Home > Comparison > Basic Materials > IFF vs DD

The competitive dynamic between International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. shapes the specialty chemicals sector’s evolution. IFF focuses on natural, plant-based ingredients across consumer products, emphasizing innovation in flavors and fragrances. DuPont operates as a diversified materials science leader, targeting electronics, mobility, and water solutions. This analysis contrasts their strategic trajectories to identify which offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. hold pivotal roles in the specialty chemicals sector.

International Flavors & Fragrances Inc.: Specialty Ingredients Innovator

International Flavors & Fragrances Inc. leads as a specialty chemicals manufacturer focusing on flavors, fragrances, and cosmetic actives. Its core revenue stems from supplying natural and synthetic ingredients to consumer products globally. In 2026, it strategically emphasizes expanding natural, plant-based solutions across Nourish and Health & Biosciences segments to capture growing demand for clean-label products.

DuPont de Nemours, Inc.: Advanced Materials Powerhouse

DuPont de Nemours, Inc. serves as a technology-driven materials provider with a broad portfolio spanning electronics, mobility, and water solutions. Its revenue engine revolves around engineered materials for semiconductors, transportation, and industrial markets. The company’s 2026 focus targets innovation in high-performance materials and integrated safety systems, aiming to strengthen its footprint in sustainable and advanced manufacturing sectors.

Strategic Collision: Similarities & Divergences

Both companies compete within specialty chemicals but differ sharply in approach: IFF pursues a consumer-focused ingredient ecosystem, while DuPont prioritizes industrial technology solutions. Their primary battleground lies in innovation-driven product development for evolving market needs. Investors will note IFF’s consumer product orientation contrasts with DuPont’s heavy industrial exposure, defining distinct risk and growth profiles in this competitive landscape.

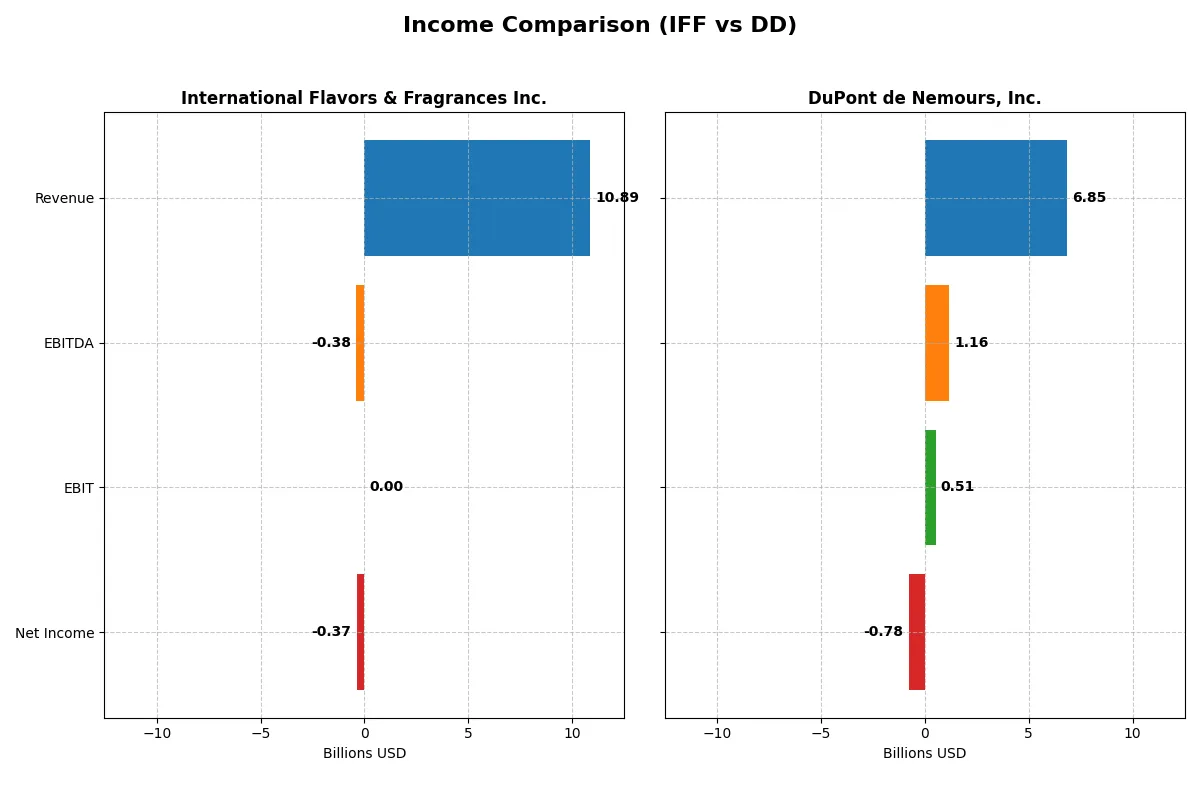

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| Revenue | 10.9B | 6.8B |

| Cost of Revenue | 6.95B | 4.78B |

| Operating Expenses | 2.53B | 1.21B |

| Gross Profit | 3.94B | 2.07B |

| EBITDA | -382M | 1.16B |

| EBIT | 0 | 513M |

| Interest Expense | 229M | 313M |

| Net Income | -374M | -779M |

| EPS | -1.46 | -1.87 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with higher efficiency and stronger profitability over recent years.

International Flavors & Fragrances Inc. (IFF) Analysis

IFF’s revenue declined steadily from 12.4B in 2022 to 10.9B in 2025, dragging net income from a 2.7B profit in 2021 to a 374M loss in 2025. Its gross margin holds firm at 36.2%, but net margin sinks to -3.4%, reflecting deteriorating bottom-line efficiency and a sharp EBIT drop to zero in 2025.

DuPont de Nemours, Inc. (DD) Analysis

DD’s revenue contracted sharply from 13.0B in 2022 to 6.8B in 2025, with net income swinging from a 5.9B high in 2022 to a 779M loss in 2025. Gross margin stands at 30.3%, lower than IFF’s, while EBIT margin remains positive at 7.5%. However, net margin deepened to -11.4%, signaling significant operational and net profitability challenges.

Margin Resilience vs. Revenue Contraction

IFF shows stronger gross margin resilience but faces significant net income erosion, while DD maintains a positive EBIT margin despite steeper revenue declines. IFF’s more stable margins offer a clearer path to recovery, whereas DD wrestles with heavier net losses and volatility. Investors seeking margin stability may favor IFF’s profile over DD’s sharper contraction and deeper net losses.

Financial Ratios Comparison

These vital ratios serve as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| ROE | 1.75% (2024) | 3.01% (2024) |

| ROIC | 2.63% (2024) | 3.54% (2024) |

| P/E | 89.07 (2024) | 19.02 (2024) |

| P/B | 1.56 (2024) | 0.57 (2024) |

| Current Ratio | 1.84 (2024) | 1.33 (2024) |

| Quick Ratio | 1.32 (2024) | 0.88 (2024) |

| D/E | 0.69 (2024) | 0.31 (2024) |

| Debt-to-Assets | 33.6% (2024) | 19.6% (2024) |

| Interest Coverage | 2.51 (2024) | 5.00 (2024) |

| Asset Turnover | 0.40 (2024) | 0.34 (2024) |

| Fixed Asset Turnover | 2.65 (2024) | 2.15 (2024) |

| Payout Ratio | 211.5% (2024) | 90.3% (2024) |

| Dividend Yield | 2.37% (2024) | 4.75% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, revealing hidden risks and operational excellence through core profitability and valuation insights.

International Flavors & Fragrances Inc.

IFF shows weak profitability with a 0% ROE and negative net margin at -3.43%, signaling operational challenges. Despite a favorable P/E of -46.13 and zero P/B, its valuation appears stretched amid poor returns. A 2.37% dividend yield suggests some shareholder returns despite limited growth reinvestment.

DuPont de Nemours, Inc.

DD suffers from negative profitability, with ROE at -5.6% and net margin at -11.37%, indicating deeper earnings struggles. Its P/E of -21.54 and P/B of 1.21 reflect a more moderate valuation. DD maintains a solid current ratio of 2.42 and a higher dividend yield of 3.56%, supporting shareholder income amid reinvestment.

Valuation Stretch vs. Financial Stability

DD offers a better balance of favorable ratios and shareholder returns, with stronger liquidity and dividend yield. IFF’s valuation is more stretched, driven by weak profitability despite dividends. Investors prioritizing stability and income may prefer DD, while those tolerating risk face a tougher choice with IFF.

Which one offers the Superior Shareholder Reward?

I compare International Flavors & Fragrances (IFF) and DuPont de Nemours (DD) on dividends, payout ratios, and buybacks. IFF yields around 2.37% with payout ratios above 200%, signaling unsustainable dividends given its negative earnings in 2025. Its free cash flow per share is $2.35, supporting modest dividend coverage but raising concerns due to negative profitability. IFF’s buyback activity is limited, weakening total return potential. DD offers a higher dividend yield near 3.56% with a payout ratio under 100%, reflecting a more conservative, sustainable distribution. Its free cash flow per share is $0.54, lower than IFF’s, but earnings are less volatile. DD’s robust share buyback program complements dividends, enhancing shareholder reward. Historically, firms like DD with balanced dividends and buybacks outperform peers in total return. I conclude DD presents a superior shareholder reward in 2026 due to sustainable payouts and active capital return.

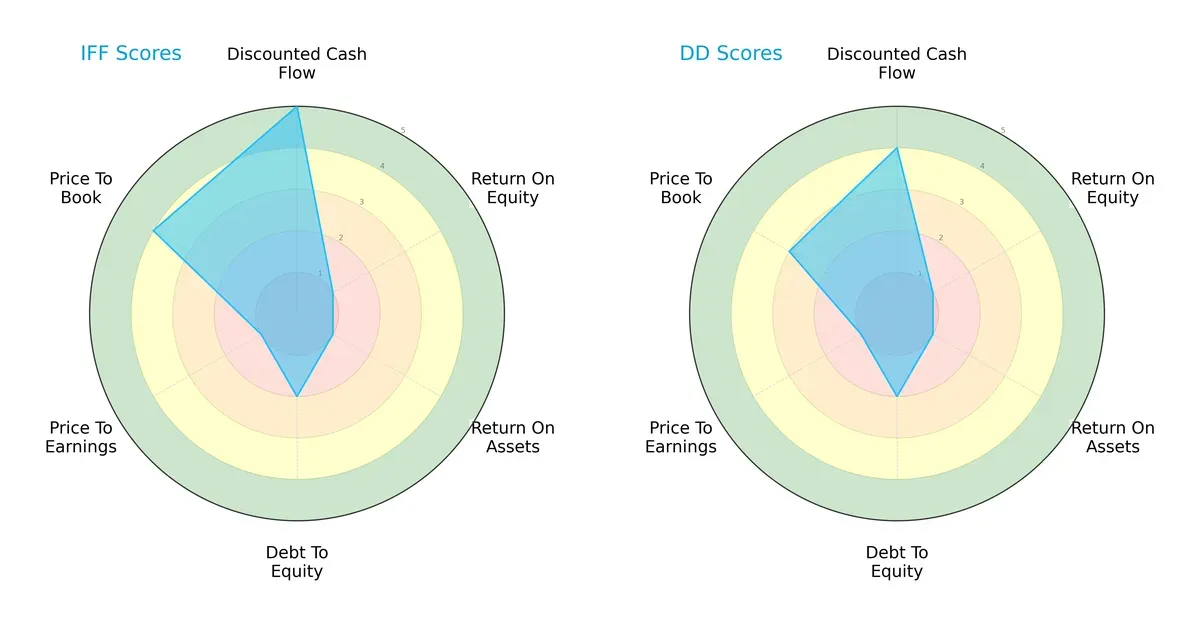

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of International Flavors & Fragrances Inc. and DuPont de Nemours, Inc.:

International Flavors & Fragrances (IFF) excels in discounted cash flow (DCF) with a very favorable score of 5, indicating strong cash generation potential. DuPont (DD) follows closely with a favorable 4. Both firms struggle with return on equity (ROE) and return on assets (ROA), scoring very unfavorably at 1 each, signaling operational efficiency challenges. Debt-to-equity scores are equally unfavorable at 2, reflecting moderate leverage risks. IFF’s higher price-to-book (P/B) score of 4 versus DD’s 3 suggests better market valuation relative to book value. Overall, IFF presents a more balanced profile anchored by superior valuation metrics, while DD relies on moderate cash flow strength.

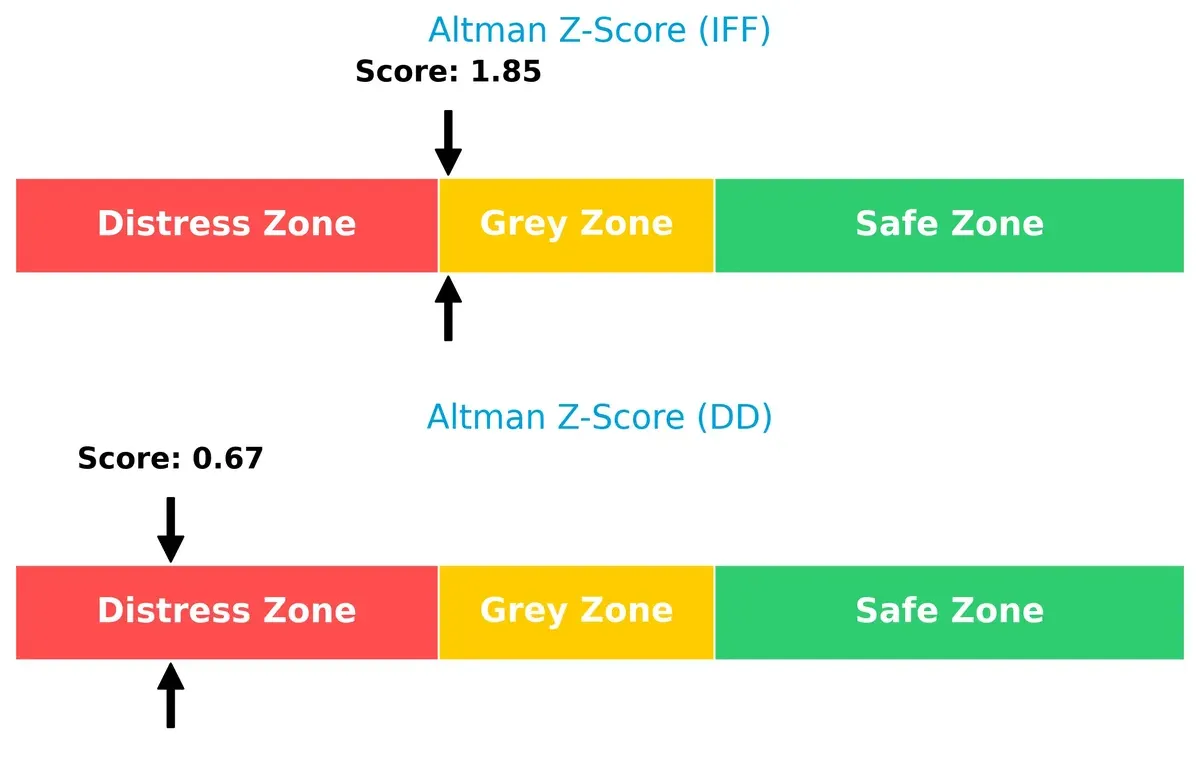

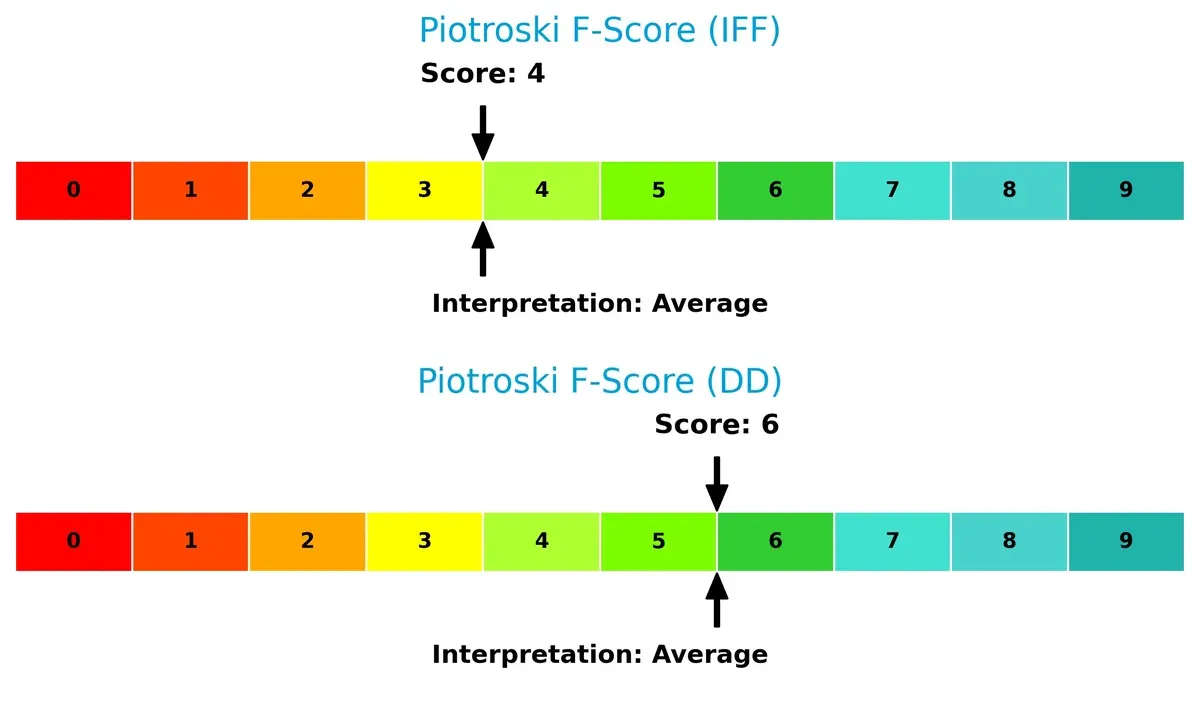

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score comparison highlights diverging solvency risks between IFF and DD:

IFF’s score of 1.85 places it in the grey zone, implying moderate bankruptcy risk but some financial resilience. In contrast, DD’s 0.67 signals distress zone vulnerability, raising red flags on its long-term survival prospects in this cycle. Investors should prioritize IFF for stronger solvency amid economic uncertainty.

Financial Health: Quality of Operations

Piotroski F-Score analysis underscores differences in operational quality between the two firms:

IFF and DD both register average Piotroski scores—4 and 6 respectively—indicating middling financial health. DD’s slightly better score suggests marginally stronger internal metrics, but neither firm demonstrates peak operational quality. Caution is warranted as both show room for improvement in profitability and efficiency indicators.

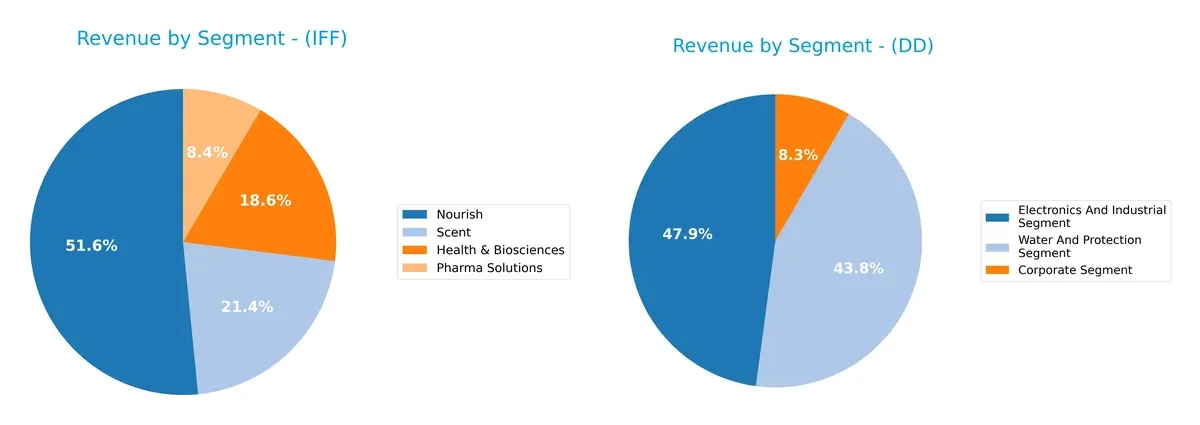

How are the two companies positioned?

This section dissects the operational DNA of IFF and DD by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The final objective is to confront their economic moats and identify which business model offers the most resilient, sustainable competitive advantage in today’s market landscape.

Revenue Segmentation: The Strategic Mix

This comparison dissects how International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. diversify their income streams and reveals their dominant sector bets:

IFF anchors revenue in Nourish at $5.87B, with significant contributions from Health & Biosciences ($2.11B) and Scent ($2.44B), showing a balanced portfolio across consumer and health sectors. DD leans on Electronics & Industrial ($5.93B) and Water & Protection ($5.42B), but its Corporate segment at $1.03B signals less diversification. IFF’s mix reduces concentration risk, while DD’s focus suggests infrastructure dominance but higher exposure to industrial cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD):

IFF Strengths

- Diversified product segments including Nourish, Pharma, Scent, Health & Biosciences

- Global revenue balanced across EMEA, North America, Asia, Latin America

- Favorable valuation metrics: PE and PB ratios

- Low debt levels with favorable debt-to-assets ratio

- Dividend yield at 2.37%

DD Strengths

- Broad industrial segments covering Electronics, Water, Corporate areas

- Strong global footprint with high revenue in Asia Pacific and U.S. & Canada

- Favorable current and quick ratios indicating liquidity strength

- Reasonable debt levels with favorable debt-to-assets ratio

- Dividend yield higher at 3.56%

- Favorable PE and PB ratios

IFF Weaknesses

- Unfavorable profitability metrics: negative net margin, zero ROE and ROIC

- Poor liquidity ratios: current and quick ratios at zero

- Weak asset turnover and interest coverage ratios

- Unavailable WACC data limits cost of capital analysis

DD Weaknesses

- Negative net margin and ROE indicating profitability challenges

- ROIC below WACC, signaling capital inefficiency

- Interest coverage below safe threshold

- Asset turnover below sector norms, signaling operational inefficiency

Both companies show diversified revenue streams and solid global presence. However, IFF struggles with liquidity and profitability metrics, while DD faces challenges in profitability and operational efficiency despite better liquidity. These weaknesses highlight areas each company must address to enhance financial health and capital allocation effectiveness.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone protects long-term profits from relentless competition and margin erosion. Let’s examine the durable advantages of two specialty chemical giants:

International Flavors & Fragrances Inc.: Intangible Assets and Innovation Edge

IFF’s moat stems from powerful intangible assets—proprietary formulas and brand partnerships—that sustain steady gross margins near 36%. However, a declining ROIC signals emerging challenges. New natural ingredient lines in health and biosciences could deepen this moat if profitability rebounds in 2026.

DuPont de Nemours, Inc.: Technology-Driven Cost Advantage

DuPont leverages advanced materials technology to maintain diversified revenue streams and a solid 7.5% EBIT margin. Unlike IFF, DuPont currently sheds value with ROIC below WACC and a sharp profitability decline. Yet, expansion in semiconductor and water purification markets offers potential to stabilize and rebuild its moat.

Intangible Assets vs. Technology Innovation: Which Moat Holds Stronger?

Both firms face shrinking returns, but IFF’s intangible asset base provides a wider moat than DuPont’s eroding technology cost advantages. IFF is better positioned to defend market share through innovation, while DuPont must reverse value destruction to remain competitive.

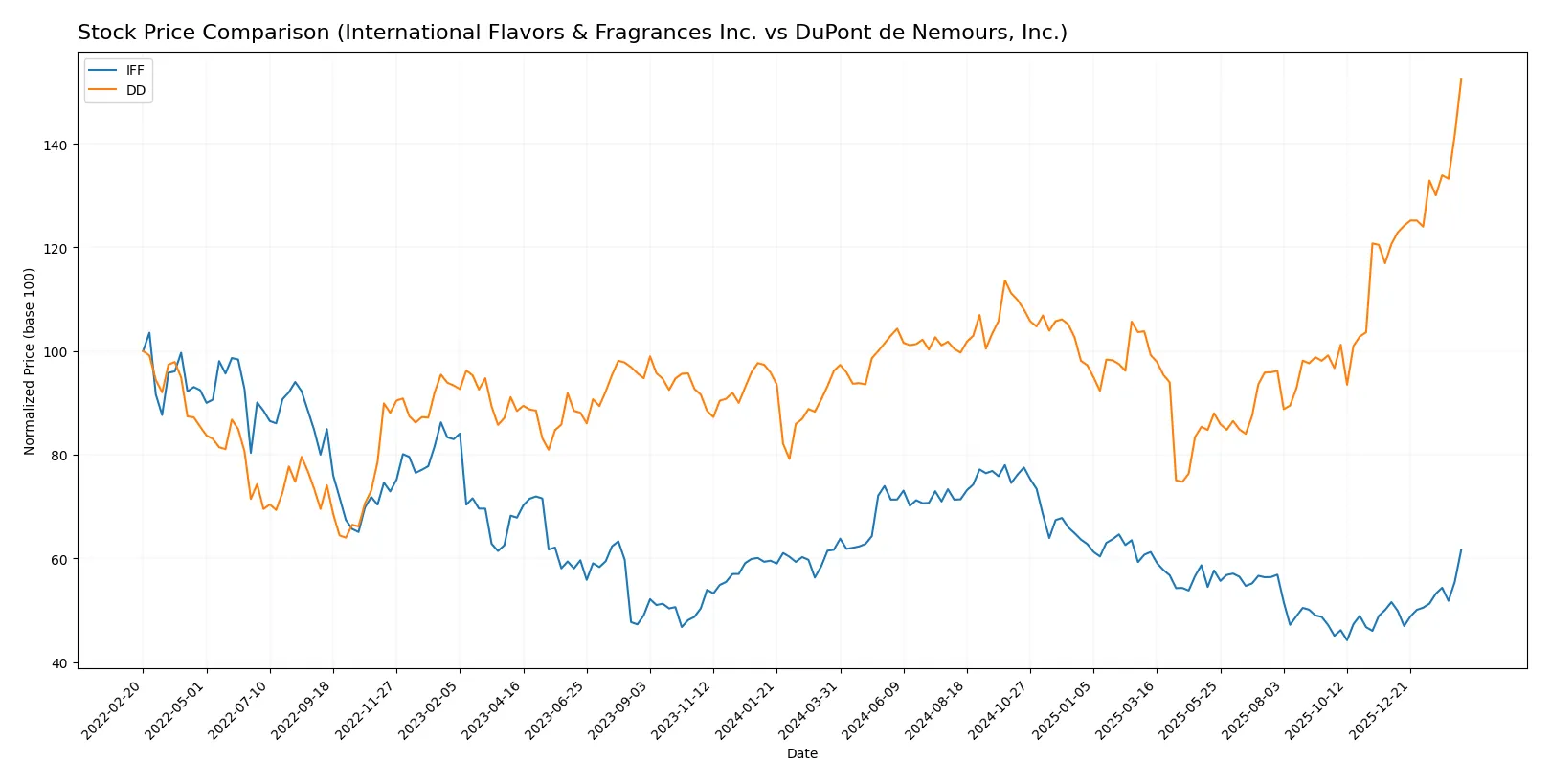

Which stock offers better returns?

The past year shows contrasting price dynamics: International Flavors & Fragrances Inc. (IFF) experienced mild overall decline with recent strong gains, while DuPont de Nemours, Inc. (DD) delivered robust bullish growth accelerating throughout.

Trend Comparison

IFF’s stock declined slightly by 0.1% over the past 12 months, indicating a neutral to bearish trend with accelerating momentum in recent months, highlighted by a 19.46% gain from November 2025 to February 2026.

DD’s stock surged 58.47% over the same 12-month span, reflecting a clear bullish trend with accelerating gains. The recent 26.28% rise further confirms strong upward momentum.

Comparing both, DD delivered significantly higher market performance than IFF, showing stronger sustained growth and acceleration over the year.

Target Prices

Analysts present a mixed but cautiously optimistic target consensus for these specialty chemicals leaders.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Flavors & Fragrances Inc. | 80 | 97 | 88.71 |

| DuPont de Nemours, Inc. | 46 | 161 | 73.88 |

IFF’s consensus target stands about 7% above its current price of $83, signaling moderate upside. DuPont shows a wider target range with a consensus 47% above its current $50 price, reflecting greater analyst uncertainty but meaningful potential gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

International Flavors & Fragrances Inc. Grades

The following table summarizes recent grades for International Flavors & Fragrances Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-13 |

| Citigroup | Maintain | Buy | 2026-02-13 |

| Oppenheimer | Upgrade | Outperform | 2026-02-13 |

| Mizuho | Maintain | Outperform | 2026-02-12 |

| Argus Research | Maintain | Buy | 2026-01-22 |

| Citigroup | Maintain | Buy | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

DuPont de Nemours, Inc. Grades

The following table summarizes recent grades for DuPont de Nemours, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Outperform | 2026-02-12 |

| Jefferies | Maintain | Buy | 2026-02-11 |

| UBS | Maintain | Buy | 2026-02-11 |

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| Citigroup | Maintain | Buy | 2026-02-11 |

| Keybanc | Maintain | Overweight | 2026-02-11 |

| Citigroup | Maintain | Buy | 2026-01-21 |

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| Keybanc | Maintain | Overweight | 2026-01-09 |

| UBS | Maintain | Buy | 2026-01-07 |

Which company has the best grades?

Both companies receive predominantly positive grades, with multiple “Buy,” “Overweight,” and “Outperform” ratings. DuPont de Nemours holds a slight edge with more consistent “Overweight” and “Buy” grades. This may signal stronger institutional confidence, potentially influencing investor sentiment and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

International Flavors & Fragrances Inc. (IFF)

- Faces intense rivalry in specialty chemicals with pressure on margins amid innovation demands.

DuPont de Nemours, Inc. (DD)

- Operates in diverse segments but competes with larger integrated chemical firms, risking margin compression.

2. Capital Structure & Debt

International Flavors & Fragrances Inc. (IFF)

- Shows favorable debt-to-equity but weak interest coverage, signaling potential stress servicing debt.

DuPont de Nemours, Inc. (DD)

- Maintains moderate leverage with better current and quick ratios, yet interest coverage remains marginal.

3. Stock Volatility

International Flavors & Fragrances Inc. (IFF)

- Beta near 1.04 indicates volatility close to market average, with moderate liquidity.

DuPont de Nemours, Inc. (DD)

- Higher beta at 1.16 suggests elevated volatility and heavier trading volume, increasing risk.

4. Regulatory & Legal

International Flavors & Fragrances Inc. (IFF)

- Must comply with strict global regulations on cosmetics and food ingredients, facing reform risks.

DuPont de Nemours, Inc. (DD)

- Faces complex regulatory environments across industrial and environmental sectors, with litigation potential.

5. Supply Chain & Operations

International Flavors & Fragrances Inc. (IFF)

- Relies on diverse natural raw materials vulnerable to climate and geopolitical disruptions.

DuPont de Nemours, Inc. (DD)

- Complex global supply chains in advanced materials are susceptible to geopolitical and logistic bottlenecks.

6. ESG & Climate Transition

International Flavors & Fragrances Inc. (IFF)

- Faces pressure to innovate sustainable ingredients amid rising ESG investor scrutiny.

DuPont de Nemours, Inc. (DD)

- Must accelerate climate transition in energy-intensive segments to meet tightening regulations and investor demands.

7. Geopolitical Exposure

International Flavors & Fragrances Inc. (IFF)

- Operates globally, exposing it to trade tensions and currency risks, especially in emerging markets.

DuPont de Nemours, Inc. (DD)

- Broad international footprint subjects it to geopolitical risks including tariffs and regional instability.

Which company shows a better risk-adjusted profile?

IFF’s biggest risk lies in weak profitability and operational efficiency, despite manageable debt levels. DD struggles most with financial distress signals and volatile market exposure but benefits from stronger liquidity. DD’s slightly favorable ratio profile contrasts with IFF’s more unfavorable metrics. The 2025 Altman Z-Score places DD in the distress zone, raising bankruptcy concerns, while IFF remains in a grey zone, indicating moderate risk. Therefore, I view IFF as offering a marginally better risk-adjusted profile, given its relatively steadier balance sheet and lower stock volatility.

Final Verdict: Which stock to choose?

International Flavors & Fragrances Inc. (IFF) stands out for its unique ability to generate stable cash flow despite recent operational challenges. Its superpower lies in a resilient brand portfolio that supports pricing power. A point of vigilance remains its declining profitability and cash conversion cycle, which could pressure margins. I see IFF fitting well in portfolios seeking Aggressive Growth with a tolerance for short-term volatility.

DuPont de Nemours, Inc. (DD) offers a strategic moat through its diversified industrial chemicals platform and stronger balance sheet. Its safety profile is superior to IFF, reflected in healthier liquidity ratios and lower leverage. DD appeals to investors favoring GARP (Growth at a Reasonable Price), combining growth potential with better financial stability amid cyclical headwinds.

If you prioritize aggressive growth fueled by brand strength and cash generation, IFF is the compelling choice despite current margin pressures. However, if you seek a more stable investment with a durable industrial moat and balanced risk, DD offers better stability and value preservation. Both present analytical scenarios with risks, so aligning with your risk appetite remains essential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. to enhance your investment decisions: