In the rapidly evolving landscape of quantum technology, two companies stand out: D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ). Both firms operate within the technology sector but focus on distinct aspects of quantum computing—D-Wave on hardware and software solutions, while Arqit specializes in quantum cybersecurity. This comparison will delve into their innovation strategies and market positions, aiming to identify which company presents the more compelling opportunity for investors like you.

Table of contents

Company Overview

D-Wave Quantum Inc. Overview

D-Wave Quantum Inc. is at the forefront of quantum computing, providing advanced systems, software, and services tailored for various industries. Based in Burnaby, Canada, the company has developed its fifth-generation quantum computer, Advantage, and offers a suite of tools including Ocean, a comprehensive open-source programming platform. D-Wave’s cloud-based service, Leap, grants users real-time access to quantum computing capabilities, facilitating applications in artificial intelligence, drug discovery, and financial modeling. With a market cap of approximately $7.83B, D-Wave’s innovative solutions position it as a leader in the rapidly evolving technology sector.

Arqit Quantum Inc. Overview

Arqit Quantum Inc., headquartered in London, UK, specializes in cybersecurity solutions leveraging quantum technology. The company’s primary offering, QuantumCloud, allows devices to generate encryption keys securely, enhancing data protection across various platforms. With a market cap of about $394M, Arqit focuses on providing robust cybersecurity services that cater to both satellite and terrestrial needs, making it a notable player in the software infrastructure space, particularly within the growing field of quantum cybersecurity.

Key Similarities and Differences

Both D-Wave and Arqit operate within the quantum technology sector but focus on different applications. D-Wave emphasizes quantum computing systems for diverse industries, while Arqit specializes in quantum-based cybersecurity solutions. Their business models reflect these priorities, with D-Wave leveraging hardware and software integration, and Arqit focusing on software services for encryption and data protection.

Income Statement Comparison

Below is a comparison of the income statements for D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ) for their most recent fiscal years.

| Metric | D-Wave Quantum Inc. | Arqit Quantum Inc. |

|---|---|---|

| Revenue | 8.83M | 0.29M |

| EBITDA | -138.05M | -20.19M |

| EBIT | -139.98M | -23.75M |

| Net Income | -143.88M | -54.58M |

| EPS | -0.75 | -10.79 |

Interpretation of Income Statement

In the most recent fiscal year, D-Wave Quantum Inc. saw a slight increase in revenue to 8.83M from 8.76M, while Arqit Quantum Inc. experienced a significant drop in revenue from 640K to 290K. Both companies reported negative net incomes, with D-Wave’s losses widening to 143.88M, compared to Arqit’s loss of 54.58M. D-Wave’s EBITDA margin remains deeply negative, indicating ongoing challenges in managing operational costs effectively. Overall, D-Wave shows signs of stability in revenue, but both firms face considerable financial struggles, necessitating a cautious approach for potential investors.

Financial Ratios Comparison

The following table provides a comparative overview of key financial ratios and revenue for D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ).

| Metric | QBTS | ARQQ |

|---|---|---|

| ROE | -2.30% | -4.62% |

| ROIC | -0.45% | -1.67% |

| P/E | -11.22 | -0.53 |

| P/B | 25.76 | 2.44 |

| Current Ratio | 6.14 | 1.94 |

| Quick Ratio | 6.08 | 1.94 |

| D/E | 0.61 | 0.08 |

| Debt-to-Assets | 0.19 | 0.04 |

| Interest Coverage | -19.82 | -110.72 |

| Asset Turnover | 0.04 | 0.01 |

| Fixed Asset Turnover | 0.77 | 0.27 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The ratios for both companies indicate significant challenges. D-Wave Quantum shows higher liquidity with a current ratio of 6.14, suggesting robust short-term financial health, but its negative ROE and P/E ratios raise concerns about profitability. Conversely, Arqit Quantum has a lower current ratio and significantly worse margins, emphasizing operational struggles. Both companies present high risk, particularly in terms of leverage and profitability, indicating they may not be suitable for conservative investors.

Dividend and Shareholder Returns

D-Wave Quantum Inc. (QBTS) does not pay dividends, reflecting its focus on reinvestment amid negative net income. The company is in a high-growth phase, prioritizing R&D to enhance its quantum computing capabilities. Despite not distributing profits, QBTS engages in share buybacks, which can signal confidence in its future prospects.

On the other hand, Arqit Quantum Inc. (ARQQ) also refrains from dividend payments, emphasizing growth and innovation. Its lack of income and reliance on capital for expansion aligns with long-term shareholder value creation. Both companies’ approaches suggest a commitment to sustainable growth, albeit with inherent risks.

Strategic Positioning

D-Wave Quantum Inc. (QBTS) holds a significant market share in quantum computing, leveraging its advanced Advantage system and various software solutions. In contrast, Arqit Quantum Inc. (ARQQ) focuses on cybersecurity, providing unique encryption services through its QuantumCloud platform. Both companies face competitive pressure from emerging technologies and established players, underscoring the need for continuous innovation to mitigate risks associated with technological disruption in their respective markets.

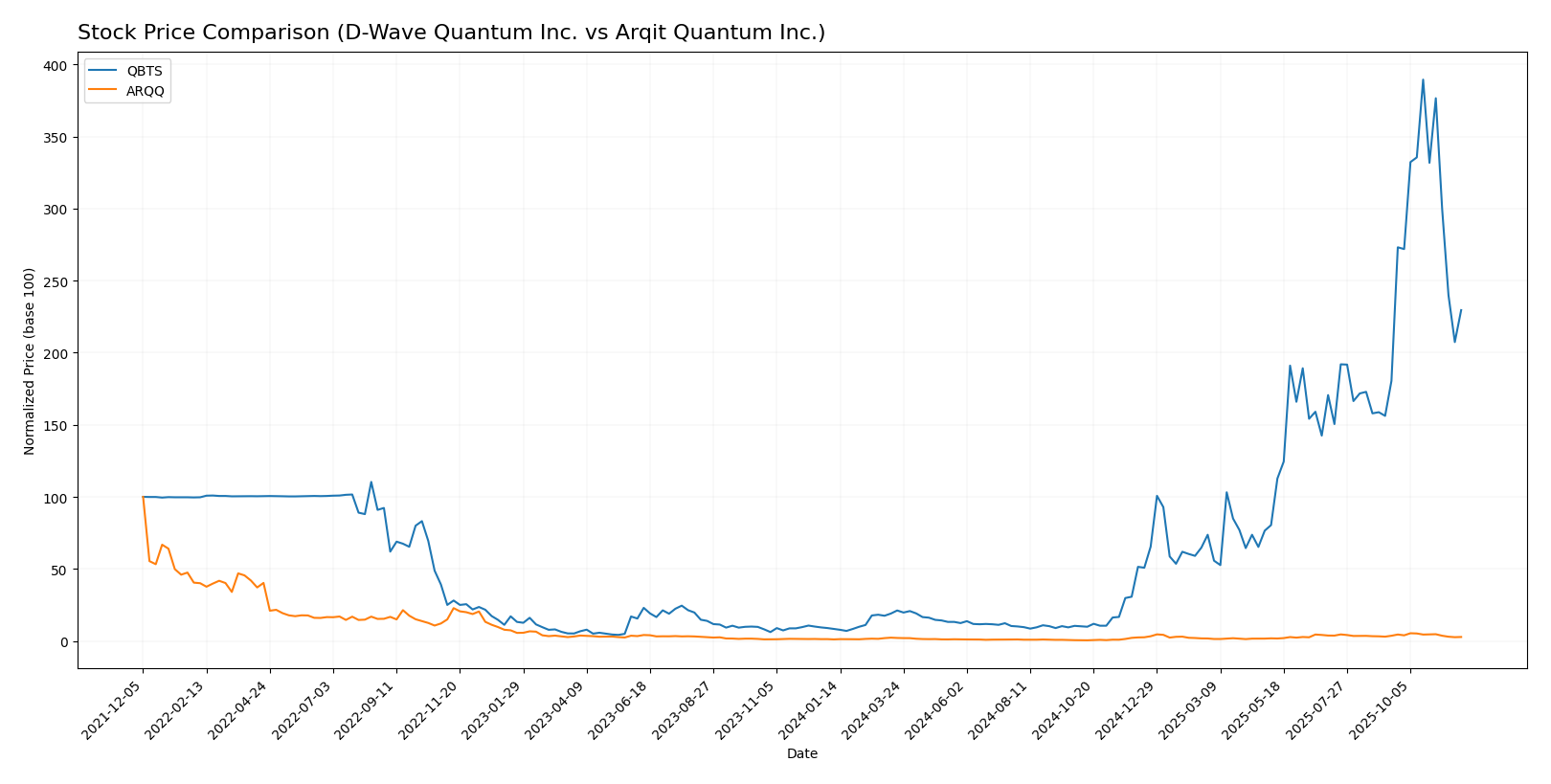

Stock Comparison

In this analysis, I will examine the stock performance of D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ) over the past year, highlighting key price movements and trading dynamics that have influenced their trajectories.

Trend Analysis

D-Wave Quantum Inc. (QBTS) has exhibited a remarkable price change of +2650.52% over the past year, indicating a strong bullish trend. The highest recorded price during this period was 38.33, while the lowest was 0.69. However, the trend is currently experiencing a deceleration, with a recent decrease of -23.64% noted between September 14, 2025, and November 30, 2025. This recent downturn, accompanied by a standard deviation of 6.27, suggests increased volatility in the short term, although the overall bullish sentiment remains intact.

Arqit Quantum Inc. (ARQQ) has also shown a significant price increase of +156.12% over the same timeframe, classifying it as a bullish trend as well. The stock reached a high of 49.92 and a low of 4.19 during this period. However, the recent trend has shifted negatively, with a decrease of -23.64% observed since mid-September 2025. The volatility is marked by a standard deviation of 8.24, indicating a level of uncertainty in the stock’s price movements. Additionally, the trend is characterized by deceleration, suggesting potential caution for investors in the near term.

In summary, both stocks have experienced substantial growth over the past year, but recent trends indicate specific challenges that may warrant careful consideration before making investment decisions.

Analyst Opinions

Recent analyses suggest a cautious outlook on both D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ). Analyst ratings indicate a “C-” for QBTS, reflecting weak financial metrics and a high debt-to-equity ratio, suggesting investors should hold their positions. Conversely, ARQQ holds a “C” rating, with slightly better fundamentals, yet still warrants a hold recommendation. The consensus for both companies leans toward a hold for the current year, emphasizing a wait-and-see approach as market conditions evolve.

Stock Grades

We have reliable grading data for two companies, which reflects their current standing in the market.

D-Wave Quantum Inc. (QBTS) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | maintain | Buy | 2025-11-10 |

| Rosenblatt | maintain | Buy | 2025-11-07 |

| Canaccord Genuity | maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-07 |

| B. Riley Securities | maintain | Buy | 2025-09-22 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

| Benchmark | maintain | Buy | 2025-08-04 |

| B. Riley Securities | maintain | Buy | 2025-07-23 |

| B. Riley Securities | maintain | Buy | 2025-06-18 |

| Benchmark | maintain | Buy | 2025-06-18 |

Arqit Quantum Inc. (ARQQ) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | maintain | Buy | 2023-09-26 |

Overall, both D-Wave Quantum Inc. and Arqit Quantum Inc. maintain a strong “Buy” rating from reputable grading companies, indicating positive investor sentiment and consistent performance expectations in the quantum technology sector.

Target Prices

The consensus target prices for D-Wave Quantum Inc. and Arqit Quantum Inc. reflect optimistic expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| D-Wave Quantum Inc. (QBTS) | 40 | 26 | 35.25 |

| Arqit Quantum Inc. (ARQQ) | 60 | 60 | 60 |

For D-Wave Quantum Inc. (QBTS), the consensus target price of 35.25 indicates significant upside potential compared to its current price of 22.59. Meanwhile, Arqit Quantum Inc. (ARQQ) has a target consensus of 60, suggesting that analysts expect its stock to appreciate substantially from the current price of 25.74.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ).

| Criterion | D-Wave Quantum Inc. | Arqit Quantum Inc. |

|---|---|---|

| Diversification | Strong focus on quantum computing solutions | Limited product offerings primarily in cybersecurity |

| Profitability | Negative net margin (-16.3%) | Negative net margin (-186.3%) |

| Innovation | Advanced quantum computing technology | Emerging cybersecurity solutions |

| Global presence | Operates in multiple regions | Primarily UK-focused |

| Market Share | Niche in quantum computing | Small market presence in cybersecurity |

| Debt level | Moderate (debt-to-equity ratio of 0.61) | Low (debt-to-equity ratio of 0.08) |

Key takeaways: D-Wave has a robust innovation track in quantum computing but struggles with profitability. In contrast, Arqit offers a niche cybersecurity solution but has significant financial challenges and limited market presence.

Risk Analysis

The table below outlines the key risks associated with two companies, D-Wave Quantum Inc. and Arqit Quantum Inc.

| Metric | D-Wave Quantum Inc. | Arqit Quantum Inc. |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant market risks due to their positions in the volatile tech sector. Arqit, in particular, displays high operational risk stemming from its heavy reliance on advanced cybersecurity solutions, which can be susceptible to rapid technological changes.

Which one to choose?

When comparing D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ), both companies exhibit significant challenges. QBTS shows a gross profit margin of 63% but suffers from negative net income margins, indicating operational struggles. Its stock trend is bullish with substantial price increases over the past year. ARQQ, while also experiencing a bullish trend, has a higher debt-to-equity ratio and a less favorable profitability outlook, evidenced by its negative net margins and substantial operating expenses. Analysts rate QBTS with a grade of C- and ARQQ with a C, suggesting QBTS may present slightly more favorable conditions for growth potential.

Investors seeking growth may prefer QBTS due to its promising stock trend, while those prioritizing stability might find ARQQ’s fundamentals concerning. Both companies face risks associated with market dependency and high operational costs.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of D-Wave Quantum Inc. and Arqit Quantum Inc. to enhance your investment decisions: