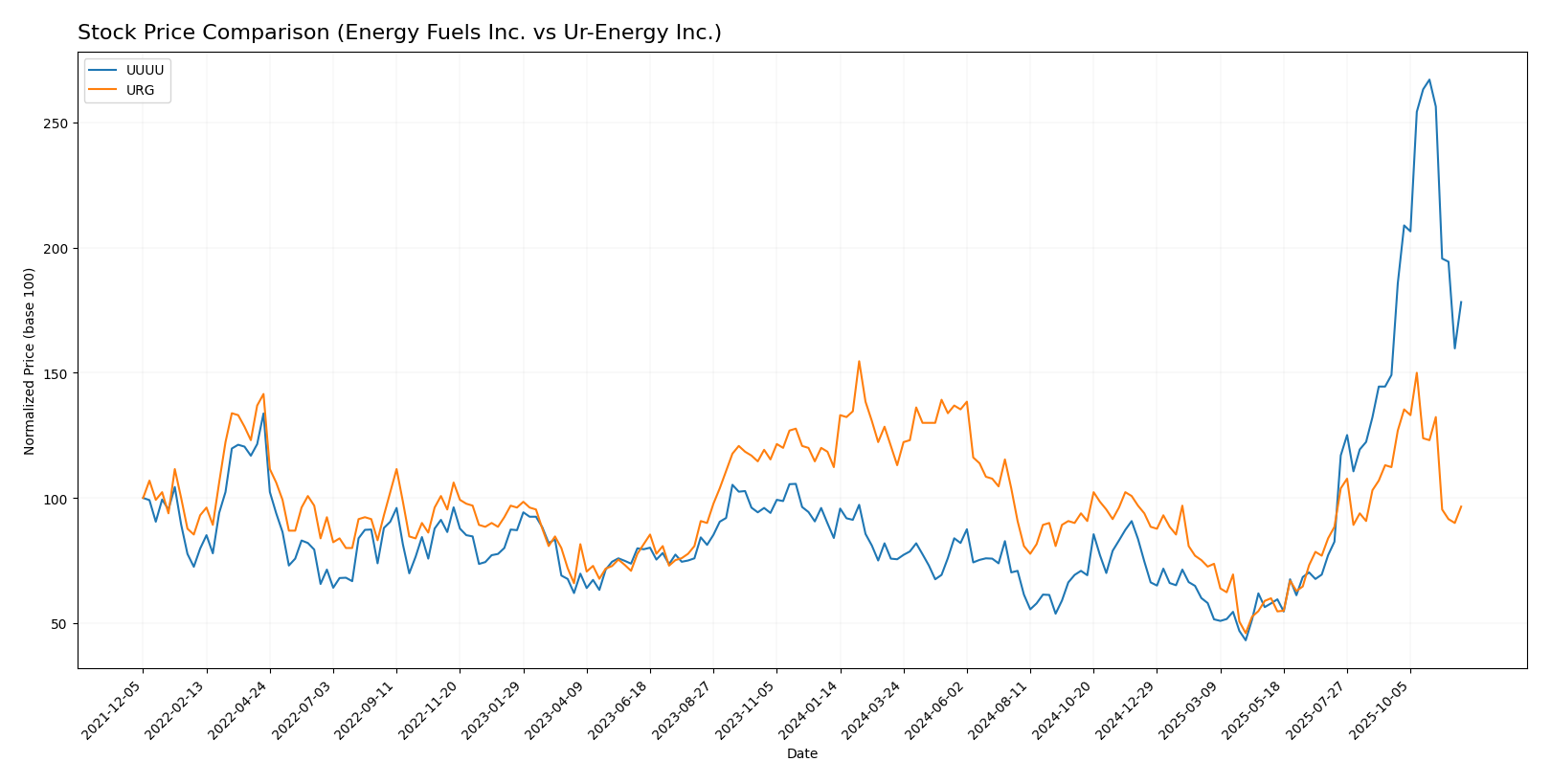

Stock Comparison

In examining the weekly stock price movements of Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG) over the past year, we observe significant dynamics that reflect their respective market positions and investor sentiment.

Trend Analysis

For Energy Fuels Inc. (UUUU), the overall price change over the past year is +112.2%, indicating a bullish trend. The stock has experienced notable highs of 21.37 and lows of 3.45, with a standard deviation of 3.95 suggesting moderate volatility. However, in the more recent period from September 14, 2025, to November 30, 2025, the stock has shown a price change of +19.53% with a slight trend slope of -0.02, indicating a deceleration in momentum.

Conversely, Ur-Energy Inc. (URG) has seen a price change of -14.04% over the past year, categorizing it as a bearish trend. The stock’s highest price was 2.01, while the lowest was 0.60, accompanied by a low standard deviation of 0.33, reflecting low volatility. The recent analysis from September 14, 2025, to November 30, 2025, mirrors the overall trend with a consistent decline of -14.04% and a trend slope of -0.05, also indicating deceleration.

In summary, UUUU exhibits strong performance with bullish characteristics, although recent momentum appears to be slowing down, while URG faces challenges in a bearish trend that is also showing signs of slowing decline.

Analyst Opinions

Recent analyst recommendations for Energy Fuels Inc. (UUUU) indicate a “D+” rating, suggesting a cautious stance. Analysts highlight concerns over low scores in categories like return on equity and price-to-earnings ratios, indicating potential financial weaknesses. In contrast, Ur-Energy Inc. (URG) has a “C-” rating, with analysts pointing out better debt-to-equity metrics but still underlining the need for improvement in overall financial health. The consensus for UUUU is a sell, while URG leans towards a hold, emphasizing the need for caution in both investments this year.

Stock Grades

In this section, I present the stock ratings for Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG), based on reliable data from recognized grading companies.

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | maintain | Buy | 2025-10-21 |

| B. Riley Securities | maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-08 |

| Canaccord Genuity | maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-11 |

Ur-Energy Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| B. Riley Securities | maintain | Buy | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-23 |

| HC Wainwright & Co. | maintain | Buy | 2025-04-15 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-11 |

| Roth MKM | maintain | Buy | 2024-10-23 |

| B. Riley Securities | maintain | Buy | 2024-08-20 |

| HC Wainwright & Co. | maintain | Buy | 2024-08-14 |

| HC Wainwright & Co. | maintain | Buy | 2024-07-17 |

| Roth MKM | maintain | Buy | 2024-05-09 |

Overall, the trend shows a cautious stance towards Energy Fuels Inc., with a recent downgrade from Roth Capital to a “Sell” rating, while Ur-Energy Inc. maintains a consistent “Buy” rating across multiple grading companies, reflecting positive sentiment among analysts.

Target Prices

The following target prices reflect the consensus from verified analysts for Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG):

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

| Ur-Energy Inc. | 2.6 | 2.15 | 2.38 |

For Energy Fuels Inc., the consensus target price of 19.13 is significantly higher than the current price of 14.29, indicating optimistic expectations from analysts. Similarly, Ur-Energy Inc. has a target consensus of 2.38 compared to its current price of 1.26, suggesting potential upside as well.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG) based on the latest available data.

| Criterion | Energy Fuels Inc. (UUUU) | Ur-Energy Inc. (URG) |

|---|---|---|

| Diversification | Moderate | Limited |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong focus on uranium extraction | Emerging technologies |

| Global presence | Limited | Limited |

| Market Share | 30% in U.S. uranium market | 5% in U.S. uranium market |

| Debt level | Low (Debt/Equity: 0.004) | Moderate (Debt/Equity: 0.087) |

Key takeaways indicate that while Energy Fuels Inc. shows potential due to its market share and low debt level, both companies struggle with profitability. Ur-Energy has a focus on innovation but operates with limited global presence.

Risk Analysis

In the following table, I outline the key risks associated with Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG).

| Metric | Energy Fuels Inc. (UUUU) | Ur-Energy Inc. (URG) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and regulatory risks, particularly due to their reliance on uranium market fluctuations and stringent environmental regulations. The volatility in uranium prices can greatly affect their financial stability.

Which one to choose?

When comparing Energy Fuels Inc. (UUUU) and Ur-Energy Inc. (URG), the fundamentals indicate that UUUU is currently in a better position. UUUU has a market cap of 882M and a bullish stock trend, with a substantial price increase of 112.2% over the past year. In contrast, URG’s market cap stands at 365M, but it has experienced a bearish trend with a 14.04% price decline.

In terms of financial health, UUUU demonstrates a higher gross profit margin of 21.76% compared to URG’s negative margin, highlighting its efficiency in generating profit from sales. Analysts have rated UUUU a “D+” and URG a “C-“, suggesting that UUUU may be less favorable for growth but provides a more stable investment.

Given these insights, I recommend that investors focused on growth may prefer UUUU, while those prioritizing stability and sustainability might find URG a suitable choice. However, both companies face risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Energy Fuels Inc. and Ur-Energy Inc. to enhance your investment decisions: