In a world increasingly driven by data and complex problem-solving, D-Wave Quantum Inc. stands at the forefront of the quantum computing revolution, fundamentally reshaping industries from finance to pharmaceuticals. With its flagship products like the fifth-generation Advantage quantum computer and innovative services such as Leap, D-Wave is not just a competitor but a pioneer, propelling technological advancements that enhance efficiency and intelligence. As we delve into D-Wave’s financial health, we must consider whether its robust growth potential justifies its current market valuation.

Table of contents

Company Description

D-Wave Quantum Inc. (NYSE: QBTS), founded in 2020 and headquartered in Burnaby, Canada, is a pioneering player in the quantum computing industry. The company develops advanced quantum computing systems, including its fifth-generation Advantage quantum computer, along with a comprehensive suite of software and services such as the Ocean toolkit and the cloud-based Leap platform. D-Wave caters to various sectors, including financial services, life sciences, and manufacturing, positioning itself as a leader in the integration of quantum solutions for applications in AI, drug discovery, and more. As the quantum computing landscape evolves, D-Wave’s commitment to innovation and its robust ecosystem play a critical role in shaping the future of computing technology.

Fundamental Analysis

In this section, I will analyze D-Wave Quantum Inc.’s income statement, financial ratios, and dividend payout policy to provide insights into its financial health.

Income Statement

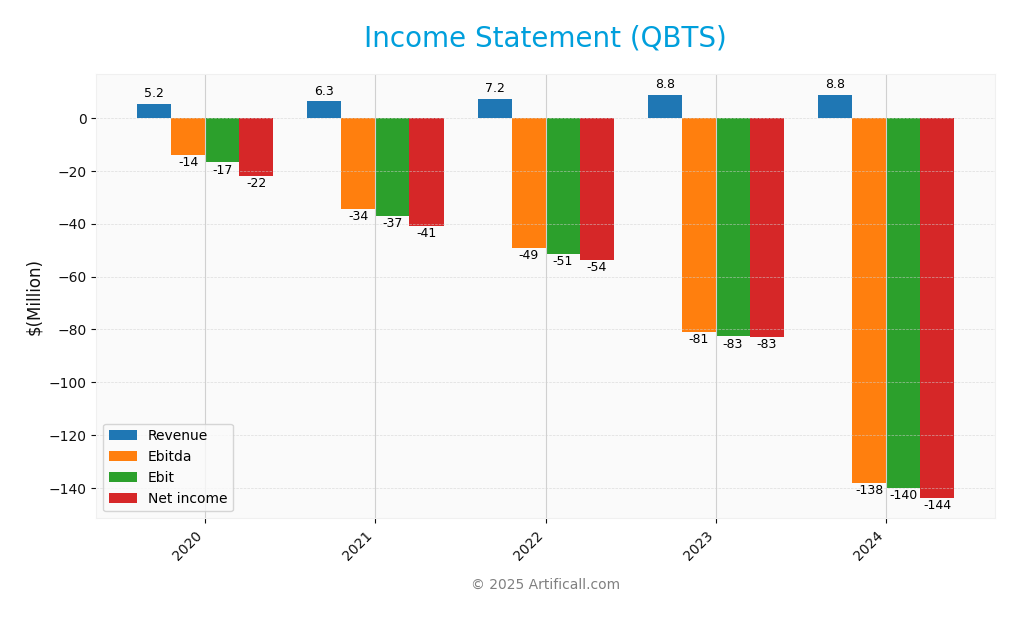

The following table presents the Income Statement for D-Wave Quantum Inc. (QBTS) over the fiscal years 2020 to 2024, providing a clear view of revenue, expenses, and net income trends.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 5.16M | 6.28M | 7.17M | 8.76M | 8.83M |

| Cost of Revenue | 915K | 1.75M | 2.92M | 4.14M | 3.26M |

| Operating Expenses | 35.71M | 43.48M | 63.71M | 85.17M | 82.79M |

| Gross Profit | 4.25M | 4.53M | 4.25M | 4.62M | 5.56M |

| EBITDA | -14.06M | -34.36M | -49.03M | -80.83M | -138.05M |

| EBIT | -16.79M | -36.96M | -51.37M | -82.68M | -139.98M |

| Interest Expense | 5.18M | 4.01M | 2.33M | 2.16M | 3.90M |

| Net Income | -21.97M | -40.97M | -53.70M | -82.72M | -143.88M |

| EPS | -0.20 | -0.33 | -0.45 | -0.60 | -0.75 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2024-03-29 | 2025-03-14 |

Interpretation of Income Statement

Over the analyzed period, D-Wave Quantum Inc. has shown a steady increase in revenue from 5.16M in 2020 to 8.83M in 2024. However, net income has consistently been negative, indicating ongoing operational challenges. The gross profit margin has remained relatively stable, while significant increases in operating expenses have led to widening losses, notably in 2024. The sharp rise in EBITDA loss signals potential challenges in scaling operations effectively. The most recent year reflects a slowdown in revenue growth alongside escalating losses, emphasizing the need for strategic reevaluation and risk management moving forward.

Financial Ratios

The following table presents the financial ratios for D-Wave Quantum Inc. (QBTS) over the years available.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -425.72% | -652.54% | -748.67% | -944.45% | -1629.99% |

| ROE | -67.12% | -223.21% | 1.82% | 3.38% | -229.67% |

| ROIC | -84.16% | -184.25% | -403.84% | -161.48% | -45.01% |

| P/E | -52.01 | -30.04 | -3.21 | -1.47 | -11.22 |

| P/B | 34.91 | -67.06 | -5.85 | -4.96 | 25.76 |

| Current Ratio | 3.45 | 1.53 | 0.87 | 4.18 | 6.14 |

| Quick Ratio | 3.24 | 1.33 | 0.73 | 3.99 | 6.08 |

| D/E | 0.14 | -2.15 | -1.44 | -2.97 | 0.61 |

| Debt-to-Assets | 9.82% | 133.78% | 156.92% | 122.40% | 19.20% |

| Interest Coverage | -6.08 | -9.71 | -25.46 | -37.38 | -19.82 |

| Asset Turnover | 0.11 | 0.21 | 0.27 | 0.15 | 0.04 |

| Fixed Asset Turnover | 0.88 | 0.53 | 0.63 | 0.81 | 0.77 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing D-Wave Quantum Inc. (QBTS) reveals key financial ratios that indicate its financial health as of FY 2024. The current ratio stands at 6.14, reflecting strong liquidity, suggesting the company can easily cover short-term liabilities. However, its net profit margin is a concerning -16.30%, indicating ongoing losses. The solvency ratio is negative, at -1.03, highlighting potential long-term financial instability. Profitability ratios are weak, with an EBIT margin of -15.86% and a return on equity of -2.30%, which raises red flags about sustainable profitability. The high price-to-book ratio of 25.76 suggests overvaluation, while the debt-to-equity ratio of 0.61 indicates moderate leverage. Overall, while liquidity is strong, significant profitability and solvency issues warrant caution for potential investors.

Evolution of Financial Ratios

Over the past five years, D-Wave Quantum Inc. has shown a troubling trend in its financial ratios. The current ratio improved from 1.53 in 2021 to 6.14 in 2024, indicating enhanced liquidity, but profitability has deteriorated, with net profit margins dropping from -6.53% in 2021 to -16.30% in 2024. This trend underscores increasing financial strain despite improved short-term asset management.

Distribution Policy

D-Wave Quantum Inc. (QBTS) does not currently pay dividends, which aligns with its focus on reinvestment and growth during this high-growth phase. The lack of dividend payments is indicative of a strategy prioritizing research and development, essential for maintaining a competitive edge in the quantum computing sector. However, the company does engage in share buybacks, reflecting a commitment to returning value to shareholders. This approach, while limiting immediate cash returns, supports sustainable long-term value creation if managed prudently.

Sector Analysis

D-Wave Quantum Inc. operates in the Computer Hardware industry, specializing in quantum computing systems and services, with key products like the Advantage quantum computer and cloud-based Leap service. Its competitive advantages include innovative technology and a strong presence in sectors like AI and life sciences.

Strategic Positioning

D-Wave Quantum Inc. (QBTS) holds a unique position in the rapidly evolving quantum computing market, with a market share bolstered by its fifth-generation Advantage quantum computer and a comprehensive suite of software tools. Despite competitive pressure from established players and emerging technologies, D-Wave’s focus on practical applications, such as artificial intelligence and financial modeling, differentiates it. The company’s innovative cloud-based services, like Leap, enable real-time access to quantum resources, enhancing its competitive edge. As the market faces technological disruptions, D-Wave’s strategic positioning aims to capitalize on growth opportunities across various industries, including financial services and life sciences.

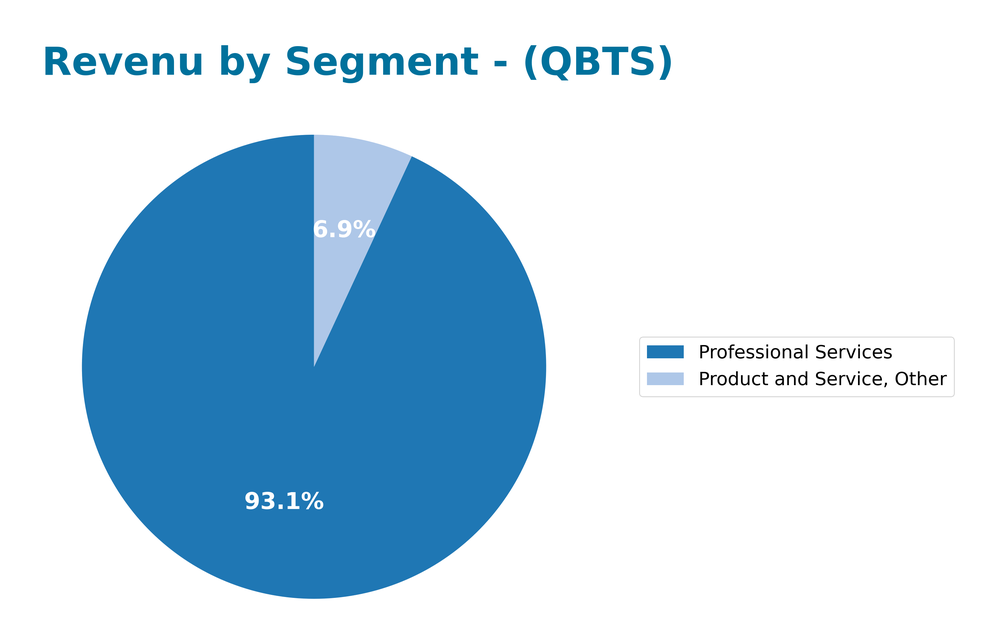

Revenue by Segment

The following chart illustrates D-Wave Quantum Inc.’s revenue distribution by segment for the fiscal years 2022 to 2024.

In analyzing the revenue trends for D-Wave Quantum Inc., we can observe that Professional Services has consistently been the dominant revenue driver, though it experienced a notable decline from 3.82B in 2023 to 1.94M in 2024. Meanwhile, the segment for “Product and Service, Other” shows some growth, increasing from 47K in 2023 to 144K in 2024. This shift indicates a potential diversification of revenue sources; however, the sharp drop in Professional Services raises concerns regarding dependency on this segment, suggesting margin risks and the need for strategic adjustments moving forward.

Key Products

D-Wave Quantum Inc. offers a range of innovative quantum computing products designed to meet the needs of various industries. Below is a summary of their key products:

| Product | Description |

|---|---|

| Advantage | A fifth-generation quantum computer that provides advanced capabilities for solving complex problems in various applications, from AI to financial modeling. |

| Launch | A quantum computing onboarding service that helps enterprises integrate quantum solutions into their existing workflows, facilitating smoother transitions and deployments. |

| Ocean | A comprehensive suite of open-source programming tools designed to enable developers to create and optimize quantum applications efficiently. |

| Leap | A cloud-based service offering real-time access to D-Wave’s live quantum computer, including hybrid solvers and educational resources for developers and researchers. |

| D-Wave Launch | A professional service that guides businesses from problem identification to the deployment of production-ready quantum applications, ensuring effective implementation. |

By leveraging these products, D-Wave Quantum Inc. positions itself as a leader in the quantum computing industry, catering to diverse fields such as AI, drug discovery, and cybersecurity.

Main Competitors

No verified competitors were identified from available data. D-Wave Quantum Inc. holds an estimated market share within the quantum computing sector, showcasing a strong competitive position with its advanced quantum technologies and services. The company operates predominantly in the technology sector, specifically focusing on quantum computing solutions for various industries, including financial services and life sciences.

Competitive Advantages

D-Wave Quantum Inc. (QBTS) holds a strong position in the burgeoning quantum computing sector, primarily due to its innovative offerings like the Advantage quantum computer and the comprehensive Ocean software suite. These tools enable enterprises to tackle complex problems across various industries, such as AI, drug discovery, and financial modeling. Looking ahead, D-Wave’s expansion into cloud services and hybrid solutions presents substantial growth opportunities. By enhancing accessibility and support for businesses transitioning to quantum technology, D-Wave is well-positioned to capture a significant share of the market as demand for quantum computing escalates.

SWOT Analysis

The purpose of this analysis is to provide a clear overview of D-Wave Quantum Inc.’s strategic position in the market.

Strengths

- Innovative quantum technology

- Strong client base across industries

- Established market presence

Weaknesses

- High operational costs

- Limited public awareness

- Dependence on niche market

Opportunities

- Growing demand for quantum computing

- Expansion into new industries

- Partnerships with tech giants

Threats

- Intense competition

- Rapid technological changes

- Economic downturns impacting funding

Overall, D-Wave Quantum Inc. demonstrates strong potential with its innovative technology and established client base, but it must address its weaknesses and navigate external threats effectively. A focus on expanding market awareness and diversifying its client base could enhance its strategic position moving forward.

Stock Analysis

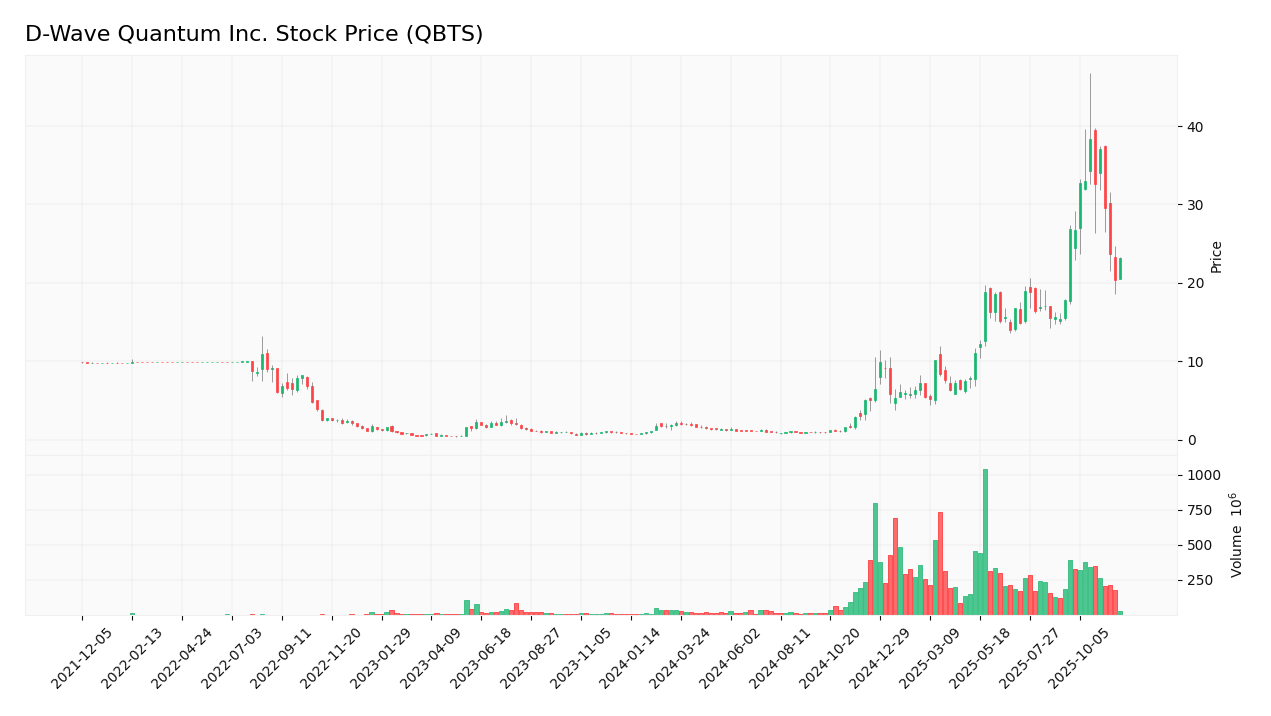

Over the past year, D-Wave Quantum Inc. (QBTS) has experienced significant price movements, culminating in a remarkable bullish trend with a price change of 2713.83%. The trading dynamics have shown a notable shift in investor interest, reflecting strong market participation.

Trend Analysis

Analyzing the stock’s performance over the past year, I observe a staggering price change of 2713.83%, which categorically indicates a bullish trend. Despite this positive trajectory, the recent trend from September 14, 2025, to November 30, 2025, shows a more modest price increase of 30.12%. This recent movement, coupled with a trend slope of -0.11, suggests a deceleration in price acceleration. The stock has fluctuated between a high of 38.33 and a low of 0.69, indicating notable volatility with a standard deviation of 9.46 over the overall period and 6.23 in the recent timeframe.

Volume Analysis

In terms of trading volumes, D-Wave Quantum Inc. has recorded a total volume of approximately 17.64B over the last three months, with buyer-driven activity constituting 55.98% of this volume. The volume trend is increasing, and recent data indicates a buyer dominance of 59.92% from September 14 to November 30, 2025. This suggests a generally positive investor sentiment, with increasing market participation as buyers appear to outweigh sellers.

Analyst Opinions

Recent analyst recommendations for D-Wave Quantum Inc. (QBTS) have been cautious, with a consensus rating of “sell.” Analysts highlight concerns about the company’s financial metrics, particularly its low scores in discounted cash flow, return on equity, and price-to-earnings ratios. The overall score of C- indicates significant challenges in profitability and asset management. Analysts suggest that investors should be cautious due to high debt levels relative to equity. As of now, I recommend monitoring the stock closely rather than initiating new positions.

Stock Grades

D-Wave Quantum Inc. (QBTS) has received consistent stock ratings from several reliable grading companies, reflecting a positive outlook from analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-10 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| B. Riley Securities | Maintain | Buy | 2025-06-18 |

| Benchmark | Maintain | Buy | 2025-06-18 |

The overall trend in grades for QBTS indicates a strong consensus among analysts, with multiple firms maintaining their “Buy” and “Overweight” ratings. This consistency suggests confidence in the company’s performance and growth potential in the quantum computing sector.

Target Prices

The consensus among analysts for D-Wave Quantum Inc. (QBTS) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 26 | 35.25 |

Overall, analysts expect QBTS to reach a target price of approximately 35.25, reflecting strong potential within the current market conditions.

Consumer Opinions

Consumer sentiment surrounding D-Wave Quantum Inc. (QBTS) reflects a mix of optimism and skepticism, showcasing the company’s innovative approach alongside some operational concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| “D-Wave’s technology is revolutionary!” | “Customer support needs improvement.” |

| “Impressive potential for quantum computing.” | “Pricing is a bit steep for small businesses.” |

| “Great advancements in AI integration.” | “Complexity of the product is a barrier.” |

Overall, consumer feedback indicates strong praise for D-Wave’s innovative technology and potential, but recurring issues with customer support and product complexity highlight areas for improvement.

Risk Analysis

In evaluating D-Wave Quantum Inc. (QBTS), it is crucial to consider the potential risks that could affect the company’s performance. Below is a table summarizing key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for quantum computing tech | High | High |

| Technological Risk | Rapid advancements by competitors in quantum tech | Medium | High |

| Regulatory Risk | Changes in government policies affecting tech firms | Medium | Medium |

| Financial Risk | Potential cash flow issues due to high R&D costs | High | Medium |

Synthesis: The most pressing risks for D-Wave Quantum Inc. are market fluctuations and technological advancements from competitors, both of which can significantly impact the company’s growth and market share in the competitive landscape of quantum computing.

Should You Buy D-Wave Quantum Inc.?

D-Wave Quantum Inc. has been struggling with significant losses, reporting a negative net income of -143.88M for the fiscal year 2024, indicating continued profitability challenges. The company carries a total debt of 38.38M, which contributes to concerns regarding its financial stability. Over the last few years, the fundamentals show negative trends, particularly in profitability margins, and the company’s current rating stands at C-.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has reported a negative net margin of -16.30%, highlighting ongoing losses. Additionally, D-Wave has a high debt-to-assets ratio of 0.192, indicating a substantial level of debt relative to its assets. The long-term trend is negative, as evidenced by a recent price decline of 30.12%. Moreover, the seller volume has recently exceeded buyer volume, suggesting a lack of demand for the stock.

Conclusion Given the unfavorable signals present, it may be prudent to wait before considering any investment in D-Wave Quantum Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- D-Wave Quantum (QBTS) Jumps After €10M Contract and Surpasses 100 Enterprise Customers – What’s Next? – Yahoo Finance (Nov 22, 2025)

- D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? – MarketBeat (Nov 24, 2025)

- Prediction: This Will Be D-Wave Quantum’s Stock Price by 2035 – Yahoo Finance (Nov 23, 2025)

- D-Wave Quantum (QBTS): Examining Valuation After Recent Volatility and Long-Term Gains – Yahoo Finance (Nov 25, 2025)

- Quantum Computing Stocks IonQ, Rigetti Computing, and D-Wave Quantum Can Plunge Up to 58%, According to Select Wall Street Analysts – The Motley Fool (Nov 03, 2025)

For more information about D-Wave Quantum Inc., please visit the official website: dwavesys.com