In a world increasingly reliant on advanced audio technology, Cirrus Logic, Inc. transforms how we experience sound across various devices, from smartphones to home theater systems. As a trailblazer in the semiconductor industry, Cirrus Logic has earned a reputation for its innovative low-power, high-precision mixed-signal processing solutions. With a diverse product lineup that enhances audio quality and user experience, I invite you to consider whether Cirrus Logic’s fundamentals still align with its market valuation and growth potential.

Table of contents

Company Description

Cirrus Logic, Inc. is a fabless semiconductor company founded in 1984 and headquartered in Austin, Texas. Specializing in low-power and high-precision mixed-signal processing solutions, Cirrus Logic offers an array of products including codecs that integrate analog-to-digital and digital-to-analog converters, smart codecs, digital signal processors, and amplified sound technologies. The company’s innovative audio products are widely used in smartphones, tablets, laptops, and automotive entertainment systems, positioning it as a key player in the semiconductor industry. With a diverse portfolio that spans consumer electronics to industrial applications, Cirrus Logic is committed to enhancing user experiences through technology, underscoring its role as an innovator in the audio solutions market.

Fundamental Analysis

In this section, I will analyze Cirrus Logic, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

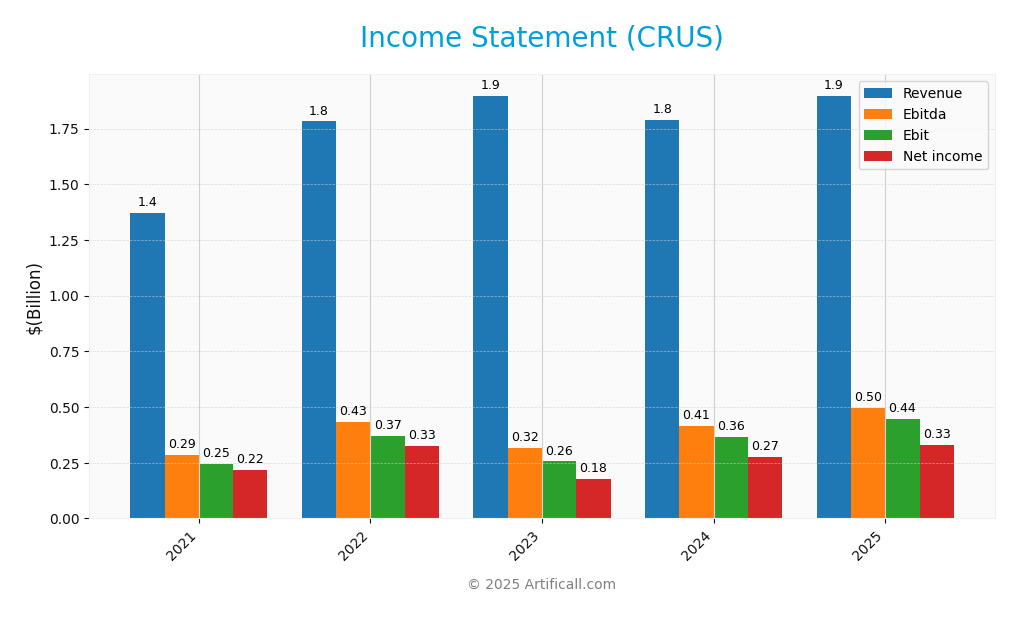

The following table presents the income statement for Cirrus Logic, Inc. (CRUS) over the last five fiscal years, offering insights into the company’s financial performance.

| Income Statement Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 1.37B | 1.78B | 1.90B | 1.79B | 1.90B |

| Cost of Revenue | 661.93M | 857.82M | 940.64M | 872.82M | 900.04M |

| Operating Expenses | 470.12M | 557.30M | 707.95M | 572.61M | 585.68M |

| Gross Profit | 707.30M | 923.64M | 956.98M | 916.07M | 996.04M |

| EBITDA | 285.70M | 431.67M | 316.44M | 413.14M | 496.76M |

| EBIT | 246.30M | 369.61M | 255.64M | 364.85M | 444.91M |

| Interest Expense | 1.06M | 0.95M | 0.90M | 0.92M | 0.90M |

| Net Income | 217.34M | 326.36M | 176.70M | 274.57M | 331.51M |

| EPS | 3.74 | 5.70 | 3.18 | 5.06 | 6.24 |

| Filing Date | 2021-05-21 | 2022-05-20 | 2023-05-19 | 2024-05-24 | 2025-05-23 |

Interpretation of Income Statement

Over the last five years, Cirrus Logic, Inc. has demonstrated a positive trend in revenue, increasing from 1.37B in 2021 to approximately 1.90B in both 2023 and 2025. Notably, net income has also shown an upward trajectory, reaching 331.51M in 2025, reflecting a robust operational performance. The margins have remained relatively stable, with gross profit margins around 52% in recent years. In 2025, the company saw a slight increase in EBITDA, indicating improved operational efficiency. However, the revenue growth rate appears to have stabilized compared to the previous fiscal year, suggesting a cautious outlook moving forward.

Financial Ratios

Here are the financial ratios for Cirrus Logic, Inc. (CRUS) over the most recent fiscal years.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 15.87% | 18.32% | 9.31% | 15.35% | 17.48% |

| ROE | 15.65% | 20.40% | 10.66% | 15.11% | 17.01% |

| ROIC | 12.88% | 17.31% | 9.26% | 12.54% | 14.05% |

| P/E | 22.67 | 14.88 | 34.43 | 18.17 | 15.95 |

| P/B | 3.55 | 3.04 | 3.67 | 2.74 | 2.71 |

| Current Ratio | 3.94 | 3.17 | 4.70 | 5.93 | 6.35 |

| Quick Ratio | 3.13 | 2.65 | 3.63 | 4.72 | 4.82 |

| D/E | 0.10 | 0.11 | 0.09 | 0.09 | 0.07 |

| Debt-to-Assets | 7.78% | 8.38% | 6.84% | 6.96% | 6.18% |

| Interest Coverage | 224.39 | 386.43 | 277.32 | 375.37 | 456.97 |

| Asset Turnover | 0.75 | 0.84 | 0.92 | 0.80 | 0.81 |

| Fixed Asset Turnover | 4.75 | 5.43 | 6.52 | 5.80 | 6.62 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Cirrus Logic, Inc. (CRUS) financial health through its ratios for FY 2025 reveals a strong liquidity position, with a current ratio of 6.35 and a quick ratio of 4.82, indicating robust short-term financial stability. Solvency is also solid, with a debt-to-equity ratio of 0.074, suggesting low leverage and manageable debt levels. Profitability ratios are encouraging, highlighted by a net profit margin of 17.48% and an EBIT margin of 23.46%, signaling effective cost management. Efficiency ratios are adequate, such as an asset turnover of 0.81, though the inventory turnover at 3.01 could be improved. Overall, while the company exhibits strong financial metrics, attention should be given to operational efficiencies to sustain growth.

Evolution of Financial Ratios

Over the past five years, CRUS has demonstrated overall improvement in its profitability and liquidity ratios. The current ratio has increased from 3.94 in FY 2021 to 6.35 in FY 2025, reflecting a significant enhancement in short-term financial health. However, profitability margins have shown some volatility, necessitating continued monitoring.

Distribution Policy

Cirrus Logic, Inc. (CRUS) does not pay dividends, reflecting a strategic choice to reinvest profits into growth opportunities rather than distribute them to shareholders. During its high-growth phase, CRUS prioritizes research and development, which aligns with long-term shareholder value creation. Additionally, the company engages in share buybacks, contributing to shareholder returns. Overall, this approach appears to support sustainable long-term value creation, given the ongoing investment in future growth and innovation.

Sector Analysis

Cirrus Logic, Inc. operates in the semiconductor industry, providing innovative mixed-signal processing solutions. Key competitors include Analog Devices and Texas Instruments, while its competitive advantages lie in low-power technology and a diverse product portfolio.

Strategic Positioning

Cirrus Logic, Inc. (CRUS) holds a competitive edge in the semiconductor industry, primarily through its innovative low-power mixed-signal processing solutions. With a market cap of approximately $5.96B, the company has carved out a significant share in the audio codec market, catering to various devices such as smartphones and laptops. However, the competitive landscape remains intense, with pressures from both established players and emerging startups that are leveraging technological advancements. Continuous innovation is crucial as the sector faces rapid disruptions, particularly in areas like AI-enhanced audio technology and energy-efficient applications.

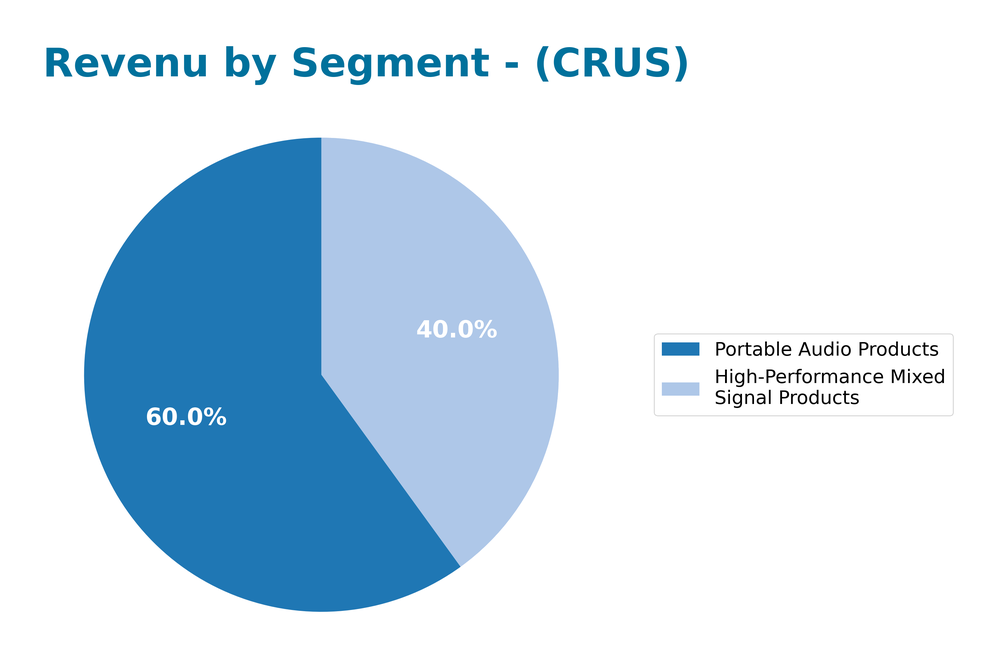

Revenue by Segment

The following chart illustrates the revenue generated by Cirrus Logic’s segments for the fiscal year 2025, highlighting the performance of its primary product lines.

In FY 2025, Cirrus Logic reported revenues of $758.9M from High-Performance Mixed Signal Products and $1.14B from Portable Audio Products. The Portable Audio segment continues to be the primary revenue driver, although its growth has shown signs of slowing compared to previous years. The High-Performance Mixed Signal Products segment is also experiencing gradual growth, which suggests a diversification strategy. Overall, while both segments contribute significantly to revenue, the company faces margin risks due to competitive pressures in the audio market, necessitating careful monitoring of future performance.

Key Products

Cirrus Logic, Inc. specializes in high-performance semiconductor solutions. Below is a table outlining some of their key products and their descriptions:

| Product | Description |

|---|---|

| Audio Codecs | Integrated circuits that combine analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) for high-quality audio processing. |

| Smart Codecs | Advanced codecs that include a digital signal processor (DSP) to enhance audio performance and user experience. |

| Boosted Amplifiers | Amplifiers designed to deliver improved sound quality in various audio applications, such as smartphones and home theaters. |

| Digital Signal Processors | Specialized chips that process audio signals for applications requiring high fidelity and low power consumption. |

| SoundClear Technology | A suite of tools, software, and algorithms aimed at enhancing audio playback, voice capture, and noise cancellation. |

| Haptic Drivers | Solutions that provide tactile feedback in devices, improving user interaction and experience in applications like gaming and mobile devices. |

| Camera Controllers | Integrated circuits that manage camera functions in smartphones and other imaging devices, ensuring high-quality image capture. |

| Fast-Charging ICs | Power management chips that enable rapid charging for electronic devices, enhancing convenience for users. |

These products reflect Cirrus Logic’s commitment to innovation in the semiconductor industry, particularly in mixed-signal processing solutions.

Main Competitors

No verified competitors were identified from available data. However, Cirrus Logic, Inc. operates within the semiconductor industry, focusing on low-power mixed-signal processing solutions. Given its innovative product offerings and market position, Cirrus Logic is likely to hold a notable share in the audio processing niche of the technology sector.

Competitive Advantages

Cirrus Logic, Inc. (CRUS) exhibits strong competitive advantages in the semiconductor industry through its innovative low-power and high-precision mixed-signal processing solutions. The company’s expertise in audio technologies, such as SoundClear and smart codecs, positions it well in rapidly expanding markets like AR/VR and automotive entertainment. Looking ahead, Cirrus Logic plans to launch new products focused on enhancing audio experiences and energy-efficient solutions, tapping into growing demands in consumer electronics and industrial applications. This strategic approach should bolster its market share and drive future growth, making it a compelling option for investors.

SWOT Analysis

This analysis aims to evaluate the strengths, weaknesses, opportunities, and threats facing Cirrus Logic, Inc. (CRUS) to inform strategic decision-making.

Strengths

- Strong market position in low-power semiconductors

- Diverse product portfolio across various applications

- Established customer relationships in tech sectors

Weaknesses

- Dependence on a limited number of customers

- High competition in the semiconductor industry

- Vulnerability to supply chain disruptions

Opportunities

- Growing demand for audio solutions in consumer electronics

- Expansion into emerging markets

- Innovations in mixed-signal processing technology

Threats

- Rapid technological advancements

- Economic downturns affecting consumer spending

- Fluctuations in component pricing

Overall, Cirrus Logic, Inc. possesses a solid market presence and diverse offerings but must address its customer reliance and competitive pressures. By focusing on innovation and market expansion, the company can strategically position itself to leverage growth opportunities while managing inherent risks.

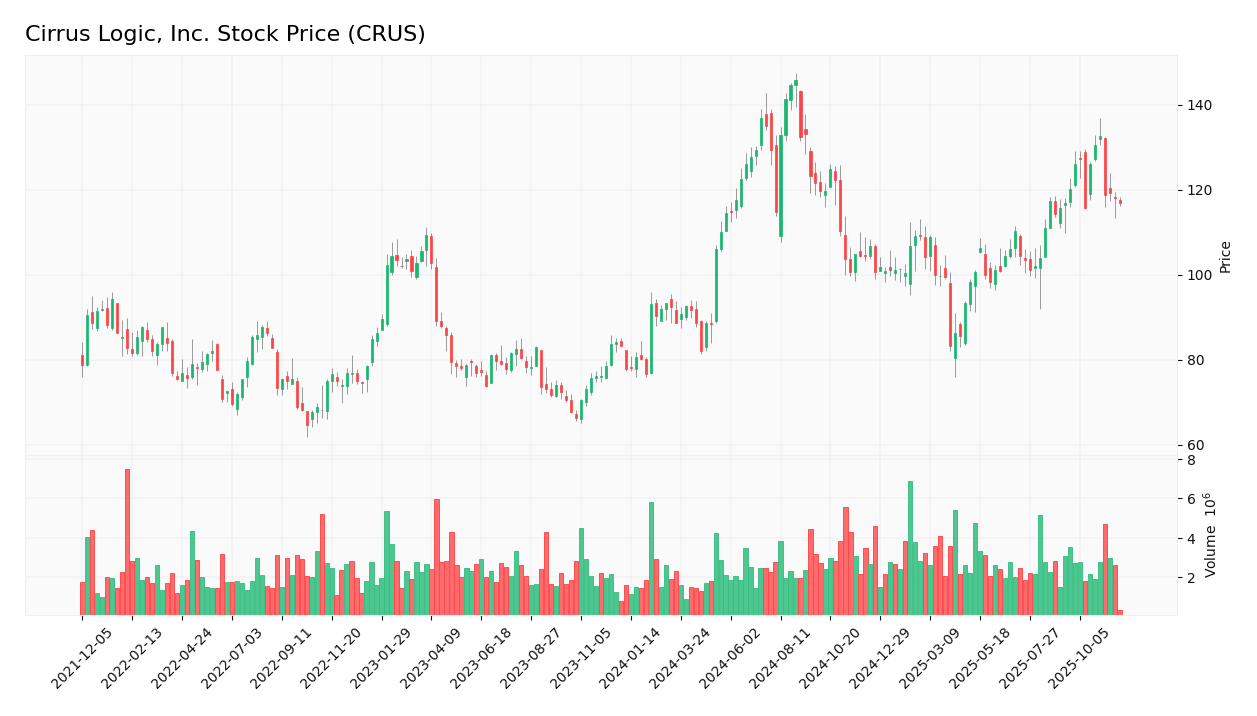

Stock Analysis

In the past year, Cirrus Logic, Inc. (CRUS) has exhibited significant price movements, culminating in a robust bullish trend. The stock price has seen notable fluctuations, which reflect the dynamic trading environment surrounding the company.

Trend Analysis

Over the past two years, CRUS has experienced a strong bullish trend, with a percentage change of +50.14%. Despite this overall positive trajectory, the recent trend has shown a slight deceleration, with a minimal percentage change of -0.01% from September 14, 2025, to November 30, 2025. The stock reached a notable high of 145.69 and a low of 76.7, indicating a substantial range of price movement. The standard deviation of 15.86 further highlights the stock’s volatility during this period.

Volume Analysis

In the last three months, CRUS has recorded a total trading volume of 314.56M shares, with buyer-driven activity accounting for 55.1% of this volume. The trading volume trend is increasing, suggesting heightened investor participation and a positive sentiment among buyers. Recently, from September 14, 2025, to November 30, 2025, buyer volume surged to 22.01M shares, representing a dominant buyer behavior with a percentage of 69.89%. This trend reinforces a strong demand for the stock, likely indicating bullish investor sentiment.

Analyst Opinions

Recent recommendations for Cirrus Logic, Inc. (CRUS) indicate a strong consensus to buy. Analysts have given an overall rating of “A,” highlighting solid fundamentals with scores of 4 for discounted cash flow and return on equity. Notably, the return on assets score is impressive at 5, suggesting efficient asset utilization. While the debt-to-equity and price metrics are moderate, the optimistic outlook reflects confidence in CRUS’s growth potential. Overall, the consensus leans towards a buy for the current year, pointing to favorable market conditions and growth prospects.

Stock Grades

Cirrus Logic, Inc. (CRUS) has recently received consistent ratings from several reputable grading companies, indicating a stable outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-11-05 |

| Benchmark | maintain | Buy | 2025-11-05 |

| Barclays | maintain | Equal Weight | 2025-11-05 |

| Keybanc | maintain | Overweight | 2025-11-05 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Stifel | maintain | Buy | 2025-10-17 |

| Stifel | maintain | Buy | 2025-09-12 |

| Barclays | maintain | Equal Weight | 2025-05-07 |

| Barclays | maintain | Equal Weight | 2025-04-22 |

| Stifel | maintain | Buy | 2025-04-17 |

Overall, the trend indicates a strong sentiment towards CRUS, with multiple firms maintaining their positive ratings. The consistency of ratings, particularly from companies like Stifel and Barclays, suggests confidence in the stock’s performance moving forward.

Target Prices

The consensus among analysts for Cirrus Logic, Inc. (CRUS) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 155 | 95 | 137.5 |

Overall, analysts expect CRUS to perform well, with a consensus target price suggesting a significant potential upside.

Consumer Opinions

Consumer sentiment about Cirrus Logic, Inc. (CRUS) reveals a mix of enthusiasm and concern, reflecting the company’s impact in the semiconductor industry.

| Positive Reviews | Negative Reviews |

|---|---|

| “Outstanding sound quality in their products!” | “Price points are higher than competitors.” |

| “Excellent customer support and service.” | “Inconsistent product availability.” |

| “Innovative technology that enhances user experience.” | “Some products have reliability issues.” |

Overall, consumer feedback on Cirrus Logic, Inc. showcases strengths in sound quality and customer support, while weaknesses often relate to pricing and product reliability.

Risk Analysis

In evaluating Cirrus Logic, Inc. (CRUS), it is essential to consider the following risks that could impact its performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in semiconductor demand can affect sales. | High | High |

| Supply Chain Disruptions | Dependency on suppliers for critical components may lead to production delays. | Medium | High |

| Regulatory Changes | New regulations in technology could impose additional costs. | Medium | Medium |

| Competition | Intense competition from larger tech firms may pressure margins. | High | Medium |

| Technological Obsolescence | Rapid advancements may render existing products less relevant. | Medium | High |

The most significant risks for CRUS involve market volatility and supply chain disruptions, as these factors directly influence revenue stability and operational efficiency.

Should You Buy Cirrus Logic, Inc.?

Cirrus Logic, Inc. (CRUS) has demonstrated a positive net margin of 17.48% in 2025, indicating strong profitability. The company maintains a low debt level, with a debt-to-equity ratio of 0.074, suggesting effective management of financial leverage. The fundamentals have shown improvement, with consistent revenue growth, while the rating of ‘A’ reflects a favorable outlook.

Favorable signals The company’s profitability is highlighted by a positive net margin of 17.48%. Additionally, Cirrus Logic has a low debt-to-equity ratio of 0.074, which indicates strong financial stability. The overall rating of ‘A’ further suggests a solid performance relative to its peers.

Unfavorable signals There are no unfavorable signals present in the data for this company.

Conclusion Given the positive net margin, low debt levels, and strong rating, Cirrus Logic, Inc. appears favorable for long-term investors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Will Weakness in Cirrus Logic, Inc.’s (NASDAQ:CRUS) Stock Prove Temporary Given Strong Fundamentals? – Yahoo Finance (Nov 22, 2025)

- Magnetar Financial LLC Grows Position in Cirrus Logic, Inc. $CRUS – MarketBeat (Nov 24, 2025)

- Cirrus Logic Reports Record Fiscal Second Quarter Revenue of $561.0 Million – Stock Titan (Nov 04, 2025)

- 3,853 Shares in Cirrus Logic, Inc. $CRUS Purchased by AXQ Capital LP – MarketBeat (Nov 24, 2025)

- Empirical Finance LLC Makes New $996,000 Investment in Cirrus Logic, Inc. $CRUS – MarketBeat (Nov 21, 2025)

For more information about Cirrus Logic, Inc., please visit the official website: cirrus.com