In a rapidly evolving tech landscape, Elastic N.V. (ESTC) and Domo, Inc. (DOMO) stand out as prominent players in the software application sector. Both companies leverage innovative strategies to enhance data management and analysis, yet they cater to different aspects of the market. Elastic specializes in search solutions that drive real-time analytics, while Domo focuses on providing a comprehensive business intelligence platform. In this article, we’ll explore which of these dynamic companies presents the most compelling opportunity for savvy investors like you.

Table of contents

Company Overview

Elastic N.V. Overview

Elastic N.V. (ticker: ESTC) focuses on providing advanced search and analytics solutions that empower organizations to harness their data effectively. Founded in 2012 and headquartered in Mountain View, California, Elastic operates primarily in the Software – Application industry. Its flagship product, the Elastic Stack, includes tools like Elasticsearch, Kibana, and Logstash, which facilitate real-time data ingestion, search, and visualization across diverse environments. With a market capitalization of approximately $7.48B, Elastic serves a global clientele, aiming to optimize data-driven decision-making in multi-cloud settings.

Domo, Inc. Overview

Domo, Inc. (ticker: DOMO) operates a cloud-based business intelligence platform that connects users from executives to frontline employees, providing them with real-time data insights. Established in 2010 and based in American Fork, Utah, Domo is designed to streamline data management and enhance collaboration across organizations. The company has a market capitalization of around $454.4M and emphasizes accessibility, enabling users to manage business operations directly from their smartphones. Domo’s platform transforms complex data into actionable insights, thereby fostering better decision-making.

Key similarities between Elastic and Domo lie in their focus on software solutions that enhance data accessibility and insights. However, while Elastic leans towards search and analytics, Domo concentrates on business intelligence and real-time data connectivity, showcasing distinct approaches to data management.

Income Statement Comparison

The following table presents a comparison of the latest income statements for Elastic N.V. and Domo, Inc. This analysis will help investors understand the financial performance of both companies.

| Metric | Elastic N.V. | Domo, Inc. |

|---|---|---|

| Revenue | 1.48B | 317M |

| EBITDA | 6M | -50M |

| EBIT | -6M | -59M |

| Net Income | -108M | -82M |

| EPS | -1.04 | -2.13 |

Interpretation of Income Statement

In 2025, Elastic N.V. reported a significant increase in revenue to 1.48B from 1.27B in the previous year, indicating a positive growth trend. However, net income remained negative at -108M, suggesting ongoing challenges in profitability. Meanwhile, Domo, Inc. showed slight revenue growth but still faced a net loss of -82M, reflecting persistent operational difficulties. Both companies exhibit negative EBITDA, pointing towards ongoing investment needs and efficiency improvements. Investors should note the importance of evaluating margin improvements and operational strategies moving forward.

Financial Ratios Comparison

Below is a comparative table showing the most recent revenue and financial ratios for Elastic N.V. (ESTC) and Domo, Inc. (DOMO).

| Metric | Elastic N.V. (ESTC) | Domo, Inc. (DOMO) |

|---|---|---|

| ROE | -11.66% | 46.23% |

| ROIC | -11.80% | 197.65% |

| P/E | -82.65 | -3.98 |

| P/B | 9.64 | -1.84 |

| Current Ratio | 1.92 | 0.56 |

| Quick Ratio | 1.92 | 0.56 |

| D/E | 0.64 | -0.76 |

| Debt-to-Assets | 22.95% | 63.23% |

| Interest Coverage | -2.17 | N/A |

| Asset Turnover | 0.57 | 1.48 |

| Fixed Asset Turnover | 51.28 | 8.17 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios reveal a stark contrast between Elastic N.V. and Domo, Inc. Elastic shows significant inefficiencies, highlighted by negative ROE and ROIC, as well as a high P/E ratio indicating overvaluation. In contrast, Domo displays strong profitability metrics, particularly in ROE and ROIC, despite its negative earnings. The high debt-to-assets ratio for Domo raises concerns about financial leverage, while Elastic’s stronger liquidity ratios suggest a better short-term solvency position. Investors should approach these companies with caution, as both exhibit unique risks.

Dividend and Shareholder Returns

Both Elastic N.V. (ESTC) and Domo, Inc. (DOMO) do not pay dividends, reflecting a reinvestment strategy typical in high-growth companies. Elastic focuses on expanding its platform, while Domo grapples with financial challenges. Both companies engage in share buybacks, which may support share prices but also carry risks of unsustainable capital allocation. Ultimately, this lack of dividends may align with long-term value creation, provided their growth strategies prove successful.

Strategic Positioning

Elastic N.V. (ESTC) commands a significant market share in the cloud-based search and analytics segment, bolstered by its comprehensive Elastic Stack products. With a market cap of 7.48B, ESTC faces competitive pressure from other software application companies, yet its innovative solutions position it well against technological disruptions. In contrast, Domo, Inc. (DOMO), with a market cap of 454M, offers a distinct business intelligence platform that faces fierce competition, particularly in real-time data accessibility and user engagement. Both companies must continuously innovate to maintain their competitive edge in an evolving market landscape.

Stock Comparison

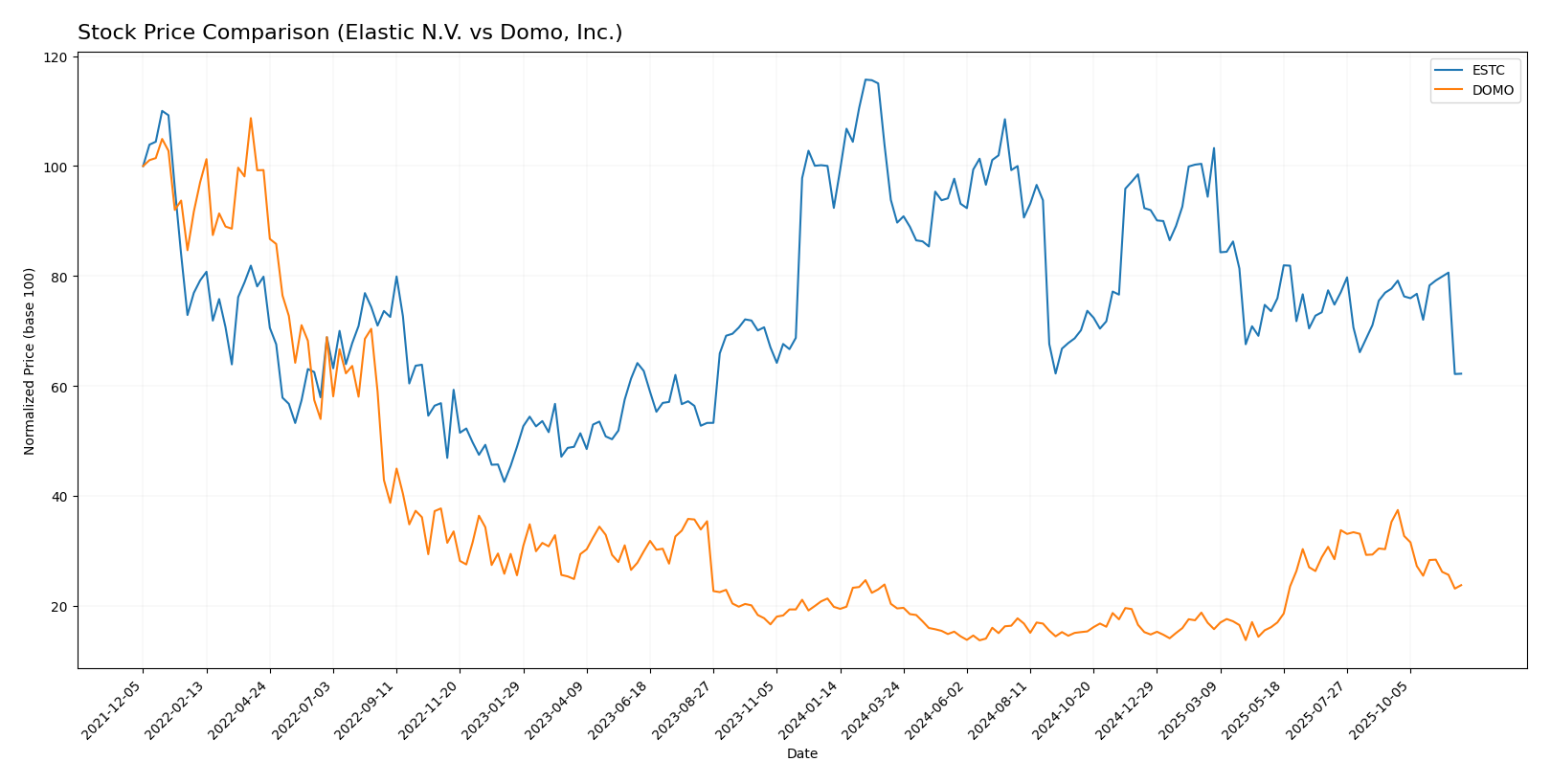

In this section, I will analyze the weekly stock price movements of Elastic N.V. (ESTC) and Domo, Inc. (DOMO) over the past year, focusing on key price dynamics, fluctuations, and overall trends.

Trend Analysis

Elastic N.V. (ESTC) Over the past year, ESTC has experienced a price change of -32.66%, indicating a bearish trend. The stock has seen notable highs of 130.39 and lows of 70.04, with volatility measured at a standard deviation of 14.91. The trend has shown deceleration during this period.

In the more recent analysis from September 14, 2025, to November 30, 2025, ESTC further declined by -19.92% with a standard deviation of 6.91, reflecting a continued bearish sentiment.

Domo, Inc. (DOMO) In contrast, DOMO has demonstrated a price change of +19.87% over the last year, indicating a bullish trend. The stock reached a high of 18.06 and a low of 6.62, with a lower volatility of 2.99. However, the trend has been characterized by deceleration.

In the recent analysis period from September 14, 2025, to November 30, 2025, DOMO’s price fell by -32.63%, coupled with a standard deviation of 2.1, suggesting a shift towards a more cautious outlook despite the overall yearly performance.

Analyst Opinions

Recent analyst recommendations for Elastic N.V. (ESTC) indicate a cautious stance, with a rating of C- from analysts, suggesting a hold due to weak scores in financial metrics such as return on equity and price-to-earnings. Conversely, Domo, Inc. (DOMO) holds a slightly better rating of C, with analysts highlighting its strong return on equity but overall recommending a cautious hold as well. The consensus for both companies leans towards a hold for 2025, indicating that investors should be cautious and consider the current financial landscape before making decisions.

Stock Grades

I’ve analyzed the latest stock ratings for two companies, Elastic N.V. (ESTC) and Domo, Inc. (DOMO), providing insights into their current investment outlook.

Elastic N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-24 |

| JP Morgan | maintain | Overweight | 2025-11-21 |

| Piper Sandler | maintain | Overweight | 2025-11-21 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-21 |

| Wells Fargo | maintain | Equal Weight | 2025-11-21 |

| DA Davidson | maintain | Neutral | 2025-11-21 |

| Stifel | maintain | Buy | 2025-11-21 |

| Morgan Stanley | maintain | Overweight | 2025-11-21 |

| Truist Securities | maintain | Buy | 2025-11-21 |

| Guggenheim | maintain | Buy | 2025-11-21 |

Domo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JMP Securities | maintain | Market Outperform | 2025-09-10 |

| Cantor Fitzgerald | maintain | Overweight | 2025-08-28 |

| DA Davidson | maintain | Neutral | 2025-08-28 |

| TD Cowen | upgrade | Buy | 2025-08-26 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-25 |

| JMP Securities | maintain | Market Outperform | 2025-06-25 |

| DA Davidson | maintain | Neutral | 2025-05-22 |

| Lake Street | maintain | Hold | 2025-05-22 |

| Cantor Fitzgerald | maintain | Overweight | 2025-05-22 |

| JMP Securities | maintain | Market Outperform | 2025-05-22 |

In summary, both companies exhibit a trend of maintaining their current grades with a mix of Buy and Overweight ratings from several reputable firms. Elastic N.V. shows consistent support from analysts, while Domo, Inc. recently received an upgrade, indicating a positive shift in investor sentiment.

Target Prices

The consensus target prices for the following companies indicate a range of expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Elastic N.V. | 134 | 76 | 108 |

| Domo, Inc. | 50 | 15 | 24.5 |

For Elastic N.V. (ESTC), the target consensus of 108 suggests significant upside potential compared to its current price of 70.38. Meanwhile, Domo, Inc. (DOMO) has a consensus of 24.5, which also indicates growth potential from its current price of 11.47.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Elastic N.V. (ESTC) and Domo, Inc. (DOMO) based on their most recent financial metrics.

| Criterion | Elastic N.V. (ESTC) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | Moderate | Limited |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong R&D | Moderate R&D |

| Global presence | Strong | Moderate |

| Market Share | Growing | Limited |

| Debt level | Moderate (0.23) | High (0.63) |

Key takeaways indicate that while Elastic N.V. shows a stronger global presence and innovation capabilities, both companies face profitability challenges. Domo’s higher debt level poses additional risks for investors.

Risk Analysis

In the following table, I present a comparative analysis of key risks associated with two technology companies, Elastic N.V. (ESTC) and Domo, Inc. (DOMO).

| Metric | Elastic N.V. | Domo, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | High | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant operational risks due to their reliance on software and cloud services. Elastic has a moderate market risk profile, while Domo shows higher sensitivity to market fluctuations. Recent trends indicate growing regulatory scrutiny in the tech sector, which could impact both companies.

Which one to choose?

In comparing Elastic N.V. (ESTC) and Domo, Inc. (DOMO), I observe that both companies face challenges with profitability. ESTC has a market cap of approximately $8.94B, with a negative net profit margin of -7.29% and a bearish stock trend, having declined by 32.66%. In contrast, DOMO, with a market cap of $0.33B, shows a bullish trend with a price increase of 19.87%, though it also struggles with a negative net profit margin of -25.91%.

Analyst ratings indicate that ESTC has a C- grade, while DOMO holds a C rating, reflecting a slightly better outlook for the latter. However, both face risks, primarily due to competition and market dependence.

Recommendation: Investors focused on growth may prefer DOMO for its recent stock trend, while those prioritizing stability may find ESTC a more established option despite its current challenges.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Elastic N.V. and Domo, Inc. to enhance your investment decisions: