In the ever-evolving world of uranium mining, Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) emerge as significant players, each with unique strengths and strategies. Both companies operate within the same industry, targeting similar markets while pursuing innovative approaches to uranium extraction and processing. As the demand for clean energy sources grows, understanding their respective positions and potential can guide investors in making informed decisions. Join me as we delve into the nuances of these two companies to determine which one presents the more compelling investment opportunity.

Table of contents

Company Overview

Energy Fuels Inc. Overview

Energy Fuels Inc. (ticker: UUUU) is a leading player in the uranium industry, focused on the extraction and recovery of uranium in the United States. With a market capitalization of approximately $3.39B, the company operates several key projects including the Nichols Ranch and Alta Mesa projects, and the White Mesa Mill in Utah. Energy Fuels aims to provide a reliable supply of uranium to support nuclear energy generation, positioning itself as a sustainable energy resource in the U.S. With a workforce of around 1,260 employees, the company emphasizes safety and environmental stewardship in its operations.

Denison Mines Corp. Overview

Denison Mines Corp. (ticker: DNN) is a Canadian company specializing in the acquisition, exploration, and development of uranium properties, primarily in the Athabasca Basin of northern Saskatchewan. With a market cap of approximately $2.19B, Denison is known for its flagship Wheeler River project, which holds significant uranium resources. Founded in 1997 and headquartered in Toronto, Denison Mines aims to capitalize on the growing demand for nuclear energy while adhering to high environmental and safety standards.

Key Similarities and Differences

Both Energy Fuels and Denison Mines operate within the uranium sector, focusing on extraction and processing. However, Energy Fuels has a larger market presence in the U.S. with multiple projects, while Denison Mines is concentrated in Canada, particularly the Athabasca Basin. Their business models reflect regional differences in market demands and regulatory environments, impacting their operational strategies and growth potential.

Income Statement Comparison

The following table provides a comparative view of the most recent income statements for Energy Fuels Inc. and Denison Mines Corp., highlighting key financial metrics.

| Metric | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Revenue | 78.1M | 4.0M |

| EBITDA | -43.0M | -81.8M |

| EBIT | -48.2M | -91.7M |

| Net Income | -47.8M | -91.1M |

| EPS | -0.28 | -0.10 |

Interpretation of Income Statement

In the most recent fiscal year, Energy Fuels Inc. experienced a significant increase in revenue to $78.1M from $37.9M the previous year, while Denison Mines Corp. saw a revenue rise to $4.0M from $1.9M. However, both companies reported negative EBITDA and EBIT margins, indicating ongoing operational challenges. The net losses for both firms persisted, with Energy Fuels’ net loss narrowing slightly compared to Denison’s more substantial deficit. This suggests that while revenue growth is promising, both companies face critical issues in managing expenses and achieving profitability, necessitating careful risk management for potential investors.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent financial metrics for Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN).

| Metric | UUUU | DNN |

|---|---|---|

| ROE | -9.05% | -16.15% |

| ROIC | -6.67% | -10.03% |

| P/E | -18.47 | -25.35 |

| P/B | 1.67 | 4.09 |

| Current Ratio | 3.88 | 3.65 |

| Quick Ratio | 2.76 | 3.54 |

| D/E | 0.004 | 0 |

| Debt-to-Assets | 0.0036 | 0 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.13 | 0.01 |

| Fixed Asset Turnover | 1.42 | 0.02 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies demonstrate significant challenges as indicated by their negative return metrics (ROE and ROIC) and a lack of dividend distributions. UUUU shows a better current and quick ratio, suggesting superior liquidity. However, both firms are heavily reliant on equity with minimal debt, indicating conservative financial leverage. The high P/B ratio for DNN raises concerns about overvaluation compared to its book value. Overall, caution is warranted when considering investments in these stocks due to their weak performance indicators.

Dividend and Shareholder Returns

Neither Energy Fuels Inc. (UUUU) nor Denison Mines Corp. (DNN) pay dividends, which can be attributed to their ongoing reinvestment strategies amid high growth phases. Both companies are focused on funding their operations and capital expenditures rather than returning cash to shareholders. While they engage in share buybacks, the absence of dividends raises questions about sustainable long-term value creation. Investors should consider whether the growth potential justifies this approach.

Strategic Positioning

Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) are both key players in the uranium sector, with UUUU holding a market cap of 3.39B and DNN at 2.19B. UUUU operates significant projects in the U.S., while DNN focuses on the Canadian market, particularly the Wheeler River project. Both companies face competitive pressure from each other and emerging technologies aimed at enhancing uranium extraction and processing. As the demand for nuclear energy rises, their strategic positioning will be crucial in capturing market share.

Stock Comparison

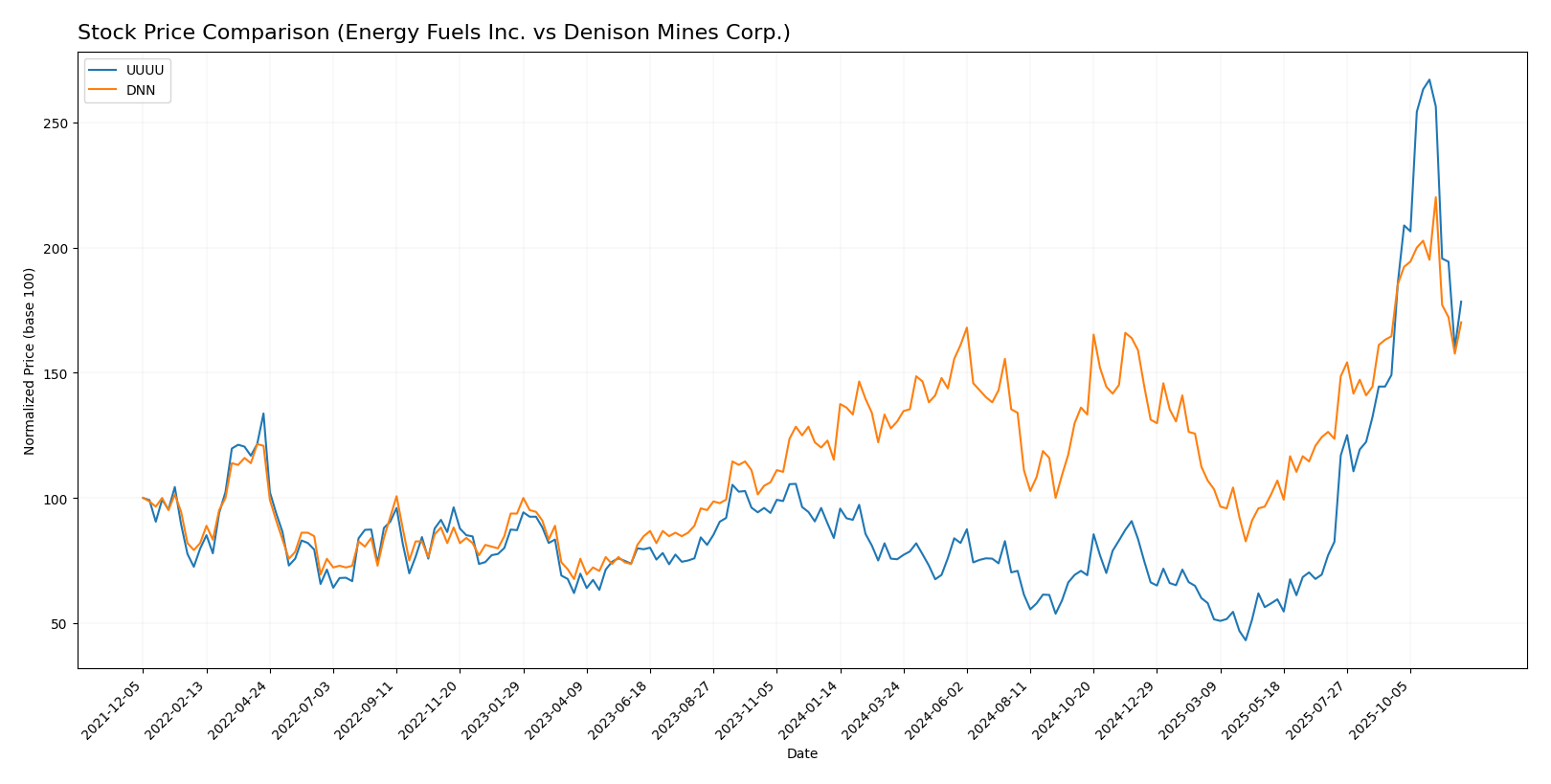

In this section, I will analyze the stock price movements and trading dynamics of Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) over the past year, highlighting significant trends and fluctuations.

Trend Analysis

Energy Fuels Inc. (UUUU) has experienced a notable price change of 112.43% over the past year, indicating a bullish trend. Despite this overall increase, the trend shows signs of deceleration recently, with a more modest price change of 19.66% from September 14, 2025, to November 30, 2025. The highest recorded price during this period was 21.37, while the lowest was 3.45. The standard deviation of 3.95 suggests a reasonable level of volatility in the stock’s price.

Denison Mines Corp. (DNN) has also shown a strong performance with a 47.59% increase over the last year, categorized as a bullish trend. Similar to UUUU, DNN has demonstrated deceleration in its recent trend, with a price change of 3.38% during the same recent period. The stock reached a high of 3.17 and a low of 1.19, with a lower standard deviation of 0.39, indicating less volatility compared to UUUU.

Both stocks display positive overall performance, but recent data suggests a cautious approach is warranted as both trends are losing momentum.

Analyst Opinions

Recent analyst recommendations for Energy Fuels Inc. (UUUU) indicate a cautious stance, with a rating of D+. Analysts cite concerns over its financial health and low scores in return on equity and assets as key deterrents. Conversely, Denison Mines Corp. (DNN) holds a slightly better rating of C-, benefiting from a more favorable discounted cash flow score. Overall, the consensus leans towards a “sell” for both stocks in 2025, reflecting a cautious outlook amid market volatility.

Stock Grades

In this section, I will provide the latest stock ratings for Energy Fuels Inc. and Denison Mines Corp., based on reliable analyses from verified grading companies.

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | maintain | Buy | 2025-10-21 |

| B. Riley Securities | maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-08 |

| Canaccord Genuity | maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-11 |

Denison Mines Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | maintain | Buy | 2024-10-23 |

| TD Securities | maintain | Speculative Buy | 2023-06-27 |

| Raymond James | maintain | Outperform | 2023-06-27 |

| TD Securities | maintain | Speculative Buy | 2023-06-26 |

| Raymond James | maintain | Outperform | 2023-06-26 |

| Credit Suisse | downgrade | Underperform | 2017-07-18 |

| Credit Suisse | downgrade | Underperform | 2017-07-17 |

| Roth Capital | maintain | Buy | 2016-02-10 |

| Credit Suisse | upgrade | Neutral | 2014-04-01 |

| Credit Suisse | upgrade | Neutral | 2014-03-31 |

Overall, Energy Fuels Inc. has seen a recent downgrade to “Sell” by Roth Capital, while maintaining a “Buy” from HC Wainwright & Co. In contrast, Denison Mines Corp. maintains a consistent positive outlook with multiple “Buy” ratings, indicating a stable investor sentiment. As always, I recommend performing due diligence and considering risk management strategies before making investment decisions.

Target Prices

The current consensus target prices for Energy Fuels Inc. and Denison Mines Corp. are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

| Denison Mines Corp. | 2.6 | 2.6 | 2.6 |

Energy Fuels Inc. has a consensus target price of 19.13, significantly above its current stock price of 14.295, indicating positive analyst expectations. Meanwhile, Denison Mines Corp. has a consensus target price of 2.6, closely aligning with its current price of 2.445, suggesting a more stable outlook.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) based on the latest available data.

| Criterion | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | High focus on R&D | Moderate focus on R&D |

| Global presence | Primarily US | Primarily Canada |

| Market Share | 5% (Uranium sector) | 3% (Uranium sector) |

| Debt level | Very low (0.004) | None |

Key takeaways indicate that both companies face challenges in profitability, with significant negative margins. Energy Fuels has a slightly better market share and lower debt levels, while Denison has a focused presence in Canada. Investors should weigh the potential for innovation against these weaknesses.

Risk Analysis

The table below highlights various risks associated with Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN).

| Metric | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Moderate | Low |

Both companies are exposed to substantial market and regulatory risks, particularly given the volatility in the uranium sector. Additionally, operational challenges are significant for Denison, highlighted by its high operational risk, while Energy Fuels faces environmental scrutiny. Caution is advised when considering investments in these firms due to these factors.

Which one to choose?

When comparing Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN), the fundamentals reveal contrasting profiles. UUUU has a market cap of $882M with a D+ rating, indicating significant challenges, particularly in profitability (-61% net profit margin). Its stock trend is bullish, with a 112.43% price increase over the last year, but risk factors include high operating expenses and negative earnings.

Conversely, DNN has a market cap of $2.31B and a C- rating, reflecting a more stable position, though still facing profitability issues (-22% net profit margin). Its price trend is also bullish, with a 47.59% increase, but it has a higher price-to-earnings ratio of 21.99.

For growth-focused investors, DNN may be the better choice due to its relatively stronger market presence and less volatility. However, those prioritizing stability may find UUUU’s recent price momentum appealing despite its risks.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Energy Fuels Inc. and Denison Mines Corp. to enhance your investment decisions: