In the dynamic world of uranium mining, Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU) stand out as two key players. Both companies operate within the same industry, focusing on the extraction and development of uranium, which is crucial for nuclear energy. Their innovative strategies and market positioning offer intriguing contrasts that warrant a closer look. As we delve into this analysis, I aim to help you determine which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Energy Fuels Inc. Overview

Energy Fuels Inc. (Ticker: UUUU) is a prominent player in the uranium industry, dedicated to the extraction, recovery, exploration, and sale of uranium in the United States. Headquartered in Lakewood, Colorado, the company operates several projects, including the Nichols Ranch and Hank projects in Wyoming, and the Alta Mesa project in Texas. With a market capitalization of approximately $3.39B, Energy Fuels is well-positioned to capitalize on the growing demand for uranium, especially as the world shifts towards cleaner energy sources. Their focus on both conventional and in situ recovery methods underscores their commitment to sustainable practices within the energy sector.

enCore Energy Corp. Overview

enCore Energy Corp. (Ticker: EU) is another key player in the U.S. uranium sector, focusing on the acquisition, exploration, and development of uranium resource properties. Based in Corpus Christi, Texas, enCore holds significant interests in various projects across New Mexico, South Dakota, and Utah, particularly in the Grants Uranium Belt. With a market capitalization of around $493M, enCore is strategically positioned to expand its resource base and leverage emerging opportunities in uranium production. The company’s efforts are aligned with the increasing energy demands and the growing emphasis on nuclear energy as a low-carbon alternative.

Key Similarities and Differences

Both Energy Fuels and enCore Energy operate in the uranium industry, focusing on exploration and development of uranium resources. However, Energy Fuels has a more diversified project portfolio across multiple states, while enCore is concentrated in specific regions with high mineral potential. Moreover, Energy Fuels has a significantly larger market capitalization, reflecting its broader operational scale and established position in the market.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU), highlighting key financial metrics.

| Metric | Energy Fuels Inc. (UUUU) | enCore Energy Corp. (EU) |

|---|---|---|

| Revenue | 78.1M | 58.3M |

| EBITDA | -43.0M | -67.6M |

| EBIT | -48.2M | -72.2M |

| Net Income | -47.8M | -61.4M |

| EPS | -0.28 | -0.34 |

Interpretation of Income Statement

In the most recent year, Energy Fuels Inc. (UUUU) exhibited significant growth in revenue, increasing from 37.9M to 78.1M, reflecting a positive trend. However, both companies remain in a challenging financial position, with negative net income figures. enCore Energy Corp. (EU) also reported increased revenue but with a larger loss compared to the previous year. Margins have yet to stabilize, indicating ongoing operational inefficiencies. Overall, while UUUU shows a promising increase in revenue, the overall profitability and margin stability for both companies are areas of concern, necessitating careful monitoring for investors.

Financial Ratios Comparison

In the table below, I’ve summarized the most recent financial ratios for Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU). This comparison can help us assess their financial health and investment potential.

| Metric | UUUU | EU |

|---|---|---|

| ROE | -9.05% | -21.49% |

| ROIC | -6.67% | -17.34% |

| P/E | -18.47 | -10.11 |

| P/B | 1.67 | 2.17 |

| Current Ratio | 3.88 | 2.91 |

| Quick Ratio | 2.76 | 2.21 |

| D/E | 0.004 | 0.072 |

| Debt-to-Assets | 0.0036 | 0.060 |

| Interest Coverage | 0 | -41.60 |

| Asset Turnover | 0.127 | 0.149 |

| Fixed Asset Turnover | 1.42 | 0.20 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

In this analysis, both companies show negative return ratios (ROE, ROIC), indicating inefficiencies in generating profit from equity and capital. UUUU displays a stronger current and quick ratio, suggesting better short-term liquidity compared to EU. However, EU’s lower debt ratios may indicate less financial risk. Both companies currently lack dividends, which may concern income-focused investors. Overall, caution is advised when considering investments in these firms due to their negative profitability and high leverage.

Dividend and Shareholder Returns

Both Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU) do not pay dividends, reflecting their focus on reinvestment strategies and growth phases. This approach is typical for companies in the resource sector that prioritize funding exploration and development over immediate shareholder returns. Nevertheless, both companies engage in share buyback programs, which can enhance shareholder value by reducing share dilution. Overall, the lack of dividend payments aligns with their growth strategies but may pose risks if not managed prudently, impacting long-term value creation for shareholders.

Strategic Positioning

Energy Fuels Inc. (UUUU) holds a significant market share in the uranium sector, boasting a market cap of 3.39B. Its diverse uranium extraction projects, including the Nichols Ranch and White Mesa Mill, position it favorably against competitors. Conversely, enCore Energy Corp. (EU), with a market cap of 493M, focuses on strategic acquisitions and exploration in New Mexico, which may expose it to competitive pressures. Both companies face technological disruptions and evolving market dynamics that could impact their positioning and profitability.

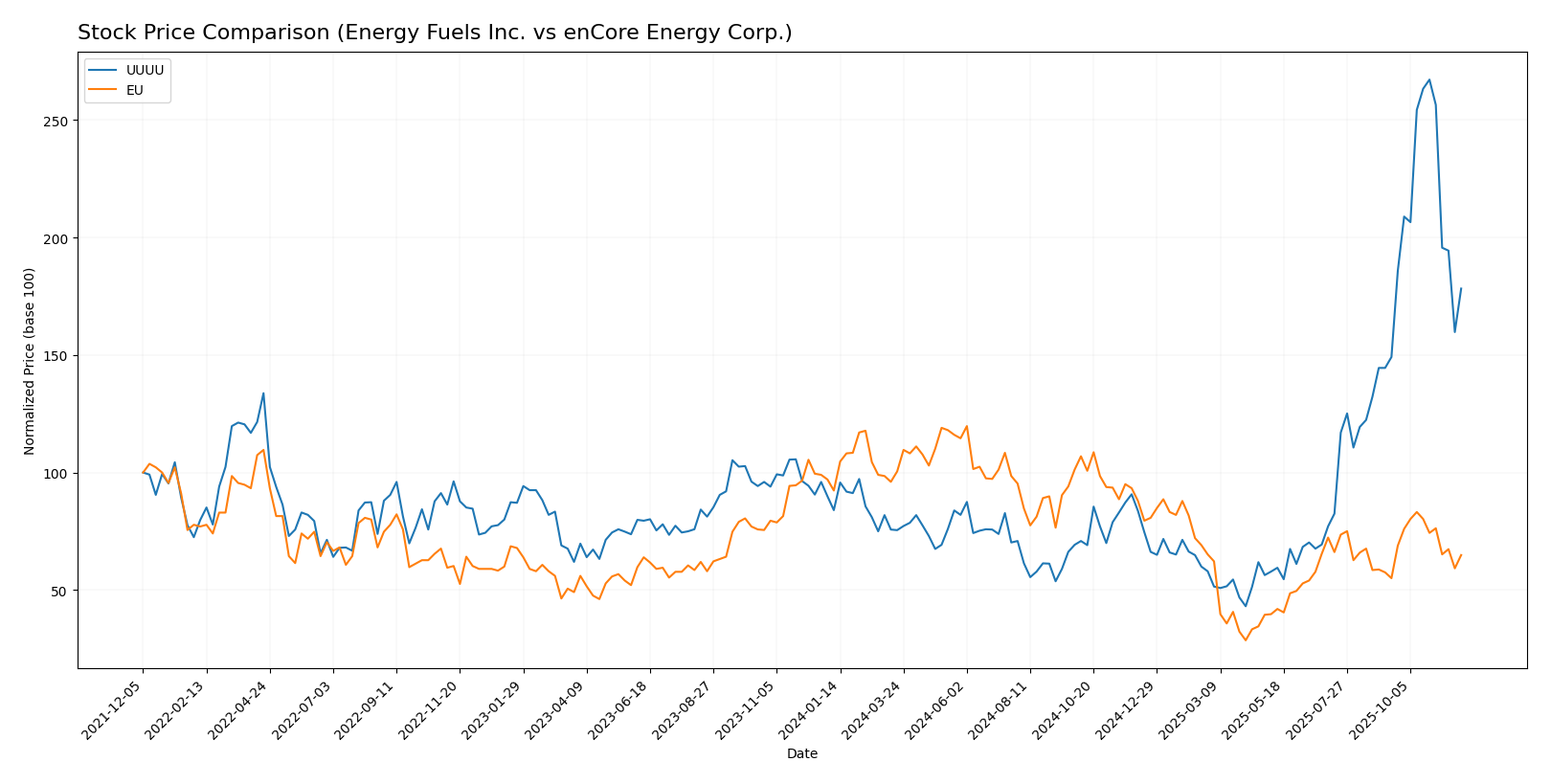

Stock Comparison

In this section, I will analyze the weekly stock price movements of Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU) over the past year, highlighting key price dynamics and trading patterns.

Trend Analysis

Energy Fuels Inc. (UUUU): Over the past year, UUUU has experienced a significant price increase of 112.2%. This bullish trend indicates a strong upward movement in the stock, despite a recent deceleration in acceleration. The stock reached a notable high of 21.37 and a low of 3.45, suggesting substantial volatility with a standard deviation of 3.95. Recently, the stock has shown a price change of 19.53% from September 14, 2025, to November 30, 2025, with a standard deviation of 3.14, indicating relatively stable recent movements despite the overall trend slope being slightly negative at -0.02.

enCore Energy Corp. (EU): Conversely, EU has faced a challenging year with a price decrease of -29.72%, indicating a bearish trend characterized by acceleration in the downward movement. The stock’s highest price was 4.85, and the lowest was 1.16, with an overall volatility measured by a standard deviation of 0.96. In the recent period, EU has shown a price increase of 17.87% from September 14, 2025, to November 30, 2025, with a lower standard deviation of 0.34. This suggests some stabilization in the recent trend, although the overall trend slope remains at -0.02.

Analyst Opinions

Recent analyst recommendations indicate a cautious stance on Energy Fuels Inc. (UUUU) with a rating of D+, suggesting a sell position due to low scores in key financial metrics. In contrast, enCore Energy Corp. (EU) has a slightly better rating of C-, indicating a hold position, as analysts see potential for improvement, particularly in its debt-to-equity ratio. Overall, the consensus for UUUU is a sell, while EU leans towards hold, reflecting mixed sentiments in the current market environment.

Stock Grades

In the current trading landscape, it’s essential to stay informed about stock ratings to make educated investment decisions. Here are the latest grades for Energy Fuels Inc. and enCore Energy Corp.

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | maintain | Buy | 2025-10-21 |

| B. Riley Securities | maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-08 |

| Canaccord Genuity | maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-11 |

enCore Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-13 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-18 |

| HC Wainwright & Co. | maintain | Buy | 2024-11-19 |

| HC Wainwright & Co. | maintain | Buy | 2024-10-07 |

| HC Wainwright & Co. | maintain | Buy | 2024-08-15 |

| HC Wainwright & Co. | maintain | Buy | 2024-06-14 |

| B. Riley Securities | maintain | Buy | 2024-05-15 |

Overall, we can observe a trend of stability in the grading for enCore Energy Corp., with consistent “Buy” ratings from HC Wainwright & Co. However, Energy Fuels Inc. has experienced a downgrade to “Sell” from Roth Capital, indicating some caution in that stock’s outlook.

Target Prices

The consensus target prices for the following companies indicate analyst expectations regarding their future performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

| enCore Energy Corp. | 7 | 7 | 7 |

For Energy Fuels Inc. (UUUU), the consensus target price of 19.13 suggests a significant upside potential compared to its current price of 14.29. Meanwhile, enCore Energy Corp. (EU) has a stable target consensus of 7, which is well above its current trading price of 2.64, indicating strong bullish sentiment among analysts.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU).

| Criterion | Energy Fuels Inc. (UUUU) | enCore Energy Corp. (EU) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong R&D focus | Emerging technology |

| Global presence | Limited | Limited |

| Market Share | 10% in U.S. Uranium | 5% in U.S. Uranium |

| Debt level | Very low (Debt/Equity: 0.004) | Moderate (Debt/Equity: 0.075) |

Key takeaways reveal that while both companies face profitability challenges, Energy Fuels Inc. shows stronger innovation capabilities and a much lower debt level, making it a potentially safer investment compared to enCore Energy Corp.

Risk Analysis

In the following table, I outline key risks associated with two companies in the uranium industry: Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU).

| Metric | Energy Fuels Inc. | enCore Energy Corp. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market and regulatory risks. Energy Fuels has been impacted by volatile uranium prices, while enCore deals with operational challenges in project development. The uranium sector remains sensitive to geopolitical tensions and regulatory changes, making careful analysis essential for investors.

Which one to choose?

When comparing Energy Fuels Inc. (UUUU) and enCore Energy Corp. (EU), UUUU appears to have stronger fundamentals despite its current challenges. UUUU’s recent earnings report indicates a significant revenue increase to $78.1M, yet it also operates at a loss with a net income of -$47.8M. In contrast, EU reported revenues of $58.3M but a higher net loss of -$61.4M. UUUU exhibits a bullish trend with a price change of 112.2%, while EU has seen a bearish shift of -29.72%. Analysts rate UUUU as a D+ and EU as a C-, suggesting that UUUU may present more risk but also potential for recovery.

For growth-focused investors, UUUU may be preferable, while those prioritizing stability might lean towards EU, given its relatively better rating. However, both companies face substantial industry risks such as market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Energy Fuels Inc. and enCore Energy Corp. to enhance your investment decisions: