In the dynamic world of uranium investments, two players stand out: Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY). Both operate within the uranium industry but adopt distinct strategies—Cameco focuses on uranium production, while Uranium Royalty Corp. specializes in managing a diverse portfolio of royalty interests. With the growing demand for nuclear energy and the ongoing market shifts, understanding their unique approaches is crucial. Join me as I analyze which company presents the more compelling opportunity for investors.

Table of contents

Company Overview

Cameco Corporation Overview

Cameco Corporation (CCJ) is a leading player in the uranium industry, focusing on the exploration, mining, and milling of uranium. Headquartered in Saskatoon, Canada, the company operates through two main segments: Uranium and Fuel Services. The Uranium segment is dedicated to the production and sale of uranium concentrate, while the Fuel Services segment specializes in refining and fabricating uranium into fuel bundles for nuclear reactors. With a market capitalization of approximately $37.8B, Cameco has positioned itself as a vital supplier to nuclear utilities across the Americas, Europe, and Asia, reflecting its commitment to sustainable energy solutions.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (UROY) operates as a unique entity in the uranium sector, focusing on acquiring and managing a diversified portfolio of uranium royalties. Established in 2017 and based in Vancouver, Canada, the company has interests in various prominent uranium projects across North America and internationally. With a market capitalization of around $486M, Uranium Royalty Corp. aims to capitalize on the growing demand for uranium while minimizing operational risks by leveraging its royalty-based business model.

Key similarities between Cameco Corporation and Uranium Royalty Corp. include their focus on the uranium industry and commitment to supporting nuclear energy. However, their business models differ significantly: Cameco is involved in direct production and sales, while Uranium Royalty focuses on acquiring royalty interests, thus minimizing operational exposure and capital requirements.

Income Statement Comparison

The following table presents a comparative analysis of the income statements for Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY) for their most recent fiscal years.

| Metric | CCJ | UROY |

|---|---|---|

| Revenue | 3.14B | 15.60M |

| EBITDA | 789.34M | -4.75M |

| EBIT | 474.91M | -4.87M |

| Net Income | 171.85M | -5.65M |

| EPS | 0.40 | -0.045 |

Interpretation of Income Statement

In the latest fiscal year, Cameco Corporation (CCJ) demonstrated significant revenue growth, increasing from 2.59B in 2023 to 3.14B in 2024, which reflects a healthy upward trend. Meanwhile, Uranium Royalty Corp. (UROY) faced a substantial decline in revenue, decreasing from 42.71M in 2024 to 15.95M in 2025. CCJ’s net income of 171.85M showcases its ability to maintain profitability, whereas UROY reported a loss, indicating challenges in operational efficiency. Notably, CCJ’s EBITDA margin remains robust, while UROY continues to struggle with negative margins, highlighting divergent paths for these companies in the uranium sector.

Financial Ratios Comparison

In this section, I will present a comparative analysis of the most recent revenue and financial ratios for Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY).

| Metric | CCJ | UROY |

|---|---|---|

| ROE | 2.70% | -1.92% |

| ROIC | 3.79% | -1.73% |

| P/E | 187.01 | -56.00 |

| P/B | 5.05 | 1.07 |

| Current Ratio | 1.62 | 233.49 |

| Quick Ratio | 0.80 | 233.49 |

| D/E | 0.20 | 0.0007 |

| Debt-to-Assets | 0.13 | 0.0007 |

| Interest Coverage | 3.98 | -11.02 |

| Asset Turnover | 0.32 | 0.05 |

| Fixed Asset Turnover | 0.95 | 82.51 |

| Payout ratio | 40.52% | 0% |

| Dividend yield | 0.22% | 0% |

Interpretation of Financial Ratios

CCJ shows strong performance metrics, particularly in return on equity (ROE) and a reasonable current ratio, indicating sound financial health. However, its high P/E ratio suggests that the stock may be overvalued. In contrast, UROY struggles with negative profitability metrics, highlighted by its negative ROE and P/E, indicating significant risk. The extremely high current ratio for UROY signals potential liquidity but raises concerns about efficient asset utilization. Investors should tread cautiously with UROY, given its current losses and operational challenges.

Dividend and Shareholder Returns

Cameco Corporation (CCJ) pays a dividend with a yield of 0.22% and a payout ratio of 40.5%, indicating a commitment to return value to shareholders while maintaining adequate cash flow coverage. In contrast, Uranium Royalty Corp. (UROY) does not distribute dividends, focusing instead on reinvesting for growth during its current expansion phase. UROY engages in share buybacks, suggesting a strategy to enhance shareholder value over time. Overall, CCJ’s approach appears more sustainable for long-term value, while UROY’s strategy hinges on future growth potential.

Strategic Positioning

Cameco Corporation (CCJ) holds a dominant market share in uranium production, with a market cap of approximately 38B, reflecting its robust position in the industry. In contrast, Uranium Royalty Corp. (UROY), with a market cap of around 486M, operates as a royalty company, which exposes it to higher volatility and competitive pressure. Both companies face technological disruptions and market fluctuations, but Cameco’s established operations provide a significant competitive edge in an evolving energy landscape.

Stock Comparison

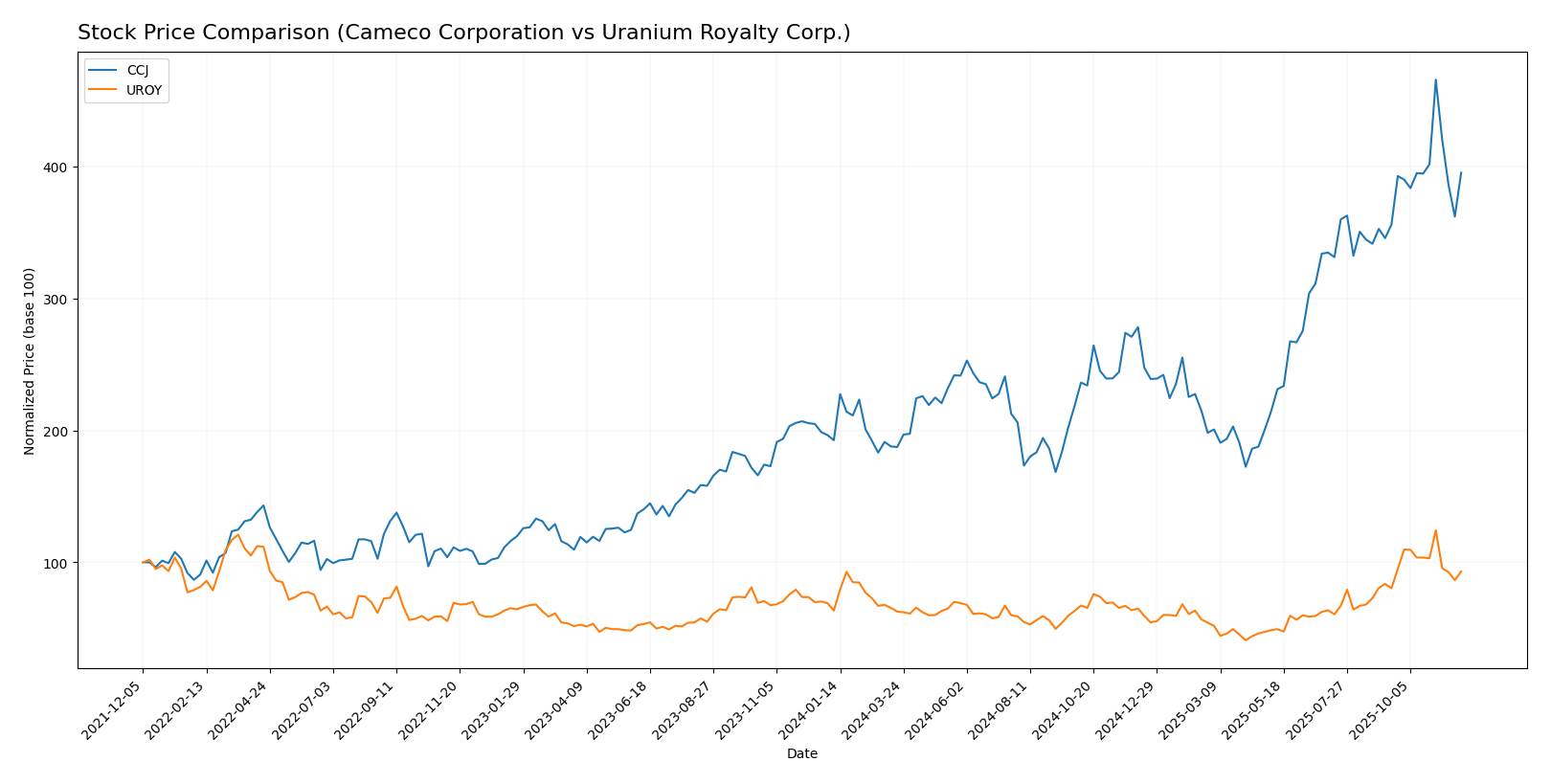

In analyzing the stock price movements of Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY) over the past year, we can observe significant price dynamics that reflect broader market trends and investor sentiment.

Trend Analysis

For Cameco Corporation (CCJ), the stock has experienced a remarkable price change of 105.28% over the past year. This indicates a bullish trend, with notable acceleration in price, as evidenced by the highest price reaching 102.21 and the lowest at 36.96. The standard deviation of 15.32 suggests a moderate level of volatility in its price movements.

In the recent analysis from September 14, 2025, to November 30, 2025, the stock has increased by 11.04%, further confirming its bullish trend with an acceleration status. The trend slope of 0.41 indicates a positive momentum.

For Uranium Royalty Corp. (UROY), the stock has shown a price change of 46.57% over the past year, also reflecting a bullish trend, albeit with a deceleration in recent price movements. The highest price was 4.86, while the lowest was 1.6, with a standard deviation of 0.62, indicating lower volatility compared to CCJ.

In the recent period from September 14, 2025, to November 30, 2025, UROY’s price has increased by 15.76%, though the trend slope of -0.01 suggests a slight deceleration in its upward momentum. The overall buyer percentage stands at 51.5%, indicating a balanced market sentiment, yet recent buyer behavior has shifted to seller-dominant.

In summary, both stocks demonstrate strong bullish trends, but investors should remain cautious about the evolving dynamics in UROY’s recent performance.

Analyst Opinions

Recent recommendations for Cameco Corporation (CCJ) show a consensus rating of “buy,” with analysts highlighting a solid return on assets score of 4 and a balanced debt-to-equity ratio. In contrast, Uranium Royalty Corp. (UROY) has garnered a “hold” rating, primarily due to lower scores in discounted cash flow and return on equity. Analysts like those at FMP have rated CCJ with a B- overall score, while UROY received a C rating. This indicates a clear preference for CCJ among investors looking for growth in the uranium sector.

Stock Grades

I have reviewed the latest stock grading data, and here are the findings for Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY).

Cameco Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Outperform | 2025-11-13 |

| RBC Capital | maintain | Outperform | 2025-10-31 |

| Goldman Sachs | maintain | Buy | 2025-10-29 |

| RBC Capital | maintain | Outperform | 2025-08-01 |

| RBC Capital | maintain | Outperform | 2025-06-20 |

| GLJ Research | maintain | Buy | 2025-06-12 |

| Goldman Sachs | maintain | Buy | 2025-06-11 |

| GLJ Research | maintain | Buy | 2025-03-12 |

| RBC Capital | maintain | Outperform | 2025-03-04 |

| Scotiabank | maintain | Outperform | 2024-08-19 |

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2021-07-01 |

Overall, both companies exhibit strong grades, with CCJ maintaining an “Outperform” rating from reputable firms and UROY consistently receiving “Buy” ratings. This suggests a positive sentiment towards these stocks in the current market landscape.

Target Prices

Cameco Corporation (CCJ) has reliable target price data available, reflecting a consensus among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation | 109 | 70 | 95.75 |

Analysts expect Cameco’s stock price to reach a consensus target of 95.75, which is above its current price of 86.76, suggesting potential for growth. Unfortunately, no verified target price data is available for Uranium Royalty Corp. (UROY).

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY) based on the most recent data.

| Criterion | Cameco Corporation (CCJ) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | High (Uranium, Fuel Services) | Low (Pure-play royalty focus) |

| Profitability | Moderate (Net Profit Margin: 5.48%) | Negative (Net Profit Margin: -36.26%) |

| Innovation | Moderate (Focus on refining processes) | Low (Limited innovation efforts) |

| Global presence | Strong (Operates in Americas, Europe, Asia) | Limited (Geographically concentrated) |

| Market Share | High (Top uranium producer) | Low (Emerging player) |

| Debt level | Low (Debt-to-Equity: 0.20) | Minimal (Debt-to-Equity: 0.0007) |

In conclusion, Cameco Corporation demonstrates a strong market presence and diversification, while Uranium Royalty Corp. struggles with profitability and innovation. Investors should weigh these factors carefully when considering their portfolios.

Risk Analysis

The following table summarizes key risks associated with Cameco Corporation (CCJ) and Uranium Royalty Corp (UROY).

| Metric | Cameco Corporation (CCJ) | Uranium Royalty Corp (UROY) |

|---|---|---|

| Market Risk | High – volatile uranium prices | High – dependent on uranium market trends |

| Regulatory Risk | Moderate – subject to nuclear regulations | Moderate – must comply with mining laws |

| Operational Risk | Moderate – mining and production challenges | High – operational inefficiencies possible |

| Environmental Risk | High – potential environmental impacts from mining | Low – primarily a royalty company |

| Geopolitical Risk | Moderate – geopolitical tensions affecting uranium supply | Moderate – exposure to global uranium markets |

Both companies face significant market and operational risks, especially due to their reliance on uranium prices. CCJ, being a major producer, has a higher exposure to environmental and operational challenges. UROY, while having lower environmental risks, is vulnerable to market fluctuations.

Which one to choose?

In comparing Cameco Corporation (CCJ) and Uranium Royalty Corp. (UROY), I find that CCJ appears to be the stronger candidate for investors. CCJ has a robust market cap of 32.1B CAD and impressive margins, including a net profit margin of 5.5% and a solid operating profit margin of 16.3%. Its stock has experienced a bullish trend, appreciating by 105.3% recently, with analysts rating it a B-. Meanwhile, UROY, with a market cap of 316M CAD, has a lower rating of C, negative profit margins, and a high debt-to-equity ratio, indicating significant risk.

For growth-oriented investors, CCJ is likely the better option, while those prioritizing risk mitigation and stability might still consider UROY, despite its current challenges. However, both companies face risks related to market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cameco Corporation and Uranium Royalty Corp. to enhance your investment decisions: