Home > Comparison > Basic Materials > ECL vs IFF

The strategic rivalry between Ecolab Inc. and International Flavors & Fragrances Inc. shapes the specialty chemicals sector’s future. Ecolab operates as a capital-intensive industrial giant, focusing on water, hygiene, and infection prevention across diverse industries. In contrast, IFF specializes as a high-margin provider of natural ingredients and fragrances for consumer products. This analysis evaluates which company offers superior risk-adjusted returns amid evolving market demands and sector dynamics for diversified portfolios.

Table of contents

Companies Overview

Ecolab Inc. and International Flavors & Fragrances Inc. both hold pivotal roles in the specialty chemicals market, shaping diverse industrial needs.

Ecolab Inc.: Water, Hygiene, and Infection Prevention Leader

Ecolab dominates the water treatment and hygiene solutions sector, generating revenue through industrial, institutional, and healthcare segments. Its 2026 strategy focuses on expanding integrated water and energy management services, leveraging data analytics to enhance operational efficiency across manufacturing and food processing industries.

International Flavors & Fragrances Inc.: Innovator in Sensory and Nutritional Ingredients

International Flavors & Fragrances specializes in natural and synthetic ingredient solutions for cosmetics, food, and pharmaceuticals. In 2026, it prioritizes growth in plant-based and biotech-derived products, targeting the evolving consumer demand for sustainability and health-conscious formulations globally.

Strategic Collision: Similarities & Divergences

Both companies operate within specialty chemicals but pursue distinct philosophies: Ecolab emphasizes service-driven solutions with a closed-loop approach, while IFF leans on innovation in ingredient diversity and open collaboration. Their competitive battleground centers on sustainable product innovation. Investors face contrasting profiles—Ecolab offers operational resilience, IFF bets on growth through product innovation.

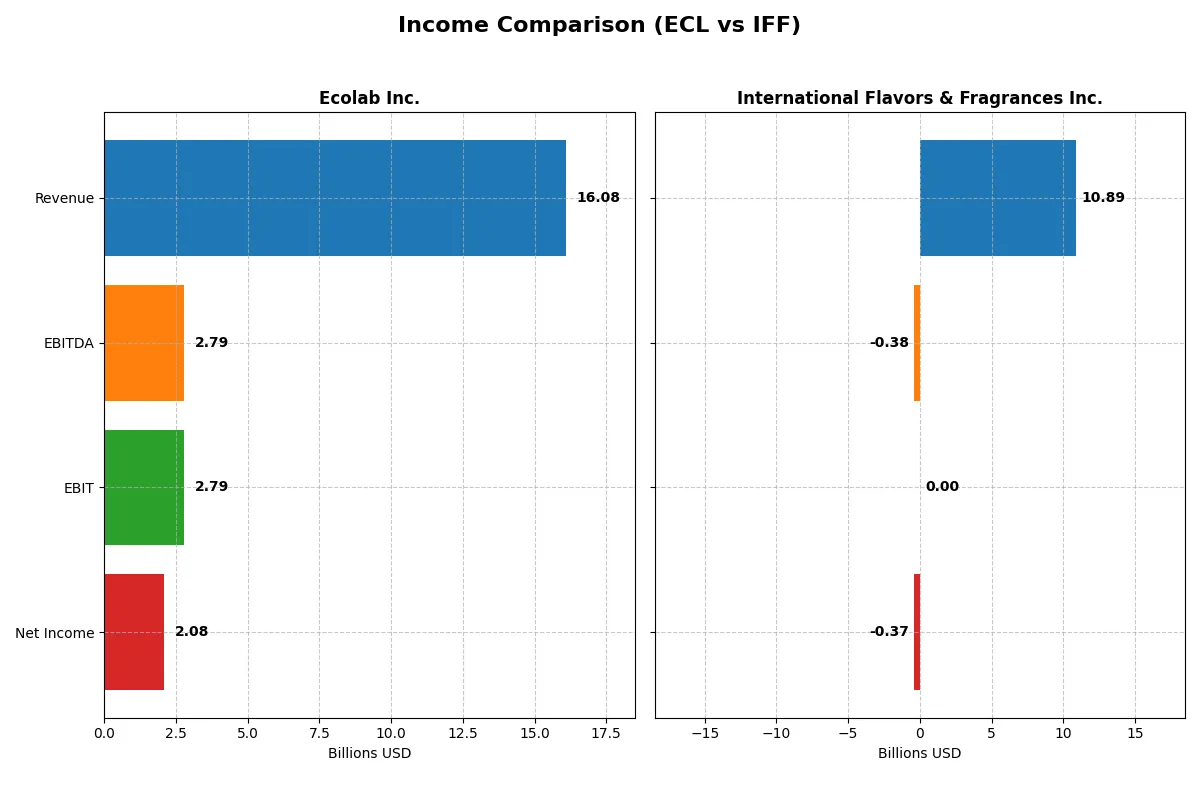

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines, revealing who dominates the bottom line in 2025:

| Metric | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Revenue | 16.1B | 10.9B |

| Cost of Revenue | 8.9B | 6.9B |

| Operating Expenses | 4.2B | 2.5B |

| Gross Profit | 7.2B | 3.9B |

| EBITDA | 2.8B | -382M |

| EBIT | 2.8B | 0 |

| Interest Expense | 241M | 229M |

| Net Income | 2.1B | -374M |

| EPS | 7.33 | -1.46 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals which company converts revenue into profit most efficiently and sustainably over recent years.

Ecolab Inc. Analysis

Ecolab’s revenue rose steadily from 12.7B in 2021 to 16.1B in 2025, with net income surging from 1.1B to 2.1B. Its gross margin improved to a healthy 44.5%, while net margin reached 12.9%, signaling robust profitability. Despite slight earnings pressure in 2025, Ecolab maintains strong operational momentum and margin discipline.

International Flavors & Fragrances Inc. Analysis

IFF’s revenue declined from 11.7B in 2021 to 10.9B in 2025, with net income swinging from a positive 268M to a loss of 374M. Its gross margin fell to 36.2%, and net margin turned negative at -3.4%. The 2025 figures reveal a company struggling with profitability and operational efficiency amid shrinking top-line performance.

Margin Resilience vs. Profitability Struggles

Ecolab clearly outperforms IFF in revenue growth, margin stability, and profitability over the 2021–2025 period. Ecolab’s expanding net income and solid margins contrast sharply with IFF’s declining revenues and persistent losses. For investors prioritizing sustainable profit generation, Ecolab’s profile presents a more attractive and reliable investment foundation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| ROE | 21.2% | 0% |

| ROIC | 11.2% | 0% |

| P/E | 35.8 | -46.1 |

| P/B | 7.61 | 0 |

| Current Ratio | 1.08 | 0 |

| Quick Ratio | 0.81 | 0 |

| D/E | 0.90 | 0 |

| Debt-to-Assets | 35.8% | 0% |

| Interest Coverage | 11.4 | -1.67 |

| Asset Turnover | 0.65 | 0 |

| Fixed Asset Turnover | 3.19 | 0 |

| Payout ratio | 36.6% | -109.4% |

| Dividend yield | 1.02% | 2.37% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and revealing operational strength critical for investors’ decisions.

Ecolab Inc.

Ecolab shows strong profitability with a 21.24% ROE and a 12.91% net margin, signaling operational efficiency. However, its P/E ratio at 35.83 suggests the stock is expensive compared to market averages. The company balances this with a modest 1.02% dividend yield, indicating steady shareholder returns alongside reinvestment in growth.

International Flavors & Fragrances Inc.

IFF posts negative profitability metrics, including a -3.43% net margin and 0% ROE, reflecting operational challenges. Despite a favorable negative P/E of -46.13, this stems from losses rather than value. The 2.37% dividend yield offers income, but weak liquidity ratios and no clear reinvestment signal underline elevated risk.

Premium Valuation vs. Operational Safety

Ecolab’s ratios reflect solid profitability and reasonable risk, though at a premium valuation. IFF struggles operationally but provides higher dividend income. Investors seeking stable growth and operational safety may prefer Ecolab, while income-focused investors accepting higher risk might consider IFF’s profile.

Which one offers the Superior Shareholder Reward?

I compare Ecolab Inc. (ECL) and International Flavors & Fragrances Inc. (IFF) by examining their dividend yield, payout ratios, and share buyback intensity. ECL pays a modest 1.02% dividend yield with a sustainable 36.6% payout ratio and consistent buybacks supporting long-term value. IFF offers a higher 2.37% yield but with negative net margins and erratic payout ratios exceeding 100%, signaling dividend stress. IFF’s weak free cash flow coverage (30%) and recent losses raise concerns about distribution sustainability. ECL’s disciplined capital allocation and stable cash generation provide a more reliable shareholder return profile. I conclude ECL offers superior total shareholder reward in 2026 due to its balance of yield, payout prudence, and buyback consistency.

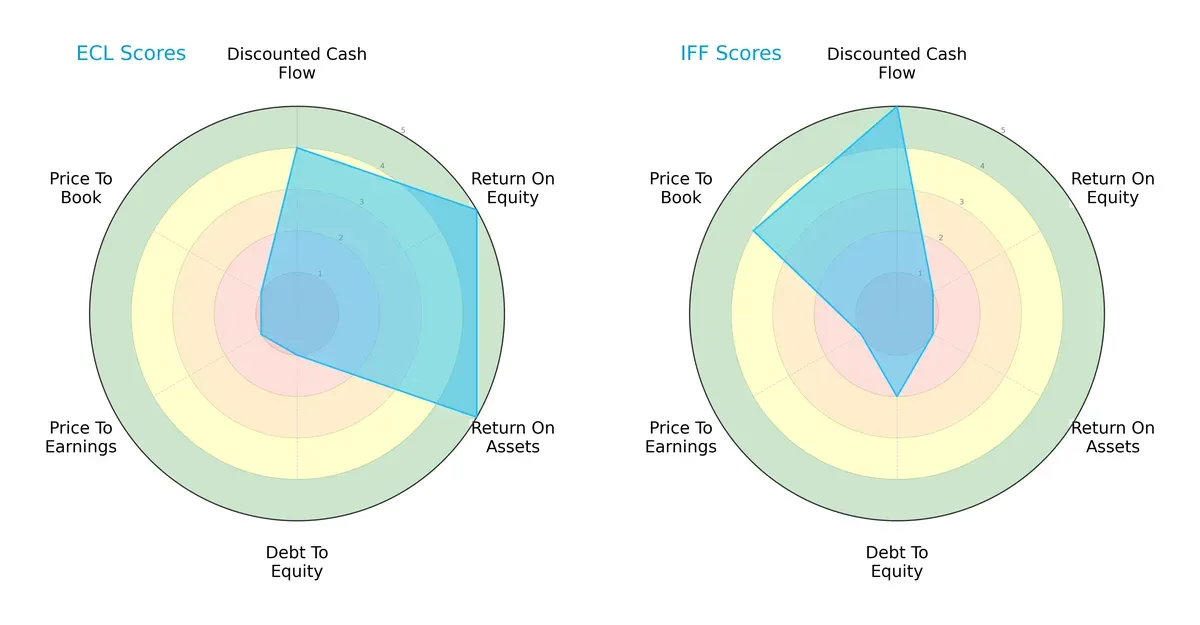

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the core financial DNA and trade-offs shaping Ecolab Inc. and International Flavors & Fragrances Inc.:

Ecolab shows strength in profitability with top ROE and ROA scores (5 each), but suffers from high leverage and valuation concerns (Debt/Equity, P/E, P/B all at 1). IFF excels in discounted cash flow valuation (5) and has a more reasonable Price-to-Book score (4), but struggles with profitability metrics (ROE and ROA at 1). Ecolab presents a more balanced operational profile, while IFF leans heavily on valuation appeal amid weaker returns.

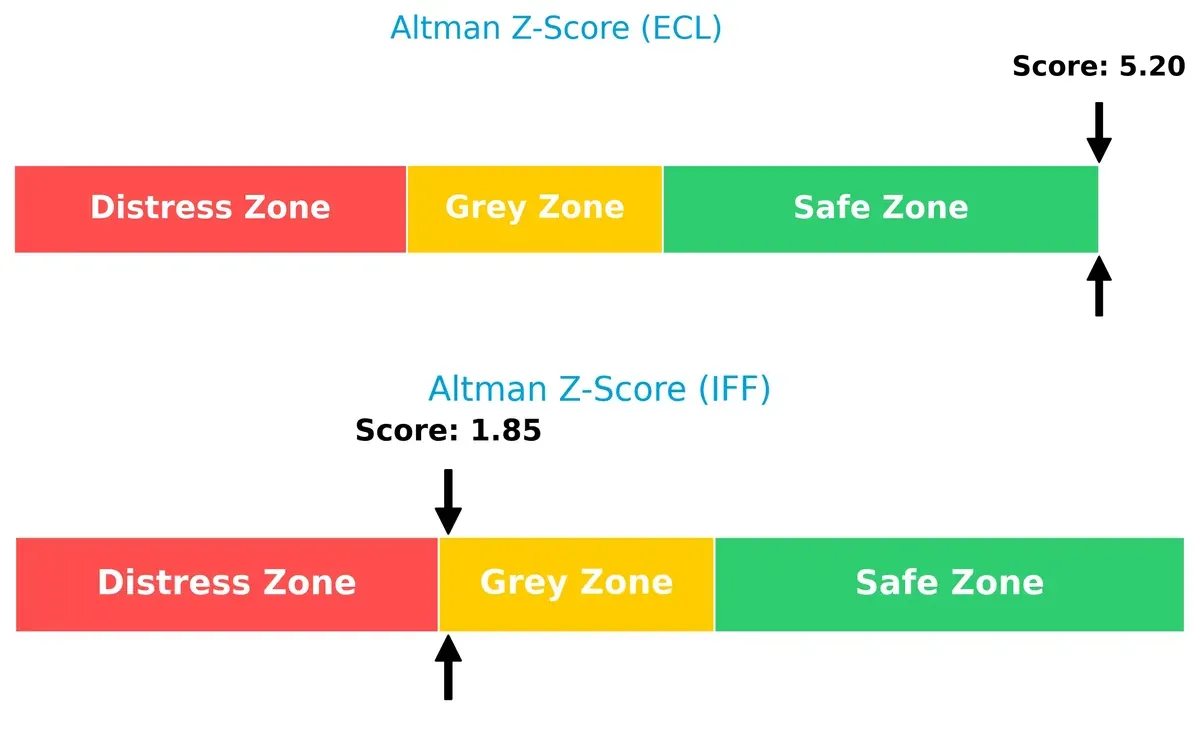

Bankruptcy Risk: Solvency Showdown

Ecolab’s Altman Z-Score of 5.2 places it firmly in the safe zone, signaling robust financial stability. IFF’s score of 1.85 sits in the grey zone, indicating moderate bankruptcy risk in this cycle:

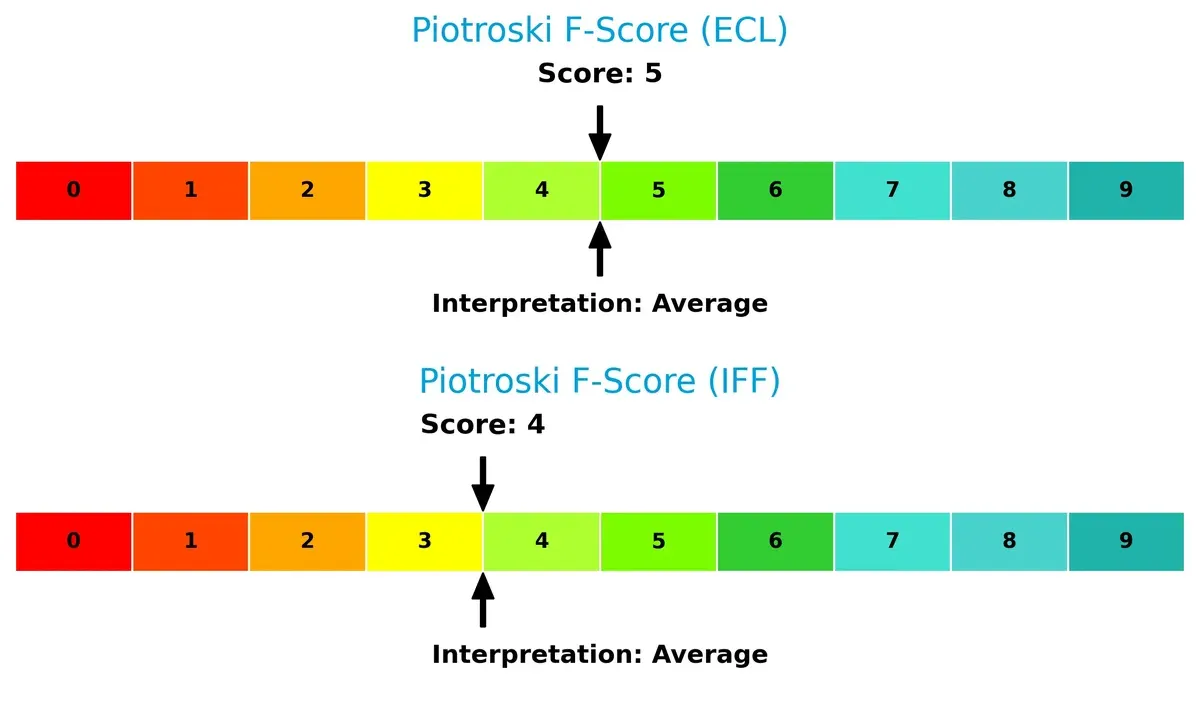

Financial Health: Quality of Operations

Ecolab’s Piotroski F-Score of 5 reflects average financial health, slightly outperforming IFF’s 4, which also signals average but with marginally higher internal risks:

How are the two companies positioned?

This section dissects ECL and IFF’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers a more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

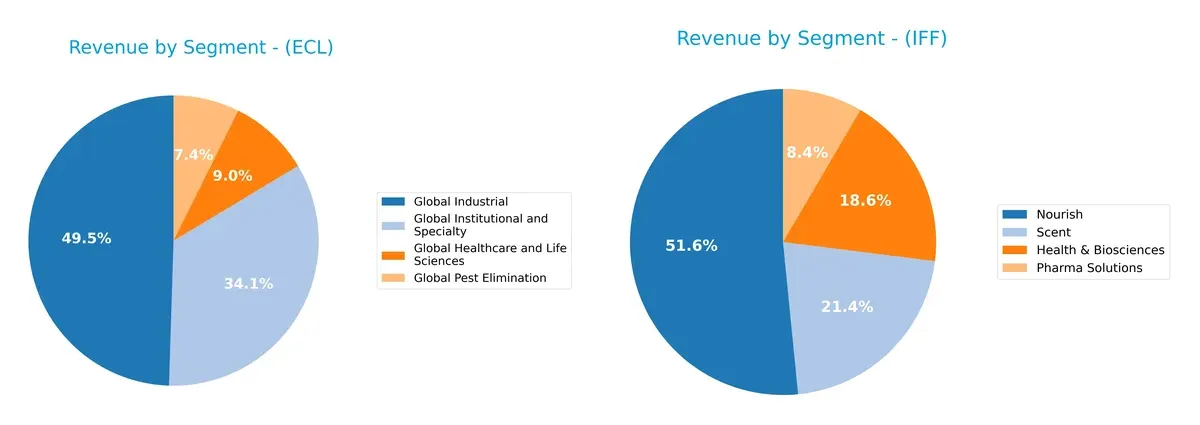

This comparison dissects how Ecolab Inc. and International Flavors & Fragrances Inc. diversify their income streams and reveals where their primary sector bets lie:

Ecolab anchors revenue in “Global Industrial” with $7.9B in 2024, supported by three other sizable segments totaling $8.0B, showing solid diversification. IFF pivots on “Nourish” at $5.9B but also draws heavily from “Health & Biosciences” and “Scent,” totaling $4.5B. Ecolab’s mix mitigates concentration risk via broad industrial exposure, while IFF’s focus signals strategic bets on consumer-driven biosciences and fragrances ecosystems.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Ecolab Inc. and International Flavors & Fragrances Inc.:

Ecolab Inc. Strengths

- Favorable net margin and ROE indicate strong profitability

- Positive ROIC above WACC shows efficient capital allocation

- Diverse product segments across industrial, healthcare, pest control, and institutional markets

- Broad global presence with significant revenue from US, Europe, Asia, and Latin America

International Flavors & Fragrances Inc. Strengths

- Favorable valuation metrics with low PE and PB ratios

- Higher dividend yield at 2.37% compared to Ecolab

- Product diversification including nourish, pharma, scent, and health biosciences

- Geographic diversification with strong presence in Asia, EMEA, North America, and Latin America

Ecolab Inc. Weaknesses

- High PE and PB ratios suggest expensive stock price relative to earnings and book value

- Neutral liquidity ratios (current and quick) indicate limited short-term financial flexibility

- Moderate debt levels with 35.77% debt to assets ratio

- Neutral asset turnover may imply moderate operational efficiency

International Flavors & Fragrances Inc. Weaknesses

- Negative net margin and zero ROE and ROIC reflect poor profitability and capital returns

- Unfavorable liquidity ratios at zero signal financial distress or reporting gaps

- No reported WACC and very low interest coverage raise solvency concerns

- Low asset turnover and fixed asset turnover indicate weak operational efficiency

Overall, Ecolab demonstrates solid profitability and efficient capital use, supported by diversified global operations. IFF’s strengths lie in valuation and dividend appeal but suffer from weak profitability and liquidity issues. These contrasts highlight differing strategic and financial challenges each company faces in 2026.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s dissect the core moats of these two industry players:

Ecolab Inc.: Operational Excellence and Scale Moat

Ecolab’s moat stems from high switching costs and scale in water and hygiene solutions. Its 3.4% ROIC premium over WACC and 49.8% ROIC growth reflect efficient capital use and margin stability. Expansion into healthcare and industrial markets in 2026 should deepen this advantage.

International Flavors & Fragrances Inc.: Innovation-Dependent Moat

IFF relies on intangible assets and innovation in fragrances and specialty ingredients, contrasting with Ecolab’s operational scale. However, its declining ROIC signals weakening capital efficiency. Market disruptions and product innovation in 2026 will be critical to regain footing.

Efficiency Moat vs. Innovation Moat: Who Holds the Line?

Ecolab’s growing ROIC and value-creating capital deployment reveal a wider, more sustainable moat. In contrast, IFF’s declining profitability exposes vulnerability. Ecolab is better positioned to defend and expand its market share amid competitive pressures.

Which stock offers better returns?

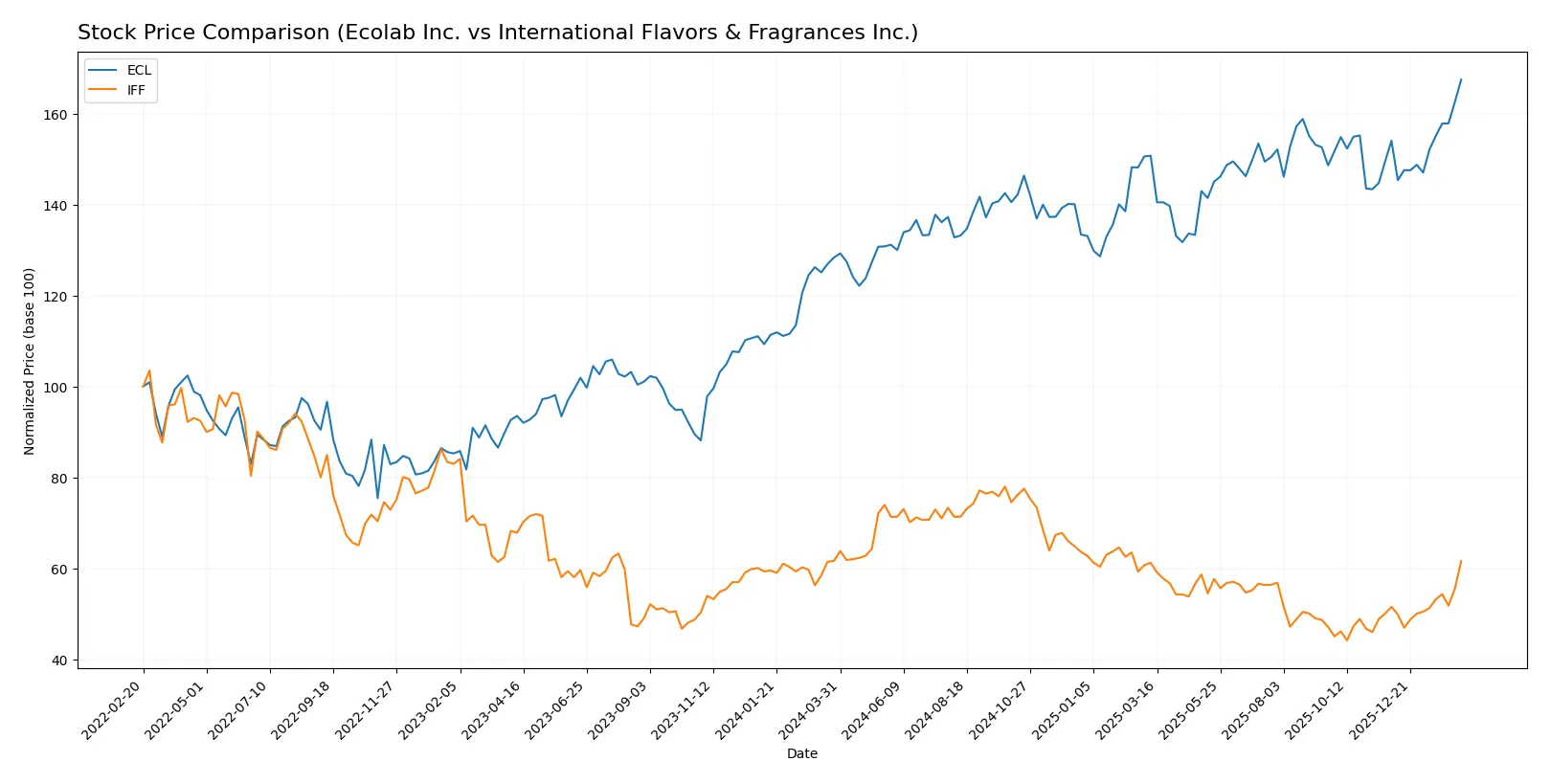

Both Ecolab Inc. and International Flavors & Fragrances Inc. experienced significant price movements and trading volume shifts in the past year, reflecting distinct market dynamics and momentum patterns.

Trend Comparison

Ecolab Inc. shows a bullish trend with a 30.49% price increase over the past 12 months, accelerating from a low of 218.16 to a high of 299.17, supported by strong buyer dominance.

International Flavors & Fragrances Inc. registers a slight bearish trend with a -0.1% price change in 12 months, despite recent acceleration and a 19.46% gain since November 2025, amid moderate volatility.

Comparing both, Ecolab delivers the highest market performance with a clear upward trajectory, while International Flavors & Fragrances remains largely flat over the full year despite recent gains.

Target Prices

Analysts present a cautiously optimistic consensus for these specialty chemicals leaders.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Ecolab Inc. | 300 | 345 | 325.1 |

| International Flavors & Fragrances Inc. | 80 | 97 | 88.71 |

Ecolab’s target consensus sits about 8.6% above its current price of 299.17, signaling moderate upside. IFF’s consensus shows roughly 7% potential growth from 83, reflecting steady analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the latest institutional grades for Ecolab Inc. and International Flavors & Fragrances Inc.:

Ecolab Inc. Grades

The table below lists recent grades assigned to Ecolab by major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BNP Paribas | maintain | Outperform | 2026-02-12 |

| Exane BNP Paribas | maintain | Outperform | 2026-02-12 |

| JP Morgan | maintain | Neutral | 2026-02-11 |

| RBC Capital | maintain | Outperform | 2026-02-11 |

| Citigroup | maintain | Buy | 2026-02-11 |

| Stifel | maintain | Buy | 2026-02-11 |

| Jefferies | maintain | Buy | 2026-02-11 |

| Wells Fargo | maintain | Equal Weight | 2026-02-11 |

| UBS | maintain | Neutral | 2026-02-11 |

| Citigroup | maintain | Buy | 2026-01-21 |

International Flavors & Fragrances Inc. Grades

Below are recent grades assigned to International Flavors & Fragrances by leading grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2026-02-13 |

| Citigroup | maintain | Buy | 2026-02-13 |

| Oppenheimer | upgrade | Outperform | 2026-02-13 |

| Mizuho | maintain | Outperform | 2026-02-12 |

| Argus Research | maintain | Buy | 2026-01-22 |

| Citigroup | maintain | Buy | 2026-01-21 |

| UBS | maintain | Neutral | 2026-01-12 |

| Barclays | maintain | Overweight | 2025-11-07 |

| UBS | maintain | Neutral | 2025-11-06 |

| B of A Securities | maintain | Buy | 2025-10-14 |

Which company has the best grades?

Both companies receive mostly positive grades, but International Flavors & Fragrances has recent upgrades to Outperform and consistent Buy/Overweight ratings. Ecolab shows a mix of Outperform, Buy, and Neutral grades. Investors might view IFF’s upgrade momentum as a stronger signal of near-term confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Ecolab Inc.

- Operates globally in water, hygiene, and infection prevention with strong industrial and healthcare segments, facing intense specialty chemicals competition.

International Flavors & Fragrances Inc.

- Focuses on flavor, fragrance, and biosciences markets with broad consumer product exposure but struggles with profitability and competitive pressures.

2. Capital Structure & Debt

Ecolab Inc.

- Maintains moderate leverage with DE ratio 0.9 and 35.8% debt-to-assets; interest coverage strong at 11.57x, indicating debt is manageable.

International Flavors & Fragrances Inc.

- Shows no reported debt metrics, but zero interest coverage and weak liquidity ratios suggest potential capital structure distress.

3. Stock Volatility

Ecolab Inc.

- Beta near 1 (0.992) indicates stock moves roughly in line with the market, offering moderate volatility risk.

International Flavors & Fragrances Inc.

- Slightly higher beta (1.042) implies marginally greater stock volatility relative to market benchmarks.

4. Regulatory & Legal

Ecolab Inc.

- Exposure to industrial and healthcare regulations globally, requiring compliance with environmental and safety standards.

International Flavors & Fragrances Inc.

- Faces regulatory scrutiny in cosmetics, food safety, and pharma ingredient markets across multiple international jurisdictions.

5. Supply Chain & Operations

Ecolab Inc.

- Complex, global supply chains in chemicals and services; operational efficiency supported by favorable fixed asset turnover (3.19).

International Flavors & Fragrances Inc.

- Supply chain complexity in natural ingredients and biotech segments; operational metrics unavailable, signaling transparency risks.

6. ESG & Climate Transition

Ecolab Inc.

- Positioned in water and hygiene solutions, potentially benefiting from ESG trends but must manage environmental footprint.

International Flavors & Fragrances Inc.

- ESG risks elevated due to product formulations and sourcing natural ingredients amid growing sustainability demands.

7. Geopolitical Exposure

Ecolab Inc.

- Global industrial and healthcare footprint exposes it to trade tensions and regional regulatory shifts.

International Flavors & Fragrances Inc.

- Wide geographic sales coverage including emerging markets increases vulnerability to geopolitical volatility and currency risks.

Which company shows a better risk-adjusted profile?

Ecolab faces moderate leverage and regulatory risks but benefits from strong operational metrics and financial stability. In contrast, IFF suffers from negative profitability, weak liquidity, and unclear capital structure, raising alarm bells. I view Ecolab as the safer investment with a stronger risk-adjusted profile. Ecolab’s Altman Z-Score (5.20) places it firmly in the safe zone, while IFF’s score (1.85) signals moderate financial distress risk. This discrepancy reflects Ecolab’s robust interest coverage and operational efficiency versus IFF’s zero interest coverage and unfavorable liquidity, underscoring the critical risk gap.

Final Verdict: Which stock to choose?

Ecolab Inc. (ECL) stands out with its superpower of generating strong, sustainable returns on invested capital well above its cost of capital. This indicates a durable competitive advantage and consistent value creation. A point of vigilance is its premium valuation multiples, which may limit near-term upside. ECL suits portfolios seeking steady, long-term growth with quality.

International Flavors & Fragrances Inc. (IFF) offers a strategic moat rooted in its niche specialty ingredients market and recurring revenue streams. Its valuation appears more attractive versus ECL’s, but its earnings weakness and declining return on capital raise safety concerns. IFF fits investors comfortable with higher risk in pursuit of potential turnaround opportunities.

If you prioritize proven capital efficiency and stable profitability, Ecolab outshines with a very favorable moat and robust financial health. However, if you seek value plays with growth potential despite short-term challenges, IFF offers a compelling scenario as a turnaround candidate with a lower entry price. Each choice aligns differently with risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ecolab Inc. and International Flavors & Fragrances Inc. to enhance your investment decisions: